Delmaine Donson

Direct Digital Holdings (NASDAQ:DRCT) is a digital advertising agency, that operates in both the demand (companies trying to purchase advertising) and supply (publications trying to sell advertising) side of the business. The company claims to specialize in multicultural, diverse demographics.

Last year, I wrote an article about DRCT, in which I recognized the company’s tremendous growth and looked at it cautiously. The multiple asked for the company were high, and I was unsure about some aspects, such as the source of the tremendous growth of the sell-side business, the accumulation of receivables, and customer concentration. I commented that I did not consider DRCT an opportunity.

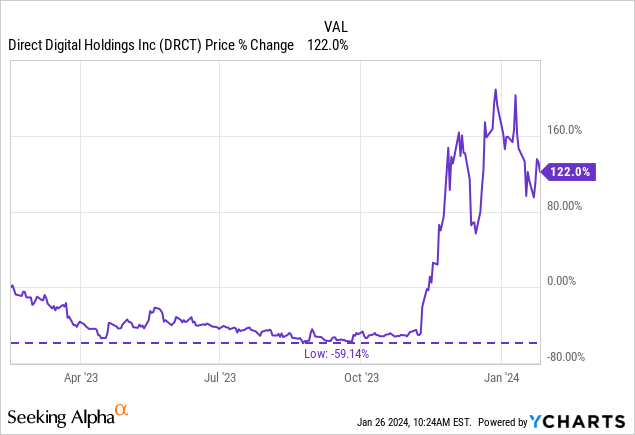

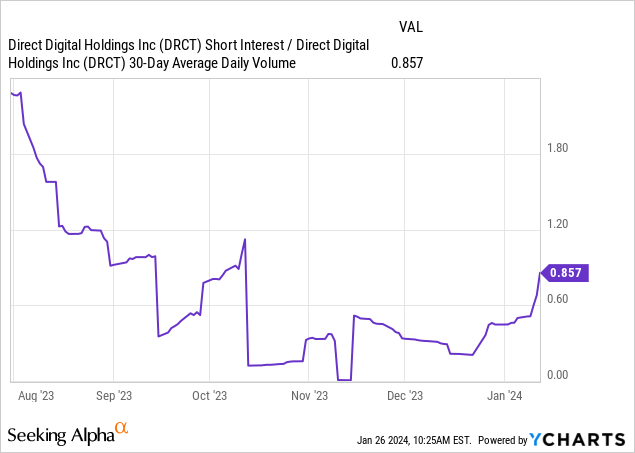

Since then, the stock originally lost a lot of territory, more than halving in price, while the operations continued in the previous, high growth trend. However, after the report of 3Q23 results in November, the stock started rallying, from $2.5 to $15 in less than two months. This rally was caused by good results and probably high short interest to average liquidity, which resulted in a squeeze.

In this article, I review the very good results of the company, and I try to approach the issue of their sustainability from a few angles. My conclusion is that the company’s results might be sustainable, but its valuation currently leaves only a minimal margin of safety. Therefore, I continue to consider DRCT not an opportunity.

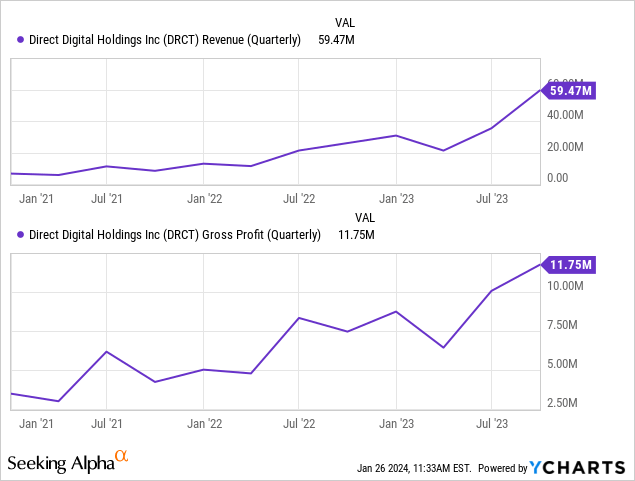

Tremendous growth

Since going public, DRCT’s sell-side segment has been growing off the charts. The gross profit growth numbers look less tremendous because the sell-side segment has lower margins (around 15%) than the buy-side segment. Still, in the past two years, gross profits have more than doubled.

