JHVEPhoto

There was a time when Disney (NYSE:DIS) was my second-largest position (trailing only Apple in my dividend growth portfolio).

That was 5+ years ago.

It was before the dawn of the streaming wars. The company was dominating the box office and printing cash with its linear television model. And I was extremely bullish on the company’s future due to the strength of its IP and its well-diversified business model.

My oh my, how things have changed.

Today, Apple is still my largest position (by far). But, Disney is no longer in my portfolio.

Selling My Stake

After a dividend cut and years of underperformance, I finally decided to cut ties with Disney in favor of stocks that better face the perpetual compounder strategy that I’ve adopted this year.

I sold Disney back in October.

I was looking for some tax-loss opportunities to offset a big tax bill that I have coming due at the end of the year and when Disney’s recent dip pushed my shares down into the red, I finally hit the sell button at $81.59 at an 11.2% loss.

I quickly reallocated the proceeds into higher conviction picks.

I used the Disney proceeds to buy shares of Honeywell (HON) at $181.75, PepsiCo (PEP) at $157.12, Coca-Cola (KO) at $52.09, Canadian National Railway (CNI) at $106.34, and McDonald’s (MCD) at $247.08.

This trade was made at the height of the GLP-1 drug scare…when it appeared that investors believed no one would eat sugar ever again.

I didn’t buy into that thesis and was happy to accumulate some of the highest-quality stocks in the food/beverage space at historical discounts.

I also added heavily to a couple of beaten-down industrial names that are proven compounders.

All in all, I’ve been happy with the trade. I was able to stash away some cash for my recent home purchase and still increased the size of my passive income stream.

Overall, I also believe that I increased the quality of my holdings and I’m sleeping well at night no longer having exposure to the media/entertainment industry.

Moving Away From Media/Entertainment Stocks

You see, in recent years, I’ve sold off positions in companies appreciate AT&T (T), Netflix (NFLX), Comcast (CMCSA), and Disney (DIS).

There was a time when I was extremely bullish on this area of the market.

I’ve written about my Wall-E thesis…which was based upon the Pixar film depicting a future where AI and automation have made it so human beings didn’t have to do anything but sit back, relax, and stare at screens.

Everyone was obese and with GLP-1 drugs being all the rage these days, it looks appreciate I might have nailed that part of the thesis.

