Manuel Milan/iStock Editorial via Getty Images

The following segment was excerpted from this fund letter.

Belron is one of the premier global businesses we have come across, but it’s really only in the past five years that a confluence of factors have come together to enable it to earn the returns commensurate with its global positioning. Belron has virtually every beneficial attribute outside of an IT growth or natural monopoly business you could wish to find. Market leadership in every one of its major markets, pricing power, network effect, a material technology advantage in an industry where technological change – in vehicle glass – becomes a moat of vast significance. The company produces prodigious cash flow which has facilitated generous dividends and capital returns to the equity owners via private equity-style financial engineering and debt refinancing.

Since late 2021, Belron has been owned by four shareholder groups:

- Staff and management with 11%;

- The private equity group Clayton, Dubilier and Rice (CD+R) via an SPV (20.5%);

- An investor group of San-Francisco based Hellman & Friedman, Singapore’s GSIC and Blackrock (18.2%); and

- The Belgian listed, family-controlled conglomerate, D’Ieteren Group with 50.3% and which is equity accounted in D’Ieteren’s books.

Hence, D’Ieteren is the only realistic avenue for public investment in Belron. Moreover, since D’Ieteren is 63% controlled by the eponymous family whose predecessors incorporated the company as a coach builder in 1805, and is only listed in Brussels, plus there are other assets within the holding company, the vast majority of investors seem happy to let the opportunity pass by.

Dynasty Trust started acquiring shares in D’Ieteren in the third quarter of 2023 at an implied valuation of Belron (on our maths) 58% lower than the November 2021 transaction where the investor group acquired their shares from CD+R. D’Ieteren shares are up about 31% since then, but the ongoing performance of the holding company’s largest asset by far, continues to more than justify the Top 10 position in our portfolio, despite the four-fold run up in the shares since late 2020. That came after a fifteen-year period where the shares did very little at all.

Some folks ask why we often run through the history of a company, occasionally going back half a century. In our view, in this specific case (and of course, many others) it’s only by tracking back through the history that provides a thorough understanding of why Belron is where it is today, and how the hockey-stick growth “opportunity” has come together in a shortish period of about 5-6 years.

D’Ieteren has a long history in “personal transport” in Belgium, having been a vehicle body builder at one stage and diversifying into distribution and parts replacement. Until 1999, the two major activities after WWII were the acquisition of the Belgian distributorship for VW in 1948 – the models now distributed by d’Ieteren Auto amount to ~23% of the Belgian market – and as the 60% owner of Avis Europe, the car rental business which had a London Stock Exchange listing. The Avis stake was sold in October 2011 to the US parent for €411 million but D’Ieteren now has interests in two other specialist parts businesses, the auto distributor, some amazing heritage buildings and its own “morceau de détritus” (Moleskine) to remind the company to stick to its knitting.

As we will see, given the private equity shareholders, and the “peak” debt within Belron where two term loans ($1.58 billion and $868 million) totaling $2.45 billion come due in April 2028 and 2029 respectively, it is not beyond comprehension that Belron may be floated as a public entity within the next two to three years and D’Ieteren sell down their stake a little further. Any bulge-bracket investment banker worth their salt will be on the doorstep of Rue du Mail4.

To examine how Belron fits within D’Ieteren, we break the story into five pieces:

The Belron back story; The rising valuation of Belron’s equity via party-party transactions; Belron’s financial growth with its acceleration in the past five years and perceived future prospects; How D’Ieteren has financially benefitted from Belron – arguably an even bigger story than Belron’s growth and increased valuation; and evaluating the current entry point to Belron via D’Ieteren.

