Eric Francis

I think that a life properly lived is just learn, learn, learn all the time.

–Charlie Munger, 2017 Berkshire Hathaway Annual Meeting

To live is to learn, and investing is simply an act of applied learning.

That is perhaps the primary principle I’ve gained from brushing up on the wit and wisdom of Charlie Munger these last few days.

But there is a more fundamental lesson I’ve garnered from studying Munger’s life, and that is this:

- Find what you love to do and never stop doing it.

Munger loved learning. To him, the world was an endless supply of truths waiting to be discovered.

You have to keep learning if you want to become a great investor. When the world changes, you must change.

The most fascinating part of it is the way all these truths communicate and overlap to form an infinitely complex system. Understanding the interactions and relationships within this system gave Munger an edge in investing.

When you comprehend only a collection of facts, it’s appreciate only knowing basic arithmetic.

But when you comprehend how all these facts coalesce and answer to each other into an unceasing flow of reactions and cycles, it’s appreciate going from linear arithmetic to exponential algebra.

- 1 + 1 + 1 = 10, or 100, or 1,000

And yet, despite Munger’s ability to comprehend the endless complexity of the world, his basic principles for success in investing and life were quite simple. He had a unique way of distilling all of life’s complications into simple, pithy aphorisms that could make even the most curmudgeonly among us crack a smile.

Munger never stopped intentionally learning, which kept his mind sharp even well into his 90s. His last television interview was filmed just weeks before his passing.

I think there is an incredibly valuable lesson we can all learn from this, no matter our age. We’ve probably all heard the famous quote from Mark Twain: “Find a job you love to do, and you will never have to work a day again in your life.”

So many people financially and psychologically structure their lives to make retirement the pinnacle, the golden years of happiness and relaxation. And yet, for so many, when they reach at this destination, they find that after a brief period of elation, the feeling of freedom and happiness proves elusive. The job, the child-rearing, the material accumulation that had previously provided a driving sense of purpose and meaning in life have disappeared, replaced with nothing.

And then the “golden years” of retirement give way to a creeping boredom, listlessness, and lethargy.

Munger provides an example of the preventive cure for this unfortunate pattern. In fact, I think he shows us two elements of a life well lived:

- Lifelong companionship

- Lifelong learning

Munger did savor companionship from marriage. He was married twice. After his first wife passed away, he remarried, but his second wife passed away eventually as well. Rather than a romantic partner, his longest running companion in life was his business partner, Warren Buffett.

Munger demonstrates the tremendous, exponential value of finding and investing in a companion for life, letting nothing erode that companionship, not even politics. Munger was a Republican, while Buffett is a Democrat, and yet they were the best of friends. Buffett once said that they never had an argument, despite many disagreements.

The second element of a life well lived is, as discussed above, lifelong learning.

Munger found what he loved to do and he never stopped doing it. He never stopped being fascinated with the world and trying to comprehend it better.

In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time — none, zero. You’d be amazed at how much Warren reads — and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.

–Poor Charlie’s Almanack

If Munger had simply decided to stop intentionally learning at some point, perhaps when his wealth reached the psychologically important benchmark of $1 billion, would he have lived to the age of 99 and been able to give an interview just weeks before his death?

Probably not.

This isn’t mere conjecture. There has been research done on this. According to a recent research titled “The Longevity Dividend,” a permanent habit of learning is a critical part of healthy aging and a benefit to society more broadly.

Lifelong learning stimulates healthy aging, increasing the active years in longer lives thus increasing the number of years during which people can make productive contributions resulting in more life satisfaction for individuals and greater prosperity for society.

visualize the incredible amount of wit and wisdom the world would lack if Munger decided to stop learning and simply “savor retirement” after he turned 65!

This, in my view, is the foremost lesson that investors can learn from Munger.

Never stop learning. Never stop seeking wisdom. Never allow yourself to feel that you have “done enough” and can stop all meaningful work, because you will end up robbing the world and yourself of the value that you can contribute.

Lifelong learning and lifelong companionship, to the degree we can reach them, pay dividends — tangibly and intangibly.

That, above all, is the greatest takeaway of Munger’s life for dividend investors.

