LPETTET

Company Overview

CVS Health Corporation (NYSE:CVS) is a US-based integrated provider of healthcare solutions across the value chain from pharmacies and primary care to health insurance for commercial and governmental customers. It is the second largest healthcare services provider in the US behind UnitedHealthcare with more than 300k employees and $322bn in revenue as of FY22. Originally starting out as a pure pharmacy chain, since the 2010s management has engaged in a strategic realignment of the business towards a fully-integrated healthcare provider, acquiring health insurance company Aetna for $69bn in 2018 with previous Aetna CEO Karen Lynch taking the helm of the new company.

After previously committing to a focus on debt paydown and restarting of shareholder returns, in 2023 management announced two additional acquisitions in primary care player OakStreet Health for $10.6bn and health-screening provider Signify Health for $8bn, losing a great deal of trust from investors. With those new acquisitions pushing leverage above 3x EBITDA again and uncertainty about the execution risk involved in the company’s ambitious strategize, CVS stock has come under increased pressure being down 26% YTD and almost 40% from their last high in early 2022. With CVS trading at c.10x my FY23 estimated EBIT and the December 5 Investor Day having provided more insight into what I think is a clear and credible path forward, I calculate current risk/reward skewed to the upside and begin CVS at a Buy rating.

Health Care Benefits – $91bn of FY22 Revenue

Through health insurer Aetna, this segment provides medical and drug insurance products and services to more than 25 million customers. Customers are grouped into commercial, which mainly includes employer and individual plans, and government, which deals with governmental unit customers as well as Medicare (incl Medicare Advantage “MA”) and Medicaid plans. With Aetna’s National PPO insurance strategize recently upgraded to 4 stars from 3.5, 2024 will see 87% of Medicare Advantage members enrolled in 4+ star plans making CVS eligible for governmental bonus payments from 2025 onwards after having recorded a c.$1bn loss of revenue in the prior year due to MA strategize rating downgrades. Key competitors in mixed commercial and government-sponsored health insurance include UnitedHealth (UNH), Cigna (CI) and Elevance Health (ELV). With current CVS CEO Karen Lynch coming directly from 2018 acquired Aetna, growing the segment’s membership base and competitive positioning is a large focus for management due to the relatively safe business model and recurring revenues it provides.

Health Services – $169bn of FY22 Revenue

The health services segment incorporates CVS’s pharmacy benefit manager (“PBM”) CVS Caremark as well as its operations in primary care (192 locations) and walk-in medical clinics (1,000+ locations). The segment mostly provides its services to customers in health insurance, large employers and governmental entities. CVS’s largest competitors in the PBM business include Cigna through articulate Scripts and UnitedHealth through Optum. In the field of primary care the competitive landscape is more fractured with several smaller and regional competitors. This segment has recently been strengthened by the mentioned acquisitions of OakStreet and Signify with management seeing the business as a key part of their strategize to become a fully integrated health care provider from insurance to the distribution of medical and pharmaceutical services to the end customer.

Pharmacy & Consumer Wellness – $107bn of FY22 Revenue

The pharmacy segment is CVS’s “traditional” retail and front-store business, operating a nationwide network of pharmacies with more than 9,000 individual locations. The segment also includes its online-retail as well as testing and vaccination services. After Rite Aid went into Chapter 11 earlier in 2023, Walgreens (WBA) remains the largest remaining pure-play pharmacy competitor, however a variety of US grocers and general retailers also function in-house pharmacies such as Walmart (WMT), Kroger (KR) and Albertsons (ACI).

