Valerie Loiseleux

Due to what has now become multiple changes in leadership over the past several years, The Walt Disney Company (NYSE:DIS) has restructured its operations multiple times. The most recent time that this was announced was back in February of this year. At that time, the company announced its goal of restoring creativity to the enterprise by changing what parts of the business are grouped together and by placing greater decision-making power in the hands of those that should be in charge. Although some may have thought that these were empty promises, management is finally making some significant steps aimed at achieving that goal.

Since its previous restructuring, Disney was set up into two primary operating segments. The first of these was the Disney Media and Entertainment Distribution segment and the second is known as Disney Parks, Experiences and Products. I was personally skeptical of the decision to group so many different operations together. And it is clear now that the situation was not working out optimally like the old management team thought it would. The company has now made the official decision to split things up again, with the goal of their galloping three segments moving forward.

While this change is important and deserves to be covered, what’s most exciting about it is that management, for the first time, has provided some really important details regarding ESPN. In recent months, management has been looking for ways to reinvent this segment, likely through some sort of strategic partnership or joint ownership with another value-added prospect. And this reveal of key financial data gives us some idea as to what ESPN might ultimately be worth. While the findings don’t support the notion that the operation is worth the $50 billion that has been floating around, that doesn’t change my view that shares are drastically undervalued.

A new structure

Before we get into the interesting details regarding ESPN, it would be helpful to give a brief overview of the new structure of Disney moving forward. As opposed to the two aforementioned operating segments, the company will now have three. The first of these will be the Entertainment segment, which will consist of Linear Networks, Direct-to-Consumer, and Content Sales/Licensing. An entire article could be dedicated to each of these sets of operations. But for the purpose of this article, a brief description will suffice.

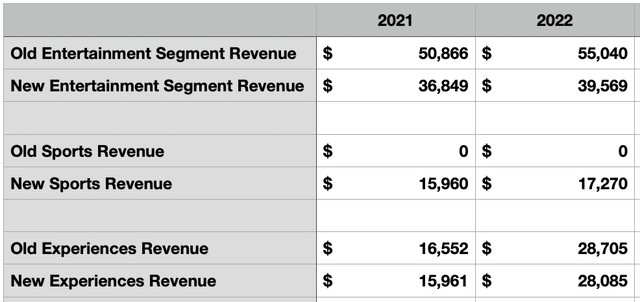

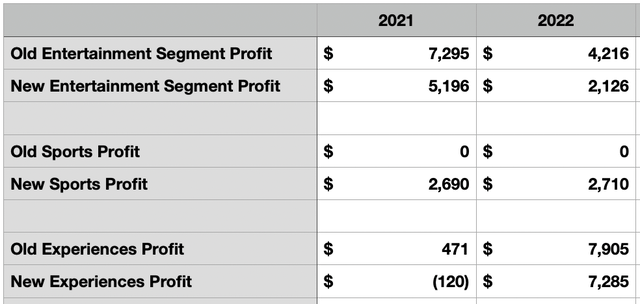

Author – SEC EDGAR Data

Linear Networks, for starters, focuses on both the domestic and international television networks and television stations that the company owns and operates. Examples include the Disney Channel, ABC, National Geographic, and more. It also includes the company’s 50% equity investment in A+E Television Networks, which operates A&E, HISTORY, and Lifetime. Direct-to-Consumer we will include all of the company’s streaming operations with the exception of ESPN+. This means Disney+, Disney+ Hotstar, and Hulu. And Content Sales/Licensing includes the sale and licensing of film and television content to other parties, the company’s theatrical distribution operations, home entertainment distribution, and a wide variety of other businesses like its Broadway productions and music distribution.

The second segment will be known simply as sports. You get 10 points if you can guess which operations fall under this unit. If you guessed ESPN, you would be correct. More specifically, it’s the 80% of ESPN that Disney owns. It also includes the ESPN+ streaming platform and Star, the latter of which is a set of sports channels in India. In the last segment will be known as experiences. This will include the company’s parks and resorts, as well as all of its Consumer Products operations.

Author – SEC EDGAR Data

Although it may seem simple to take different parts of a company and split it up, it is a rather complicated task when dealing with such a large and complex organization as Disney. In the two tables interspersed throughout this section of the article, you can see how the revenue and profits of the company will change using data from both 2021 and 2022. At the end of the day, the company generates just as much revenue and profit as it did previously. But where that revenue and profit falls has shifted rather meaningfully. The biggest difference involves the Sports segment. Since this segment did not exist previously, it had no revenue, nor did it have any profits. But now, it will be a major part of the enterprise. In 2022, it generated revenue of $17.27 billion. That’s up nicely from the $15.96 billion generated one year earlier. Operating profits, meanwhile, have gone from $2.69 billion to $2.71 billion.