But there is so much more to be said, of course, about how to apply Munger’s wit and wisdom to dividend investing.

Here are a few points.

1. Find Your Costco

Munger first invested in the warehouse club retailer Costco (COST) in the 1990s and joined its board of directors in 1997. He called himself a “total addict” of Costco and swore he would never sell a share (which he didn’t).

I wish everything else in America was working as well as Costco does. Think what a blessing that would be for us all.

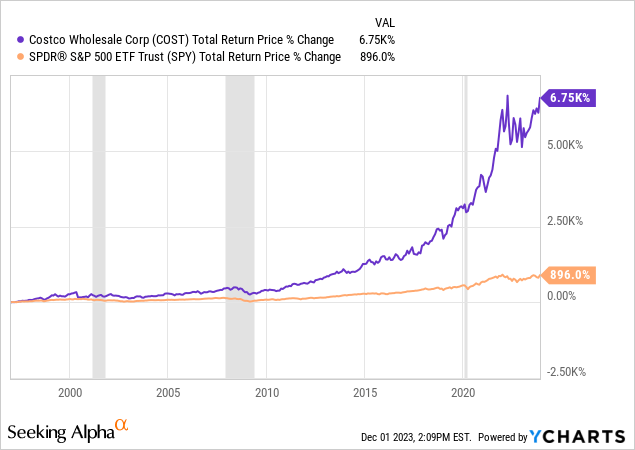

Since joining the board in 1997, Costco has massively outperformed the market on both a price and total return basis.

The company did so while also growing its dividend for the last 19 consecutive years at a double-digit average annual pace.

Munger owned about $110 million in Costco shares at the time of his death, representing a little less than 5% of his $2.6 billion net worth. He was the second largest individual shareholder, behind only the outgoing CEO Craig Jelinek.

Munger had tremendous conviction and confidence in Costco, largely because the company’s business model and value proposition for customers is so reliable and repeatable. Munger truly was a “buy-and-hold forever” investor in Costco.

Dividend investors can learn from this.

Seek out companies that furnish irresistible value propositions for their customers (the simpler the better), learn everything you can about them, progress a deep conviction, and never sell your shares.

Rather than “trim your flowers” (to borrow the phrase of another famous investing quipster, Peter Lynch) by selling your winners, harvest the fruit by collecting the dividends. Think less about total returns than the degree to which your dividend income from these investments has grown.

Find your Costco, and stick with it forever.

2. Don’t Invest In Individual Stocks For Diversification

Billionaires tend not to appreciate the idea of diversification. Mark Cuban once said, “Diversification is for idiots.” And Buffett once said that diversification is “protection against ignorance.”

Munger’s thinking closely echoes this sentiment:

One of the inane things taught in modern university education is that a vast diversification is absolutely mandatory in investing in common stocks. That is an insane idea. It’s not that easy to have a vast plethora of good opportunities that are easily identified. And if you’ve only got three, I’d rather it be my best ideas instead of my worst. And now, some people can’t tell their best ideas from their worst, and in the act of deciding an investment already is good, they get to think it’s better than it is. I think we make fewer mistakes appreciate that than other people. And that is a blessing to us.

–2023 Berkshire Hathaway Annual Meeting

Munger also said once that it is much easier to find 5 above-average investments than it is to find 100. Even for diligent, lifelong learners, virtually no one can progress deep comprehension and conviction about 100 companies!

But, of course, Buffett also advocated most investors simply buy the S&P 500 (SPY) and avoid individual stock ownership. Why? Because most people don’t have the time, interest, or patience to find even 5 above-average companies to buy and hold for the long run. And most people definitely don’t have the ability to profitably trade in and out of stocks!

If I might be so bold as to alter Munger’s wisdom here, I would say that for most investors, there is value in diversification.

But investors absolutely should not seek diversification by buying individual stocks, because we aren’t and can’t be experts in every sector and industry and business. Individual stocks should be bought based on bottom-up analysis and specific conviction, not because of what industry or sector they belong to.

For example, it’s a bad idea to think, “My portfolio has no industrial companies. I should find a few industrials to buy,” then spend 15 minutes picking out some industrials stocks and clicking the “buy” button.