How those tie together – CVS Integrated Healthcare Strategy

With those three distinct segments in place, it becomes apparent what management has envisioned for CVS. The final goal of all the acquisitons and strategic shifts seen over the past years is to create a fully integrated CVS ecoystem in which the customer will never leave a CVS operated service. This starts from the health insurance strategize he is enrolled in and goes down to the clinic where he will get surgery. Post-surgery, his condition will be monitored by the wide network of CVS primary care locations and his prescribed medications will be distributed to him via a CVS pharmacy while pricing for those drugs, which affect both the individual pharmacy and the insurance strategize, will be negotiated by CVS’ PBM. When executed correctly, this integrated model can bring tremendous value not only for the end customer, who should ultimately benefit from more competitive prices and services, but first and foremost to CVS itself, which gains an invaluable amount of leverage towards both pharmaceutical manufacturers and customers. While it is too early to make a full call on the achievability of this model, with is still being very much a show-me story, I see a lot of credibility in management’s mid-term execution strategy given additional guidance provided during the Investor Day.

Key Investment Thesis

Strong Performance in Insurance Business with advance Growth Runway through Expansion in Medicare Advantage Plans

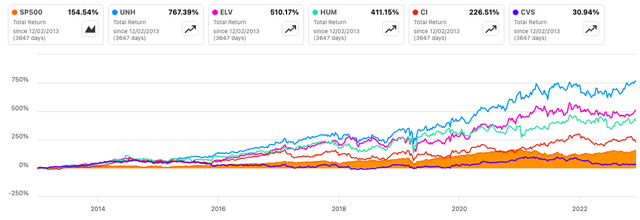

With former Aetna CEO Karen Lynch at the helm of CVS, it is evident that a large part of its future story and value lies within its insurance business. US health insurers led by UNH have outperformed the S&P 500 by a significant margin over the last 10 years, aided by recurring and stable revenues and high cash generation enabling buybacks and capital flexibility.

SeekingAlpha

Notably, CVS has not been able to engage in this, instead underperforming the index even post-Aetna acquisition in 2018. In my view this is unjustified as by all metrics CVS’ insurance business is performing very strong and above most of its key peers. Note that for peers I will only consider UNH, ELV and CI as Humana (HUM) has recently exited their commercial insurance business to become a pure-play government-focused insurance provider thus making them less comparable with CVS which offers services to both types of customers.

