Cavan Images

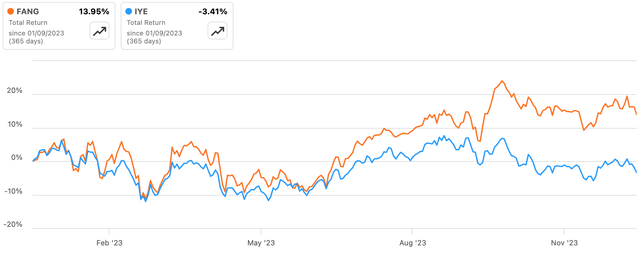

Shares of Permian-focused E&P Diamondback Energy (NASDAQ:FANG) have had a reasonable 12 months, delivering a roughly 14% total return in that time amid meaningful outperformance versus the sector, represented below by the iShares U.S. Energy ETF (IYE).

While short-term stock price movements don’t always tell you much, Diamondback is executing well right now, exceeding production guidance and generating ample amounts of free cash flow even as commodity prices have cooled a little. With a healthy balance sheet, low cost production and shareholder-friendly capital returns policy, the stock also looks attractive and moderately undervalued under mid-cycle conditions. Buy.

A Low-Cost Operator, Executing Well

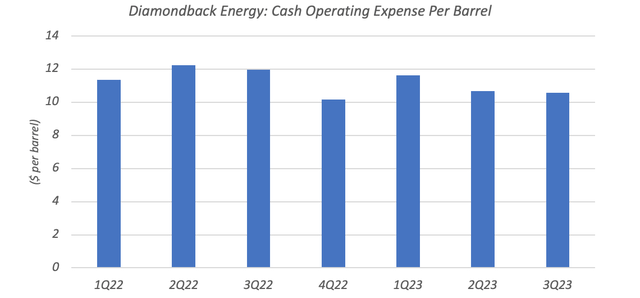

One positive feature of Diamondback’s business is its low cost base, leading to attractive cash margins. In its most recent quarter (Q3 2023), the company reported total cash operating expenses of just $10.51 per barrel, far below realized unit prices of around $54 per barrel. Interestingly, Diamondback’s cash operating expenses have remained relatively resilient despite inflation running at levels not seen for years. Even after making allowances for lost barrels (DD&A $10.61 per barrel), stock-based compensation (~$0.31 per barrel) and its net interest expense ($0.98 per barrel), it is clear that Diamondback is exceptionally profitable at current commodity prices.

Data Source: Diamondback Energy Quarterly Results Releases

While the company’s top-tier upstream assets explain a large part of this, Diamondback also benefits from other advantages. For example, it can leverage certain fixed components of its cost base over a relatively large production footprint, supporting cash margins. In Q3, for instance, the company’s total general and administrative expenses (i.e. including stock-based compensation) landed at just $0.82 per barrel, decreasing by around 13% year-on-year as underlying production rose.

Diamondback is also executing well. In Q3, the company reported average oil production of 266.1 thousand barrels per day (mbo/d), beating prior-quarter guidance by 1% at the mid-point, while total hydrocarbons production of 452.8 mboe/d beat by around 2% on the same basis. Production is guided to increase again modestly in Q4, with average oil production seen up around 2% sequentially at the mid-point and total hydrocarbons production seen up roughly 1% on the same basis.

Although commodity prices are less favorable compared to levels in 2022, Diamondback continues to generate ample levels of free cash flow (“FCF”). FCF was $820 million in Q3, rising to just over $2 billion for the first nine months of the year. While those figures are 24% and 42% lower, respectively, on comparable-period 2022 levels, 9M’23 FCF still points to a FCF yield of 7.5%, and that’s with one quarter left to report.

Compelling Capital Returns

Like many U.S. E&Ps, Diamondback has been prioritizing shareholder distributions ahead of growing production following two grueling downturns in 2015/16 and 2020. Now, the problem with cyclical companies and capital returns is that buybacks and dividends are likely to be well financed when commodity prices and cash flows are at least at mid-cycle conditions. Because this usually corresponds with favorable share prices (i.e. overvaluation), the impact of capital returns can be blunted compared to companies that exhibit more defensive cash flows or cyclical companies that are able to operate in a counter-cyclical manner.

Diamondback isn’t immune to this problem, as it does target a set return out of FCF (75% as per above). However, management is acutely aware of this and aims only to repurchase stock when they think it is meaningfully undervalued. This makes Diamondback’s capital returns potential slightly more compelling than the average stock in the sector. As per the recent shareholder letter:

As a reminder, we repurchase shares when we believe we can generate a low-teens rate of return on that repurchase at a Company Net Asset Value run at a mid-cycle price deck of $60 oil, $20 NGLs and $3 gas. Capital discipline is important in this industry, and we view returning capital to our stockholders through the same lens as allocating capital in the field.

