Chip Somodevilla/Getty Images News

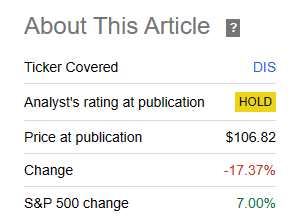

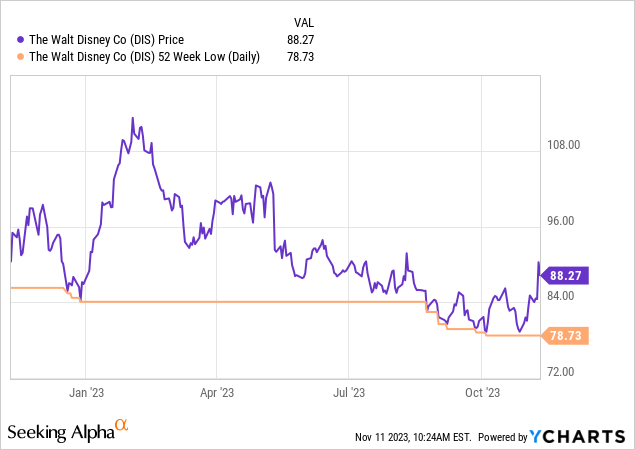

Our last coverage of The Walt Disney Company (NYSE:DIS) was almost 9 months back. While we rated the stock a hold/neutral (unlike our 2021 pieces, see here and here), we felt that the magic number was likely to be $80.

But Disney’s 2X sales multiple pre-COVID-19 was a far more profitable company with no sinkholes like Disney+. So we think we go lower based on that. Technically speaking the $80 mark has been an important bastion of support and marked the COVID-19 lows as well as the 2014 lows.

In the recent drop we came close but did not quite breach through. At a minimum we think that $80 number will be tested and likely we will go through that. We see no issues with the stock trading at even 12-14 times earnings, especially with risk free interest rates so high and the magic of Disney+ now in the rearview mirror. Look lower and look to buy under $80.

Source: 3 Years Ahead Of Schedule

The stock complied in every single way. It went lower and lagged the S&P 500 (SPY) by 24.37%

Seeking Alpha

It also went right through that $80 mark, on three occasions, but it has bounced back.

We look at the Q4-2023 results, the longer term strategy and update our call in light of the current valuation.

Q4-2023

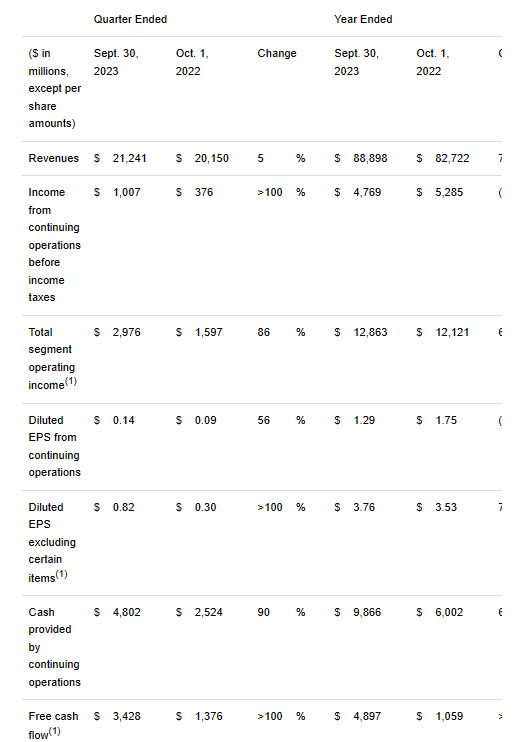

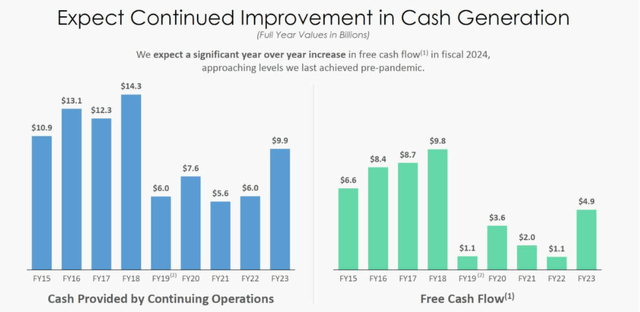

Disney’s fiscal year ends in September and the recently released results were for the fourth quarter. The media giant missed the revenue estimates by a smidge but walloped the non-GAAP EPS estimate and that sent the stock flying out of the gate. What was possibly a bigger signal for the bulls, was the free cash flow generation which exploded to $3.4 billion. As you can see below, this number is far ahead of fiscal quarter of Q4-2022. In fact, in the entire fiscal year 2022, Disney generated less than a third of this.