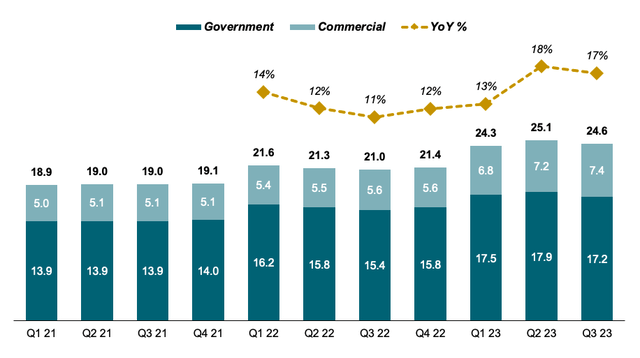

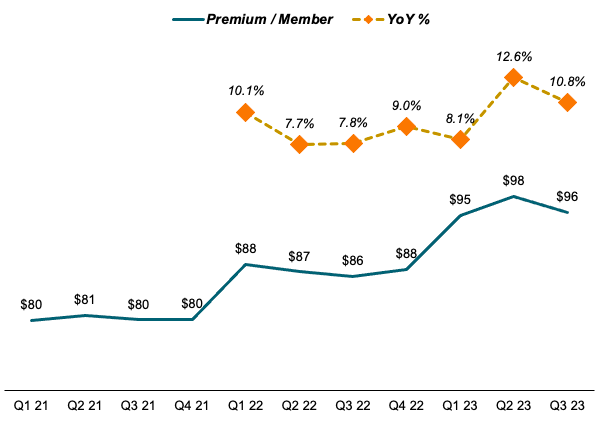

Since FY20 CVS has grown insurance premia from $18.9bn to $24.6bn as of Q3 23 for a total growth of 30% and quarterly YoY growth rates in the low to mid double digits since Q1 2022 with government customers making up the majority of revenue at c.70%. Of this 30% total growth roughly 1/3 was driven by an enhance in volumes (that is members) from 23.6MM to 25.7MM while the more significant 2/3 came from pricing (premia/member) which grew 20% from an average of $80 to around $96, showing CVS‘ significant operating leverage in the insurance business. Medicare Advantage has significantly outperformed both government and total memberships with 3.44MM members as of Q3 23 vs 2.87MM at FY20 end, a 20% total membership growth, raising its share of total government customers from 42% to 47%. It is also important to note that while total average across all member types sits at $96, CVS earns higher premia/member from its customers in governmental plans with their average at around $230 as opposed to $40 in commercial plans, driven mainly by Medicare Advantage reimbursements.

Insurance Premia Revenue Development (Company Filings)

Premia/Member Development (Company Filings)

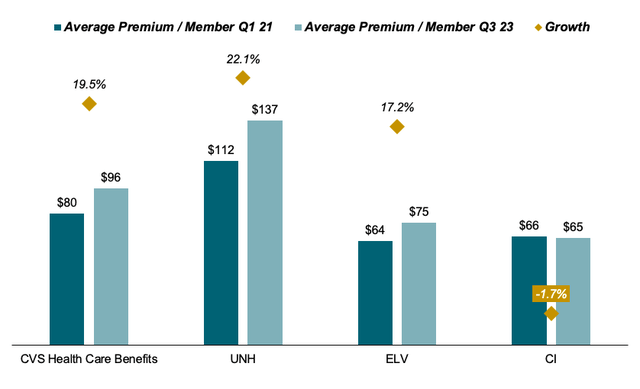

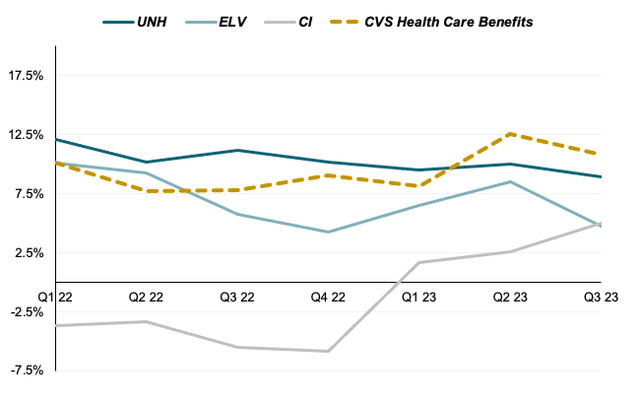

When compared to peers, CVS’ insurance business has been able to outperform most of its competitors net of UNH with a slight edge over ELV at 17% growth and a wide margin vs CI which has recorded a drop in premia/member since FY20. While UNH has seen a largely flat trajectory in quarterly YoY growth rates in premia/member and ELV has trended downwards over the period, CVS has been able to significantly outperform the group in the last 2 quarters with a sharp rise in Q2 23. Over all quarters CVS’ average YoY growth in premia/member has been just shy of 10% at 9.4%, again beating out ELV (7%) and CI (-1.3%). Notably, growth at CVS has started to accelerate in the last periods with rolling 4-quarter average at 10.1% (70bps above total period average), compared to recent weaknesses at UNH (down 70bps to 9.6%) and ELV (down 100bps to 6%).

Premia/Member Growth vs Peers (Company Filings)

Premia/Member Quarterly YoY Growth vs Peers (Company Filings)

