da-kuk

Written by Nick Ackerman, co-produced by Stanford Chemist.

Calamos Strategic Total Return Fund (NASDAQ:CSQ) has provided a solid track record by investing primarily in equities but also a sleeve of convertibles. The fund has continued to trade near its net asset value, making it difficult to get a good deal on this closed-end fund. Still, for a long-term investor, CSQ could prove to be a place to park capital and collect a healthy distribution yield.

Since our last update, CSQ’s total returns have come in mostly in-line with the broader equity market. Though, like most investments during this period, it wasn’t a straight line to get there. Instead, with the broader equity and fixed-income space, there was significant pressure in October as risk-free rates surged.

CSQ Performance Since Prior Update (Seeking Alpha)

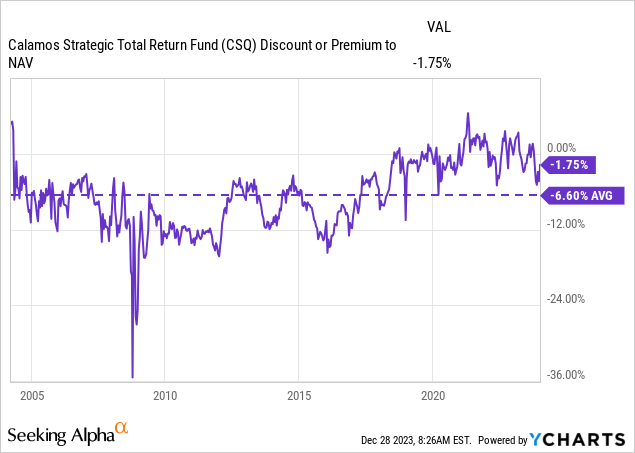

Since then, the fund’s discount has come full circle to come back to a nearly identical level it was in our prior update. Additionally, the fund released its latest annual report for the fiscal year end of October 2023. This also appears to be the first report, which is now a consolidated report of all the Calamos funds, which is an unfortunate change.

CSQ Basics

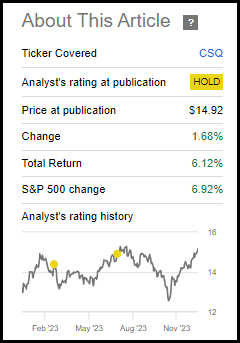

- 1-Year Z-score: -0.58

- Discount: -1.75%

- Distribution Yield: 8.11%

- Expense Ratio: 1.57%

- Leverage: 32.30%

- Managed Assets: $3.359 billion

- Structure: Perpetual

CSQ’s objective is to seek “total return through a combination of capital appreciation and current income.” They attempt to achieve this simply by; “investing in a diversified portfolio of equities, convertible securities and high yield corporate bonds.”

The fund has the ability to invest where they think the best opportunities might be. That is part of the appeal of active management: the flexibility to adapt to different situations. However, it should be noted that the fund will have “at least 50% in equity securities.”

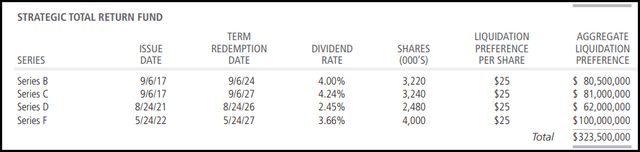

The fund runs with a fairly high amount of leverage, but this has been fairly consistent for Calamos funds. With a higher interest rate environment, we’ve naturally seen the borrowing costs increase for many closed-end funds. That is also the case for CSQ, which has borrowings based on OBFR plus 0.80%. During the last fiscal year, the interest rate charged was 5.84%. However, unlike other CEFs, which tend to rely more on these floating rate borrowings, CSQ also has incorporated fixed-rate mandatory redemption preferreds at various fixed rates.

The Fund’s MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund’s prospectus): 4.00% for Series B MRP Shares, 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares and 3.66% for Series F MRP Shares. To cover the interest expense on the borrowings under the SSB Agreement (including “net income” payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2023, the Fund’s portfolio would need to experience an annual return of 1.79% (before giving effect to expenses associated with senior securities).

