morgan23

Investment Thesis

In the investing world, finding a great opportunity with lots of potential for growth is always thrilling. As value investors, we aim to find those hidden treasures where the market may be overlooking true worth, leading to undervaluation. Today, we’re turning our attention to an exciting growth story that we believe could be a really good investment.

Crocs’ (NASDAQ:CROX) stock has had a tough time in the footwear sector lately. Their stock has dropped over 40% since last April. The buzz around their recent acquisition, HEYDUDE, hasn’t matched up to growth expectations, and the market doesn’t seem to understand the situation well. There’s a lot of pessimism built into the stock price right now.

The best thing to do is to move away from the noise and understand the real value by employing a conservative approach of Earning Power Value (EPV) where we identify the no-growth price of the stock. We believe that the stock price now is very close to the EPV.

We believe that as the issues related to HEYDUDE start to fade in the second half of this year and considering the potential for growth in the company, even the most skeptical investor might see Crocs as a great opportunity at a price where the stock hasn’t factored in any potential growth.

Business Introduction

Crocs, Inc., established in 2002, has emerged as a dominant force in the global footwear industry, defining a distinctive niche in casual fashion with its iconic, comfortable shoes. Recognized for its patented designs initially conceptualized as “boat shoes”. Crocs has capitalized on its reptilian namesake, the crocodile, to create a brand synonymous with comfort and versatility.

Headquartered in Broomfield, Colorado, Crocs operates on a global scale, employing over 6,000 individuals and achieving remarkable milestones, including the sale of over 100 million pairs of shoes annually, leading to an impressive $4 billion in annual sales revenue.

After a swift rise, Crocs went public in 2006 and became a fashion emblem that sparks strong opinions – some adore its distinct style while others aren’t as keen. Operating under two segments, Crocs and HEYDUDE, the company has solidified its position as a major player in non-athletic footwear.

The company operates across two key segments: the flagship Crocs brand and the recent addition, HEYDUDE, which has expanded the company’s market presence and revenue streams.

Before HEYDUDE, their significant acquisition was Jibbitz in October 2006, a company producing personalized charms one can stick into the holes in the Crocs bought for $10 million with a potential additional $10 million based on profitability.

The Crocs segment, historically their primary focus and still the biggest revenue generator, makes up 75% of sales. We believe the company has a MOAT in this segment due to the protective patent on the design. The effect of the moat can be observed from the operating margins which stand high at 30.5%, leaving the industry’s 11% far behind.

Meanwhile, HEYDUDE, acquired in early 2022 for $2.5 billion, constitutes 25% of sales with a margin of 18.1%. This acquisition was one of the reasons that made the stock struggle presenting us with an investment opportunity, which I’ll dive into later.

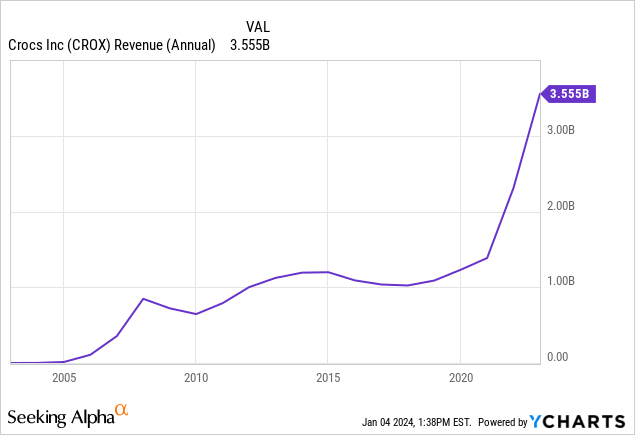

Many people in the industry talk about the fear of fads around Crocs, those brief yet wildly popular style trends that eventually fade into darkness. Despite these concerns, Crocs has stood strong for two decades, boasting an impressive CAGR of 78% over the past 20 years.

Analysis and Valuation

Crocs has some solid competitive edges that give them an upper hand in the market. First off, their brand loyalty and patents help them set prices and keep profit margins healthy. These advantages create a strong position for Crocs, especially in their flagship segment, making it tough for others to jump in and grab a slice of their market share. But in this industry, how long these advantages will last isn’t crystal clear.

Another big advantage is their management team, especially CEO Andrew Rees. Even before the pandemic, he made moves that helped the company grow. From 2008 to 2017, the business still had issues with profitability and gross profits declined from 2013-2016. Rees stepped in as CEO in 2017, bringing discipline and focus, which made a real difference in how the business ran.

Crocs acquired HEYDUDE in a leveraged transaction and the initial growth performance under this segment has been very disappointing. There are multiple reasons for this as it was acquired at the start of the interest rate hiking cycle, the slowness in consumer spending, and the wave of inflation could not have been anticipated before. Secondly, HEYDUDE is a brand of sandals where they face intense competition from all around the marketplaces in which they operate, which leads to lower margins compared to Crocs, furthermore, there are no protective patents like Crocs in this segment. Thirdly around 50% of distributors of HEYDUDE were fired when Crocs completed the transaction, this led to a very high inventory dump on Amazon and other e-commerce platforms leading to low growth rates and depressing margins of the segment.

The effect of inventory dump by the distributors is expected to fade by the second half of this year and as we move towards the recovery cycle things will start to normalize for HEYDUDE and we will see that much anticipated growth from the segment.

During the three months ending September 2023, if we divide the enterprise expenses between the two segments on a weighted average basis, the Crocs segment had an operating margin of 30.5% while HEYDUDE had a margin of 18.1%. On a consolidated basis, the operating margin was 27.5%. Although these margins have the potential to improve, I start my valuation with an operating margin of 26% to be on the conservative side.

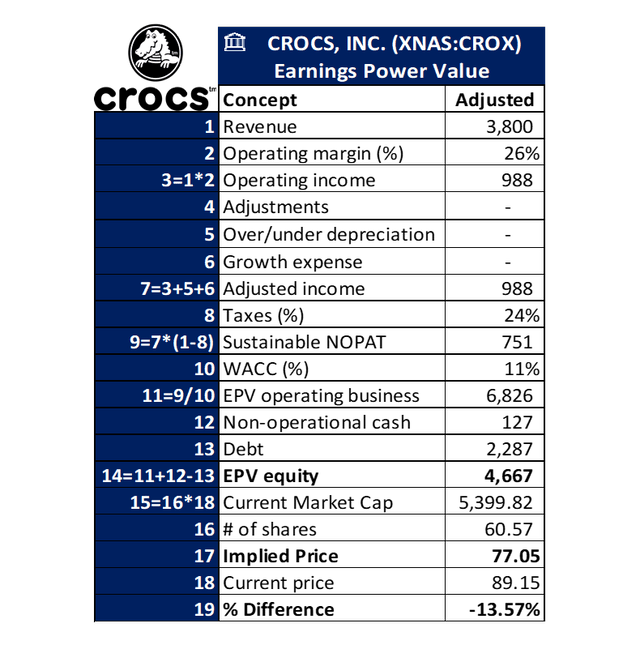

As conservative value investors we want the price on a growth story that is remarkably close to its true Earning Power Value as at this price there is essentially no growth priced in. To value Crocs we are employing very conservative estimates in our EPV model, starting with a revenue of only $3.8b where the guidance for 2025 stands at $4.3b.

Again, being conservative we use a growth capex of $0 which is a very critical input to this model. On top of this, we employ a discount rate of 11% to discount our margin of safety and reflect some critical risks regarding the current and uncertain future economic conditions leading to slowness in consumer discretionary spending.

Earning Power Value (Moat Investing)

The purpose of this exercise was to highlight the price where we would not be paying for any growth, which is around $77. From here value investors and growth investors alike can develop their own margin of safety and investment preferences. We believe that the company can grow and an opportunity to buy close to the EPV is incredibly attractive for us.

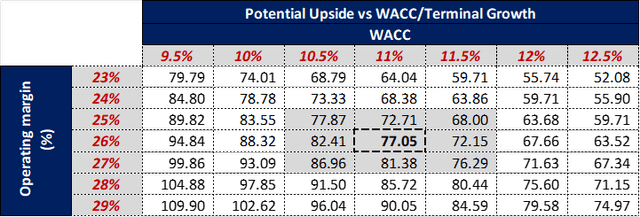

To aid all those with a different potential input than ours, we have performed a sensitivity analysis on the main value drivers.

In the table below, Sensitivity analysis highlights the potential valuation based on different operating margins and cost of capital as we believe both have room to improve.

Sensitivity Analysis (Moat Investing)

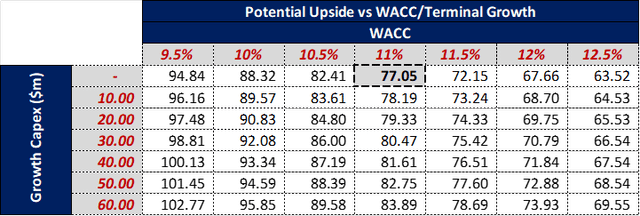

Considering our use of below-guided growth capex and higher WACC, table below is useful to understand the impact different inputs can have on the valuation.

Sensitivity Analysis (Moat Investing)

Conclusion

Despite facing challenges and risks like consumer slowness and lack of growth in the new segment, we conclude that the company is coming into undervalued territory, and at around $85 we would take 2% position and eventually increase the position to 5% targeting an average price as close to our EPV as possible.

The CEO pledged to deliver growth and management’s prioritization of reducing debt gives us hope that Crocs will continue towards normalization on the valuation front and trade at a significant premium to its EPV like a true growth stock, and ultimately shed this pessimistic investor sentiment. Furthermore, their continued expansion into emerging markets and their new product developments are additional catalysts for Crocs going forward.

Coupled with the strong brand and loyal customer base, we further believe as the overall picture around the health of the economy improves, and the markets such as China which is already in the reopening phase, and hopefully Ukraine and Russia open in the future, we will start to see Crocs returning to its full growth potential.

In conclusion, I believe that Crocs close to its EPV represents a compelling investment opportunity for investors who are looking to buy into a growth story at a significant discount and at a price where there is no growth priced into the stock.