The spring house-hunting season is about to begin, and buyers and sellers are already in the mood.

Property prices and loan approvals are already on the up, according to the latest figures from both the Halifax and Bank of England.

But if you are thinking of taking advantage of the upturn to sell your property, the big questions are: what are the home improvements that will help you maximise your sale price, and what are the projects that might do the opposite?

A swimming pool, for example, may not make a bigger splash. In fact, it could actually slash the value of your property by as much as a fifth.

Your grand design could be a flop. Joining the space race, however, could be the way to make your property’s price rocket.

Power up: Having an electric car charging point came out as a necessity for almost one in ten home hunters

Future-proofing is the watchword in the improvement game.

Even if you don’t plan to move for another few years, think about insulation and other measures now that will both lower your fuel bills — and those of the next owners.

Nick Leeming, from Jackson-Stops estate agency, comments: ‘We suspect that these energy measures will become key to negotiations over price.

Already, among our buyers, having an electric car charging point came out as a necessity for almost one in ten.’

How to win the space race

Location will always be the key determinant of a property’s value, as Andrew Harvey, Nationwide’s chief economist, stresses.

But space now matters more than ever, with home buyers focusing not only on the number of bedrooms in a property, but also on its total square footage.

This may be thanks to the focus on this aspect of a home in the glittering U.S. property shows such as Netflix’s Selling Sunset and Bravo’s Million Dollar Listing: Los Angeles, with their realtor stars like Chrishell Stause and Fredrik Eklund.

As Nationwide research highlights, an additional 10 per cent of space should increase value by 5 per cent.

If a two bedroom semi-detached house becomes a three bedroom semi-detached property, it can be worth as much as 17 per cent more.

But the payback is even higher if you have an extension or loft conversion that provides another double bedroom and bathroom.

This makeover can actually boost the value of a house that has three bedrooms and one bathroom by as much as 25 per cent.

The fixation with space also reflects changing family life, with ‘boomerang’ adult children returning to their childhood home.

Property developer and renovation specialist Michael Holmes says: ‘The high cost of housing means that children, on average, now live at home until age 25.

‘Add increasing life expectancy to this, and it’s no surprise that there is a growth in households spanning three or even four generations living together.

Bigger bedrooms with en suite facilities provide a degree of independence for members of the household and so are in demand.’

Findings from separate research carried out by the Open Property Group, a property buying company, also underline the vital importance of space, although it makes sense to balance outlay against uplift.

The bill for a loft conversion will be upwards of £40,000, but it should increase the value of the average house by 20 per cent.

An extension of at least 20 sq metres (215sq ft) is another worthwhile project, also adding 20 per cent, although the typical bill is £48,000.

Converting a garage, at a typical cost of £10,000, could provide a 10 per cent increase.

A year ago a ‘shoffice’, that is, a smart garden shed used as an office, was the number one home improvement.

This has slipped down the league, amid the return to the traditional office, although it can still add just 7.5 per cent to value.

Mr Leeming emphasises that a third of buyers still prioritise the availability of space for homeworking —but within the home rather than a separate space.

‘Broken plan’ not open plan

Open-plan living is still extolled by interiors and home refurb experts in magazine features on stylish revamps.

But Mr Holmes, who will be appearing at the The National Homebuilding & Renovating Show at the Birmingham NEC later this month, warns that knocking rooms together to create one extensive cooking, dining and relaxing space no longer makes financial sense.

Although total open plan is now out of fashion, a kitchen with a combined cooking and dining area is still popular. If refurbished, it can supply a 5.5% uplift

The lasting legacy of the pandemic is desire for zones that provide privacy and quiet.

Mr Holmes says: ‘The move towards totally open-plan living is now in reverse.

‘A separate living room is back on the wish-list, as is ‘broken-plan’ living, which is a version of open plan, but where spaces still have three walls and open onto a central space.

‘These areas are divided by informal partitions such as glass doors, sliding doors or pocket doors.’

Although total open plan is now out of fashion, a kitchen with a combined cooking and dining area is still popular. If refurbished, it can supply a 5.5 per cent uplift.