CSQ Preferred Leverage (Calamos)

These fixed rates came in handy during this rising rate environment as the borrowing rate for the floating portion has surpassed that of the fixed. However, with rates set to come down in the coming years, we could see this flip once again. On the other hand, should rates not fall materially, then these fixed rates are still going to be beneficial, and at the very least, they add some predictability.

Performance – Solid Track Record But Tight Valuation

Annualized performance for CSQ has been solid historically, and 2023 is shaping up to be another year to be a positive contributor. For the most part, this should be expected as the fund carries a significant weight to equities – and in particular, the Mag 7 names also comprise a solid portion of the fund. The returns below are as of the end of November, but December is only looking set to add positive results.

CSQ Annualized Performance (Calamos)

The continued solid performance of this fund has naturally garnered some interest in the fund. I’ve owned CSQ for a number of years now, going back to early 2018. Over the years, I have added to it periodically. However, I’ve never really gotten the chance to grow the position as much as I’d like, given the relatively tight valuation at which this fund continues to trade. At one point, this fund traded at a rather steady discount. Since then, the fund has mostly continued to flirt with a premium.

Perhaps I’m being too picky or stubborn here, but I remain a holdout to adding a significant amount until a more substantial discount. However, I will continue to hold my position and even add during overall market swoons – which included adding some in mid-2022.

Ycharts

Distribution – Sustainable And Attractive

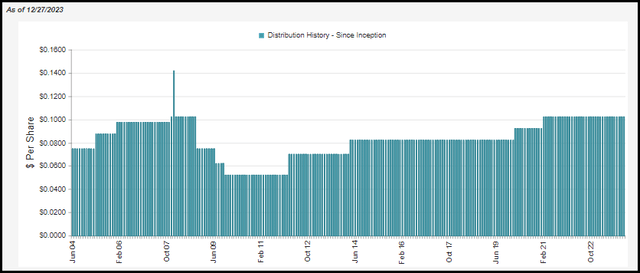

The fund had to reduce its payout several times during the Global Financial Crisis. However, since that time, the fund has been able to ratchet it back higher. At this time, the fund’s distribution rate on an NAV basis comes to a reasonable 7.97%. Given that the fund is essentially trading at its NAV rate, the share price distribution rate is around the same.

CSQ Distribution History (CEFConnect)

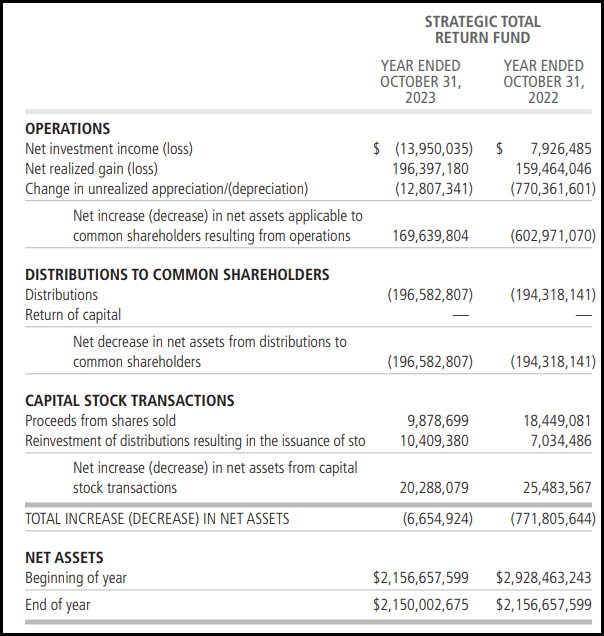

Most equity or hybrid funds rely on capital gains in some capacity to fund their payouts. In the case of CSQ, we see that the entire distribution will need to be funded via capital gains. Their last annual report for their fiscal year-end shows that NII was negative, which is a drastic change from last year.