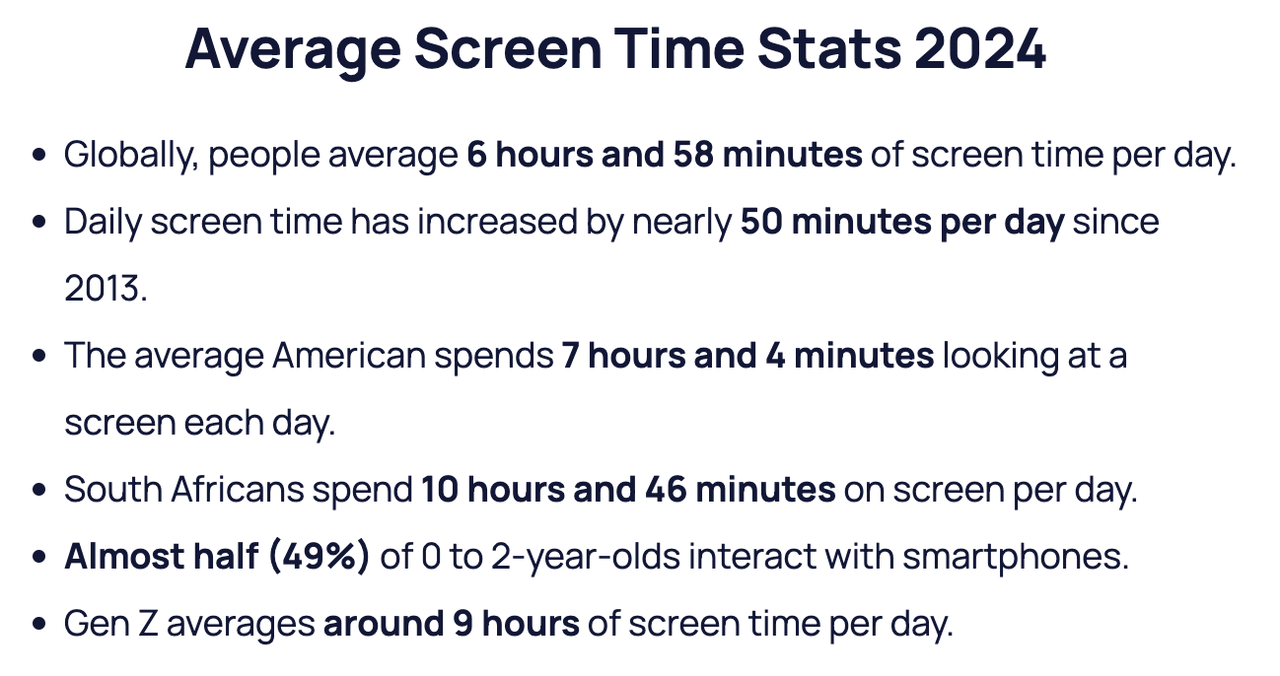

Screen time is up drastically as well.

According to Josh Howarth at Exploding Topics, we’re looking at record screen time for people across most age groups, geographic locations, and demographics.

Exploding Topics

All of this screen time is impacting our lives in many ways (mostly negative), including sleep deprivation, higher risk of diabetes, obesity, and learning deficiencies.

Moving forward, I assume that increased productivity from AI/automation will result in more and more screen time.

To me, demand for content remains a secular trend.

I got that part of my Wall-E thesis right too.

The problem is…no one has been able to capitalize on it, financially.

When I made those bullish media/entertainment investments years ago, I totally underestimated the negative impact that the streaming war would have on profitability within the entertainment industry.

Content has been commoditized and streaming distribution remains a very-low margin business.

Even Netflix, which has established itself as the leader in the streaming wars, has only recently become reliably profitable (2020 was its first year of positive operating cash flow results).

Rising competition in the streaming wars has required players to spend heavily to vie.

Disney is deep in debt right now because of its $71 billion 21st Century Fox acquisition in 2019.

At the time of that deal, I was bullish.

I assumed Disney’s then-outgoing CEO, Bob Iger (who is currently CEO as well, after returning to his post) would turn those assets into a golden goose just appreciate he did with the Pixar, Marvel, and Lucasfilm buys.

Alas, that hasn’t been the case.

Avatar (whose rights they acquired in the deal) appears to have paid off nicely (making $2.3 billion at the box office); however, I believe other popular assets such as Deadpool/X-Men have been underutilized.

Overall, I don’t think subscriber trends show that these media companies have the pricing power that they hoped they would when the streaming wars began.

Debt and Capex Hurting Shareholder Returns

Disney’s debt becomes a bigger issue in the high interest rate world that we’re living in today.

Right now, Disney’s average interest rate is still relatively low. But, interest expenses are headed higher.

Last quarter Disney spent $501 million on interest rate expenses…up from $434 million during the same quarter one year prior.

That’s what ~$42 billion of debt will do to you.

Disney has been working to reduce the burden of debt on its balance sheet.

During the last year, they’ve paid off slightly more than $3b of debt.

But, I don’t think they have the cash flows to totally pay off their debts totally in the near term (at the end of Q3 Disney had $14.2 billion of cash/cash equivalents and generated free cash flow of $3.4 billion), and therefore, having to refinance at higher rates becomes a real concern.

The Q3 results were solid, but when I factor in the mega-capex expectations that Iger had laid out in front of the company between now and the end of the decade, things get a bit more murky.

Back in September, Disney announced plans to invest $60 billion into its parks and cruises over the coming decade.

That’s actually a big part of the reason that I finally pulled the trigger on the Disney sale was because of the big capex announcement that the company made during Q3.

Parks and Resorts have been Disney’s best operating segment since the COVID recovery and I don’t blame management for investing in its most reliable cash cow.

But, this investment leads me to one of the reasons that I’ve decided to advance on from Disney: the economic sensitivity of its parts division.

Post-COVID revenge spending has bolstered Disney’s Parks and Resorts segment for a couple of years now. But, that appears to be slowing down (the company’s Parks/Resorts sales were only up 7% last quarter (a far cry from the 73% growth that Disney’s Parks segment generated in 2022).

Politics, Storytelling, and Consumer Sentiment

What’s more, it appears that political backlash from the company’s spat with Florida Governor, Ron DeSantis and several questionable story-telling decisions related to political correctness (which Iger has recently said that he hopes to correct, with the company’s priority, moving forward, being on storytelling as opposed to messaging and virtue signaling) is starting to wear on the company’s results.

Obviously, inflation (and wage inflation) doesn’t help either.