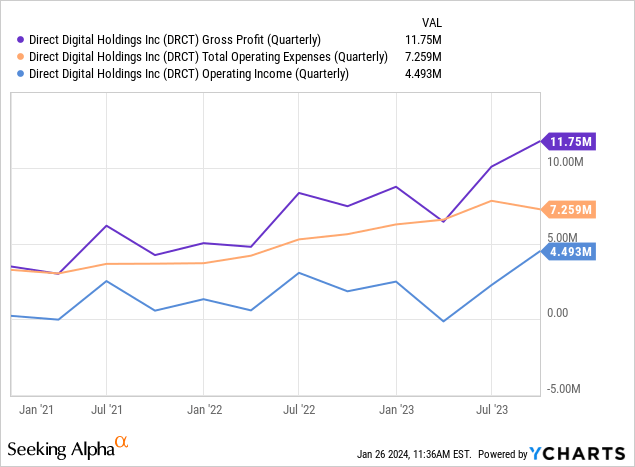

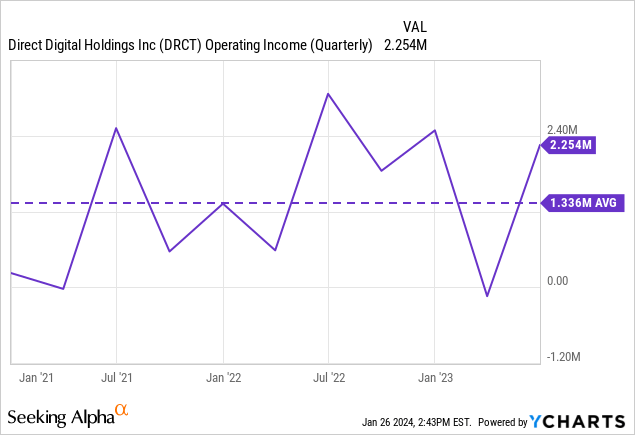

Operating expenses have accompanied the growth. Therefore, operating income growth has been more muted, but for some quarters, the company has been able to enlarge the gap and leverage operating income growth.

The considerable debate around DRCT is whether or not those growth rates are sustainable in the future. I have brought up some arguments for and against that belief.

Reasons to believe in the accounting

Some accounting measures point towards considering DRCT’s profits as real and sustainable.

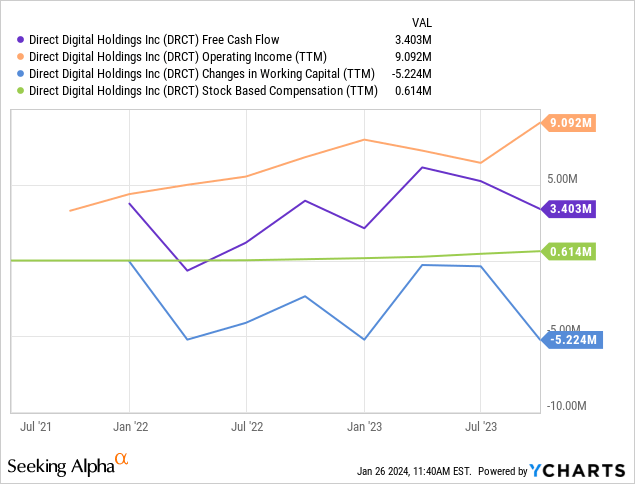

The cash flow statement is one of the first places where lousy accounting shows up. However, in the case of DRCT, free cash flows have generally followed the movements in operating income. The difference can be explained mainly by the growth in working capital (more on this later). As we can see, stock-based compensation was not used as a significant cash flow enhancer, as is common in many technology companies.