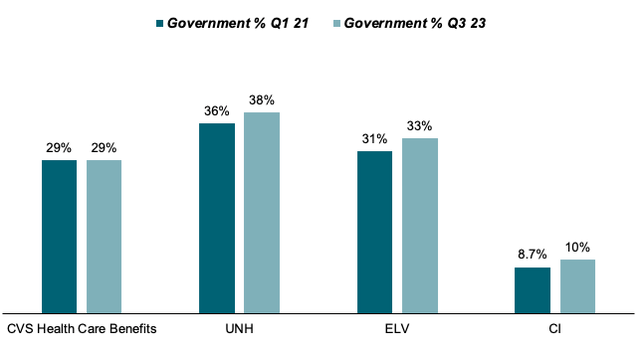

In light of this performance I view current investor perception of CVS’s insurance business as greatly underestimating its actual value and prospects. With government strategize premia/member significantly higher than those earned from commercial plans, I see great potential for CVS here to advance enhance premia/member with management specificially citing their focus on the Medicare Advantage program. Comparing membership split for Q1 21 with the most recent period, CVS has been the only player among peers that did not grow its share of government customers remaining roughly similar at 30% while UNH, ELV and CI grew their shares as they shifted more resources to more lucrative Medicare plans. As mentioned, HUM has entirely exited their commercial business to focus solely on Medicaid and Medicare with management citing superior growth opportunities and more generous funding sources through CMS (Centers for Medicare & Medicaid Services) as their key reasoning.

Company Filings

Going forward and with CVS management already putting a lot of attention towards those plans to capitalize on aging population and healthy federal spending, I calculate a large amount of upside in the insurance business. CVS’ Medicare Advantage plans continue to be among the highest rated with flagship Aetna National PPO recently regaining its 4 star rating thus making it eligible for bonus payments in coming years which should advance help the top line.

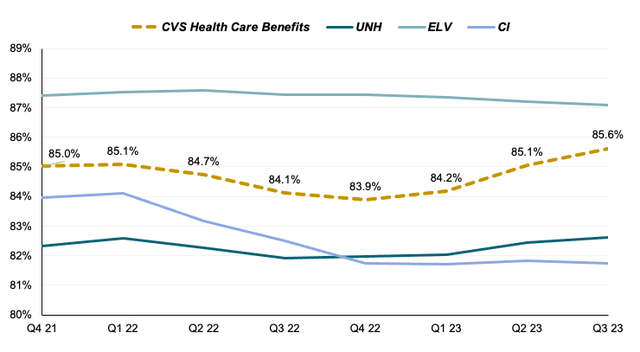

While CVS’ top line development has been impressive, recent quarters have seen a rise in the Medical Loss Ratio (“MLR”) in light of higher utilization through catchup medical treatments from the covid-era. The MLR essentially measures what percentage of collected premia the strategize provider spends on medical treatments for its members and thus serves as a proxy for gross margins. With stable administrative and selling expenses, overall operating margins in the segment have recently contracted from around 7.6% in early FY22 to 5.9% as of latest, largely due to a rise in medical treatments. Compared to peers, CVS is below ELV but significantly higher than CI and industry leader UNH which both greatly benefit from cost advantages in administering medical treatment through their network of owned and partnered clinics and primary care facilities, exactly what CVS is trying to emulate through their recent strategy in acquiring those capabilities.

Medical Loss Ratio Development vs Peers (Company Filings)

While management has recently flagged that an elevated MLR is to persist through 2024, I find an eventual ease and reconvergence to long-term averages reasonable to expect as the effect from Covid-19 catchup treatments fades. Together with the increased rollout of its primary and clinical care network and its benefits on the MLR, I expect the segment to continue towards a stable operating margin level at c.6-7%.

Recent Acquisitions help to enlarge CVS Footprint in Value-Based-Care and allow for Synergies with Insurance Business

In the course of 2023 CVS made 2 additional high-profile acquisitions, aimed at advance strengthening its positioning in primary- and value-based care. In February it acquired Oak Street Health, an operator of primary care facilities focused on Medicare-enrolled patients, for $10.6bn and in September it bought out Signify Health, a provider of in-home health risk assessments for c.$8bn. With a total value of almost $20bn, those acquisitions and the price point they came at were not received well by the market. And while I do agree that the price point and the near-term prospects for both business do not seem immediately accretive to CVS strategy and profits, I do believe there is substantial value to be captured in the long run as both targets will benefit from CVS’ massive scale and financial strength.