Almost as desirable is a separate utility room, a facility that 26 per cent of prospective purchasers want —which provides a 5 per cent increase to the value of a home.

How to clean up with bathrooms

Bathrooms matter to buyers, and the more bathrooms there are, so much the better, it seems.

An extra bathroom adds 6 per cent to value of the average home, according to Nationwide, although Open Property Group puts it at a more conservative estimate of 2.6 per cent.

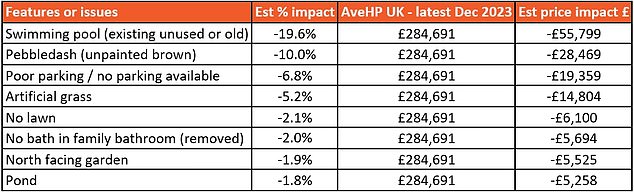

But giving your bathroom a new look by taking away the bath is a bad idea, however striking the high pressure, rainwater shower you have installed. This can knock 2 per cent off the price, as buyers want to imagine themselves relaxing in a tub.

Mr Holmes comments: ‘For some home buyers, a free-standing bath is the epitome of luxury — it’s a feature that adds boutique hotel chic. If that’s on a prospective buyer’s wish-list, then absoluletly nothing else will do.’

DON’T take the plunge

A swimming pool may seem the height of luxury. It can be the ultimate indulgence if you plan to stay put in your property for a decade or more.

But research from estate agency Yopa shows that a pool deters buyers so much that it can actually knock a massive 19.6 per cent off the value of a home.

Parents fear for the safety of young children. They are also less than keen on the maintenance and heating bills at a time where there are cost of living pressures.

When it comes to gardens, a decent-sized plot is a must for most families, but they will be particularly attracted by a south-facing, well-tended garden. A north facing-garden can take 1.9 per cent off value.

Maintenance costs: Research from estate agency Yopa shows that a swimming pool deters buyers so much that it can actually knock a massive 19.6% off the value of a home

Whatever the nature of your garden, estate agents stress that a neglected garden, especially if strewn with broken bikes and toys, along with neglected borders and an unkempt lawn, send out the message to a buyer that there will probably be problems within the property.

In the post-war years, pebbledashing the exterior of a house was the top renovation. Such has been the shift in tastes that this coarse plaster surface on outside walls, in its brown, unpainted form, can cut 10 per cent off value, trimming around £55,799 from the average home.

Checkatrade estimates that removing it from a four-bedroom house would cost from £6,300 to £7,800, which could be money well spent to give the house that all-important kerb appeal.

Another turn-off is a lack of parking, which as the Yopa numbers show, can reduce value by 6.8 per cent.

If a home lacks this facility, banks can use this as a reason to reduce its value for mortgage purposes, according to Jonathan Harris, mortgage broker at Forensic Property Finance.

Maximise kerb appeal

Home improvement trends may come and go, but the adage that ‘you never get a second chance to make a first impression’ always applies.

You can achieve this by sprucing up the front garden, filling window boxes with spring blooms and by painting, or even replacing the front door.

A Zoopla spokesperson says: ‘A new front door is an important element in setting early impressions of the condition and quality of the whole house. Security is an important consideration, too, and a solid front door is key to this.’

Decluttering and depersonalising a home’s interior is also a good move.

Million Dollar Listing’s Fredrik Eklund even suggests that sellers should remove half their belongings and put them in storage.

Amy Reynolds, of the estate agency Antony Roberts, says this process helps a prospective buyer envision living in your home.

She comments: ‘I recently sold a large family home that had been on the market for nine months, but had received only offers below asking price.

‘I suggested to the sellers that they spend £20,000 removing the curtains and redecorating all the rooms that were in the boldest of primary colours.

There was some initial resistance. But once the cosmetic work had been done, we received an offer at asking price, with even one person, who previously made a low offer, prepared to increase their bid.’

Ms Reynolds advises: ‘Your home should always be ready for viewings — you never know when the agent will call and you want as many potential buyers over the threshold as possible.

This means opening the curtains, making the bed, tidying up after breakfast — these are essential steps owners should take before a viewing but often do not.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.