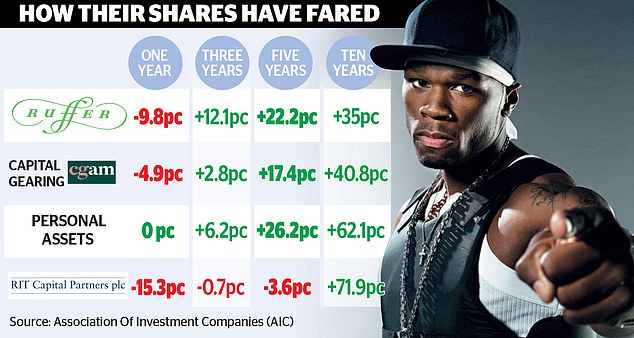

Discontent surrounds the performance of the so-called wealth preservation investment trusts Capital Gearing, Personal Assets, RIT Capital Partners and Ruffer.

These funds are foundering in their mission to provide a buffer in a challenging era through a mix of holdings, some defensive like bonds, some esoteric, like derivatives.

This would be disappointing at any time.

But it is particularly so at present when the Israeli-Hamas conflict means many investors are looking for lower-risk options.

The share prices of the four trusts stand at a discount to their net asset value (NAV), as a result of sundry misjudgments, including the failure to spot the emergence of the ‘tech is everything’ movement that has powered Silicon Valley stocks.

Facing the music: Ruffer is nicknamed ’50 Cent’ after the US rapper

RIT Capital’s discount was 18pc in August. It is now 25 per cent.

Ruffer, the best known of the quartet, aims for ‘consistent positive returns, regardless of how markets perform’.

But its shares are down and the trust has moved to a 4 per cent discount, overshadowing past successes, like a lucrative bet on complex derivative contracts during the pandemic. Since these contracts cost 50 cents each, the fund earned the nickname ’50 Cent’ after the US rapper. Wealth preservation can be rock-n’roll – or, more accurately, hip-hop.

Ben Yearsley of Shore Capital says ‘Ruffer got it wrong this year,’ and some investors are abandoning this trust and its rivals. This may be short sighted. A few economists may insist that the possibility of recession has receded. Others say that a hard or soft landing could still loom for the UK and US.

Duncan MacInnes, co manager with Jasmine Yeo of the Ruffer trust, says: ‘There is a ton of evidence in the bond markets and elsewhere that we’re heading for a slowdown. This was our call before events in the Middle East. That situation adds to the view.’

Ruffer has its lowest-ever weighting of shares, although Shell and other petroleum stocks make up 6pc of the portfolio, on the basis that oil can act as a geopolitical hedge during a period of conflict.

MacInnes and Yeo have been buying US index-linked government bonds – Treasury Inflation Protected Securities or Tips.

MacInnes says: ‘Currently there are attractive returns in low-risk assets like Tips which offer very certain returns in an uncertain world. The bonds that mature in 30 years are trading on a ‘real’ yield of 2.5 per cent – with index-linking on top.’

In 2021, when interest rates and inflation were low, you would have had to put $1,200 aside in these bonds to have spending power of $1,000 in 30 years. Today you need only $490 to achieve this – appealing to anyone saving long-term.’

Investment trusts can slim down their discounts by buying back their shares, in a move that is ordered by directors, not managers. This week Capital Gearing bought back a chunk of its shares, hoping to narrow its discount which has been caused partly by its stakes in other trusts that have tumbled to a discount, as James Carthew of the analytics group QuotedData points out.

Ruffer bought back shares in August, but Carthew argues that the board took too long to act.

Since I am an investor, I hope that the directors shoulder their responsibility to address the discounts. But, as I wrote in April, I would rather that professionals assume some of the responsibility of building the defensive section of my portfolio, and am willing, for the moment, to accept the recent results. After all, as the brokers Numis highlight, Ruffer has ‘an impressive record of insulating against market falls, most notably during Covid and the global financial crisis’.

If you are taking a closer look at the sector, note that Capital Gearing is an Interactive Investor best buy and that QuotedData considers that Personal Assets has ‘small positive progress’ towards boosting its NAV. This trust holds Tips, but also gold bullion and shares like Diageo, Nestle and Unilever, manufacturers of products that ought to be solace to consumers in a challenging epoch.

RIT Capital Partners, where the largest shareholders are members of the Rothschild family, has the widest discount – despite buybacks. Its unquoted company holdings are the source of controversy and, arguably, make the trust the riskiest proposition.

That said, Carthew observes that while RIT Capital has ‘the worst short-term track record over one year, but it has the best numbers by some distance over 10 years.’

Yearsley suggests another option – the Argonaut Absolute Return fund, run by the outspoken Barry Norris, which also strives to provide a shelter. Norris has a determinedly anti-ESG stance.

This may not accord with your views but diversification in every sense may be key to preserving your savings now.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.