Sakorn Sukkasemsakorn

Investment Thesis

Denison Mines (NYSE:DNN) is well placed for strong uranium prices.

Earlier I had stated in a bullish analysis that,

Denison has a reasonably clean balance sheet, with approximately CAD$47 million in cash and equivalents. It’s not a particularly large amount of cash. But what it lacks in cash, it more than makes up for in the fact that the business has no significant debt.

However, the business is not in production as of yet, as it must expect until the price of uranium stabilizes above $60 per lbs for a period of months. But with uranium prices jumping higher of late, there’s a lot to be excited about Denison.

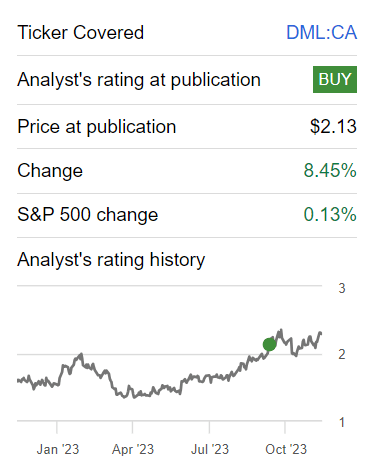

Since I wrote that piece, the share price has been trending higher, but it’s far from pricing in all its future prospects, as you’ll soon see.

Author’s work on Denison Mines

Denison’s Q3 2023 results describe how the company has successfully raised enough capital to shore up its balance sheet for at least 2 years at its current free cash flow burn rate.

But even that isn’t the full bull case. The bull case here is that if the price of uranium stabilizes at the current price, this business will soon have not only one but two mines in operation.

But what is particularly bullish here, is that the market isn’t even pricing in its second mine. There’s a lot to be bullish about here, so let’s get to it.

Why Invest in Uranium?

In the current landscape, a profound energy evolution is underway as nations endeavor to adopt a net-zero carbon future. At the heart of this transformation are two powerful drivers shaping our energy narrative: the electrification of everything and a determined push for decarbonization.

In this electrification era, we’re witnessing a sweeping shift toward electricity as the lifeblood of our daily existence. From consumer electronic gadgets to the wheels on our roads, the goal is to exchange conventional, fossil fuel-driven systems with electric alternatives. EVs are at the forefront, revolutionizing transportation and curbing the carbon footprint associated with it.

Simultaneously, the decarbonization wave seeks to redefine the very sources that power our world. The focus is on steering away from carbon-heavy fuels appreciate coal and natural gas, and instead, embracing cleaner, sustainable alternatives for electricity generation. Solar, wind, and hydropower have become linchpins in this pursuit of a greener energy mix.

Amidst this dynamic landscape, nuclear energy emerges as a pivotal player. Fueled by uranium, nuclear power plants harness controlled nuclear reactions to create electricity. Nuclear power is not only scalable, capable of meeting the colossal energy demands of our modern societies, but it also represents a low-carbon option. What’s more, green energies appreciate wind and solar power hold promise for a sustainable future, challenges remain in terms of scalability, intermittency, and the need for grid adaptation.

Furthermore, advancements in nuclear technology, particularly the development of next-generation reactors, promise enhanced safety, efficiency, and a reduction in nuclear waste.

Given this context, it’s practically obvious why uranium pricing continues to advance higher.

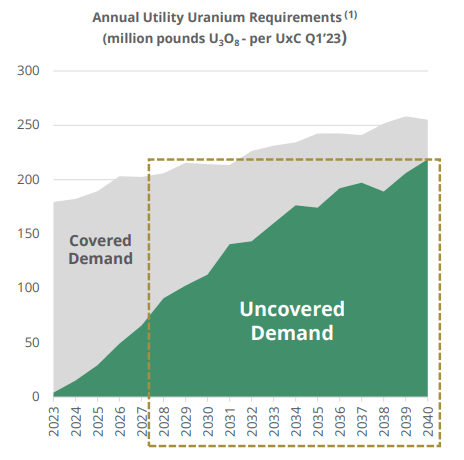

Next, allow me to put forward the following figure.

DNN November presentation

Towards the middle of this decade, there’s going to be a massive gap between the amount of supply and demand for uranium. To compound matters, to get enough supply onto the market is not only costly but also extremely time-consuming.

How to Think About Its Valuation?

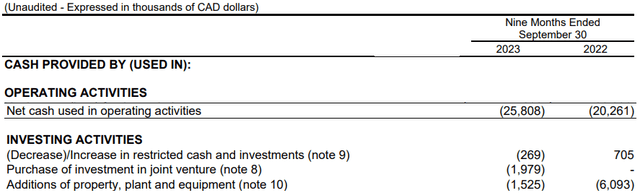

After Q3 results, Denison holds about US$100 million (CAD$140 million) of cash. Yes, the business holds no debt, but the fact of the matter is that Denison is burning through about CAD$30 million of free cash flow on an annualized basis.