Oak Street Health got acquired at a EV/LTM sales multiple of 4.9x with no EBITDA multiple available since the company is still operating at a loss. In the near term CVS management is expecting to continue, however as clinic ramp-up continues and synergies with CVS’ existing real estate footprint come into play, Oak Street is expected to contribute c.$7MM of EBITDA per clinic. Assuming management’s mid-term target of 300 clinics, this would yield a total contribution of around $2.1bn by 2026. However I do believe the real value of this acquisition does not come in Oak Street itself but rather what it provides in synergies for CVS’ existing businesses, specifically its insurance business Aetna which recently had suffered from a higher MLR that is expected to hold through FY24. The key word here is “value-based care” with Oak Street specifically focusing on at-risk Medicare-enrolled patients and having credible data evidence to show that patients treated at their facilities have on average 50% lower hospitalization rates. If CVS is able to leverage this existing base of knowledge and best practices and, through use of its financial and operational resources, advance build up this model to national scale, this could drive strong cost savings for its insurance business.

I see the Signify Health acquisition in a largely similar light. Even though financial terms of the deal in terms of revenues and expected contributions have not been communicated, I think investors should focus less on the acquired business itself and more on the potential it can have in the integrated healthcare model CVS is building. By providing in-home health screenings and assessments to Medicare-covered, at-risk patients (similarly to Oak Street), Signify can supply a credible source of advance cost savings to CVS’s insurance unit and allow it to leverage the collected data to advance enhance its offered plans. Again, one of the key issues a stand-alone Signify would have faced is obtaining the necessary human and financial capital to preserve a advance roll-out of their model with currently just 2.5MM Americans under coverage, hence the company seeking a sale, with CVS winning out against Amazon and UNH. With the backing of CVS’ existing financial capabilities and with a credible strategy for integration into its platforms in sight, I feel the deal has a tremendous amount of long-term value embedded in it.

With a strong performing insurance business that is excellently positioned for advance growth and a growing footprint in value-based care to preserve and amplify it, I think the third crucial part of CVS future value proposition lies in its massive retail footprint. While unloved by investors due to low growth prospects and growing competition from grocers and e-tailers, I view this segment as the key asset to making this strategy work. As mentioned before, one limiting factor for both Oak Street and Signify businesses has been growth, with end customer exposure being limited and regional. By leveraging its trusted brand as number 1 US pharmacy and nationwide network (85% of US population within 10 minutes of a CVS pharmacy), I calculate CVS can greatly enhance exposure towards both businesses, driving its retail customers towards Oak Street clinics and having pharmacy staff recommending in-home health assessments through Signify. This is exactly the kind of business model that CVS management envisions when it speaks about a “holistic healthcare” approach, leveraging its competencies both up- and downstream the healthcare value chain to drive superior outcomes in the overall business.

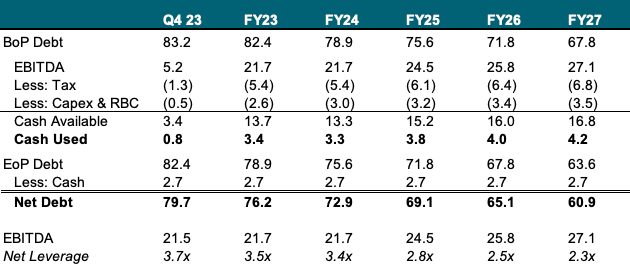

Worries about Leverage are not fundamentally justified and strong Cash Generation should enable <3x Leverage by FY25