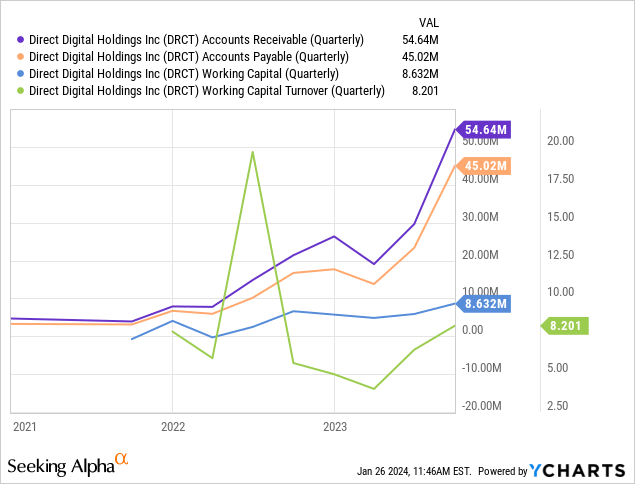

A second concern was the growth in accounts receivable and the growth in working capital. If a company is building receivables, it might indicate that it is recording revenue too aggressively or financing its customers in an unsustainable way. However, a more detailed analysis reveals that receivables have grown in line with payables, so most of the working capital is financed by current liabilities.

This is understandable, given the mechanics of DRCT’s sell-side segment. The company contracts with a publisher to help them sell their advertising space. That advertising is sold in an ad exchange that gathers sellers and buyers of digital ad space. When an ad is sold, DRCT registers a receivable (the money the exchange owes DRCT) and a payable (the money DRCT owes the publisher). In this market, it is common for the agency to make the payment to the publisher contingent on the payment from the exchange. Therefore, it is normal for DRCT to build receivables (and payables) if it is growing revenue.

A related concern was customer concentration. On its latest 10-Q report (and all previous ones), DRCT reports a customer (and receivables) concentration with a single customer of more than 70%, despite claiming thousands of sell-side clients. The confusion stems from what is an economic client and what is an accounting client. DRCT’s sell-side segment economic clients are the publishers. They hire DRCT to sell their advertising. However, from an accounting perspective, those publishers are providers, and the ad-exchange is the client. DRCT receives money from the exchange and pays the publishers, but the actual client is the publisher, and the exchange is a supplier.

Not so similar to peers

On the other hand, when comparing DRCT to public peers, many differences come to light, that are difficult to explain.

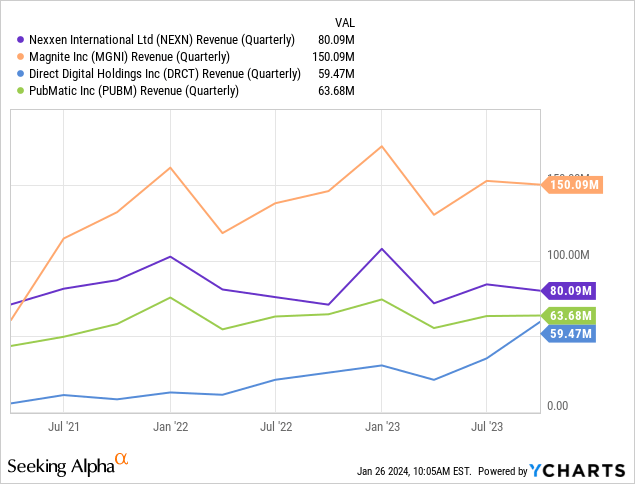

One is the treatment of their business as principal and not agent. In agent accounting, DRCT would only register as revenue the portion of the revenue share that it got from the publisher. In this way, the confusion between client-suppliers would disappear. DRCT’s revenues would be much closer to their gross profits today because the company would only register the net revenue obtained from advertising sales. Revenue growth would also be more muted because it would eliminate the effect of growing revenues but falling gross margins. Several of DRCT’s peers, including Magnite (MGNI), Nexxen (NEXN), and PubMatic (PUBM) use agent accounting.

Another one is why DRCT is the only one in the group whose revenues are growing (this is independent of the principal/agent treatment). A company has to have a significant differentiator to grow while most of its peers are stagnant or decreasing (more on this on business rationale).

