Sirirak/iStock via Getty Images

Elevator Pitch

My rating for CRH plc (NYSE:CRH) [CRH:LN] is a Hold now.

I have decided to revise my investment rating for CRH from a Buy to a Hold, as I think that it is time for CRH’s shares to take a breather. CRH stock has done pretty well in the last six months with its continued share repurchases and the conclusion of its US primary listing exercise. Going forward, portfolio restructuring could be a new catalyst for the stock, but CRH’s valuations are unappealing.

Shares Outperformed In Recent Months With Realization Of Key Catalysts

CRH’s stock price has gone up by +26.8% (source: Seeking Alpha price data) since my earlier July 11, 2023 update was published. During this same time frame, the S&P 500 rose by +10.8%, or to a lesser extent as compared to CRH.

In my July 2023 article, I outlined two key re-rating catalysts for CRH, namely its “conversion to a US primary listing” and its “share buyback plan.” The realization of these catalysts have been the key driver of CRH’s share price outperformance on both an absolute and a relative basis in the last couple of months.

The company’s US primary listing was concluded on September 25, 2023. Separately, CRH announced on December 21, 2023 that it spent a billion dollars on share repurchases in the September 25, 2023 to December 20, 2023 time period and disclosed plans to buy back another $0.3 billion worth of its own shares between late-December last year and the end of February this year.

In the subsequent sections of this article, I write about CRH’s portfolio restructuring moves and valuation metrics.

Portfolio Restructuring Is The Next Major Catalyst And Value Enhancement Driver

At the beginning of this year, CRH revealed that “the first phase” of the company’s plans to “divest its lime operations in Europe for a total consideration of c.$1.1 billion” which includes its lime operations in “Germany, Czech Republic and Ireland” have been concluded. As indicated in an earlier November 22, 2023 Seeking Alpha News article, CRH’s lime operations in other parts of Europe like “the UK and Poland” will be sold before the end of this year.

In CRH’s initial November 2023 announcement disclosing this divestiture, the company stressed that selling its European lime businesses is an indication of its “active approach to portfolio management” and noted that the sales proceeds will offer “additional capital allocation opportunities.” It is safe to assume that CRH has become more aggressive about restructuring the company’s portfolio and reallocating capital to new investments that have a more attractive growth outlook.

CRH issued a press release in the final month of the prior year indicating that it intends to buy a 57% stake in Adbri Ltd (OTCPK:ADBCF) (OTCPK:ADLDY) [ABC:AU], which it refers to as “a leading building materials business in Australia.” Adbri’s and CRH’s current consensus FY 2023-2025 revenue CAGR estimates are +5.8% and +4.6%, respectively as per S&P Capital IQ data. In its most recent annual report available, CRH noted that it derived a mere 7% of its FY 2022 revenue from the Rest of World geographic segment, which is largely contributed by its operations in “Australia, Brazil, Canada and the Philippines.” In other words, CRH has the opportunity to grow its top line contribution from the Australian market (that has decent prospects as evidenced by Adbri’s consensus forecasts) with the proposed 57% equity interest acquisition.

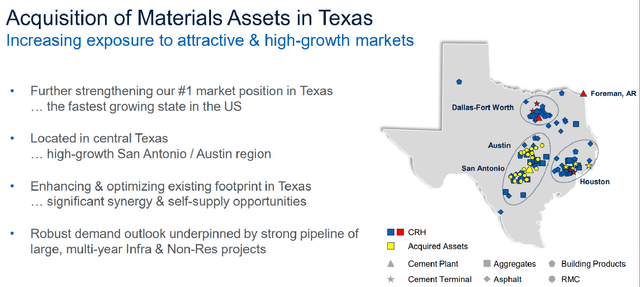

Rationale For Texas Assets Purchase Deal

CRH’s Q3 2023 Earnings Presentation Slides

Earlier in late November last year, CRH revealed that it signed a deal to buy over a “portfolio of cement and ready-mixed concrete assets in Texas.” The key strategic rationale for this particular transaction is to increase its exposure to “high growth markets (like Texas) where we’ve got competency, capability and proficiency” as per CRH’s management commentary at the Q3 2023 earnings briefing. In specific terms, this Texas asset portfolio’s pro-forma EBITDA for FY 2023 is estimated to be $170 million, or about 3% of CRH’s current consensus FY 2023 EBITDA forecast of $5,812 million (source: S&P Capital IQ).

Looking forward, it is realistic to expect that CRH will continue to leverage on portfolio restructuring initiatives such as asset sales and acquisitions to drive an acceleration of its revenue and earnings growth. Therefore, portfolio restructuring will be a critical valuation re-rating catalyst and an important value enhancement driver for CRH in the foreseeable future.

But Valuations Are Stretched

CRH’s valuations are unattractive, notwithstanding the presence of a visible catalyst in the form of portfolio restructuring as detailed in the prior section.

The market values CRH at a PEG (Price-to-Earnings Growth) multiple of 1.6 times based on its consensus next twelve months’ normalized P/E ratio of 14.6 times (source: S&P Capital IQ) and the +9.2% normalized EPS CAGR for the FY 2024-2025 financial period. A stock is typically seen to be fairly valued at a PEG metric of 1 times. Even for high-quality businesses, a valuation of 1.5 times PEG multiple or above is unappealing.

Another valuation rule of thumb indicates that an EBIT margin of 10% translates into a fair Enterprise Value-to-Sales or EV/S multiple of 1.0 times. In that respect, CRH’s consensus FY 2024 EBIT margin of 13.1% suggests that the stock could potentially command an EV/S ratio of 1.31 times. However, CRH is now trading at a higher EV/S multiple of 1.55 times as per S&P Capital IQ data.

To sum things up, CRH isn’t attractively valued following a +26.8% share price appreciation for the past six months after I wrote my earlier article.

Closing Thoughts

My view is that CRH is now deserving of a Hold (rather than Buy) rating. CRH’s buyback and primary listing catalysts were realized, but the stock has already been rewarded with a premium valuation based on metrics such as the PEG multiple.