Disney has attempted to combat this by raising prices at their resorts, but I do fear that these moves are going to hurt long-term demand.

I make a respectable salary. So does my wife. We’ve vacationed to Disney World several times in recent years with our little ones. But, the most recent round of increases is making it hard to defend another trip (no matter how much we want to go back).

And rising prices aren’t just slowing spending at parks.

It’s looking appreciate 2023 will be the first year since 2014 that Disney doesn’t produce a $1 billion blockbuster at the box office.

From princesses to superheroes to galaxies far, far away…nothing is working appreciate it once was for this company.

That isn’t to say that Disney’s IP isn’t great or that it can’t recapture the magic that created so many adoring fans over the years; however, the numbers speak for themselves.

People aren’t as excited about Disney content – for a variety of reasons – and that doesn’t bode well for its other segments (Parks, Resorts, Cruises, and Merchandise) which all benefit from the trickle-down effect created by demand for its most popular movies/shows.

For instance, last quarter, Disney’s Consumer Product segment’s sales were down 5% on a y/y basis.

A week-long trip to Disney World is going to set you back at least $5,000 (or much, much more depending on what level of resort you pick).

A trip to the theaters with the family is going to cost a couple hundred dollars with candy, drinks, and popcorn factored in.

These things are weighing heavily on families’ pocket books…and it will only get worse if we head into recession.

All in all, I’ve decided to take steps to avoid stocks that are economically sensitive.

Sticking With Perpetual Compounders

Instead, I prefer to own stocks that compound their sales/earnings/cash flows reliably, throughout any number of economic environments, due to asset-light/service-driven business models, high margins, and secular growth tailwinds.

Those are the types of companies that I can count on for reliable dividend growth moving forward (my perpetual compounder focus isn’t just about capital gains, but more importantly, reliably increasing dividends as well).

Rapid dividend growth is what I’m basing my retirement plans off of. It’s also what enables me to rest easy during times of high inflation.

I knew that Disney planned on reinstating its dividend.

Iger originally mentioned that several quarters ago.

But when I looked at Disney’s recent operating results and balance sheet I assumed that its capex plans didn’t leave a lot of wiggle room for reliable dividend growth.

Since I made that sale, Disney lived up to the expectations that Bob Iger previously set for reestablishing its dividend.

They announced a $0.30/share dividend that will be paid on January 10th, 2024.

To acquire this dividend you’d have to own Disney shares on December 11th.

This news inspired a handful of subscribers to ask me, “Are you getting back in now that Disney is paying a dividend again?”

My 30-day wash-sale period is over and I could re-enter the stock in time to acquire the upcoming payment if I wanted to.

But, this $0.30/share dividend announcement hasn’t changed my outlook on the company.

Disney is still not a stock that I’m interested in owning.

This sub-1% yield isn’t very attractive to me.

I’m happy to own low-yielders.

Actually, most of my favorite companies in the market have very low dividend yields.

But, they also have double-digit dividend growth prospects…and I don’t think that’s the case with Disney right now.

To me, there are too many uncertainties surrounding the company, its cash flows, and its long-term growth prospects to own shares.

A Difficult Stock to Evaluate

It’s very difficult to evaluate Disney because of changing consumer tastes, spending patterns, and the earnings volatility that this creates.

And since I lacked conviction in my FV calculate, I realized that I probably shouldn’t own shares.

