Shutter2U

Back in the Summer of 2016, I wrote an article analyzing Discover Financial Services (NYSE:DFS) and Synchrony Financial (SYF). The context was looking for safe financials during uncertainty surrounding the Brexit. My conclusion was both stocks were appealing, but Discover Financial had an advantage because of the dividends they offered. Seven and a half years later, Discover Financial has doubled, and Synchrony showed a nice gain and started paying dividends in its own right.

I’m not bringing this up to brag, but rather to explain why I’m taking a look at Discover Financial again. Double the size, it is nearly an entirely different company today, and with Brexit no longer a pending issue, we can look at it from an entirely new perspective. Is it still the value play today that it was way back when?

By the Numbers

| Cash & Equivalents | $9.19 billion |

| Loan Receivables | $122.7 billion |

| Total Assets | $143.4 billion |

| Interest-Bearing Deposits | $104 billion |

| Long-Term Borrowings | $19.4 billion |

| Total Liabilities | $129.2 billion |

| Shareholder Equity | $14.2 billion |

| Debt/Equity | 9.1 |

| Price/Book | 1.9 |

(source: Most recent 10-Q, SEC)

As you can see, Discover Financial remains highly leveraged, and is trading at a bit of a premium to book value. At the same time, the loans/deposits ratio has gone down, a testament to the company bringing in more business from its online banking, and growing the loans at a responsible rate.

Speaking of the loans, while the bank makes loans to all sorts of customers, 83% of the total interest income enjoyed during the year comes straight from the credit card business. That’s no surprise, as all the credit card companies seem to be surging at this time.

The Discover Card is enjoying a sort of a renaissance in recent years. The company reported in the most recent 10-K that merchant acceptance of the card has been increasing in recent years, allowing them to grow credit card loans by 21% in FY2022.

Understanding Discover Financial

In addition to a surging credit card business, the bank is enjoying healthy growth as well. In FY2022, the payment services offered are up 5%, and the direct-to-consumer deposits are up 14%, again facilitating the higher loans, especially of lucrative credit cards.

Even beyond the Discover Card, Discover Financial also owns Diners Club cards, and the company is reporting the highest revenue out of that card in the first half of the year. The Discover Network itself maintains a direct relationship with merchants, and more merchants are accepting the cards, and getting into the network in recent years.

Also owned is the PULSE Network, which handles point of sales terminals as well as cash access at ATM machines. PULSE revenue too is up 9.7% year-over-year. A nice bonus is PULSE is used in many ATMs internationally, which gives Discover Financial growing global exposure.

The Risks

I know I’m being awfully bullish on the stock, and I am, but I would be remiss if I didn’t at least cover what could potentially go wrong.

Discover Financial offers several scenarios in the 10-K, cautioning that a big change in interest rates could be a market risk as they struggle to adapt, and may also impact the number of new people who want credit cards.

Another big risk is information security. While of course Discover Financial spends a fair bit of money on security, we hardly seem to go a day without some big company screwing up and top news of how they ended up losing a bunch of customers’ data. These things happen, and when they do, they set the stage for potentially ugly lawsuits.

Discover Financial also faces the challenge of competition. Even if the Discover Card is growing in acceptance, they’re not the biggest player in the field, and Visa (V) is still a thing, capable of putting a lot of pressure on the competitors.

That’s not to say that any of these are deal breakers for Discover Financial, but they are things we as investors need to be aware of, and keep an eye out for potential hazards that could screw up the stock in the near-term.

Growth and the Positives

| 2020 | 2021 | 2022 | 2023 (9 mo) | |

| Income from C.C. Interest | $8.9 billion | $8.7 billion | $10.6 billion | $10.5 billion |

| Total Interest Income | $11.1 billion | $10.6 billion | $12.8 billion | $13 billion |

| Net Interest Income | $9.2 billion | $9.5 billion | $11 billion | $9.6 billion |

| diluted EPS | $3.60 | $17.83 | $15.50 | $9.69 |

(source: 10K and 10Q from SEC)

Despite the economic difficulties in recent years, Discover Financial enjoyed solid growth in total interest income and income from credit card loans. The diluted EPS was absolutely mind-boggling, even for a firm this size, and the PE as of the most recent fiscal year is securely in a very deep value range of 7.02.

Despite doubling in price since 2016, the dividend has remained a respectable 2.4%, and that payout is a nice little bonus for the rare occasions when nothing remarkable is going on at Discover Financial.

Growth continues to be strong on the credit cards, and the FY2023 numbers, when Q4 comes in, should be even higher than the prior year by a fair bit. The implications of high interest income are very clearly positive, and many are predicting Discover Financial will beat estimates in Q4 on top of everything else.

| 2020 | 2021 | 2022 | 2023 (9 mo) | |

| Net Cash Operations | $1.1 billion | $5.4 billion | $4.4 billion | $4.1 billion |

| Net Cash Investing | $1.5 billion | $40 million | ($25.6 billion) | ($14.7 billion) |

| Net Cash Finance | ($1.1 billion) | ($8.3 billion) | $16.1 billion | $9.3 billion |

(source: 10K and 10Q from SEC)

Keeping positive cash flow is important, and once again Discover Financial fits the bill, using finance cash to make up for money spent on investments, and ensuring that money is still coming in for FY2023.

While 2021-2022 shows this isn’t exclusively the norm, the $9 billion in cash on hand can cover a lot of issues, and makes sure that the company’s liquidity and dividend payouts are not in jeopardy.

Conclusion

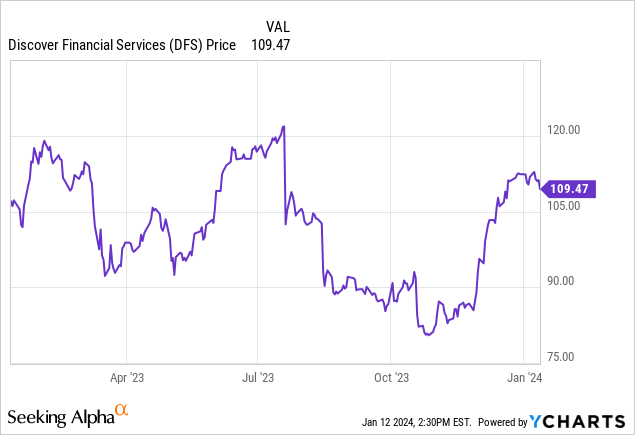

We may have missed the chance to get in on 2016, but the similar value-friendly numbers we are looking at today, combined with the growth and dividends, suggest that the rise may not be over, and longs can look forward to testing new highs.

It is hard to say how high Discover Financial might ultimately get, but a lot of analysis seems to be favoring them. That’s no surprise, given the bull market credit card companies in general are enjoying. Growing acceptance for the Discover Card only makes the company stronger going forward.

In trying to rationalize the current value of the stock, I can’t help but go to the low P/E ratio and the positive free cash flow. It is certain to keep improving with the upcoming Q4 release, and I can’t help but see many of the same positives for the company now that I did in 2016.

Indeed, the P/E ratio of 7.02 now is even better than 2016, which was almost exactly 10.0. Strong EPS in recent years shows this is no fluke, but a sign of a strong earnings generator.

I’m not saying that the stock is again poised to double from here, as it did back then, but I think a price target of $150, assuming the company continues to execute as they have been in acceptance, is not unreasonable in the medium-term.

I’m keeping a close eye on the stock, and I’d advise other longs to do the same (not bad advice for anything you own). The risk disclosures in the 10-K show things could go wrong with the company, but the odds seem much more on the side of things going right.