Helder Faria/Moment via Getty Images

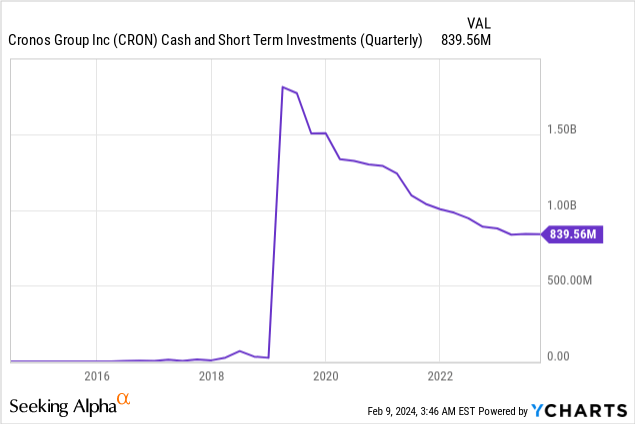

Cronos Group (NASDAQ:CRON) is flush with cash just as market enthusiasm builds around a potential decision by the Drug Enforcement Administration to move cannabis to a significantly less restrictive schedule, a move that would likely catalyze a broad market rally. The roughly $800 million market cap firm held cash, cash equivalents, and short-term investments of $840 million at the end of its fiscal 2023 third quarter. This is just over 100% of its market cap and is set against zero debt and a revenue profile on the up. I’m not entirely bullish on cannabis but CRON offers a seemingly more favorable risk and reward profile against common shares that are down 11% over the last 1 year, rising to 90% over the last 5 years. The bullish case here is that CRON’s depth of cash seems underappreciated by the stock market.

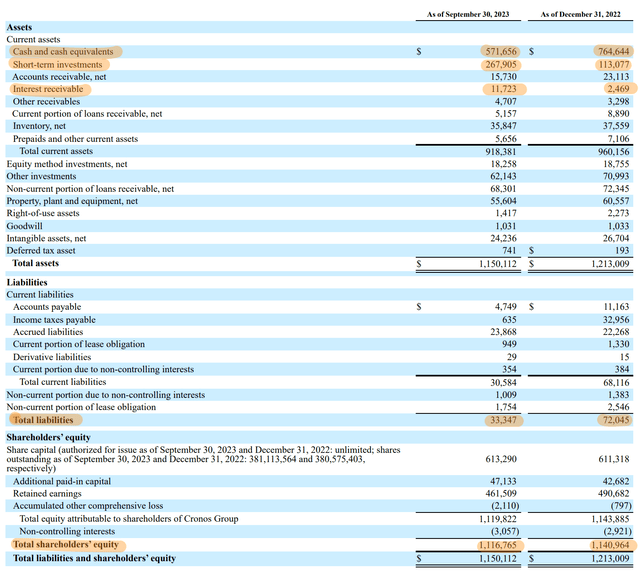

Cronos Group Fiscal 2023 Third Quarter Form 10-Q

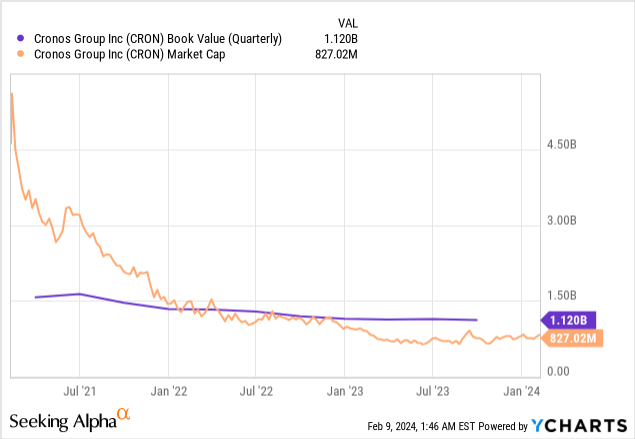

Critically, the company is trading for 0.73x book value with its Shareholders’ equity at $1.12 billion, around $2.94 per share, at the end of the third quarter. A small $24 million dip from the start of the fiscal year but 75% formed from cash and short-term investments with just 2.26% from intangibles and goodwill of $25.27 million at the end of the fourth quarter. Hence, purely from a balance sheet perspective, there is a 36% upside if the commons were to trade in line with book value. CRON is a cannabinoid company with a portfolio of brands mainly targeting the Canadian cannabis market. Its most popular brand Spinach offers pre-rolls, edibles, vapes, and a range of flower strains.