Travis D. Stice, Chairman & CEO Diamondback Energy, Q4 2023 Shareholder Letter

The company is roughly cash flow neutral at a $32 per barrel oil price. Said differently, at $32 per barrel Diamondback can maintain current production levels out of operating cashflow. The company uses hedges to provide downside protection from $55 per barrel, with its breakeven rising to $40 per barrel when including its base dividend as a cash outflow. So, even under management’s conservative (in my view) mid-cycle conditions, there is plenty of surplus FCF for special dividends and stock buybacks.

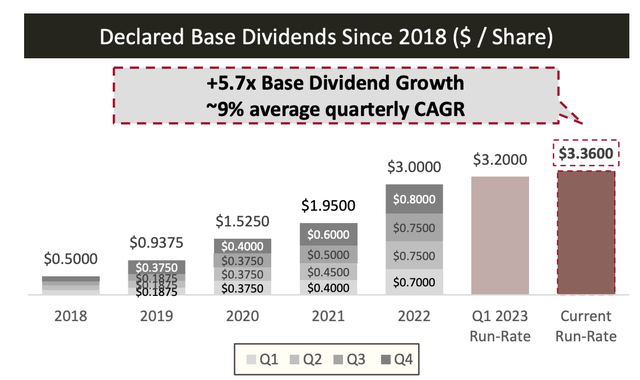

As it stands, the base dividend is $0.84 per share per quarter, or $3.36 per share annualized. With the stock at $152 as I type, that equates to a yield of 2.2%. While a spread of roughly 180bps versus the 10-year Treasury yield is unlikely to elicit much excitement from income investors, remember the base dividend does grow. Though shareholder returns are now priority, underlying production will still grow modestly at a low/mid single-digit annualized clip, providing a similar tailwind to FCF. Buybacks will also naturally support per-share growth, as the $600 million cash cost of the base dividend would be spread over fewer shares outstanding.

Diamondback’s balance sheet is in good health, which can further support its payout in times of strain. Net debt was $5.55 billion as of Q3, a reduction of over $1 billion quarter-on-quarter. With that mapping to a modest 0.9x TTM EBITDA, I expect Diamondback to lean on its balance sheet to support its dividend in the event that it becomes cash flow negative in an oil bust, giving it modest counter-cyclical returns potential. For example, the company actually raised its base dividend in 2020 in spite of the broader oil price environment. This will support total returns across the cycle.

Source: Diamondback Energy Q4 2023 Investor Presentation

Moderately Undervalued At $70 Oil

In terms of valuation, E&P’s are obviously slightly tricky to get an exact handle on as their cash flows are linked to future oil prices. As a general rule of thumb, I consider a 12x multiple of FCF under mid-cycle conditions to be a reasonable guide to fair value. That maps to a circa 6% shareholder yield based on management’s capital returns policy, with an extra 3-4% annualized from production growth leading to the 9-10% annualized returns I use as a hurdle rate.

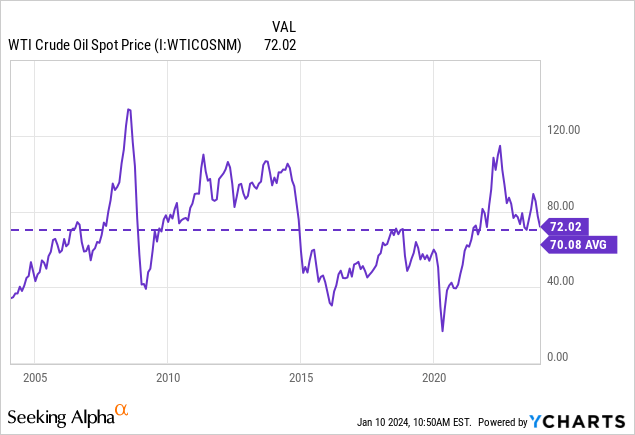

Management and many analysts peg their mid-cycle forecast in the $55-60 per barrel region, but I think this is overly conservative, and I view $70 as more apt, about in line with the long-run average and reflecting my more skeptical view of demand destruction due to the energy transition:

At $70 oil, Diamondback can generate around $2.7 billion in annual FCF, or around $15 per share, as per its investor presentation. On a multiple of 12x, that would yield a fair value of $180 per share, indicating around 20% upside from the current share price, and I open on the stock with a Buy rating.

Risks

Diamondback’s cash flows and intrinsic valuation are both highly sensitive to future commodity prices. Average prices below my mid-cycle estimate would drive a much lower fair value estimate. Furthermore, a short-term deterioration of commodity prices could drive poor near-term returns, regardless of whether through-the-cycle averages prove favorable in the longer run. As a result, an investment in Diamondback has the potential to be particularly volatile, and investors should bear that in mind when looking at this stock.