PM Images

Dave’s (NASDAQ:DAVE) rally from 52-week lows has been nothing short of dramatic, with the neobank moving up a remarkable 360%. This blistering rally came after a 52-week low reached in the aftermath of a 1-for-32 reverse split at the start of its fiscal 2023 that was forced by a roughly 96% collapse from its SPAC reference price. Dave is a mobile banking app that offers its members a range of financial products, with its core product ExtraCash offering cash advances.

Dave.com

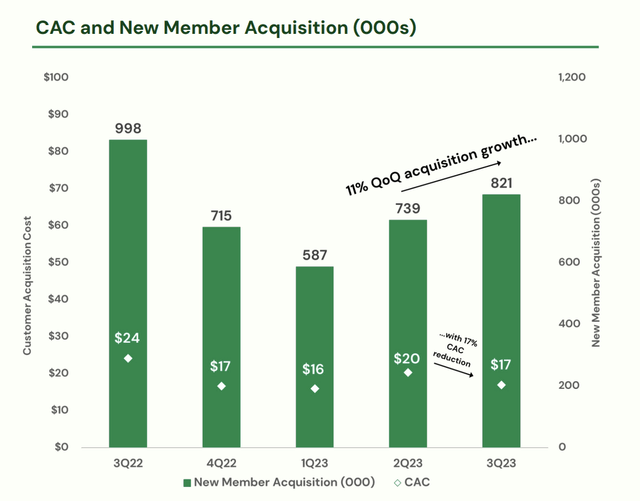

The company also offers FDIC-insured spending accounts, a savings account currently offering a 4% APY, and a quirky service called Side Hustle that allows its members to find opportunities for flexible part-time roles and to earn money from surveys. There’s intense demand here with new members at 821,000 at the end of its last reported fiscal 2023 third quarter, up 11% sequentially with Dave currently underway with a recovery in new members growth momentum.

Dave Fiscal 2023 Third Quarter Earnings Presentation

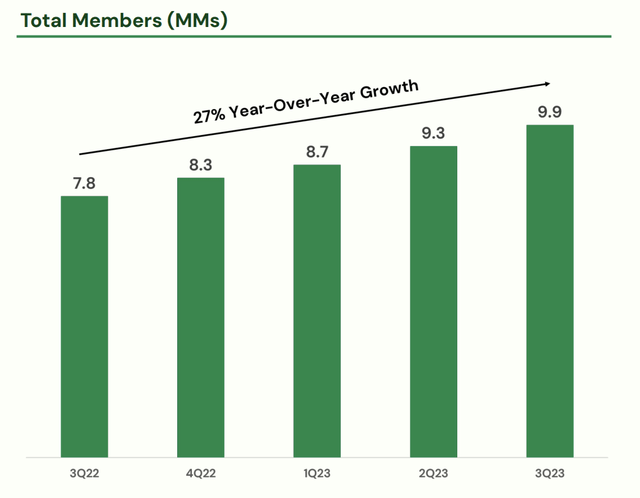

New members added dipped by 177,000 from a year ago, but Dave has been pushing a multi-pronged growth strategy with marketing that emphasizes their free banking service and instant access to short-term credit for new members with a debit card, Dave Card, that’s meant to make its overall product flywheel stickier and deepen its relationship with new members. Total members now sit at just under 10 million, up 27% over the same quarter a year ago. The stock is up markedly from when I last covered it with a neutral rating but highlighting what was then a 0.34x multiple to sales.

