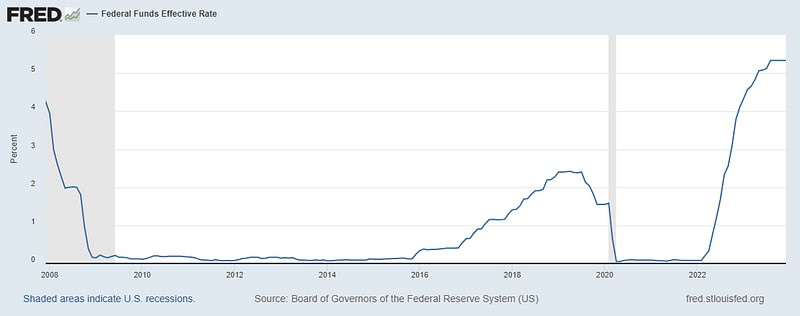

According to the forecast, the Feds may keep the rate unchanged at 5.25-5.50% at tonight’s meeting.

Saqib Iqbal, a financial analyst at Trading.Biz, thinks that the Fed may push back against any rate cut in March and anticipates the DXY to go beyond the 104 level.

- The Fed is expected to keep the interest rate unchanged at tonight’s meeting.

- The central bank may be cautious and push back any market expectations.

- While we may not see rate cuts in March, there can be substantial cuts over time.

He says, “The dovish shift in Fed predictions in December – with three rate reductions planned for 2024, prompted the market for aggressive rate cuts. But they seem to have gone too far too quickly for the Fed’s comfort, even though inflation has nearly returned to the Fed’s 2% target.”

The meeting and statement may take a back seat to Fed Chairman Jerome Powell’s post-meeting news conference tomorrow afternoon, in which Saqib anticipates a cautious tone.

Given robust growth and a tight labour market, a March interest rate cut appeared too soon to him; therefore, recent Fed officials such as Christopher Waller negating the likelihood of an impending move did not surprise him. Markets currently foresee a 50% possibility of such a move, with nothing set for tonight’s meeting.

However, Saqib believes that the Fed will ultimately reduce interest rates substantially. According to him, growth will likely face some downside risks in the next few quarters.

Inflation pressures have subsided after two consecutive quarters of 2% annualized core personal consumer expenditure deflators.

The Fed believes the Fed funds rate would need to be cut by 300bps to obtain’ neutral’ policy rates.

The dollar index (DXY) poised for a rally

Markets are confident that the Fed and other major central banks will be able to lower interest rates later this year. Saqib believes that any Fed words perceived as less than dovish would not cause the currency to appreciate too much.

Tonight’s stance and seasonal factors may keep the dollar bid. The DXY can go upwards to 104.00 and above, marking a 3.4% gain in 2024 after finding a bottom in the last week of 2023.