Disney Q4-2023 Press Release

Disney’s slide deck continued to pressure this point, with expectations of a bigger increase next year. Pre-COVID-19 we saw $12 billion annual run-rates and Bob Iger spoke about reaching that.

Disney Q4-2023 Presentation

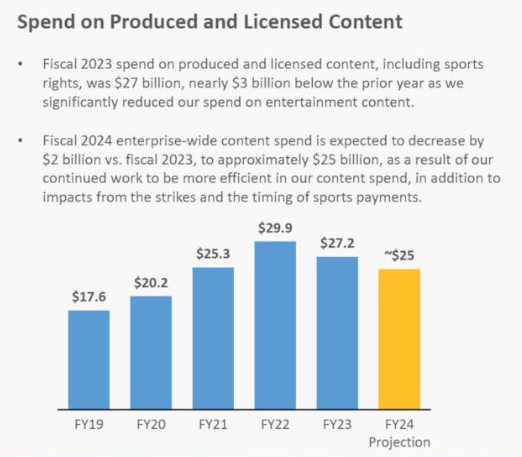

To be sure, this was not some growth story revival. The numbers were going to come from Iger’s strategy of spending with restraint (in other words, not like the US Government). The expected drop for licensed content will be about $2 billion in 2024.

Disney Q4-2023 Presentation

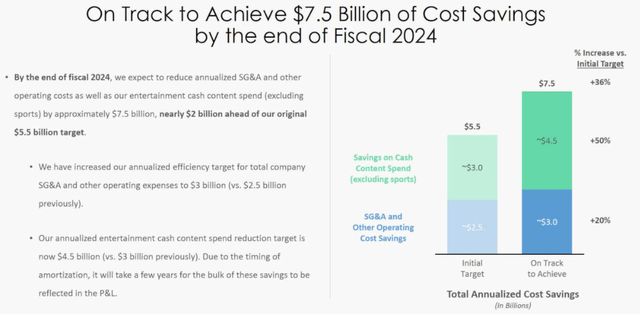

If you use a 3%-4% deflator on that, inflation adjusted spend will drop at least 11% in 2024. Other bonuses will come from the SG&A expense savings.

Disney Q4-2023 Presentation

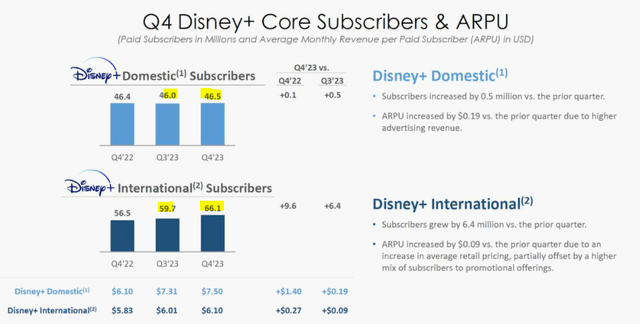

Those were the highlights from the Iger powerwalk. There were some low points as well. The much advertised growth in the Disney+ segment was primarily a feature of international (read that as very low paying) subscribers. Domestic growth was extremely muted with numbers barely ahead of Q4-2022.

Disney Q4-2023 Presentation

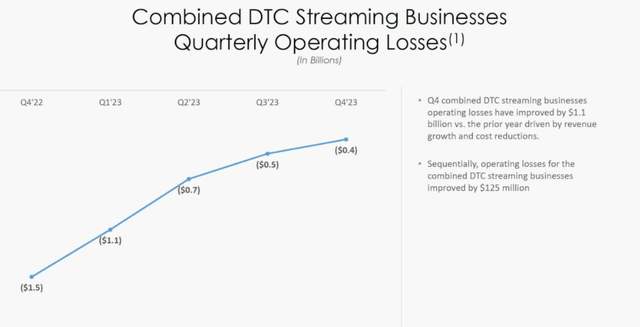

The saving grace here was that average revenue per user (ARPU) was up nicely as pricing and advertising revenues helped saved the day. Disney is still getting losses handed to it on its Direct To Consumer segment, but these losses look more manageable today versus a year back.

