Supatman/iStock via Getty Images

Investment Thesis

Coursera (NYSE:COUR) pulled in positive free cash flow for the first time in 2023, due to not only the strong revenue but also net income growth. Although its liquidity and cash position have strengthened, its profit margin has taken a hit, showing the constraints of its scale up efforts. The current price is almost double of our most bullish valuation, indicating rich premium priced in that may not be realized in the near term. We recommend a sell.

Preview

We previously covered Coursera in “Coursera: The Bottom Could Be Near” for the first time in December 2022. Our thesis was the company has strong growth momentum, but negative earnings and cash flow were a concern, in addition to a higher cost propensity accompanied with the high growth. We called for a near term bottoming for the stock to resume growth, and gave a hold recommendation. Its stock indeed bottomed out at about $10 in five months and started to rise to currently $19.61.

Updates

Coursera’s performance in 2023 is probably its best yet so far with revenue growing at the strongest pace and reaching the highest value.

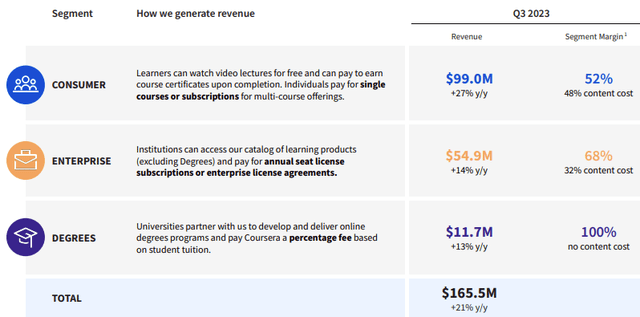

Coursera: Q3 Revenue By Segment (Company Q3 Presentation)

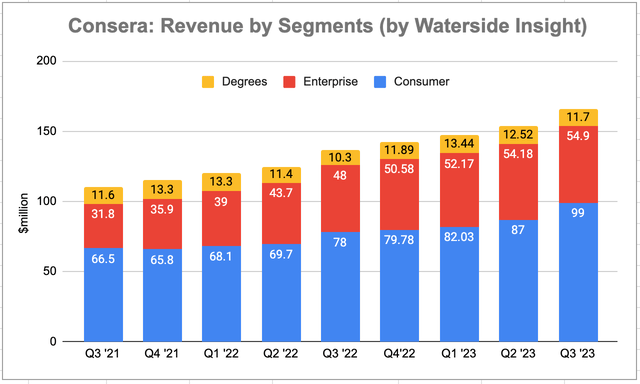

To update our previous charts on Coursera’s revenue by segments, the top line growth rate in 2023 has maintained an average 22% growth YoY. The primary driver was 25% YoY growth from its Consumer segment, which accounted for 73% of its total revenue.

Coursera: Revenue History By Segment (Calculated and Charted by Waterside Insight with data from company)

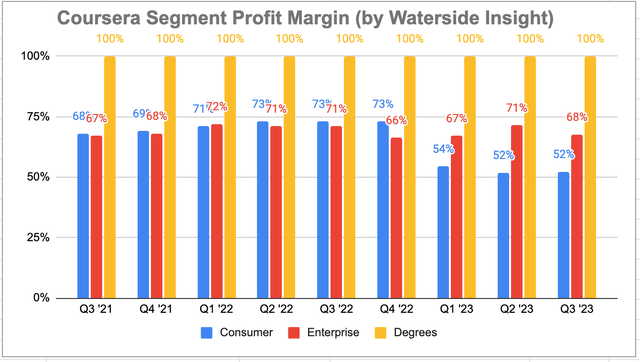

The segment margin, however, was a slip, most notably in Consumer, falling from 73% a year ago to 52%. This segment bears the most of the content cost as most of its content was started with catering to individual learners. The margin in Enterprise held up. We discussed before that its Degree segment, which is a reconfiguration of existing content into degree programs in partnership with universities, bears no content creation cost and is always 100% margin. Coursera has been making expansion for the Degrees this year. The company announced a partnership with the University of Texas to launch a micro-credential program in the summer, which targets the 240,000 learners in the UT system.

Coursera: Segment Profit Margin History (Calculated and Charted by Waterside Insight with data from company)