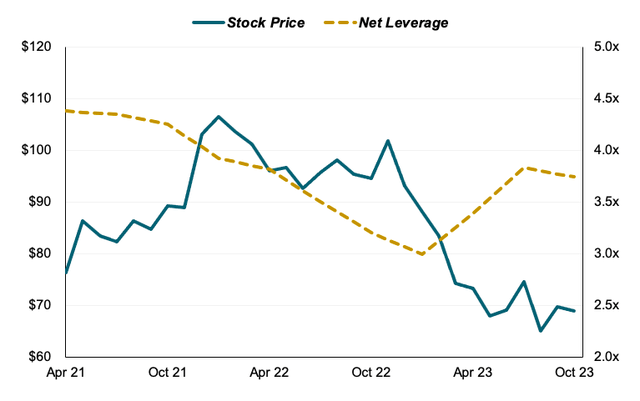

After the Aetna acquisition CVS had initially committed to a swift debt paydown to restart shareholder distributions. When management however announced two additional acquisitions, financed by significant amounts of new debt, investor sentiment soured, driven by both management’s change of course and worries about CVS’ already high debt position in times of 4%+ interest rates. From FY20 on, CVS had gradually improved its leverage from 4.4x in Q1 21 to about 3.0x in Q4 22, before rising again to currently 3.7x, slightly off its 3.8x peak in Q2 23.

Looking at CVS share price and leverage levels (defined as Net Debt / LTM EBITDA), this becomes apparent with the inflection point having come in late 2022, shortly after the company announced its intent to acquire Signify, advance exacerbated by the Oak Street announcement in February 2023.

S&P Market Intelligence, Company Filings

Given CVS strong and non-cyclical cash generation, I view such fears about the renewed rise in leverage and general concerns about CVS’ capital structure to be overblown. While its current net debt/EBITDA ratio of 3.7x is widely ahead of peers (UNH: 0.7x, ELV: 1.5x, CI: 2.2x), I see no immediate risk to its credit profile with no major repayment scheduled and interest coverage above 10x as of Q3 23. Assuming a cash flow proxy of EBITDA less taxes and Capex as well as 25% of generated cash allocated to debt paydowns to allow for risk-based capital and dividend coverage, I calculate CVS can reach a <3x level of leverage by FY25, supported by strong projected growth in EBITDA in 2025. With leverage below 3x management should be able to fully refocus most of their cash flow actions on rewarding shareholderes through dividend raises and share buybacks which are highly valued by investors in the insurance space as evident by the c.15% rise in Cigna’s share price after announcing an additional $10bn buyback program post call-off of the proposed Humana merger.

CVS Debt Paydown plan (Company Filings and Author’s Projections)

Valuation

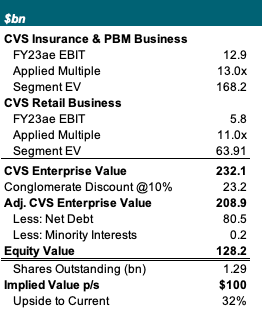

I value CVS using a Sum of the Parts (SOTP) approach, splitting the company into two different businesses: The “Retail” business, which incorporates the Pharmacy & Consumer Wellness division and the “Insurance & PBM” business, which combines the Health Services and the Health Benefits segments. I will then apply separate peer-derived multiples to the respective FY23 projected EBITs of both business to derive an enterprise value for the CVS enterprise. For the Retail business multiples will largely be derived from peers operating in the pharmacy and grocery (including pharmacy services) space. For the Insurance and PBM business I will use trading multiples of peers UNH, ELV and CI as proxy given similar operations in both PBM and Medical Insurance.