The Belron back-story

The predecessor companies of Belron5 were founded in 1896 and 1909 in South Africa. The Lubner family involvement commenced in the 1920’s, alongside one of the two original founding families, the Brodie’s. The development of the business accelerated as a supplier of vehicle glass to Ford and GM in the late 1920s and became a publicly listed entity Plate Glass and Shatterprufe Industries (‘PGSI’) in 1947. In the early 1960s, PGSI recognised there was a new emerging and large market in vehicle glass repair and replacement (VGRR); PGSI commenced acquiring other participants in the South African market and gradually started an overseas expansion. In tandem with Pilkington, the massive UK glass manufacturer, one of the first areas of expansion was Australia with a takeover offer for Frank G. O’Brien in 1972. The exercise ended in a stalemate with the offer being overbid by an alternative, but the Directors selling their shares to PGSI valuing the company (at $1.05/share) at A$14 million. Three years later, having acquired 66% in the original bid, PGSI came back at $0.50 (not a misprint) to mop up the rest, including the counter-bidder’s 16.7% holding6.

In 1983, the newly renamed overseas business (Solaglass) bought its first UK businesses – including Autoglass – and five years later expanded into Continental Europe with the acquisition of Carglass. To facilitate the exit of Pilkington from the domestic business in 1992, PGSI saw South African Breweries (‘SAB’) acquire a majority of the public company, with the Lubner family still retaining over 20% and in the key management roles.

Solaglass became Belron and through the 1990s, the company made small acquisitions and then roll-ups in the USA to establish share in the largest global marketplace. In 1998, Belron merged its US business with the market leader Safelite to give the combined group a ~35% market share, but Belron owned only 45% of the business. It sold off the stake in 1999 but returned to buy Safelite holus bolus in 2007 for $334 million (debt funded) after Safelite had been through a Chapter 11 bankruptcy restructuring.

D’Ieteren’s entry point to Belron came in July 1999 when SAB decided to exit its 68% stake in PGSI valuing the equity of entire business at €340 million (SAR2.13 billion at the time); however, PGSI was heavily indebted to the tune of SAR2.4 billion (~€390 million). The takeover offer for the public business was done in tandem with Belgian investment company Copeba via a 70/30 JV company Dicobel.

If the 70/30 venture and high debt didn’t make the analysis at the time messy enough, Dicobel only owned 78% of the key Belron asset, with the Lubners and Bordies owning the 22% minority. Additionally, the acquisition also included ~52% of Plate Glass Holdings, South Africa’s main glass manufacturer.

D’Ieteren certainly knew its LBO maths. Dicobel was capitalised with subscribed capital of €249 million, so the consolidated entity at 31 December 1999 – a few weeks after completion – was carrying €690 million in net debt, albeit with > €260 million of receivables.

Ronnie Lubner – one of the two patriarchs of the family with his brother Bertie – purchased the Plate Glass Holdings stake for €43 million7 in September 2001 – leaving the entity free to pursue the expansion strategy for Belron. Ronnie’s son Gary Lubner moved in as CEO: he stepped down as CEO after 23 years in March 2023, and 35 with the company. Lubner (like his father and uncle) inculcated an extraordinarily strong culture, seen each year in his piece in the D’Ieteren annual report, but most easily examined in an interview with a trade publication in 2004.8,9

Stakes in Belron have transacted at increasing valuations

The original structure of the Belron acquisition – with an auto-related conglomerate sat alongside a private investor, with the original family and management as a significant minority – meant a slew of related party agreements and options to sell at various times.

At the commencement in late 1999, D’Ieteren’s effective stake in Belron was 54.6% (70% of Dicobel which owned 78% of Belron). The stake was increased by 2% in 2002 by Dicobel purchasing another 2.9% for an estimated €10.8 million. From July 2004 to September 2009, D’Ieteren increased its effective stake in Belron to 90.2% via small purchases of the management minority stakes, one significant 12% purchase in July 2004 – at an effective Belron equity valuation of €625 million, and the buy-out in steps of Copeba from Dicobel, the last of which in September 2009 valued Belron at €1,683 million.