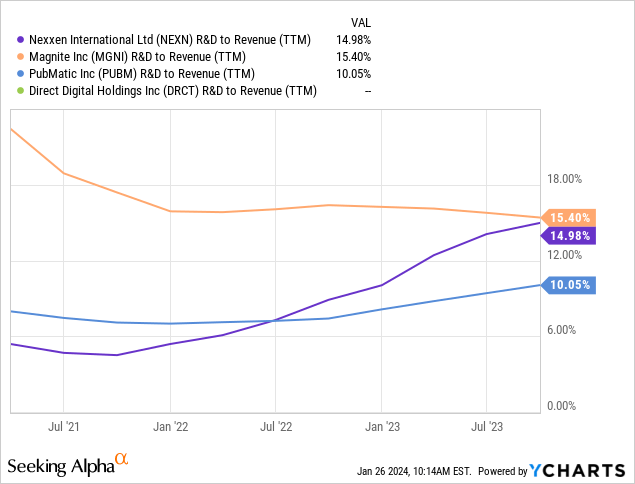

Another difference is R&D and intangibles spending. All of DRCT’s peers spend above 10% of their (net basis) revenue on research and development because they need to have good technology platforms to serve their clients (this is programmatic advertising so a lot has to be automated). At the same time, DRCT’s spending on R&D or intangibles is negligible. It doesn’t even show up as an income statement account.

The business rationale

Before we touched on accounting aspects. However, is there a rationale for DRCT’s sell-side segment growth? This is more important than the accounting, and the answer is yes.

DRCT has been growing but the growth engine has been the sell-side segment. This segment works with publishers to help them monetize their ad space.

DRCT’s specialty, they claim, is their inventory of multicultural (BIPOC, LQBTIQ, minority, diverse, you name it) owned and target publishers. And advertisers have been trying to reach minorities because it is profitable (more targeting means better advertising) and also because they want to reach diversity expenditure quotas. This article from Forbes cites large buy-side agencies committing to spend 2% to 5% of their clients’ money only on minority-owned publications. McDonald’s committed to 10% by 2025, and Coca-Cola to 8%. The same has been reported more recently by WSJ.

A problem with that need is how to confirm that a publisher is minority-owned (there are some minority-business certificates from each state) and that the content is good quality. By sourcing and curating publishers, DRCT can help with that. In that same Forbes article, one of Colossus SSPs (DRCT’s sell-side segment) is cited saying that Colossus has been one of their fastest growing SSPs.

This rationale is not exempt from problems.

One of them is that DRCT seems to be growing above the DE&I trend. In this interview, DRCT’s CEO mentions that only 20% of their impressions are multicultural. That would mean that most of the growth is happening outside of this area.

Another problem is that companies in the SSP space will eventually catch up with the inventory advantage via more investment in sourcing and curating publishers. Especially if DRCT’s multicultural publishers are concentrated (they claim to have 30 thousand publishers but a few of them could actually move the needle), then their competitors can work with them and offer better terms, or just compete with DRCT’s advantage away.

Finally, the DE&I could face a backlash, as has been discussed in the US recently. Companies could stop their DE&I-oriented budgets, and move towards other forms of targeting. This would also eliminate DRCT’s advantage.

Valuation and conclusions

So far, the accounting does not seem to point towards unsustainability of DRCT’s growth, although they have significant differences with its peers.

On the other hand, the company has a rationale for growth, which is the DE&I trend among advertisers. This is where I believe most risk is located. Mostly, why DRCT is growing way above that trend, and how sustainable (in terms of demand from publishers and lack of competition from peers) it is.

Sometimes, defining a risk is hard, but we can invert the process and compare it with the current return offered, to understand if too much is being asked out of uncertainty.

DRCT’s latest quarter was outstanding, and the company generated more than $4 million in operating income. However, even with growing gross profits, the company had been unable to grow operating income consistently before that. Up to 2Q23, the company was consistently posting operating income that ranged around an average of $1.4 million per quarter.

That number would add up to about $6 million per year, which is already pretty low when compared to a market cap of $170 million. This is simply too low of an operating return on the investment, even for a company where there are not so many unknowns.

But even if we extrapolated from the recent $4 million mark for a whole year (representing a 185% increase over the previous average), we would arrive at $16 million in operating profits, from which $4 million in interest expenses have to be subtracted, after which $12 million remain pre-tax, and approximately $8 million post-tax. That is still more than a 20x P/E ratio, which is super high. The only way to pay for a 20x P/E ratio (which is already a bullish statement in the case of DRCT) is to be pretty sure that growth in the future is almost certain. This is not the case for DRCT, for which there is substantial doubt. Therefore, I prefer to wait.

If DRCT’s stock price fell, to maybe below $5, offering much better ratios, then I would reconsider the investment, and dig deeper into the company’s markets and the sustainability of its competitive advantage. However, at this time that uncertainty (and risk of being wrong) does not offer any meaningful compensating return in exchange.