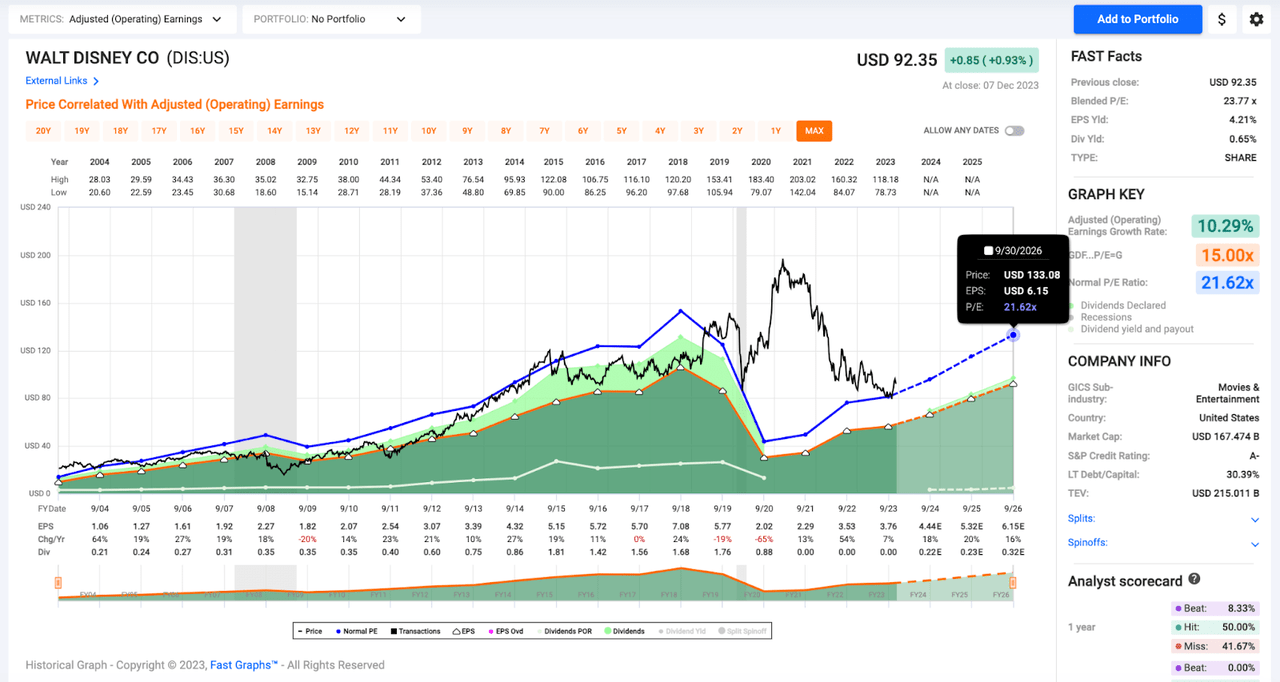

Obviously, the pandemic was a very unique hurdle for public-facing companies appreciate Disney to contend with, but its earnings fell 65% in 2020.

That was after a -19% earnings print in 2019 having to do with the Fox acquisition and increased capex as the company attempted to build Disney+ into a formidable streaming option.

Disney saw a huge bottom-line bounce back in 2022, with EPS soaring 54%.

However, even with that growth in mind, 2022’s $3.53 full-year EPS was still less than half of 2018’s $7.08/share annual total.

Right now, analysts expect to see Disney compound its earnings at a 20% clip moving forward over the next several years.

However, even with those torrid growth prospects in mind, Disney’s full-year 2026 EPS is still likely to be a dollar less than the 2018 figure.

And honestly, with a potential recession on the horizon, I think analysts may be too optimistic here.

Disney’s 2023 EPS growth came in at 7% and that was with a record year from the parks.

The Media/Studios segment is still struggling and if Parks & Resorts fall apart because of macroeconomic pressure…well, I think DIS is going to have a hard time hitting that 2026 consensus target of $6.15/share.

With all of that in mind, the question remains, what should investors pay for Disney shares?

Historically, they’ve traded at a premium to the market, in the 20-22x range.

F.A.S.T. Graphs

As you can see, if Disney continues to follow the historical trend line and analysts are right about that rapid earnings growth, inventors buying shares here are going to make a lot of money.

However, those are two big “ifs” in my book.

And I don’t have the faith in the media industry anymore to stick around for “ifs”.

Disney’s 10 and 20-year average P/E ratios are 25x and 21.6x, respectively.

However, that average is largely made up of data from before the streaming wars.