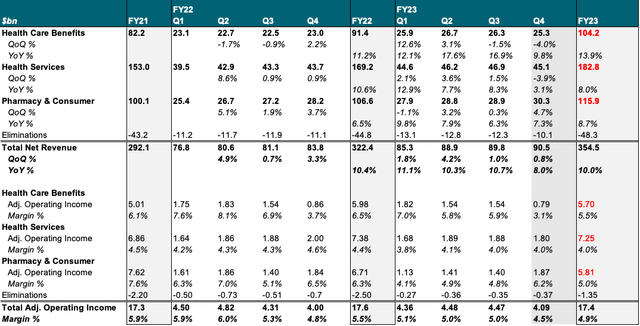

For all CVS reported segments I expect total FY23 sales to come in at midpoint of management’s guidance at c.$355bn, up 10% vs FY22. I model Health Care Benefits at $104bn (+13.9% YoY), Health Services at $183bn (+8% YoY) and Pharmacy & Consumer at $116bn (+8.7% YoY). Total corporate eliminations remain in line with previous year at c.$48bn. For operating profit, management expects a weaker Q4 (in part driven by normal seasonality in the insurance business) with overall FY24 midpoint of guidance at $17.4bn (4.9% margin vs FY22 5.5%). I expect Health Care Benefits margins at c.5.5% for a segment EBIT of $5.7bn with margins down from 6.5% YoY, largely due to a higher MLR and capacity utilization. Health Services margin levels are also expected to be down, driven by the dilutive acquisitions of Oak Street and Signify and for FY23 management expects c.$7.3bn in operating profit at 4.0% margin. Pharmacy & Consumer EBIT is projected to reject significantly YoY to c.$5.8bn due to weaker margins from reimbursement pressure (5.0% vs FY22 6.3%).

CVS Financial Model (Company Filings and Author’s Projections)

Allocating segment EBIT to the two distinct businesses I procure total FY23ae EBIT figures of $12.9bn for Insurance & PBM and $5.8bn for Retail respectively.

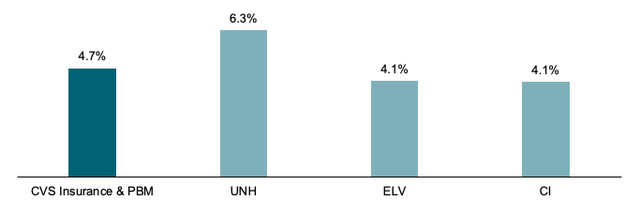

I value Insurance & PBM at 13x EBIT, which is a slight premium to ELV and CI but below UNH. I believe this is justified given CVS’ higher growth in premia/member as well as slightly better margins at 4.7% vs 4.1% for both ELV and CI.

FY23e EBIT Margins % (S&P Market Intelligence and Author’s Projections)

For CVS’ Retail business I apply an EV/EBIT multiple of 11x, blended from Walgreens (WBA) L5Y multiple average of 14x (which I believe to be too high given the significant headwinds the business is facing both near- and long-term) and current multiples for grocery retailers Kroger (KR) and Albertsons (ACI), both of which trade at c.11x and have significant pharmacy operations.

Flowing those assumptions into my SOTP model I reckon a total CVS EV of $230bn (o/w $168bn attributed to Insurance & PBM). Given investors’ natural preference for pure play businesses I apply a (somewhat conservative) 10% conglomerate discount for an adjusted EV of $209bn. Deducting net debt and minority interests I reach at an Equity Value of $128bn or $100 per share, implying c.32% upside from current (December 14) trading levels.

CVS SOTP Valuation (Company Filings and Author’s Projections)

Wrap-Up and Outlook

Overall I view CVS as one of the most underappreciated assets in the US large cap space. While behind industry leader UNH, its insurance business has outperformed peers Cigna and Elevance in both pricing and membership expansion with ample headspace for advance growth driven by advance focus on government-sponsored Medicare plans. Combined with the company’s recent push into primary and value-based care and the possibility to effectively leverage its existing brand equity and customer network to grow in these sectors, I believe there is significant value in CVS’ long-term value proposition. That being said, I confess investors’ recent aversion towards the stock as there remains a sizeable amount of execution risk in this “show-me” story.

I do however believe that this has been fully priced in at current multiples and I do not calculate advance contraction from here on. Similarly, with earnings expected to stabilize in FY24, I see risk/reward strongly skewed to the upside. On the flipside, I calculate a retreat in MLRs down to the mid-80s and a faster than expected paydown in debt to have the potential to drive a significant rerating of shares to levels of competitors Cigna and Elevance and unlock significant value in the stock.