ESPN is in play

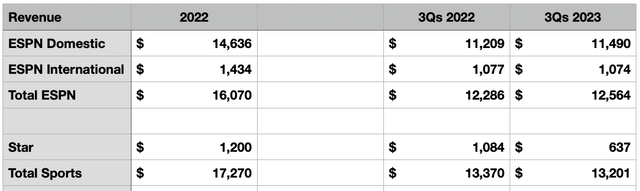

The biggest takeaway from this change is that management has finally, for the first time, revealed significant financial data covering ESPN. This includes both the traditional business known as ESPN and the streaming service called ESPN+ that the company has historically kept separate from the rest of the sports entertainment operation. In the chart below, you can see revenue data covering the first three quarters of 2023 for Sports data covering at the same time of the 2022 fiscal year. That includes breakout data for ESPN on its own. In the same chart, you can see results for the 2022 fiscal year in its entirety.

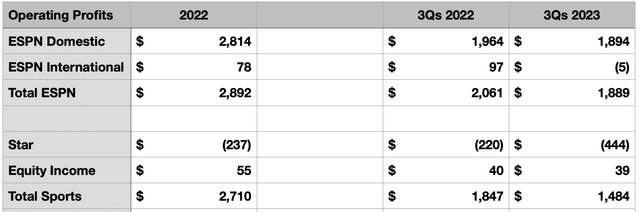

Author – SEC EDGAR Data

Although this does not have as many years worth of data as I would like to see, it is pretty telling on its own. Last year, ESPN brought in $16.07 billion worth of revenue. Operating profits came in at $2.89 billion. This year, we are seeing some strength from the brand from a revenue perspective. In the first nine months of 2023, revenue came in at $12.56 billion. That’s up from the $12.29 billion reported one year earlier. All of that strength came from the firm’s domestic operations. On the other hand, the bottom line is facing some issues. Higher costs have resulted in profits falling from $2.06 billion in the first three quarters of 2022 to $1.89 billion the same time this year. Obviously, we don’t know what the final quarter has in store. But if we annualize the results experienced so far, we would expect revenue for the year in its entirety to be $17.05 billion and operating income to be a bit lower than last year, with a rough estimate of $2.18 billion.

Author – SEC EDGAR Data

There have been a lot of rumors going around regarding what Disney might ultimately do with ESPN. Although I don’t think an outright sale is likely, some have suggested that the company could sell it off for around $50 billion. Apple (AAPL) has even been suggested as a potential buyer. At the end of the day, it’s really difficult to know what a platform like ESPN is worth. Cable is dying, but the streaming service is doing quite well for itself and, as a whole, ESPN continues to expand on the top line. It has a virtual monopoly, or something close to it, in the sports industry, particularly when talking about the U.S. market. But based on the data we are seeing here, $50 billion might seem a stretch.

I will be perfectly honest with you when I say that there aren’t any good comparables to pair ESPN up against for valuation purposes. The closest thing that I could think of to compare it to would be entertainment conglomerate Comcast (CMCSA). The fact of the matter is that Comcast is a very diverse business. But it has a tremendous amount of sports related content. I would have opted instead to compare it to pure play streaming services. But since streaming is still a very small part of the larger ESPN brand, that didn’t feel right. Last year, Comcast generated revenue of $121.43 billion. Its operating profits came in at $14.04 billion. On an enterprise value basis, the company is worth $270.76 billion.

Author – SEC EDGAR Data

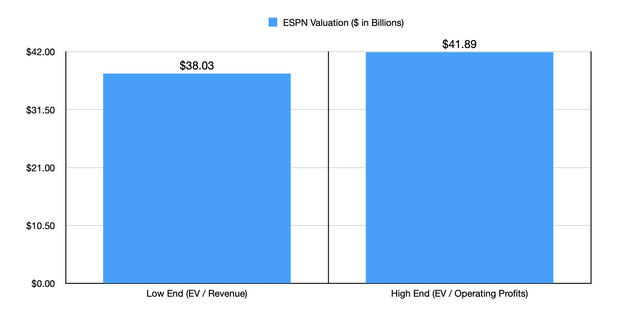

In a sale, we would likely be looking at a debt free and cash free ESPN being offloaded. If that’s the case, the market price paid would be the same as enterprise value. Comcast is currently trading at 2.23 times revenue and at 19.28 times operating profits. If we apply this same multiple to ESPN, we would end up with a value of between $38 billion and $41.9 billion. Is it possible we could get up to $50 billion because of the sheer market presence that ESPN brings to the table? I suppose so. But that seems like a stretch to me. This valuation could also be useful if Disney sells off a portion of ESPN as part of some broader strategic initiative. But only time will tell what happens there.

Takeaway

These are exciting times for Disney and the company’s shareholders. As a shareholder myself, I am ecstatic to see management finally put out some interesting data regarding ESPN. It’s also refreshing to see the company reorganize its operations. The new structure makes a great deal more sense to me, and this further underscores the quality management that’s currently at the helm. Add on top of this all of the other positive things the company has had going for it recently, and I have decided to maintain my ‘strong buy’ rating on the stock.