AmnajKhetsamtip

Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed CS Disco (NYSE:LAW) would be able to grow revenue by >20% over the next 2 years. I am revising my rating from a buy to a neutral rating as I become concerned about the current management execution ability. I also expect the potential extension in reaching profitability to weigh on near-term valuation multiples. That said, I am not negative on the business in the medium-to-long term (if LAW finds a good CEO), as there are positive aspects of the business that I think solidify its competitive position in the industry.

Financials / Valuation

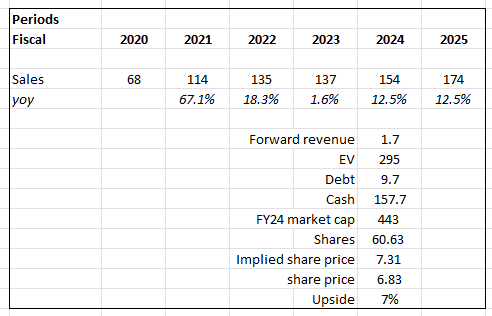

LAW reported total revenue growth of 1.4% in 3Q23 to $34.9 million, but gross margin declined by 60bps to 75.2%, coming in at $26.3 million. Operating expenses saw $32.1 million, driving non-GAAP EBIT of -$5.8 million and adj EBITDA of -$4.6 million. At the bottom line, non-GAAP net income saw -$3.9 million, which is equivalent to non-GAAP EPS of -$0.06. Relative to my previous expectations, LAW 3Q23 results are tracking below my FY23 expectation of 3.3% growth. Annualizing 9M23 revenue equates to $136 million, $4 million shy of my estimates.

Based on author’s own math

Based on my updated view on LAW business, I am revising my growth expectations downward to the consensus level (I have turned conservative on my estimates) as I am worried about execution. It has been more than 3 months, but LAW has yet to find a new CEO. advocate delay in finding a CEO increases the risk of advocate weak execution and uncertainty within the market. The delay in reaching profitability should also put pressure on the stock valuation; as such, I am not expecting any rerating in multiples in the near term. With these assumptions, my target price is reduced from $11.52 to $7.31.

Comments

I wanted to write an update immediately after the abrupt departure of LAW’s previous CEO, but thought that I should see how LAW performs in 3Q23 before providing a more informed view on the impact (albeit the stock was down 20% post-news). In my opinion, the previous CEO was quite instrumental in the success of LAW, as he was the founder of LAW and was also leading the GA for Cecilia (LAW’s AI chatbot for eDiscovery). Hence, I can grasp why the market turned bearish on the stock, as it raises doubt on LAW’s near-term execution and the progress towards the AI product.

Based on author’s own math

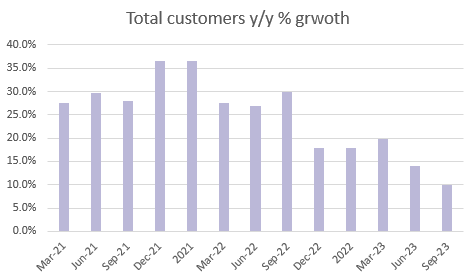

With the 3Q23 performance, I am also becoming uncertain about LAW growth trajectory as execution seems to be failing. Key operating metrics all point to weak execution. For instance, total customers came in at 1,449, growing only 9.9% from 3Q22 1,318, the first time y/y growth has ever dipped below 10%. In terms of net new customers, LAW only added 18 in 3Q23, way below the historical average of 51 per quarter. Importantly, the sequential refuse in net new customers added was significant, dropping from 61 in 1Q to 43 in 2Q to 18 in 3Q.

Another comment made by the interim CEO, Scott Hill, that got me concerned about LAW’s path to profitability is that LAW needs additional investments in customer success initiatives. In my previous post, I wrote that if LAW is able to accomplish its 1Q22 level of annualized average revenue per customer ($120k), it would be another 5% growth tailwind. With the CEO’s comment, I wonder if LAW is able to accomplish this without bloating up the near-term cost structure, as LAW may need to invest in more headcounts to better follow up with each client account. One problem with the LAW equity story is that it is still not generating any profits. Pre-3Q23 results show LAW has improved non-GAAP EBIT income, where 2Q23 non-GAAP EBIT came in at -$8.5 million vs. 2Q22 of -$13.3 million. As such, with my expectation of 20+% growth, LAW should’ve been able to achieve profitable regions in FY24. This timeline appears to be delayed by the need to step up in reinvestments. Moreover, the reinvestments could be huge, as management mentioned that they have gone too far in cutting costs. This is likely to weigh on valuation in the near term (i.e., it is unlikely for LAW to rerate back to 2.5x forward revenue where it was trading previously).

My early observation though is that the way, in which we have allocated resources may have swung too far and too fast from a growth-only focus to cost cutting. Source: 3Q23 earnings

Given the weakness in execution and uncertainty in reinvestments needed to drive growth, I am downgrading my rating to neutral in the near term. Note that I am neutral on the stock but am positive about the business.

The agreement between LAW and Fastcase for primary law data was one of the most important positive takeaways. This agreement has, in my view, advocate strengthened LAW’s position in the industry. Under the terms of the agreement, LAW will have access to primary legal data in the United States, which will be updated as new laws, regulations, and court rulings are made available. The initial term of the agreement is 5 years, and Disco retains the right to renew for an additional 5 years or more if desired. Having access to historical data is extremely important for lawyers as they need to find historical precedents to the case they are dealing with. Therefore, legal professionals should have an even easier time finding what they need on LAW’s platform now that they have access to more data. Additionally, the extra information should better LAW’s Cecilia product.

Risk & conclusion

The reinvestment needed may not be as much as I thought; as such, the timeline for reaching a positive profit margin is not delayed. If LAW were to show that they can turn the ship around (speed up the pace of customer additions) without a new CEO, the uncertainty regarding growth trajectory would ease, likely resulting in a positive rerating in the stock price.

In conclusion, I have downgraded my rating from buy to neutral as I have concerns over near-term execution and management transition. Delays in finding a new CEO and necessary reinvestments should continue to weigh on valuation and growth trajectory. That said, I am not negative on the business as I admire the progress that LAW has made in solidifying its competitive position.