SARINYAPINNGAM

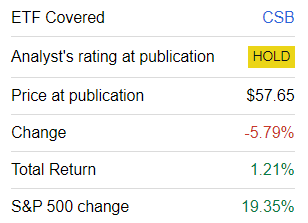

Continuing my series of updates on dividend ETFs, today I would like to give a second look to the VictoryShares US Small Cap High Div Volatility Wtd ETF (NASDAQ:CSB). My initial assessment provided in April 2022 was predominantly lukewarm, with quality concerns and performance disadvantages impacting the rating most. Today’s analysis is not bullish either. The key reason for that is CSB’s performance, which I would call somewhat paradoxical or incongruous. I will elaborate on that shortly. As to the factor mix under the hood, this is a deeply contrarian portfolio with a value tilt, ignoring the growth factor almost entirely, with quality remaining below a level I would call adequate for a dividend-centered ETF, warranting a more cautious outlook. I also have a few critical remarks on dividend growth.

What Is The Crux Of CSB?

In short, CSB’s essential idea is to amalgamate high-yield dividend-paying U.S. small-cap stocks, placing more weight on those that sport stronger low-volatility characteristics. As described on its website, the basis for CSB’s strategy is the Nasdaq Victory US Small Cap High Dividend 100 Volatility Weighted Index. As we know from the fact sheet, the said index represents about one-fifth of the Nasdaq Victory U.S. Small Cap 500 Volatility Weighted Index, with components selected using the dividend yield: the higher, the better. The low-volatility ingredient is added via weighting, with constituents having a lower “standard deviation over the past 180 trading days” seeing their weights boosted and vice versa. The index that serves as a selection universe is, in turn, based on the Nasdaq US Small Cap Index; it represents the 500 largest names from it with “positive earnings across the last 12 months.” From the prospectus, we know that a 25% cap is applied to sectors.

To add a bit more context, I should note that this also results in low-beta stocks climbing to the top, as illustrated by the tables with the largest five and the smallest five holdings of CSB as of March 22. The top five:

| Stock | Weight | 24M Beta |

| MGE Energy (MGEE) | 1.7% | 0.50 |

| MDU Resources (MDU) | 1.6% | 0.59 |

| MSC Industrial Direct Co. (MSM) | 1.5% | 0.83 |

| The Wendy’s Company (WEN) | 1.5% | 0.74 |

| National Fuel Gas Company (NFG) | 1.4% | 0.70 |

The smallest five:

| Stock | Weight | 24M Beta |

| Steelcase (SCS) | 0.6% | 1.15 |

| Nordstrom (JWN) | 0.6% | 1.94 |

| Camping World Holdings (CWH) | 0.6% | 1.51 |

| MillerKnoll (MLKN) | 0.6% | 1.50 |

| Shutterstock (SSTK) | 0.6% | 1.61 |

Data from Seeking Alpha and the ETF

Commenting On CSB’s Performance Anomalies

Since my previous article was published on April 15, 2022, CSB has overwhelmingly underperformed the S&P 500 index.

Seeking Alpha

An investor might suggest that the ETF performed sluggishly last year as its strategy is in fact calibrated for challenging times, thanks to a defensive tilt (a lower standard deviation impacting components’ weights) and a margin of safety (a higher dividend yield means a mostly stronger value profile overall), not to outperform the S&P 500 during the periods when investors are quickly bidding up multiples and share prices are soaring market-wide. But this is only partly true.

CSB was a disappointment last year, as it trailed the iShares Core S&P 500 ETF (IVV) by 13.71% in total return. Yet the major paradox of CSB’s strategy is that even though it outperformed the S&P 500 ETF in 2022, a year that was close to ideal for value style and the low volatility factor to demonstrate their potential, it was deeply in the red nonetheless. Meanwhile, strategies centered on high-yield and/or less-volatile large/mid-caps fared much better in 2022, as illustrated by the table below:

| ETF | 2022 total return |

| WisdomTree U.S. High Dividend ETF (DHS) | 7.95% |

| Franklin U.S. Low Volatility High Dividend Index ETF (LVHD) | -1.81% |

| Invesco S&P 500 Low Volatility ETF (SPLV) | -4.89% |

| SPDR SSGA US Small Cap Low Volatility Index ETF (SMLV) | -7.96% |

| CSB | -13.10% |

| iShares Core S&P Small-Cap ETF (IJR) | -16.19% |

| IVV | -18.16% |

| Invesco S&P SmallCap High Dividend Low Volatility ETF (XSHD) | -19.48% |

Data from Portfolio Visualizer

In my view, the gist is that the small-size factor (which is more of a SMID factor, as I will illustrate below) appears to be the essential detractor, diminishing the impact of low-beta, high-yield stocks on the total returns. This raises the question of whether the entire approach of preparing for market storms with portfolios like CSB’s is viable and workable. I would say it is not.

We saw a mostly similar effect in the case of the Invesco S&P SmallCap High Dividend Low Volatility ETF (XSHD), a passively managed ETF with a relatively similar mandate, which I reviewed in February 2023. The problem with XSHD is that it underperformed both CSB and IVV in 2022.

Still, what is also surprising is that since its inception, CSB nonetheless outperformed all the ETFs shown above, with the exception being only IVV. It also delivered a much stronger annualized return, compared to the iShares Russell 2000 Value ETF (IWN), an ETF tracking the index CSB compares its performance to. It outperformed XSHD by 9.56% over the January 2017–February 2024 period. LVHD trailed it by 2.19% over January 2016–February 2024.

| Portfolio | CSB | IVV | DHS | SMLV | IJR | IWN |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $21,273 | $28,246 | $18,808 | $18,711 | $20,771 | $18,337 |

| CAGR | 9.19% | 12.86% | 7.64% | 7.57% | 8.89% | 7.32% |

| Stdev | 20.04% | 16.04% | 15.14% | 18.93% | 21.14% | 21.80% |

| Best Year | 30.11% | 31.25% | 23.03% | 29.38% | 26.61% | 31.98% |

| Worst Year | -13.10% | -18.16% | -7.39% | -7.69% | -16.19% | -14.75% |

| Max. Drawdown | -33.03% | -23.93% | -25.89% | -33.46% | -36.12% | -37.93% |

| Sharpe Ratio | 0.46 | 0.74 | 0.46 | 0.4 | 0.44 | 0.36 |

| Sortino Ratio | 0.71 | 1.15 | 0.68 | 0.6 | 0.65 | 0.53 |

| Market Correlation | 0.84 | 1 | 0.84 | 0.85 | 0.89 | 0.87 |

Data from Portfolio Visualizer. The period is August 2015–February 2024

What Is The CSB Portfolio In The Current Iteration?

As of March 22, CSB had 100 equities in the portfolio, with all the GICS sectors represented except for real estate. Financials are the dominant allocation, with a 24.7% weight. Under the hood, there is a predominantly mid-cap, value-heavy, growth-light portfolio with questionable quality characteristics.

The statement about the ‘mid-cap’ tilt might sound perplexing since, as described on the ETF’s website, CSB

… offers exposure to small-cap, dividend-yielding US stocks, without subjecting investors to the inherent limitations of traditional market-cap or yield weighting it.

But investors should be neither confused nor surprised. A mid-cap tilt is a well-known and well-researched issue in the small-cap ETF universe. I have addressed it multiple times, including in the June 2023 article on the Roundhill Acquirers Deep Value ETF (DEEP). In the case of CSB, only 18.7% of its net assets are allocated to companies with a sub-$2 billion market cap, with the weighted average standing at $3.2 billion, as per my calculations.

However, as of my previous assessment, CSB’s WA market cap was almost 2x lower at $1.64 billion. For clarity, just about 26% of its holdings (weight as of April 13, 2022) retained their place in the portfolio. So the corollary here is that its factor mix might gyrate between small- and mid-caps, so it would be fairer to expect more of a SMID portfolio going forward.

