Andrii Yalanskyi

Direct Digital Holdings (NASDAQ:DRCT) is one of the most exciting recent IPOs, and the firm looks positioned for significant growth. Due to strong earnings estimates, the market has valued the stock highly. While the company looks to have a promising next decade ahead, I believe investors should be cautious and consider how a potential slowdown in growth could affect the stock at its current valuation.

2024 Operations Update

Direct Digital Holdings operates through Colossus SSP, Huddled Masses, and Orange 142 subsidiaries. The firm offers sophisticated sell-side and buy-side advertising platforms catering to multiple sectors. It has over 125,000 monthly clients, generating 300 billion impressions every month.

The company raised its mid-point fiscal 2023 revenue guidance to $180 million, indicating 101% YoY growth. This is a reflection of its confidence in its growth strategies and leverage in operations, strengthened by favourable market trends.

Direct Digital Holdings’ CEO, Mark D. Walker, has discussed strategic partnerships, including a collaboration with Amazon (AMZN) Publisher Services. It involves integrating Direct Digital’s Colossus SSP with Amazon’s Transparent Ad Marketplace. This should provide its media partners with increased access to direct, premium, and scalable advertising.

In addition to the Amazon collaboration, Walker has mentioned a strategy focused on cities covering prominent geographic areas. The firm is aiming to increase its presence in the advertising and technology sectors. Its collaborations and partnerships will be crucial in optimizing reputation and scalability.

Financial Analysis

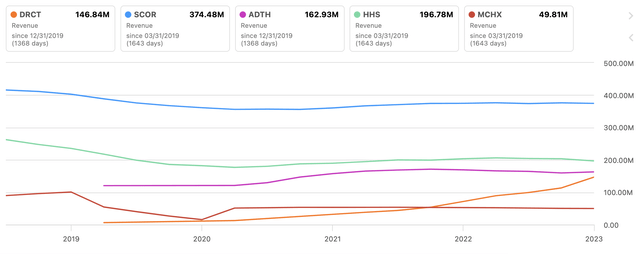

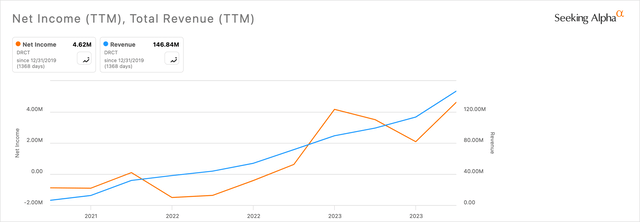

The company’s total revenue, while relatively low compared to some of its major peers, is growing steadily. It has present YoY revenue growth of 105.32%. The firm’s net income has a staggering 642.70% YoY growth.

Seeking Alpha Author, Using Seeking Alpha

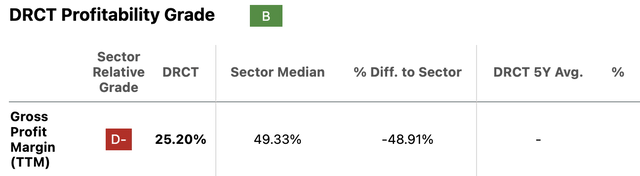

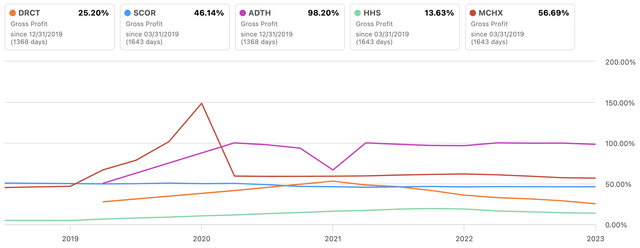

While the company has quite a strong net margin, its gross margin is less appealing, showing an almost -50% difference to the sector median:

This is made further evident by looking at the chart of its major peers compared on the metric, where it comes in near the bottom of the group:

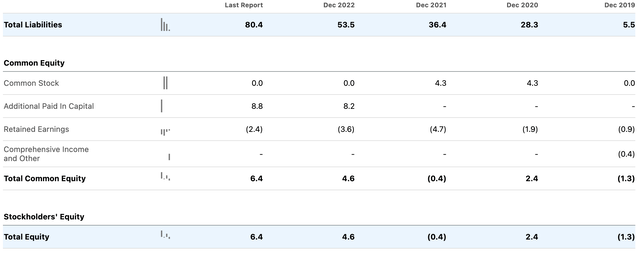

As is often expected with a company so early on in its development, its balance sheet is highly leveraged; it was founded in 2005, with its IPO in 2022. While the low level of equity in relation to total liabilities could inhibit growth and pose some risk in case of economic challenges, a high level of leverage is acceptable, considering the firm is in a heavy growth stage.