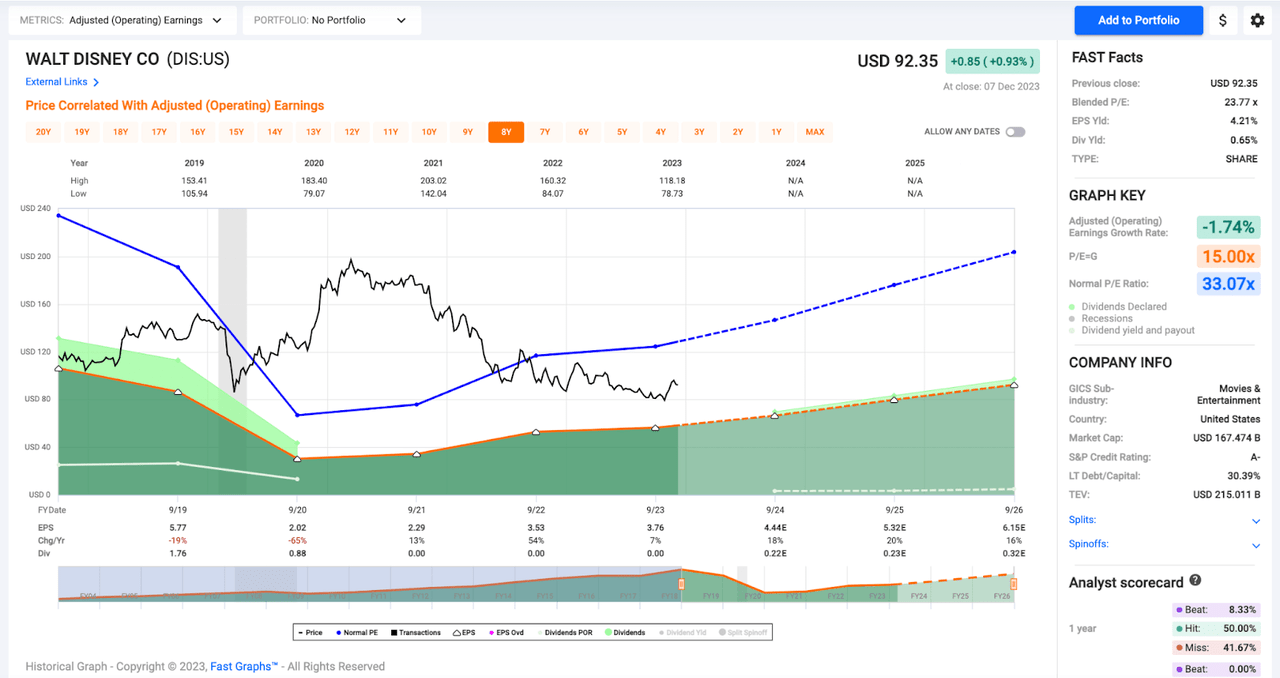

And things become even more difficult to wade through when I look at more recent averages.

Disney’s average P/E during the past 5 years is north of 33x because of the huge premium that shares carried during 2020 and 2021 caused by its stock price and its fundamentals heading in two separate directions.

F.A.S.T. Graphs

In hindsight, that was the time to sell. But, hindsight doesn’t matter much in the present, and at the time, I bought into the hype that Disney+ was going to take over the world.

I suppose there’s an argument to be made that a 33x multiple is fair if I truly believed that Disney would compound its earnings at a 20% rate over the next several years. But, I do not.

This isn’t a company with secular trend trends behind it. It’s dependent on the consumer and I’m not looking to pay such high multiples for any consumer discretionary stock.

I decided that a ~20x multiple was probably fair. That’s below historical averages, but above the broader market’s premium, reflecting Disney’s strong IP and double-digit growth prospects.

However, 20x ttm earnings back when I sold was ~$75/share.

20x forward earnings (if you believe that analysts are correct and Disney will grow its EPS by 18% this year) is nearly $89.00.

I wouldn’t be surprised to see 2024 be more in line with 2023 and therefore, a 20x multiple on my forward calculate was roughly $83/share.

With that ttm multiple of $75/share and the forward multiple at $83/share, I was content to sell my shares at $81.60 (because with the tax-loss savings in mind, I was essentially breaking even at $83).