Closing The Discount

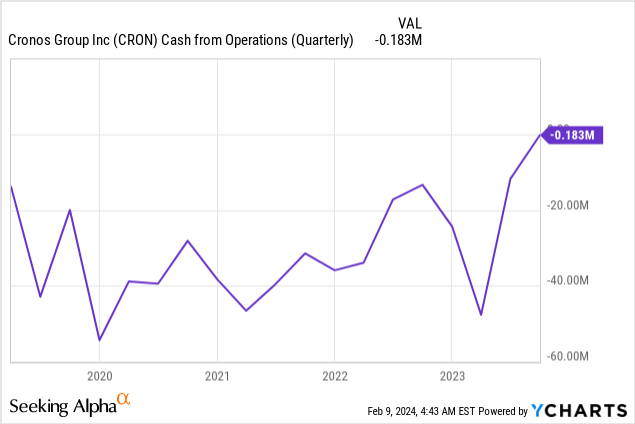

CRON’s discount reflects cannabis operations that are loss-making and burning cash. The company’s cash, cash equivalents, and short-term investments were $877.7 million at the start of its fiscal 2023 and have since declined by $38 million to its current level. Not insignificant but still a dip and the market is pricing in further dips. Hence, closing this current discount to book will first hinge on the company’s reversing its operational losses. CRON generated $24.81 million in revenue during its third quarter, up 21.6% versus its year-ago comp and a strong $5.24 million beat on consensus estimates.

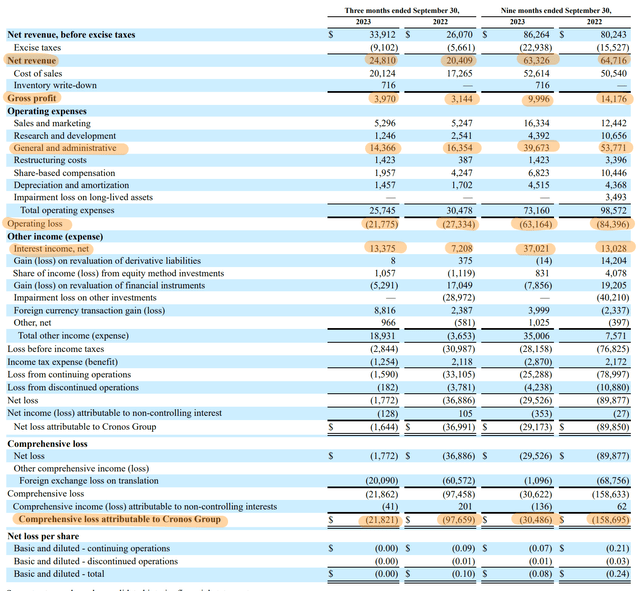

Cronos Group Fiscal 2023 Third Quarter Form 10-Q

The quarter saw CRON generate record quarterly revenue which drove gross profit that at $3.97 million meant a margin of roughly 16%, a growth of 60 basis points over its year-ago comp. General and administrative expenses also fell by roughly $2 million to $14.37 million, reducing G&A and a percent of net revenue to 58% from 80% a year ago. This is a material reduction as CRON pushes through with its target to pare back operating expenses by $20 million to $25 million through its fiscal 2023 with a further $10 million to $15 million of cost savings anticipated to be realized through fiscal 2024.

Growth Against A Quasi-Fortress Balance Sheet

The company generated a comprehensive loss of $21.82 million during the third quarter, a material improvement from a year ago when it lost $97.66 million on the back of losses from discontinued operations. Bears would highlight that the direction of travel for cash has been down since the company took the opportunity to issue new equity at the height of the cannabis bubble in 2019 when its common shares were trading at nearly $22 per share. However, this direction of travel is set to change with higher base interest rates driving record interest income just as CRON sees revenue move ahead of market expectations.

CRON is set to earn at least $52 million in interest from its cash and short-term investments through a full four quarters. Interest income earned during the third quarter at $13.38 million was up $6.17 million from its year-ago comp, an 86% rate of change. Hence, currently high base interest rates have become a tailwind for the firm whose cash burn from operations during the nine months preceding the end of its third quarter at roughly $60 million dipped from $65 million in its year-ago quarter due to the material growth of interest income.

This improvement in cash burn will likely see its total short-term liquidity position start to ramp up after more than five years of decline, a step change that would force to market to reconsider the value of the commons. The current discount seems unsustainable against this scenario and CRON forms a buy on what could be a reversion to book value on consistent future quarters of short-term liquidity growth, reduced operating expenses, and cash burn on a positive trajectory. CRON has essentially built a fortress balance sheet that has transformed its financial standing just as possible market sentiment towards cannabis tickers could be set for an improvement.