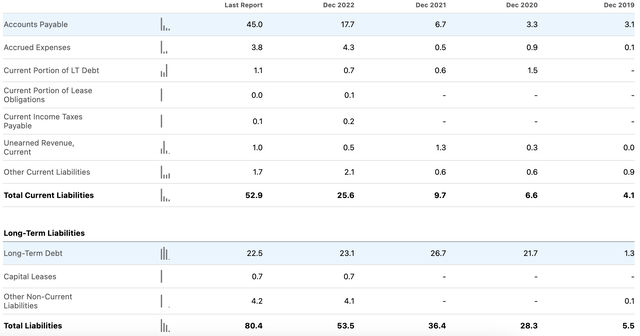

Most of its liabilities are accounts payable, as well as a significant amount of long-term debt:

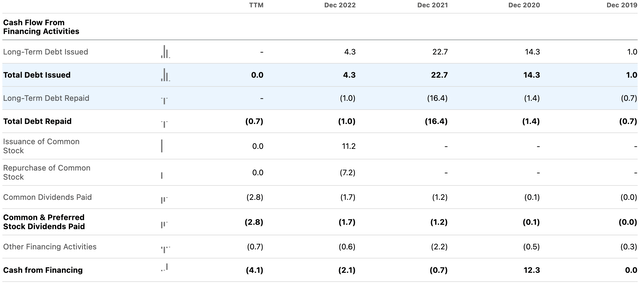

A lot of said long-term debt was issued in 2021 and 2020, but a significant amount was repaid in 2021 as well:

Also, the company currently does not pay a dividend and has not made any plans to start doing so in the next twelve months. Therefore, investors looking for passive income opportunities at this time from DRCT stock should look elsewhere. The complete reinvestment of earnings and a common stock repurchase of $7.2 million in 2022 also evidences a price-return focus for the firm at this time, a strategy I think is wise to gain traction in the public market.

Valuation Risk

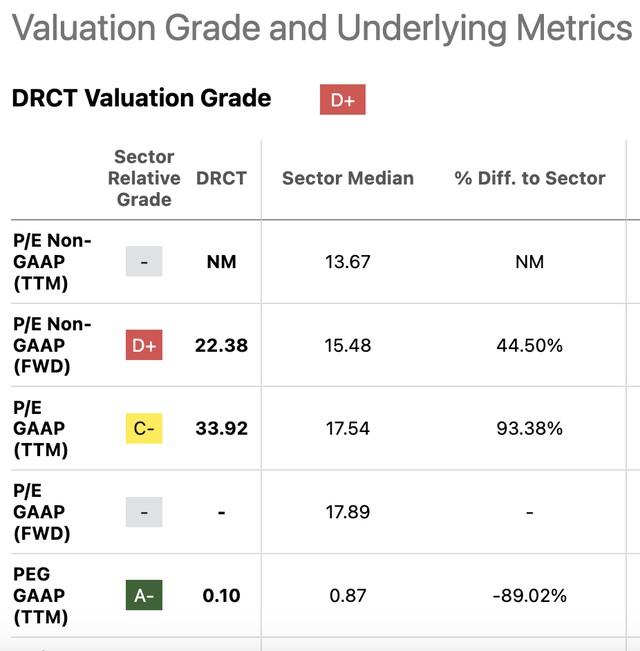

The company’s valuation seems to be the most obvious risk to me, rated D+ by Seeking Alpha’s Quant Factor Grades with a P/E non-GAAP ratio of around 22.5 and a P/E GAAP ratio of around 34. On the GAAP measure, it has around a 93% higher ratio than the sector median of around 17.5.

Nonetheless, the firm’s PEG ratio is a very strong 0.10, around a -89% difference from the sector median of 0.87. This represents the firm’s strong growth prospects and, in some respects, helps to validate its present stock price.