CSQ Annual Report (Calamos)

The funds’ total investment income actually rose to nearly $78 million on the back of higher interest and dividends received from the $71.134 million last year.

The lower NII was partially the result of $10.175 million in amortization that reduced TII. That was a slight increase from the $8 million in amortization last year.

That said, the primary factor was the interest expenses on the notes payable, which came from $11.679 million to $44.287 million in the latest fiscal year. That was, to reiterate, the result of the average borrowings on their credit facility rising materially year-over-year.

Going forward, we should expect to see those borrowing costs ease off as rates come down. That could take what was a headwind against the fund’s income generation and once again become a potential tailwind for supporting the distribution.

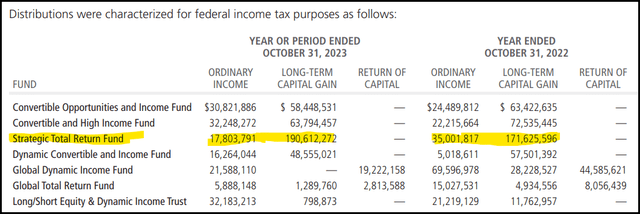

For tax purposes, the fund has contributed the primary classification would have been long-term capital gains for the previous two years. That isn’t all that unexpected, given the operations breakdown for the fund that we see above. This also makes it an okay fund to hold in a taxable account, as LTCG is more favorable than ordinary income rates.

CSQ Distribution Tax Classifications (Calamos (highlights from author))

CSQ’s Portfolio

The portfolio turnover rate for CSQ has indicated that the managers haven’t been overly aggressive in making changes, nor have they been doing nothing either. The latest fiscal year reflects this once again, with a mild turnover rate of 29%. That can be compared to the average over the last five years of 28.4%, including fiscal 2023.

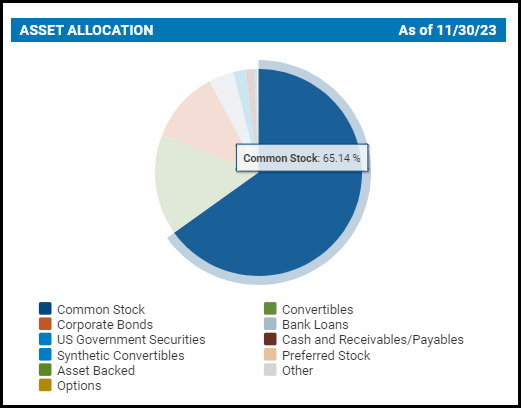

With that, there have not generally been massive shifts in the allocations of the fund either from update to update. The latest update shows that the common stock sleeve has grown its allocation to some degree from the 60.70% allocation it weighed in at previously.

CSQ Asset Allocation (Calamos)

That increase came ever so partially on the back of a reduction in the convertible sleeve at 15.74%, where it was previously a 17.64% weight. The high-yield sleeve, which isn’t an overly large focus of the fund, still carries a somewhat meaningful weight of 11.28% currently. That was only a marginal decrease from the 11.67% previously.

In the grand scheme of it, none of these shifts have been anything too meaningful for the fund. In fact, it is likely the natural gyrations of the portfolio that caused these slight variations that we saw rather than a deliberate management team looking to make a conscious shift.

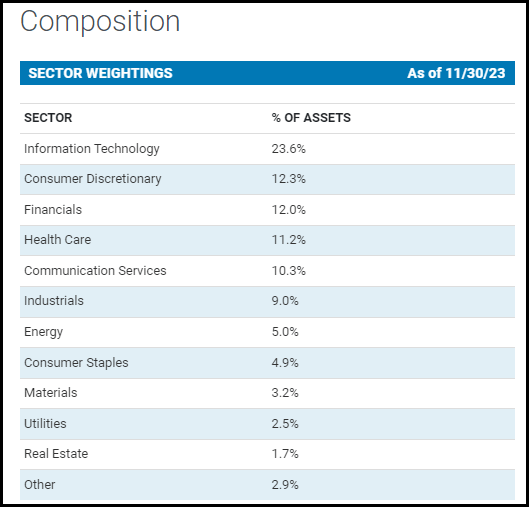

In looking at the sector composition of the fund, we similarly see only marginal differences here, as expected.