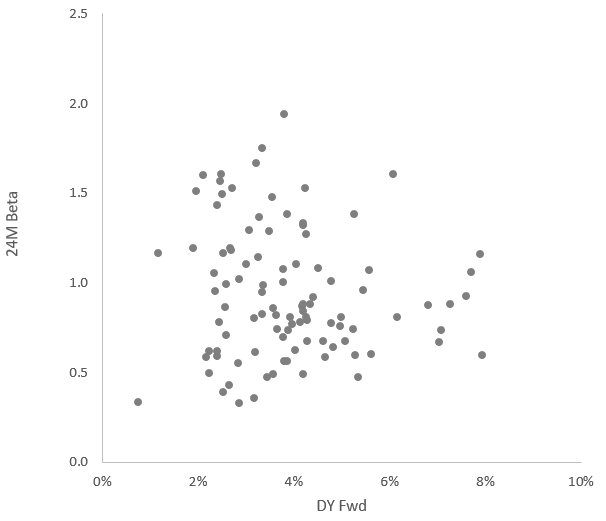

Turning to other factors, the ETF does deliver on the high-yield (hence, on value as well) and low-volatility fronts, as the scatter plot below illustrates:

Created by the author using data from Seeking Alpha and the ETF

As we can see, CSB has almost no exposure to stocks with a forward dividend yield below 2%, so the weighted average is expectedly strong at 3.9%, as per my calculations. As to the beta coefficient, the ETF does have a footprint in a few high-beta stocks, but their impact on the portfolio’s volatility is only modest, as illustrated by the WA figures below:

| Metric | CSB |

| 24M Beta | 0.89 |

| 60M Beta | 1.03 |

Created by the author using data from Seeking Alpha and the ETF

Besides, speaking about value, CSB is sporting a 7.6% earnings yield. I would say that this is a comparatively reliable figure, as there are no significant outliers in the portfolio as all the companies are profitable, with the highest EY being Cogent Communications Holdings’ (CCOI) 44%. Besides, we see a solid allocation to companies with a B- Quant Valuation grade or better, 61.3%.

What it does not deliver, as it is not supposed to, is growth. We see only low single-digit forward revenue and EPS growth rates.

| Metric | CSB |

| Revenue Fwd | 2.49% |

| EPS Fwd | 3.03% |

Created by the author using data from Seeking Alpha and the ETF

28% of the holdings have negative forward revenue growth rates, while about 42.8% are forecast to deliver lower EPS going forward. Quality also remains a problem. I am not content with just a 38.4% allocation to companies with a B- Quant Profitability grade or higher. I also find the WA Return on Assets of 4.9% unsatisfying.

Remarks On Dividend Growth Rates

Turning to dividend growth, we see rather healthy portfolio-wide growth rates.

| Metric (weighted average) | CSB |

| Div Growth 3Y | 9% |

| Div Growth 5Y | 5.6% |

Created by the author using data from Seeking Alpha and the ETF

However, I would recommend investors exercise caution when assessing a company’s dividend growth profile using the 3-year compound annual growth rates, especially when it comes to portfolio-wide CAGRs. The reason is what I would call the pandemic effect, or the 2020 effect, if you please. There was a flurry of dividend cuts or outright suspensions as companies, especially in the oil & gas industry, struggled with cash preservation. As they passed the most challenging period of the pandemic, they either reinstated dividends and/or buybacks or increased their significantly downsized DPS to the pre-pandemic levels or a bit higher, so their DPS growth rates might look spectacular as they are skewed by that effect and most likely are not sustainable in the future, and thus it would be a mistake to extrapolate them. In this regard, I believe the 5-year CAGR is fairer, and that figure is rather bleak.

Investor Takeaway

CSB has delivered some healthy returns since its inception, beating a few of its counterparts. The fairly perplexing issue is that its value- and low-volatility-centered strategy was incapable of effectively minimizing losses during the 2022 bear market, unlike its simpler high-dividend peers that are heavy in large caps. I am of the opinion that for a low-volatility ETF, the negative 13.1% total return recorded that year is unacceptable. Also, I reiterate that CSB’s quality does not appeal to me. Dividend growth rates are hardly impressive either. In sum, I would opt for a neutral stance, with my Hold rating unchanged.