So even though the business has just last month diluted shareholders by close to 4%, having earlier in 2023 raised approximately US$27 million of cash through a capital raise, this business needs uranium prices to remain elevated for it to be able to get into production.

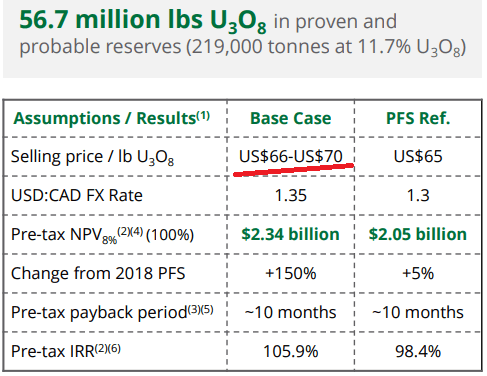

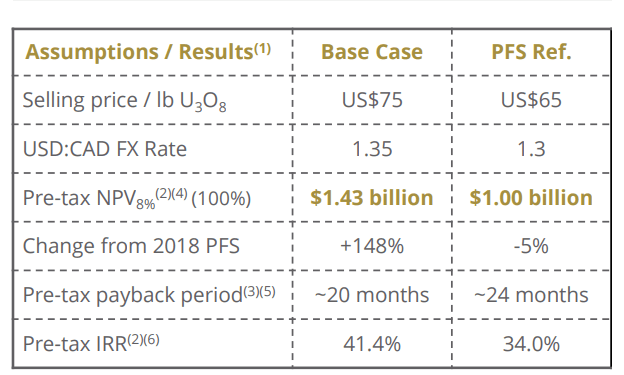

On the other hand, consider the table that follows.

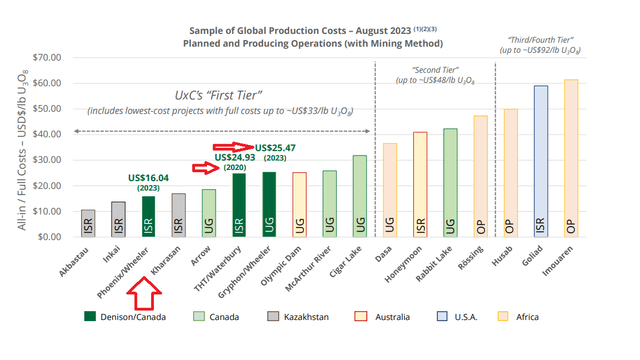

DNN presentation

What you see above is Denison’s bull case that if the price of uranium remains stably above US$70, then Denison will have access to approximately 57 million lbs of proven uranium, which would deliver a triple digit IRR, putting its Phoenix mine alone at US$1.5 billion, with the rest of its mines being given for free.

Put another way, consider this graphic.

At US$70 lbs for uranium, Denison’s current market cap is pricing in the Phoenix mine, but its Gryphon underground mine, which has a higher cost basis of US$75 per lb, is not even being priced in.

DNN presentation

The Bottom Line

Denison Mines presents a compelling investment opportunity for those seeking exposure to the rising uranium market. With a sound financial position, marked by approximately US$100 million in cash and no significant debt, the company is strategically positioned to capitalize on the increasing uranium prices.

Despite not yet being in production, Denison’s trajectory is promising, especially as uranium prices surge. The recent Q3 2023 results suggest that the company has successfully secured enough capital to fortify its balance sheet for at least the next two years at the current free cash flow burn rate.

Notably, the bull case for Denison extends beyond financial stability, as the potential for not just one but two operational mines looms on the horizon. What makes this investment particularly bullish is the market’s apparent oversight of Denison’s second mine, suggesting room for encourage upside.

Against the backdrop of a widening gap between uranium supply and demand, Denison Mines emerges as a strategic player positioned to deliver robust returns, provided uranium prices remain elevated. Investors should take note of the exciting prospect in the uranium sector.

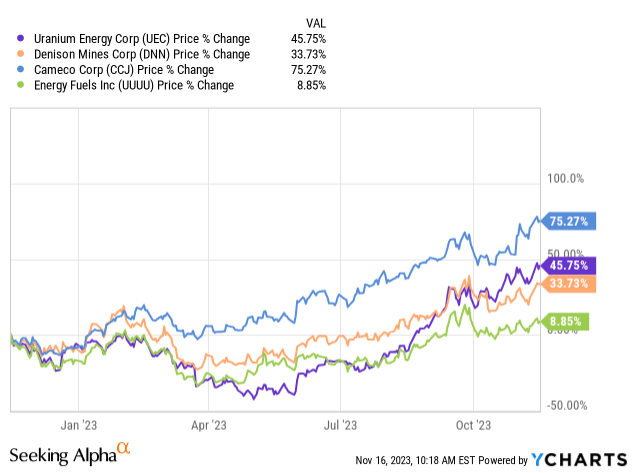

Personally I’ve chosen to invest with Uranium Energy Corp. (UEC), but I wouldn’t say there’s a lot of difference between the two.

In fact, it appears that the whole sector has been posting positive returns in this past year.