Dave Fiscal 2023 Third Quarter Earnings Presentation

Ramping Sales And The Pursuit Of Profitability

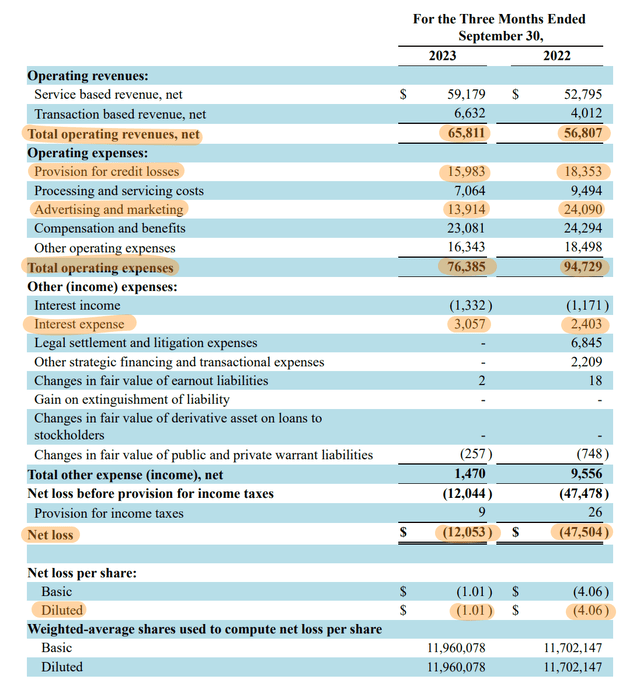

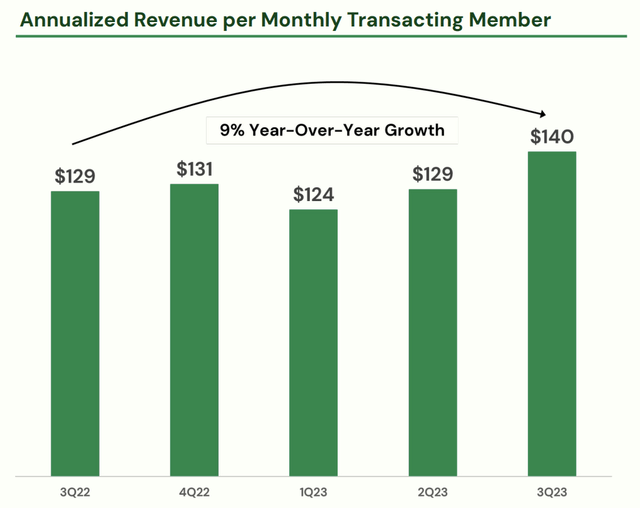

Dave generated $65.8 million in revenue during its third quarter, up 16% from its year-ago comp and growth of 7% sequentially. Growth was driven by ARPU expansion, despite the lower number of new members versus the year-ago comp. ARPU growth has been built on the back of strong new membership uptake of Dave Card and ExtraCash with rising total monthly transacting members also boosting Dave’s performance. The quarter was a blowout in terms of profitability, with Dave seeing positive momentum in almost every core metric.

Dave Fiscal 2023 Third Quarter Form 10-Q

There was an 11% sequential reduction in customer acquisition cost driven by lowering marketing spend. This figure was $13.91 million during the quarter, down $10.18 million from its year-ago comp. Further, Dave’s provision for credit losses dipped $2.37 million to $15.98 million to help drive a 19% reduction in total operating expenses to $76.39 million.

Dave Fiscal 2023 Third Quarter Earnings Presentation

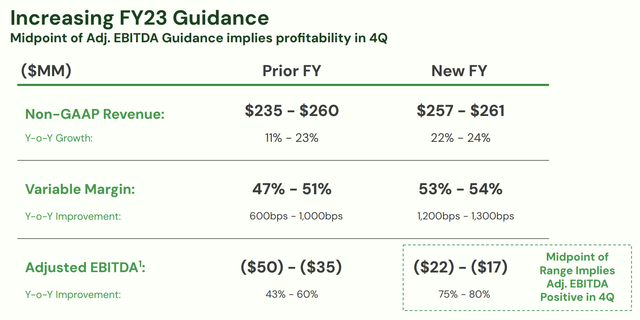

Net loss for the quarter at $12.05 million, around $1.01 per share, was down a material 75% from its year-ago figure. The company upped its full-year 2023 revenue guidance to $257 million to $261 million, a $22 million raise on the low end of a prior range of $235 million to $260 million. Adjusted EBITDA loss for the full year is also set to be not more than $22 million.

