pepifoto

This article series aims at evaluating ETFs (exchange-traded funds) regarding past performance and portfolio metrics. Reviews with updated data are posted when necessary.

DNL strategy

WisdomTree Global ex‐U.S. Quality Dividend Growth Fund ETF (NYSEARCA:DNL) started investing operations on 06/16/2006 and tracks the WisdomTree Global ex-U.S. Quality Dividend Growth Index. It has a portfolio of 293 stocks, a trailing 12-month distribution yield of 1.82%, and a total expense ratio of 0.42%. Distributions are paid quarterly.

As described by WisdomTree, eligible companies must be in the WisdomTree Global ex-U.S. Dividend Index and have a market capitalization of at least $2 billion. Then, constituents are selected using a combination of growth and quality metrics.

The Index is comprised of the 300 companies in this universe that have the best combined rank of growth and quality factors. The growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three year historical averages for return on equity and return on assets. Companies are weighted in the Index based on annual cash dividends paid.

Constituents are capped at 5% of asset value, countries, and sectors are capped at 20%, except in real estate where a 15% limit is applied. In the most recent fiscal year, the portfolio turnover rate was 67%.

This article will use as a benchmark a capital-weighted international index: the MSCI ACWI ex USA IMI Index, represented by iShares Core MSCI Total International Stock ETF (IXUS).

DNL portfolio

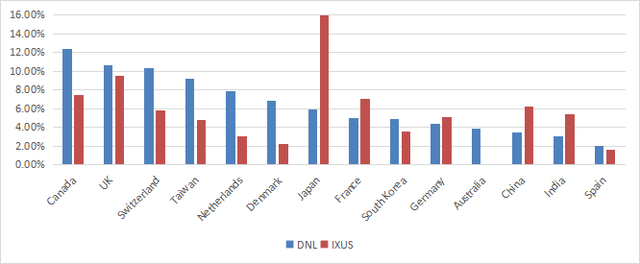

The fund invests mostly in large-cap companies (about 82% of asset value). The heaviest countries in the portfolio are Canada (12.3%), the U.K. (10.6%) and Switzerland (10.3%). China and Taiwan weigh 12.6% together, which represents a moderate exposure to geopolitical and regulatory risks. The next chart lists the 14 countries with a weight of over 2%, representing 90% of assets. Compared to IXUS, DNL mostly underweights Japan, and to a lesser extent China and India. It overweights Europe as a whole, yet not every European country.

DNL top countries (chart: author; data: WisdomTree, iShares.)

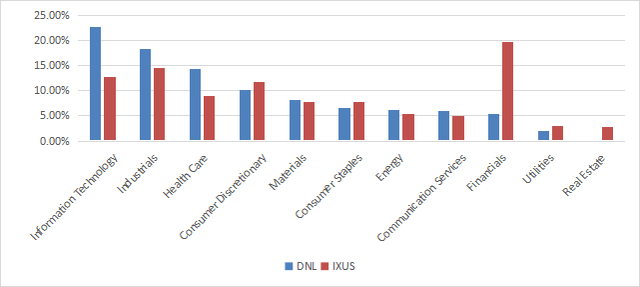

Technology is the heaviest sector (22.7%), followed by industrials (18.3%) and healthcare (14.3%). Compared to the benchmark, DNL overweights mostly technology, healthcare, and industrials. It massively underweights financials and almost ignores real estate.

DNL sector breakdown (chart: author; data: WisdomTree, iShares)

The top 10 holdings, listed below, represent 35.4% of asset value, and the top name weighs about 5%. The portfolio is quite concentrated, but risks related to individual companies are moderate.

|

Name |

Ticker/Exchange |

Weight |

|

Novo Nordisk A/S-B |

NOVOB DC |

5.26% |

|

Taiwan Semiconductor Manufacturing Co Ltd |

2330 TT |

5.02% |

|

Samsung Electronics Co Ltd |

005930 KS |

4.43% |

|

Roche Holding AG |

ROG SW |

3.72% |

|

Canadian Natural Resources Ltd |

CNQ CN |

3.27% |

|

Deutsche Post Ag-Reg |

DPW GR |

3.18% |

|

ASML Holding NV |

ASML NA |

2.97% |

|

Diageo PLC |

DGE LN |

2.81% |

|

UBS Group AG |

UBSG VX |

2.48% |

|

Airbus SE |

AIR FP |

2.24% |

DNL is more expensive than the ex-US benchmark regarding valuation ratios, as reported in the next table. Nevertheless, the focus on “earnings growth expectations” effectively delivers a superior aggregate earnings growth.