D’Ieteren’s first moves to crystallise (part of) the benefit of Belron’s increase in value came in November 2017 with the sale of a 40% equity stake at a price of €1,550 million, representing an enterprise value of €3 billion. The lower equity value than previously represents the level of distributions and returns which had been made over the preceding 8 years to the 90%+ holder, D’Ieteren (see below). Four years later, the buyer – Clayton, Dubilier and Rice – sold roughly half of its stake at an equity value of €17.2 billion (enterprise value €21 billion, a seven-fold increase over the four years) to the Hellman & Friedman, GSIC and BlackRock (BLK) consortium.

The table below illustrates the indicative equity prices and valuations of relevant tranches of Belron; as the gap between the 2009 to 2017 transactions show, the benefit to D’Ieteren – was proportionally GREATER as a result of dividends and capital returns.

Selected transactions of Belron equity10

|

€ million |

Transaction value |

stake |

Implied 100% equity |

Comments |

|

|

December 1999 |

Original takeover |

300 |

78.0% |

385 |

Assumes €43 million for Plate & Glass Holdings |

|

2002 (est) |

Dicobel buyers |

10.8 |

2.9% |

372 |

Purchase from minorities |

|

July 2004 |

D’Ieteren direct |

75.0 |

12.0% |

625 |

Purchase from minorities |

|

January 2005 |

Via Dicobel |

25.7 |

5.53% |

690 |

Via Dicobel, D’Ieteren from Copeba, adjusts for Dicobel debt |

|

April 2007 |

Copeba sale |

31.0 |

3.65% |

850 |

Sale by Copeba to D’Ieteren |

|

September 2009 |

Copeba exit |

275.1 |

16.35% |

1,683 |

Sale by Copeba to D’Ieteren |

|

December 2017 |

D’Ieterenpart sale to CB+R |

620 |

40.0% |

1,550 |

Sale by D’Ieteren to private equity |

|

December 2021 |

CB+R to other private equity |

2,890 |

16.8% |

17,200 |

Sale within private equity group |

What has changed between 2019 to 2024?

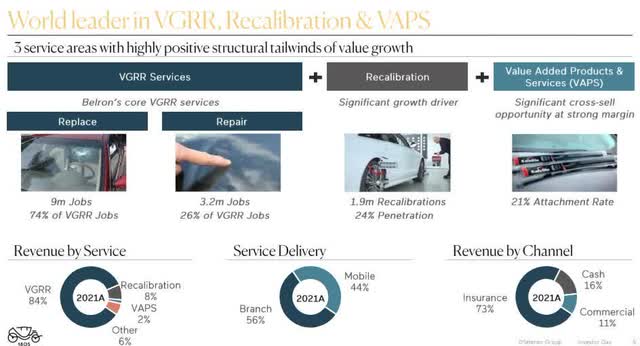

The foundations of Belron’s more recent success were clearly laid from 1999 onwards, with acquisitions and capital expenditures, cementing the businesses market leadership in all ten of its key markets. VGRR is an industry where two types of networks really matter – relationships with insurers to recommend Belron’s local operators in the replacement of vehicle glass and a large-scale network where the underlying customer chooses the company simply because of the convenience of a mobile visit. Adding in the ability to refit the widest variety of vehicle glass provides an obvious competitive advantage.

Source11

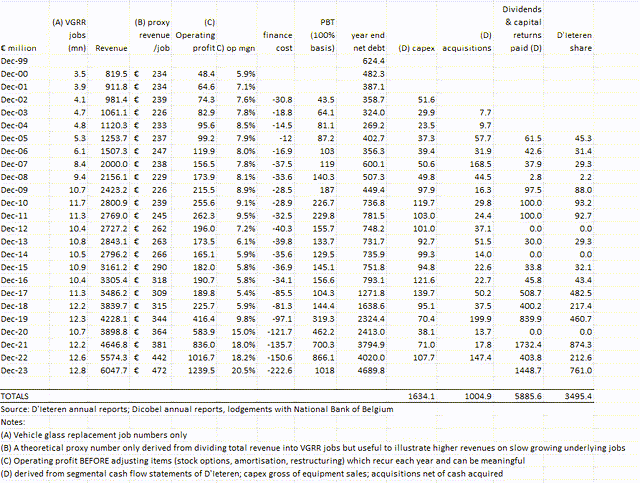

Belron: financials (100% basis) from 1999 change of control

But the explosion in profitability since 2019 – illustrated in the Belron financials above – has occurred on the back of a three-fold multiplication of operating margin, from just under 6% to over 20% in the past calendar year. This clearly reflects two aspects of the business which have long-term structural tailwinds: increasing value added services and technological change in windscreens. In effect, ADAS – Advanced Driver Assistance Systems.

The long-term tabulation of Belron’s revenue (above) since the beginning of 2000 when D’Ieteren took its initial interest EXCLUDES “adjusting charges” which occur each year, are sometimes meaningful, but include a mix of cash and non-cash items. What is notable in recent years is the growth in overall revenue despite slow growth in the number of VGRR jobs, reflecting an increase in other value-added services. It is clear, given the technology (and skill) required to refit and recalibrate, that Belron has significant pricing power in virtually all of its markets12

The near-term outlook for the company continues to be bright. At the recent 2023 results presentation13, D’Ieteren management flagged that the company was on track to achieve its 23% operating margin goal in 2025 and that volume growth of ~ 5-8% sales growth was expected in CY2024 on the back of increasing ADAS volumes – mandated in many parts of Europe – and the necessity for recalibration of such systems. The company has experienced issues with technician numbers in the USA (58% of sales, but only 4.7% sales growth in CY24) but Europe (29% of sales) grew very strongly by 14.7%.

The broad-brush guidance from the 5 March 2024 briefing suggests Belron should record ~15% pre-tax profit growth in 2024 to around €1.15 billion based on sales growth of ~7% but a further 100bp of margin expansion. The 2025 figures will crucially depend on how Belron allocates cash flow from the prior year – whether there are further dividend payments and capital returns or there is a debt paydown. Our preference would be to see a debt paydown; any very meaningful actions in this area may suggest the unit could be being readied for public markets.

Belron’s cash flow is prodigious14. In FY 2023, Belron’s after tax profit of €301m (after all adjusting charges) translated into €380 million of free cash flow after capital expenditure of ~€100 million and a negative working capital charge of €160 million; in the preceding year, thanks to working capital being broadly stable, a €318 million net profit translated to free cash flow of €439 million after net capex of €61 million.

An astonishing win for D’Ieteren

For D’Ieteren, the performance of Belron has been a gigantic windfall, which keeps on giving. We estimate that between December 1999 – having initially invested €175 million for its 70% share of Dicobel being an effective 54.6% stake in Belron – and September 2009, D’Ieteren invested around €620 million to get to ~90% of the company.

Since then, they have sold 40% of the company for €620 million to CD+R; have extracted a total of €3.5 billion in capital returns and dividends and retain a 50% stake last valued in a third-party transaction at €8.75 billion – a total of €12.72 billion. A 20-bagger over just less than 25 years.

Missed the boat completely? We think not.

Entering Belron via exposure to D’Ieteren: the non-Belron businesses

To gain exposure to Belron requires you to take exposure to the other assets within D’Ieteren as well as its financial structure. Since the aim of our piece is to focus on Belron as an outstanding enterprise, we will only briefly describe the residual businesses.

D’Ieteren has four other business assets plus financial assets; two of the businesses have been acquired in the past two and a half years, but the management skill set required to administer them is entirely consistent with the group’s core capabilities:

TVH (40%):

D’Ieteren acquired 40% of TVH15 in late 2021 for a price of €1,172 million from the vanHalst family; the founding Thermote family retain the other 60%. TVH is the world’s largest independent supplier of after-market parts for material handling and construction equipment such as forklifts, scissor lifts and other “rolling” equipment. TVH are also a global top three player in the same market for tractors. TVH has a completely global platform, stocks ~1 million separate items and is in 26 countries with revenue split c. 60/40 EMEA/America with a small percentage in APAC.

TVH was the subject of a cyber-attack in March 2023 which closed their systems for ~3 weeks. As a result, operating profit in CY23 fell 16% from €260mn to €218mn. Guidance for the CY2024 suggests revenue growth of ~10% to €1.77bn and an operating margin around 14.5%. The business easily funds its capex requirements, which have been running just below €100mn per annum from internal cash flow.

The price paid for TVH suggests an after tax P/E of around 16.7x on a normal year’s pre-tax profit of ~€250m, which in our estimation is more than reasonable. Given the disruption to the business in 2023, to be conservative we have made no adjustments to acquisition price and hence valie D’Ieteren’s equity stake at €1,170.

PHE (Parts Holding Europe):

D’Ieteren acquired PHE from Bain Capital in August 2022 for an equity value of €571m added to ~€1,130m of acquired debt for an enterprise value of €1.7bn. Management and staff own 9% of the business. PHE is an independent distributor of spare parts in France, Italy, Spain and Benelux. Given the strength of vehicle markets emerging from COVID PHE grew strongly in CY2023 with sales growth of 13% to €2.57 billion with a 90bp enhanced operating margin of 9.1%. Despite a forced disposal in France for €90 million, working capital effects restricted free cash flow and net debt remains at just below €1.2 billion. Since the year-end, PHE has refinanced two note issues of €960 million, pushing them out to a single 7-year loan.

Based on management projections of ~5% revenue growth and stable margins in CY24, the business should earn operating profit of around €244 million, leading to a pretax outcome of around €160 million. Despite the modest multiples attached to these types of businesses, we believe PHE is still worth significantly more than the equity price paid, and value the company at an effective P/E of 10x.

Moleskine:

(Let’s make it clear I love Moleskine products, but they are expensive, and I buy my notebooks from Muji or on occasional trips to Japan)

Despite the perception of the “heritage”, Moleskine was only created in the mid-1990’s by an Italian design company to recreate the heritage of oilcloth covered notebooks, usually bought in Paris. The idea was spectacular, and the trademark registered in 1996.

The same year, Syntegra Capital, a London-based private equity firm (now closed) took an initial majority stake for €17 million. In April 2013, Moleskine was IPO’d in Milan at €2.30 per share with an equity valuation of €487 million and EV of €526 million. Just over a year later, the shares were €0.95 as most investors saw the IPO as an effective sell out by the private equity groups. Surprisingly in September 2016, D’Ieteren reached agreement with Syntegra and co-holder Index Ventures to acquire their remaining shares (41% of company) for €2.40 apiece (a mere 12% premium to previous close) and acquired the whole company for €506 million.

By 2017, operating profits were already falling (from €35m to €25m in two years) and the impact of COVID was devastating, with revenue falling 38% to €102 million between 2019 and 2020. D’Ieteren has internally refinanced Moleskine’s external debt and so the parent has a €22milion internal loan, on which it was paid interest in 2023 as the operating result stabilized at €23 million.

Moleskine produces free cash before interest payments of ~ €24 million per annum; we conservatively evaluate D’Ieteren’s exposure (debt and equity) to Moleskine as being worth ~ €250 million.

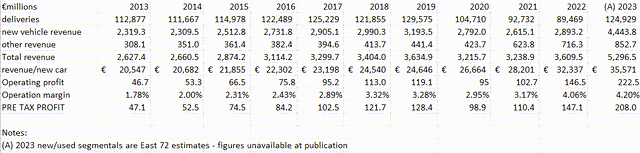

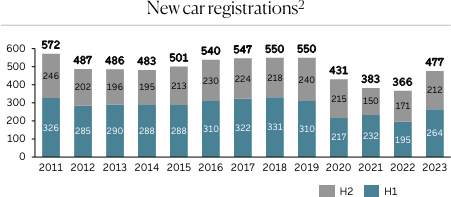

D’Ieteren Auto

D’Ieteren Auto is a predominantly wholesale distributor of Volkswagen Group (VW,Audi, Skoa, Seat, Cupra, Lamorghini, Bentley, Porsche) + Bugatti, Rimac and Microlino vehicles in Belgium. It is the 14th largest car dealer in Europe by 2022 revenues16, and has around 24% of the Belgian market.