CSQ Sector Weighting (Calamos)

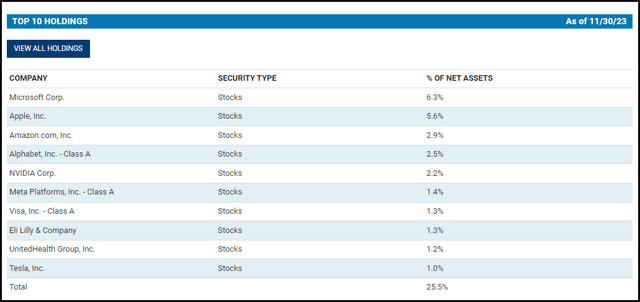

Finally, by giving the top ten a look, we can see where CSQ’s performance has come from. In particular, the emphasis on several of the Mag 7 names here is a continued driver of CSQ’s success throughout 2023.

CSQ Top Ten Holdings (Calamos)

Indeed, these were positions that we saw also in the previous update when we looked at the largest holdings in mid-2023. Microsoft (MSFT) has climbed its way to the largest holding, which dethroned Apple (AAPL) as they flip-flopped positions. Amazon (AMZN), Alphabet (GOOGL), NVIDIA (NVDA), Meta Platforms (META) and Tesla (TSLA) all make an appearance on the top ten currently – meaning the whole Mag 7 band is all here.

TSLA is a “newcomer” to the top ten, as it wasn’t listed at the end of May 2023. That said, it is not a new name for the fund overall. Over the last few years, they’ve consistently carried some exposure to this name through both convertibles and common equity positions.

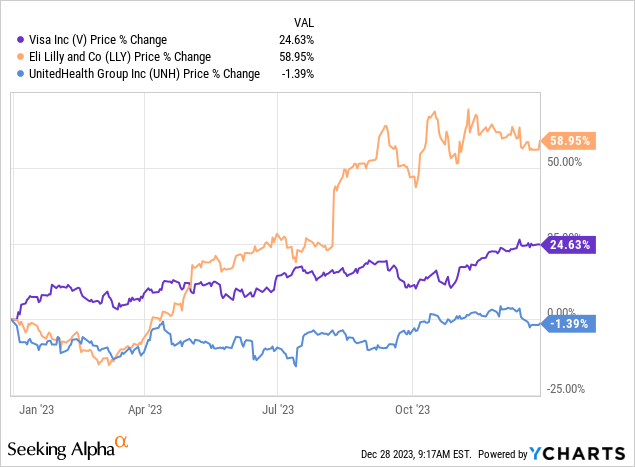

Though the emphasis is on Mag 7 names that did most of the heavy lifting this year, it isn’t as though the other names here performed terribly.

Ycharts

UnitedHealth Group (UNH) is the worst performer in terms of share price alone on a YTD basis (essentially a full year at this point.) However, there was a lot worse that one could do than going flat. For CSQ, Visa (V) and Eli Lilly and Co (LLY) also did some heavy lifting to provide solid results for the fund. These were names present in the fund in their prior fiscal year-end 2022 report as well. In fact, they were similarly some of the largest positions at that time.

Conclusion

CSQ essentially provides exposure to the equity market but also incorporates a small sleeve of convertible and high-yield allocations. The fund has provided solid long-term results with this composition. That being said, similar to some other funds out there, it is going to be highly dependent on the continued success of the Mag 7 names that comprise a high allocation to the fund.

Subsequently, those results will also drive the fund’s monthly distribution to investors as well. The distribution is currently looking quite sustainable and respectable. The fund is currently in a situation where it relies entirely on capital gains. This could shift when interest rates go down, and it can once again provide positive NII. However, the distribution doesn’t look elevated either, which should bode well, and the outlook for potential income generation could further help sustain the payout.