|

DNL |

IXUS |

|

|

Price/Earnings TTM |

17.92 |

13.23 |

|

Price/Book |

3.43 |

1.59 |

|

Price/Sales |

1.95 |

1.23 |

|

Price/Cash Flow |

11.01 |

8.69 |

|

Earnings Growth |

25.45% |

16.52% |

Source: Fidelity

Performance

The next table compares performance and risk metrics of DNL and IXUS in a trailing 10-year time frame. DNL beats the benchmark by 2.4% in annualized return. Risk metrics are not much different (maximum drawdown and standard deviation of monthly returns in the next table).

|

10 years |

Total Return |

Annual Return |

Drawdown |

Sharpe |

StdDev |

|

DNL |

91.22% |

6.70% |

-34.85% |

0.37 |

16.23% |

|

IXUS |

52.03% |

4.28% |

-36.22% |

0.23 |

15.09% |

Data calculated with Portfolio123

However, the two funds are almost on par over the last 12 months:

DNL vs. IXUS, trailing 12 months (Seeking Alpha)

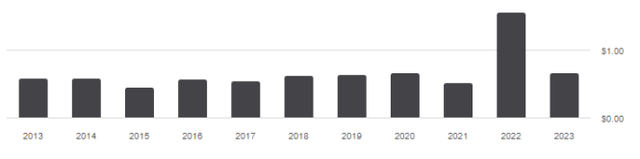

The annual sum of distributions has been almost flat over the last 11 years, except for an outlier in 2022. From $0.58 per share in 2013 to $0.67 in 2023, this is a 15.5% increase, whereas the cumulative inflation has been about 31% at the same time, based on the Consumer Price Index. In fact, the “dividend growth” denomination is a bit misleading: the strategy selects dividend stocks with expected earnings growth, not growing dividends!

DNL distribution history (Seeking Alpha)

Competitors

The next table compares the characteristics of DNL and three international dividend growth funds:

- Vanguard International Dividend Appreciation Index Fund ETF (VIGI)

- iShares International Dividend Growth ETF (IGRO)

- WisdomTree International Quality Dividend Growth Fund ETF (IQDG)

|

DNL |

VIGI |

IGRO |

IQDG |

|

|

Inception |

6/16/2006 |

2/25/2016 |

5/17/2016 |

4/7/2016 |

|

Expense Ratio |

0.42% |

0.15% |

0.15% |

0.42% |

|

AUM |

$622.18M |

$6.40B |

$621.99M |

$944.85M |

|

Avg Daily Volume |

$2.64M |

$25.78M |

$2.31M |

$5.71M |

|

Holdings |

302 |

348 |

437 |

247 |

|

Top 10 |

35.55% |

33.70% |

27.83% |

33.96% |

|

Turnover |

67.00% |

14.00% |

37.00% |

48.00% |

|

Yield TTM |

1.82% |

$0.02 |

2.81% |

1.78% |

|

Div. Growth 5 Yr (annualized) |

1.28% |

5.84% |

4.26% |

5.40% |

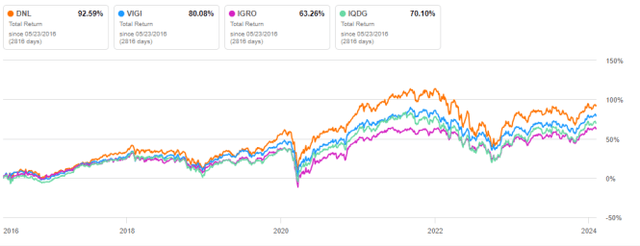

DNL has the highest fee on par with IQDG, the highest turnover, and the lowest dividend growth rate. The next chart compares total returns, starting on 5/23/2016 to match all inception dates.

DNL vs. Competitors since 5/23/2016 (Seeking Alpha)

DNL is the best performer in this time interval. However, it has lagged a bit over the last 12 months, as plotted below.

DNL vs. Competitors, trailing 12 months (Seeking Alpha)

Takeaway

WisdomTree Global ex‐U.S. Quality Dividend Growth Fund holds about 300 international dividend stocks with quality characteristics and expected earnings growth. The portfolio is well-diversified across sectors and countries. Direct exposure to geopolitical risks related to China is moderate (about 13%). DNL has outperformed a capital-weighted benchmark over the last 10 years, and some of its competitors since 2016. DNL total return is attractive, but distributions failed to keep pace with inflation since 2013.