The Rally Could Continue On Improving Credit Quality And Growing Originations

Dave Fiscal 2023 Third Quarter Earnings Presentation

Dave reduced its customer acquisition cost by 30%, grew new members, and pushed through a 9% year-over-year growth in annualized revenue per monthly transacting member to $140 with total monthly transacting members also growing 6% year-over-year to 1.9 million. This growth has opened up the specter of profitability for the bears who make up the 7.7% short interest in the commons. Dave at its current $250 million market cap could still move up on improving unit economics and what’s currently a 0.97x multiple to the midpoint of its full-year 2023 revenue guidance.

Dave Fiscal 2023 Third Quarter Earnings Presentation

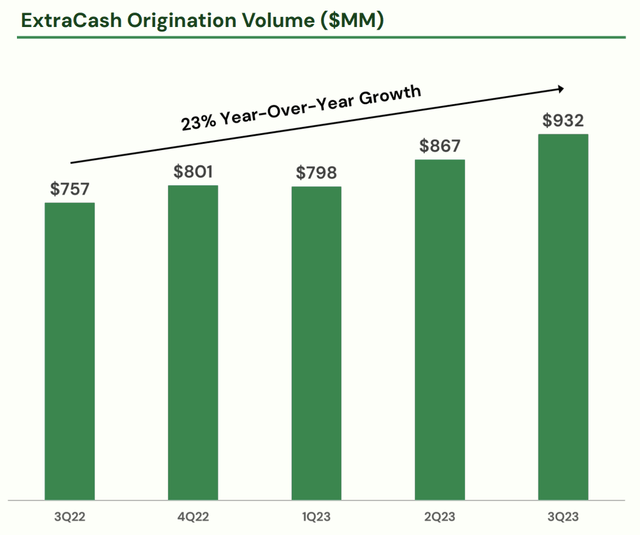

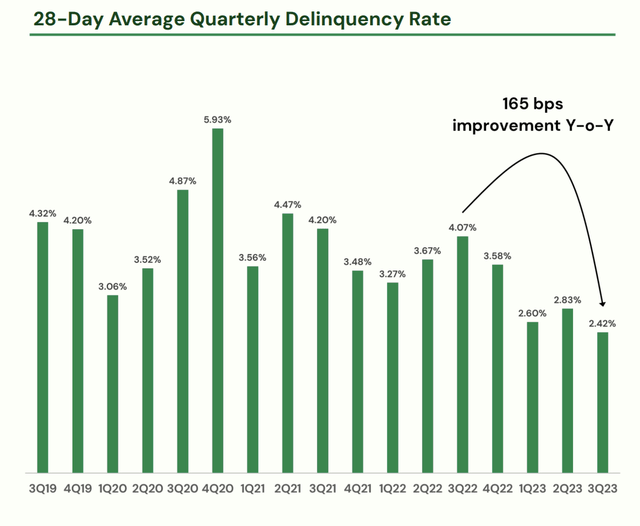

Dave’s core product is seeing steady volume growth, reaching $932 million during the third quarter. This was up 23% over its year-ago comp and grew by $65 million sequentially. That this growth came with a dip in the 28-day average quarterly delinquency rate to 2.42% from 4.07% a year ago is a positive sign for Dave’s underlying credit quality.

Dave Fiscal 2023 Third Quarter Earnings Presentation

However, it’s important to stress that Dave’s lack of profitability in a high-interest rate environment renders the commons a high-risk play. The company’s total cash, short-term investments, and restricted cash at $171 million at the end of its third quarter fell from roughly $224 million a year ago. This is against a long-term debt balance of $180 million, comprised of a $105 million convertible note and a $75 million debt facility. The company has since been able to repurchase its convertible notes back from FTX Ventures for $71 million, roughly 67 cents on the dollar. Hence, the company should realize a gain on the extinguishment of debt of $34 million when it reports fiscal 2024 first-quarter earnings. The debt was quite cheap at 3.00% per year, but the simplification of its balance sheet is a positive. I’m rating Dave as a speculative buy on improving unit economics, but prospective longs should be cognizant of the small size of the company and its risky core product providing consumer credit.