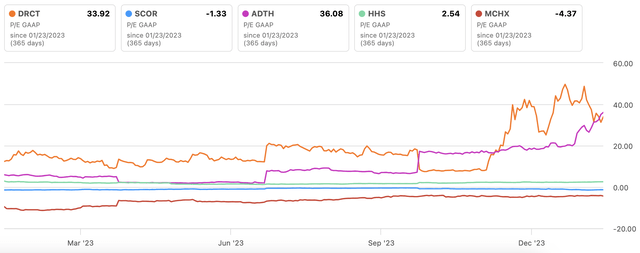

Looking at DRCT stock against its major industry peers, we can see it is almost the highest-valued of the group and has been consistently for the longest period:

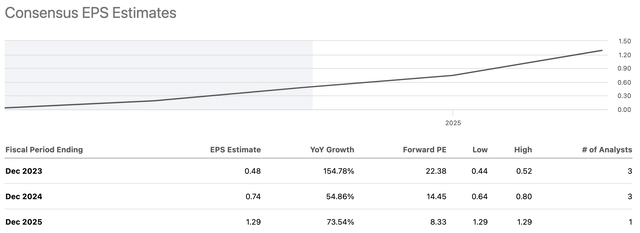

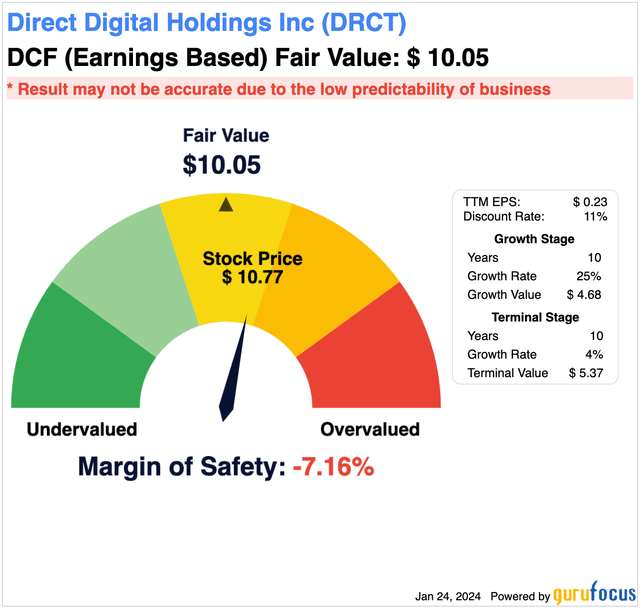

Considering the firm’s current strong growth in EPS and consensus growth estimates being very high for the next few years, I have decided to use a conservative but still optimistic 25% EPS growth rate for the 10-year growth stage of my DCF analysis. I have kept the terminal value at a standard 4%, and the discount rate is set to 11%.

Seeking Alpha Author, Using GuruFocus

Based on this conservative estimate, which accounts for a high future growth period and assumes that the firm does not encounter any significant challenges, the stock could be considered around 7% overvalued. However, such an estimation is impossible to get precise, and it instead seems fair to me to address the stock as fairly valued based on its current high P/E multiples but considerable strong growth forecasted ahead.

Further Risks

While DRCT has shown substantial growth, and investors expect this to continue, there are valid concerns about how sustainable this is. These high growth rates will likely return to the mean, and as such, the 25% EPS growth estimate outlined above could be considered too optimistic. If that is the case, the stock might be overvalued at the moment. In any case, investors should consider that volatility in the share price is likely if the company fails to maintain significant growth rates over the next ten years. Part of what will significantly affect the firm’s ability to continue compounding its growth will be how proficiently it scales its technology, talent, and infrastructure.

How the company effectively acquires and retains customers in the future will also be a significant factor contributing to its long-term success and continued growth. If the firm fails to retain its clients over the long term, the stock will not see the outsized growth some investors are expecting. To ensure the scaling process runs smoothly, the firm has hired Calvin Scharffs (formerly at Pixalate) as Vice President of Marketing and Michael Ivancic (formerly at EMX) as Head of Product. The appointments are positioned to strengthen the firm’s growing customer base and particularly enhance its sell-side technology platform.

Conclusion

Direct Digital Holdings has extremely strong growth and risks that seem relatively minor when evaluating the investment opportunity as a whole. The valuation is a just reason to proceed with caution, as is its highly leveraged balance sheet. However, a small allocation to this stock in a higher-risk portfolio might be worth considering. My analyst rating for Direct Digital stock is a Buy.