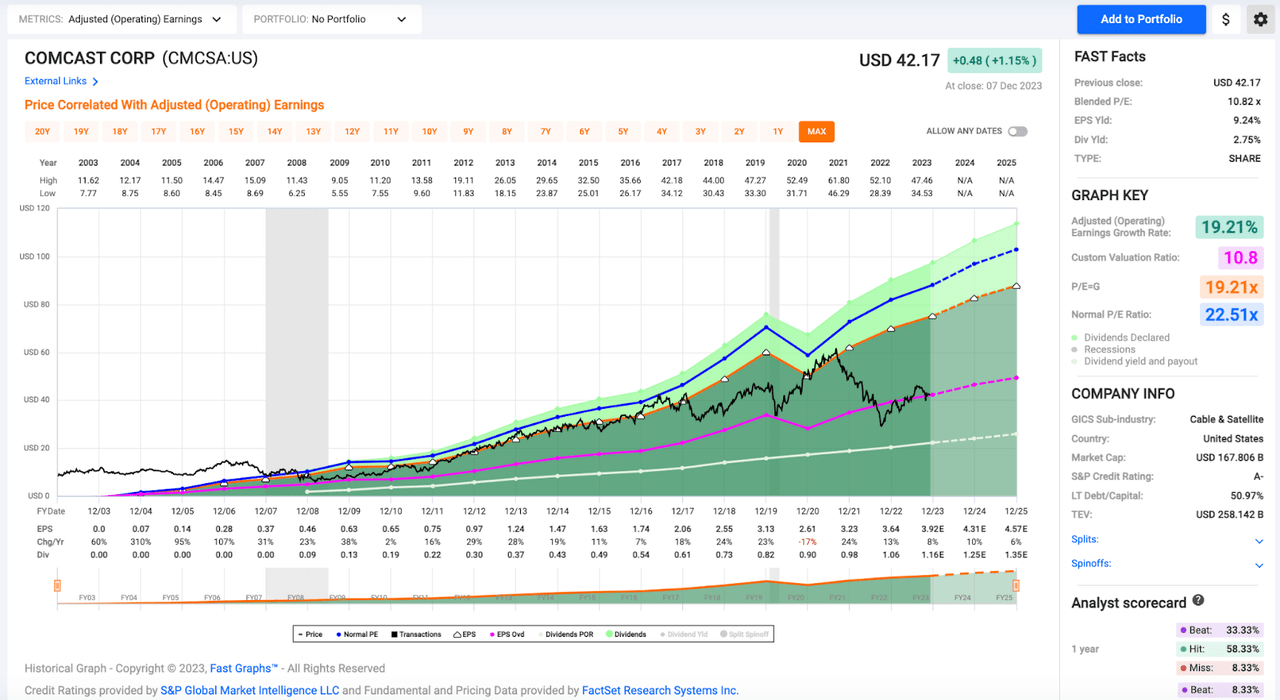

Furthermore, when I was performing these mental gymnastics, I couldn’t help but consider the fact that Comcast, which is Disney’s closest peer, in my estimation (they have strong IP, television, movie, and theme park assets), was trading for roughly 10x earnings.

F.A.S.T. Graphs

Comcast’s 2024 growth forecast is essentially in line with my more conservative, ~10% growth calculate for Disney next year.

What if the market is right about Comcast and that’s the multiple that a mature (diversified) media company deserves to trade with?

Then my 20x target for Disney would represent a gross overvaluation and potentially lose me a lot of money.

The more I think about it, the more sure I am…Disney doesn’t deserve a Netflix-appreciate multiple (NFLX shares currently trade for 28.5x forward expectations).

Why?

Because NFLX is much less economically sensitive than Disney is.

It sells a product in the $10-$20 range…whereas Disney relies on big ticket expenses from the consumer to uphold its bottom line.

All in all, the risk/reward of Disney, relative to other blue chip dividend growers who had recently sold off, wasn’t worth it to me.

And it still isn’t today because I don’t buy into that ~20% EPS CAGR story between now and 2026.

Not only does this company not face my compounder quality thresholds…it’s not a deep-value stock either.

Never Fall In Love With A Stock

Therefore, it was sitting in no-man’s land in my portfolio and when thinking about my overall financial situation, I decided to part ways with the company after years of ownership.

Now that I’m pivoting towards this new compounder-centric strategy, I’ve had to remind myself, never fall in love with a stock (as nostalgic as Disney maybe).

I have a couple of young children at home, so I’ll continue to consume Disney’s content and buy their merchandise regularly.

People who follow my work closely know that I appreciate trading card games and I’m excited about the potential of Lorcana moving forward. I’m thinking about buying into the Amber/Steel songs deck that’s been doing well at events. That’ll add to Disney’s bottom line.

And even though the prices are off-putting, my wife and I are going to do our best to make another trip to Disney World next winter happen (it’ll be nice to get out of the cold and everyone really wants to see Main Street USA all decked out with Christmas decorations).

Without a doubt, I’m a Disney fan. That hasn’t changed. But, as much as I love the company’s products, I no longer feel compelled to own shares.

Right now, I think there are better places to allocate capital.

Simply put, you won’t see me owning media/entertainment pure plays anytime soon.

I’ll stick with big tech for that exposure:

-

Apple (Apple+)

-

Amazon (Prime Video)

-

Alphabet (YouTube/YouTube TV)

Those stocks furnish amazing cash flows, much stronger balance sheets, and other revenue streams that benefit from secular tailwinds.

And I’ll target stronger companies with more predictable, reliable earnings driven by secular growth trends with any new capital that I deploy.