Disney Q4-2023 Presentation

Outlook

Disney’s focus has rightly shifted to profits and free cash flow versus that senseless growth mantra it followed in 2021. Bob Iger’s strategy shift has had less than a year to play out and the results already look very impressive. Streaming is expected to be profitable for Q4-2024.

Our new structure also enabled us to greatly enhance our effectiveness, particularly in streaming, where we’ve created a more unified, cohesive and highly coordinated approach to marketing, pricing and programing. This has helped us to improve operating results of our combined streaming businesses by approximately $1.4 billion from fiscal 2022 to fiscal 2023. And we remain confident that we will achieve profitability in Q4 of fiscal 2024.

Source: Disney Q4-2023 Conference Call Transcript

We must add here that we were a bit skeptical that the company can turn profitability levers so quickly, but it has indeed succeeded in this short timeline. So what then ails the stock? There are two issues, which might be interconnected.

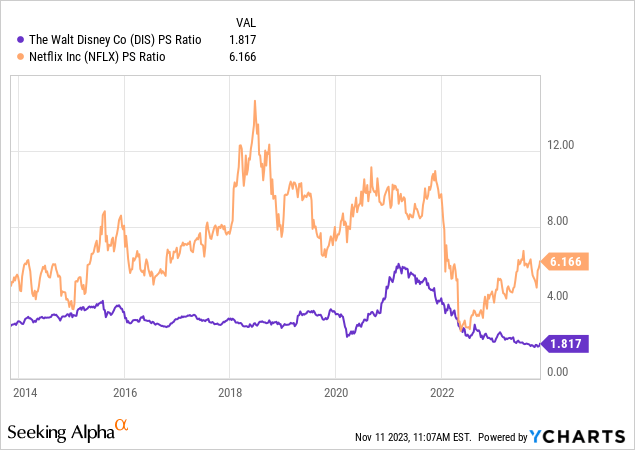

The first was that Disney traded at some incredibly ridiculous valuations and that needed to be worked off. In March 2021, Disney traded at nearly 6X sales. You are just not going to make money on longer timeframes from that multiple. People attributed to “reopening” and “streaming growth”, but revenues are not profits and paying 6X revenues is generally disaster outside the software sector.

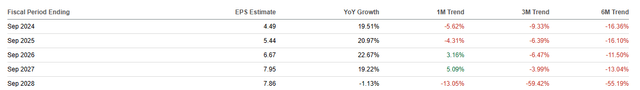

The second was that Disney analysts were an incredibly optimistic bunch. Now, most analysts lean optimistic but Disney’s expectations were off the chart. One way to visualize this is to see how earnings estimates have evolved in the face of Bob Iger delivering a great and rather rapid, turnaround. Earnings estimates for fiscal 2024 are still falling!

Seeking Alpha

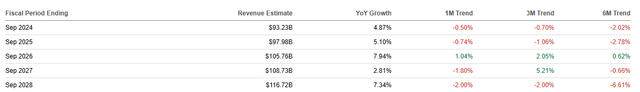

In fact, they have fallen across all recent timeframes and across all fiscal periods ahead. So expectations were so high, that even this turnaround has led to a downgrade of estimates. Think about that. More importantly, the bar still remains high for Disney to jump over. Expectations are that earnings will grow at a 20% compounded rate for the next 4 years. All on the back of very modest sales growth (shown below).

Disney Q4-2023 Presentation

So everyone has priced in some great numbers and even the recent downgrades have not really fixed that. The challenges remains that Disney will disappoint despite Bob Iger focusing on profits and free cash flow.

Verdict

Disney is cheap today relative to its history and at a price to sales multiple of under 2.0X, your odds of making a bang for your buck are high. Yes, Disney+ is nowhere near as profitable as Netflix, Inc. (NFLX), but that shows the potential for growth and at least some valuation expansion.

The problem remains what we call the hurdle rate in finance. With risk-free rates approaching 5% (reference to 10 year Treasuries here), you could see more valuation compression. There is certainly nothing wrong with a 12X-14X multiple in such an environment. We remain optimistic of the longer term strength in the franchise and believe you could manage 6-7% annual returns from here. But do you want to? You could get the same in investment grade bonds yielding 7.0%-7.5% to maturity with a fraction of the risk. So while we can swear that investors will have a happy 10 year outcome from here, relatively, we are hard pressed to slap a buy at almost 20X 2024 earnings. We reiterate a hold and would wait some more time for Bob Iger to work his magic.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.