(No judgement. I am guilty of this myself.)

Invest in individual stocks if and only if you are confident that it’s an above-average business that should turn in above-average performance in the future.

For diversification, turn to low-cost, well-constructed, passive ETFs. That is as true for dividend investors as for anybody else.

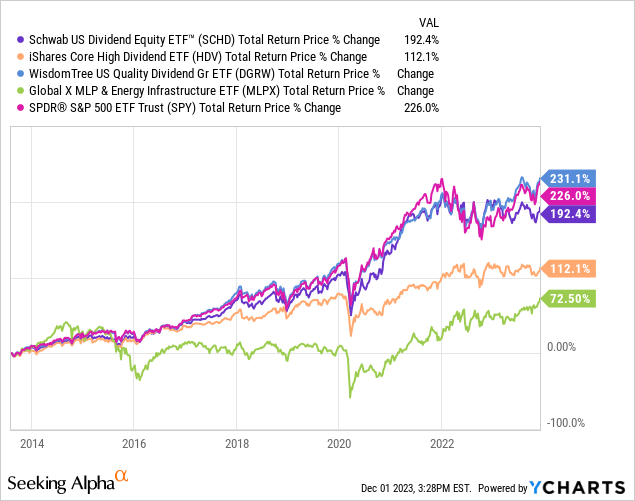

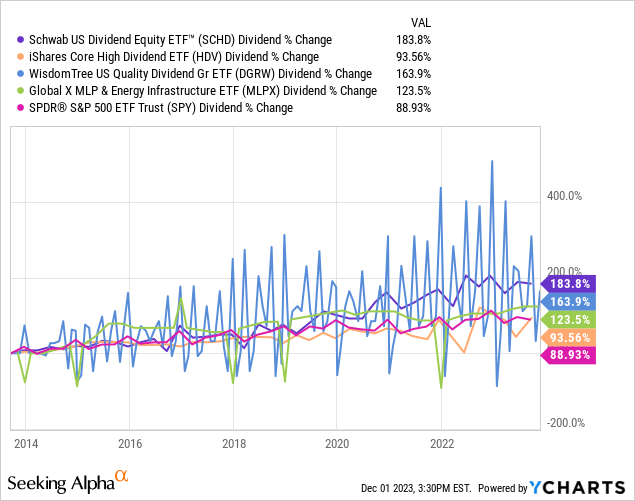

My own portfolio is heavily concentrated in real estate investment trusts (“REITs”), because my background is in real estate and that is the industry/business model I comprehend best. So, to diversify away from my tilt toward commercial real estate, I own several high-quality dividend ETFs:

- The Schwab U.S. Dividend Equity ETF (SCHD)

- iShares Core High Dividend ETF (HDV)

- WisdomTree Quality U.S. Dividend Growth ETF (DGRW)

- Global X MLP & Midstream Infrastructure ETF (MLPX)

All four of these ETFs pay growing dividends and have very little overlap with my REIT-heavy individual stock portfolio. Their collective real estate exposure is virtually nil.

Only one — DGRW — has beaten the market over the last decade in total returns…

…but all of them have beaten the market in dividend growth.

And they have done so while each offering higher dividend yields than the SPY!

For a dividend growth investor appreciate me, these four ETFs are providing exactly what I need them to: swiftly growing dividend income and diversification.

Go deep with individual stocks. Go wide with ETFs or funds.

Bottom Line

Munger gave investors many more quips and pieces of wisdom to chew on. There’s no way I could possibly cover them all, at least not as well as they could be covered. But from the preceding survey, investors can garner a handful of valuable insights:

- Commit to being a lifelong learner, both for yourself and for the world.

- Invest in your relationships and seek to nurture at least one lifelong companionship.

- Find that small number of companies about which you have deep conviction, buy their stocks, and never sell.

- Don’t look to individual stocks for diversification.

I’m sure there are many more Munger principles that are applicable to investors broadly and dividend investors specifically. This brief list will have to suffice for now, but if you think of more, please leave a comment!

For more articles in this “Dividend Investing appreciate…” series, check out: