wenbin/Moment via Getty Images

Over the past year or so, we have seen a large number of mergers and acquisitions in the oil and gas exploration and production market. When companies combine, they do so with the hope of achieving significant cost savings that they call synergies. These savings come from a number of factors, including cutting out operations that are redundant for one business but that would be required for each firm to have on its own. An accounting department would be an example. The clustering of resources can create additional synergies, and the fact that a player is larger can often mean that the firm in question can squeeze its suppliers anyway that two smaller but standalone firms might not be able to.

The latest such combination in the oil and gas exploration and production market involves publicly traded Diamondback Energy (NASDAQ:FANG) and privately held Endeavor Energy Resources. On February 12th, news broke that the companies would be combining to create yet another large behemoth in the Permian Basin. Because of the fact that Endeavor is privately held and because neither party has released fundamental data to the market regarding it, we don’t have a comprehensive picture regarding how appealing this maneuver ultimately will be. But with the data that we do have at our disposal, the transaction does seem to be appropriate for investors in Diamondback Energy.

A big deal that makes sense

According to the press release issued by Diamondback Energy that discusses its decision to absorb Endeavor, the deal in question is valued at about $26 billion. This is on an enterprise value basis. Naturally, given the size of the deal, it will involve multiple parts. First and foremost, Diamondback Energy will end up transferring to shareholders of Endeavor approximately 117.3 million units of Diamondback Energy. Based on the closing share price of the stock the day prior to the announcement, this translates to a value of $17.80 billion. The end result will be one in which shareholders of Diamondback Energy will end up with a 60.5% ownership of the combined business, while the investors in Endeavor will end up with the remaining 39.5%.

The second part of the deal involves the transfer of about $8 billion of cash. That gives us an enterprise value of $25.8 billion before factoring in net debt. This implies around $200 million worth of net debt. It’s important to note that, in a conference call regarding the transaction, Diamondback Energy’s management team stated that Endeavor has a note of about $900 million outstanding. So that implies cash on hand of around $700 million. Management did say that they will likely pay that note off at closing or close to it. As of the end of the most recent quarter, Diamondback Energy had only $830 million worth of cash and cash equivalents on its books. This means that the company will have to take on additional debt for the vast majority of the cash payment it’s making. In the related conference call, management did say that they anticipate borrowing between $5 billion and $6 billion to make the deal happen. They also referenced the possibility of engaging in non-core asset sales to bridge the gap for the rest.

Diamondback Energy

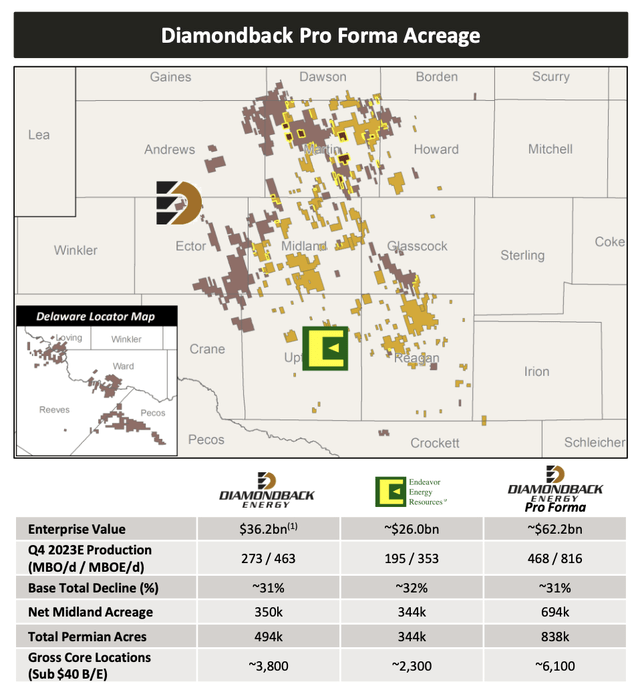

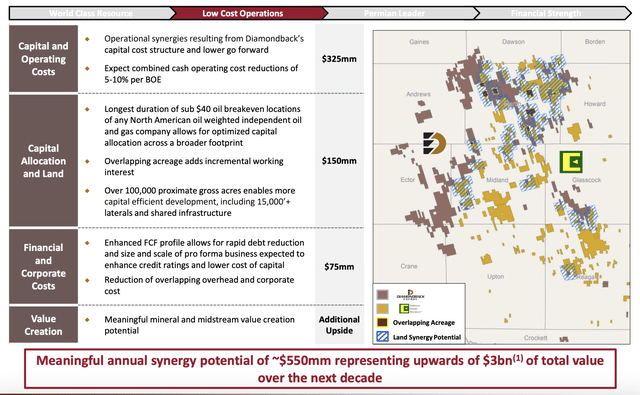

As I mentioned at the introduction to this article, a clustering of resources strategy can yield some significant cost savings. As you can see in the image above, the two companies do have a significant amount of assets that are awfully close to one another. All combined, the firm should have around 838,000 net acres of space, with 494,000 of those coming from Diamondback Energy while the remaining 344,000 will come from Endeavor. The combined 6,100 gross core locations that management pinpointed that have breakevens for oil that is below $40 per barrel represents a tremendous amount in potential resource clustering. This, combined with other things such as an overall stronger capital cost structure, will allow the company to achieve annualized synergies of around $550 million. $325 million of this will involve capital and operating costs. Another $150 million will involve capital allocation and land related expenses. And the remaining $75 million will involve financial and corporate costs.

Diamondback Energy

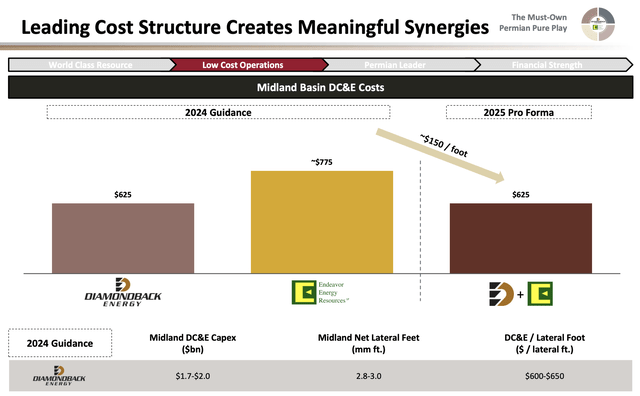

We will have to wait for more details to come out. However, we do know that one big area of cost savings will drill, complete, and equip costs. For 2024, it’s estimated that these expenses for Diamondback Energy would total around $625 per foot. By comparison, when it comes to Endeavor, these costs are $775 per foot. Management believes that by 2025, they will be able to reduce Endeavor’s cost per lateral foot to match its own. This will result in between $420 million and $450 million in annual cost reductions. Management is confident in their ability to achieve this because of how similar the assets are between the two firms.

Diamondback Energy

For 2024, Diamondback Energy is forecasting that the combined company will spend between $4.8 billion and $5.15 billion on capital expenditures. Between $2.3 billion and $2.55 billion of this will involve spending from Diamondback Energy, while the rest will involve Endeavor’s assets. So what we see here is that spending is about even. And yet, of the 808 thousand to 845 thousand boe (barrels of oil equivalent) per day that the combined company will produce, between 55.1% and 56.7% of output will come from Diamondback Energy. Considering that shareholders of that business are getting 60.5% ownership of the combined firm, this does not seem outrageous.

The goal, following the completion of this transaction, will be for the companies to quickly reduce debt. Management has decided to lower its target from delivering around 75% of free cash flow to shareholders each year to around 50% once the deal closes. At first glance, this might seem disappointing to shareholders. However, it’s important to note that the firm has a long history of growing its distribution and returning capital to shareholders in general. From 2018 through the first nine months of 2023, management returned $6.68 billion of capital directly to shareholders. And after management gets net debt below $10 billion, the prospect of increasing its capital outlays, especially if synergies are realized, becomes really positive.

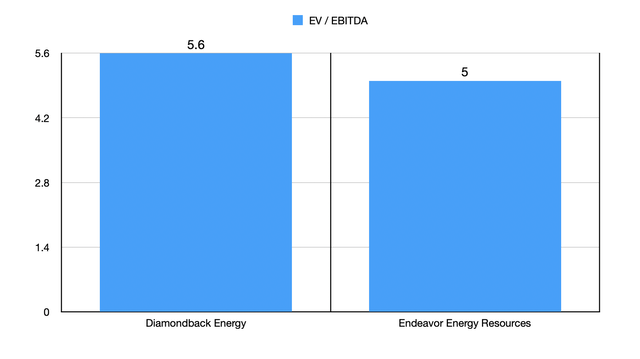

In terms of evaluating the deal and the extent to which it makes sense, the picture is rather complicated. That is because of the absence of data associated with Endeavor. The good news, however, is that we have just enough to paint an interesting picture. As I stated already, Diamondback Energy is responsible for less than its share of production. That alone is a positive sign. However, in the investor call, management said that EBITDA for Diamondback Energy should be around $5.1 billion to $5.2 billion. That implies an EV to EBITDA multiple of 5 at the midpoint. By comparison, using 2024 estimates, Diamondback Energy is trading at an EV to EBITDA multiple of 5.6.

Author – SEC EDGAR Data

In addition to this transaction looking positive from a traditional perspective, there is also another opportunity facing shareholders. That involves Viper Energy (VNOM). Historically speaking, Viper Energy makes investments in mineral interests of properties in exchange for a slice of the cash flows those properties make. When done right, this creates significant cash flow margins for shareholders of that entity. And as a company that is partially owned by Diamondback Energy, with Diamondback Energy owning 100% of the firm’s general partner interest, some attractive opportunities for Viper Energy could be around the corner in the form of what are called dropdowns.

Takeaway

As things stand, this transaction between Diamondback Energy and Endeavor is opaquer than I would typically like. However, we do have just enough information to conclude that the deal likely does make sense for both parties. The fact of the matter is that Diamondback Energy is buying up Endeavor at a price that is cheaper than what it is going for. This does not even factor in the proposed synergies. Yes, debt will be elevated and management will be prioritizing an accelerated payment of that debt, but this will only create more wealth for the business and its shareholders in the long run. Given these developments, I have no problem rating Diamondback Energy a solid ‘buy’ at this time.