Like every global auto dealer, there has been a significant rebound in revenue and profitability as the supply chain crisis has eased and vehicles are sold through, and in common with others, low cash flow profitability in 2022 was replaced with high cash generation as working capital was liberated in 2023.

D’Ieteren Automotive historic results

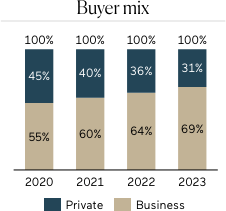

D’Ieteren expect the 2024 auto market in Belgium to flat line at around 480,000 new deliveries; their own profitability will likely be first half loaded given an order book of 58,000 vehicles, suggesting the 2023 performance could well be replicated, noting that the company is very much a business vehicles supplier.

There are a limited number of comparable listed vehicle suppliers, given many have a far larger proportional revenue from used cars. One of the UK’s largest listed suppliers, Lookers, was acquired late in 2003 at ~6x pre-tax profits.

We have lined up D’ieteren Auto with the Australian listed AP Eagers (APE.AX), given the strong market share and long term operating record; Eagers has a far higherrelative debt load but with A$11.3 billion of revenue is ~30% larger than D’Ieteren (A$8.8bn equivalent). On that basis, we would value D’Ieteren Auto equity at just under €1.8 billion, being around 12.5x equivalent after tax earnings.

Entering Belron via exposure to D’Ieteren: what are you paying?

At 31 December 2018, D’Ieteren’s market capitalisation was €1,782 million; it’s now around €11 billion. So we’ve categorically missed the boat?

For context, D’Ieteren’s market capitalisation was around the same level as nine years prior. So for many years, there was no recognition of Belron slowly building its business. Of course, there was recognition of the Moleskine issues. As Belron’s profitability has accelerated, that has been reflected to a degree in D’Ieteren’s share price, notably in 2021, when the shares nearly trebled. But in our view, a proper recognition of the positioning of Belron and its longer-term value is not yet present in the market’s pricing of D’Ieteren stock.

Based on our estimates of D’Ieteren’s other businesses – which we tabulate below – we believe the entry price to Belron is an effective equity value of €12,750 million, which compares to the last transactions in December 2021 at an equity value of €17,200 million (25% discount).

Since then, the equity holders have extracted €1.85 billion of dividends and capital returns – the split of which is deliberately obfuscated – suggesting a “base” price of €15.35 billion for the equity. However, we expect 2024 pretax earnings from Belron to be €1.15 billion against historic earnings of €866 million when the deal was consummated.

Even attributing a 20x forward P/E – below many global markets – for Belron would give an equity value of €16.1 billion after the recent dividend and capital strip. In our view, that seems conservative for a business with strong structural tailwinds, and strong market position.

|

€ millions |

Equity value estimate |

|

|

TVH (40%) |

1,170 |

Purchase price, late 2021 |

|

PHE |

1,019 |

cf purchase price 571m in August 2022 (gearing) |

|

Moleskine |

250 |

Equity and loan exposure |

|

D’Ieteren Auto |

1,797 |

12.5x P/E |

|

Cash |

916 |

Excludes loan to Moleskine |

|

Est. holding company costs |

(310) |

After tax estimate of €24 million at 13x |

|

Property |

42 |

|

|

TOTAL EXCLUDING BELRON |

4,884 |

= €89.27/issued share (54.7 million) |

|

Current Market Capitalisation |

11,259 |

Current share price €205.80 |

|

Implied value of Belron stake |

6,375 |

50.01% |

|

Implied value of Belron equity |

12,750 |

cf €17,200 in December 2021 |

Reworking the calculations suggests that at current prices of D’Ieteren, we are gaining exposure to Belron at around 15.8x after tax equivalent earnings for CY2024. In our view, for such an outstanding business, that represents excellent value.

A full realisation of Belron by D’Ieteren is possible in due course, given that 2/3 of the other holders are effectively private equity concerns and may have a standard 5-7 year holding period. Whilst an ongoing listing of D’Ieteren is an inevitability, the chances of equity retirement in some manner if this were to happen is highly likely. Remember, this is a family who have executed such strategies in their investee companies and have not issued new shares of any consequence in D’Ieteren in at least the last 25 years.

|

Footnotes 4The HQ building developed in the 1962-67 period is a fabulous piece of architecture with offices on a plinth set behind the main entryways. It is now subject to a degree of heritage conservation but is to be redeveloped in keeping with the original building. 5Why Belron? BErtie Lubner, RONnie Lubner 6Oliver-Davey Industries, an Australian listed company at the time, were the over-bidder. 7In June 2007, Remgro the South African investment holding company controlled by the Rupert family who also control Richemont bought 25% of Plate Glass Holdings and now own 38% 8Industry.glass.com/AGRR/Backissues/2004/0405/garylubner.htm 9Since leaving the executive side of Belron (he is a non executive Director) Mr Lubner was disclosed in early March 2024 as the largest donor to the Labour Party in the UK (£4.5million) 10Source: East 72 Management Pty Ltd compiled from company reports 11D’Ieteren Investor Day 2022′ 12Belron is the market leader in USA (Safelite), Canada (Lebeau, SpeedyGlass), UK (Autoglass), Australia (O’Brien), each of Belgium, Neterlands, Italy, France Spain and Germany (Carglass) 13Full year results briefing 5 March 2024 14Note the segmental cash flows for CY2023 are not currently available 15Thermote and vanHalst 16Source: ICDP/Automotive News Europe Copyright and Disclaimer © Other than material being the property of its respective owners, this presentation is copyright 2024 East 72 Management Pty Ltd. All Rights Reserved. You may not reproduce parts of this work without permission, which can be sought by email, but you are free to distribute the work on each security (D’Ieteren Group, Fairfax India Holdings and The Hong Kong and Shanghai Hotels Limited) in its entirety with full attribution. This communication has been prepared by Andrew Brown and East 72 Management Pty Limited ( E72M) (ACN 663980541); E72M is Corporate Authorised Representative 001300340 of Westferry Operations Pty Limited (AFSL 302802) of which Andrew Brown is a Responsible Manager. While E72M believes the information contained in this communication is based on reliable information, no warranty is given as to its accuracy and persons relying on this information do so at their own risk. E72M and its related companies, their officers, employees, representatives and agents expressly advise that they shall not be liable in any way whatsoever for loss or damage, whether direct, indirect, consequential or otherwise arising out of or in connection with the contents of an/or any omissions from this report except where a liability is made non-excludable by legislation. Any projections contained in this communication are estimates only. Such projections are subject to market influences and contingent upon matters outside the control of E72M and therefore may not be realised in the future. This update is for general information purposes; it does not purport to provide recommendations or advice or opinions in relation to specific investments or securities. It has been prepared without taking account of any person’s objectives, financial situation or needs and because of that, any person should take relevant advice before acting on the commentary. The update is being supplied for information purposes only and not for any other purpose. The update and information contained in it do not constitute a prospectus and do not form part of any offer of, or invitation to apply for securities in any jurisdiction. The information contained in this update is current as at 31 March 2024 or such other dates which are stipulated herein. All statements are based on E72’s best information as at 31 March 2024. This presentation may include officers and reflect their current views with respect to future events. These views are subject to various risks, uncertainties and assumptions which may or may not eventuate. E72M makes no representation nor gives any assurance that these statements will prove to be accurate as future circumstances or events may differ from those which have been anticipated by the Company. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.