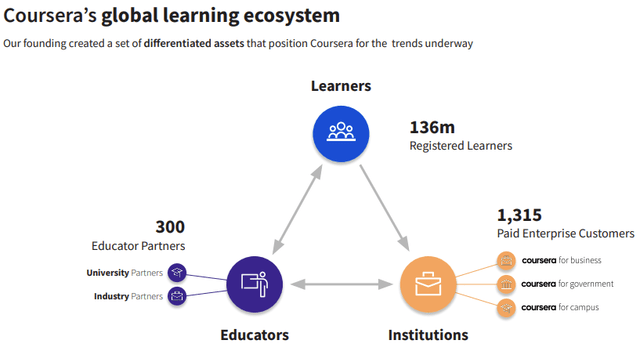

The Consumer segment is basically the bread-and-butter to Coursera. With over 136 million registered users, their preferences and demand drive the site’s content and growth directions. Most of its content first being used and filtered by the individual learners’ experience before being packaged into Enterprise customers or Degree seekers’ content, not only because the individual learners reflect more dynamical shifts in the most in-demand skills but also the direction of where it is going. So the blunt of this segment’s margin indicates the real cost of the content creation for the company. For example, its platform is AI-powered. The results may contain inaccuracy or misleading attributes. When being absent of sufficient and cost-effective methods to detect and prevent some of the risks, developing new contents may not be as scale-able and far-reaching to different subjects without incurring higher costs. So the best path of improving margin and profitability is still yet refitting its available content to different kind of users, such as Enterprise and Universities. The faster growth in these two segments can bring about higher overall margin, although for this year their growth rates are only half of the Consumer segment.

Coursera: Global Learning Ecosystem (Company Q3 Presentation)

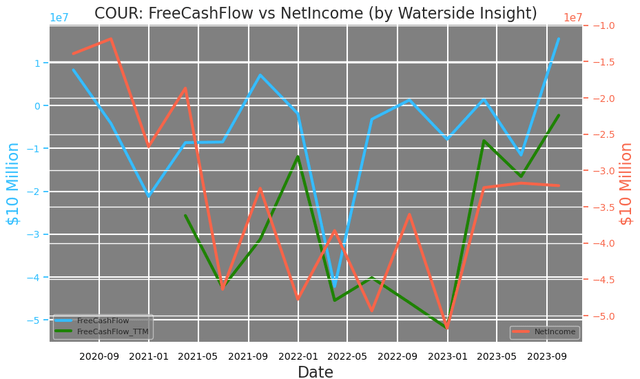

This year it marked a strong pickup for Coursera, not only from reducing its net loss but also pulling its free cash flow decisively into the positive. The efforts the company has made to improve revenue.

Coursera: Free Cash Flow vs Net Income (Calculated and Charted by Waterside Insight with data from company)

It has made no reduction in costs of revenue, but moderated the R&D expenses, which resulted in a flattening operating expenses. But since the revenue growth has been faster, overall costs and expenses’ proportion has become less by about 4% on a TTM basis since last year. This was one of the areas we were concerned about, and it seems to be under better control in aid of the margin growth.

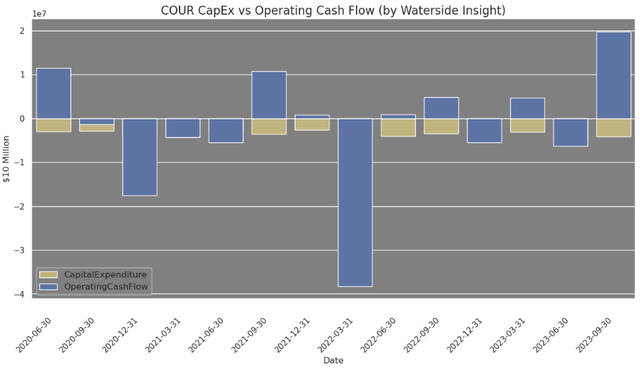

Strong operating cash flow growth has pushed the levels above its previous range, but the CapEx stays similar. This resulted in a much stronger free cash flow in the recent quarter. Besides over 20% reduction of net loss, the company also has been using more credits in paying its vendors and contractors, resulting in an almost 70% increase in accounts payable, a provision to its operational cash flow. These are the two main factors that helped improve its operating cash flow. We think Coursera has a good chance to stay free cash flow positive this year, but not without similar volatility to the past two years.

Coursera: CapEx vs Operating Cash Flow (Calculated and Charted by Waterside Insight with data from company)

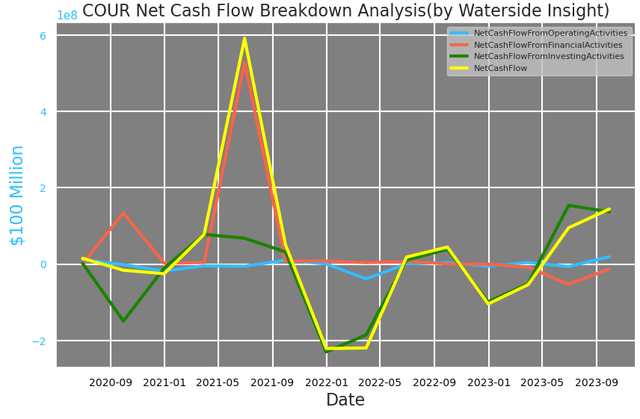

On top of stronger operating cash flow, Coursera also sees one of the largest increases of its cash flow from investing activities. It had $388 million of proceed from the sale of marketable securities, which helped lifting its total investing cash flow to $240 million. It also made about $50 million in stock repurchase as a reward to shareholders with an authorization to buy back up to $95 billion.

Coursera: Net Cash Flow Breakdown (Calculated and Charted by Waterside Insight with data from company)

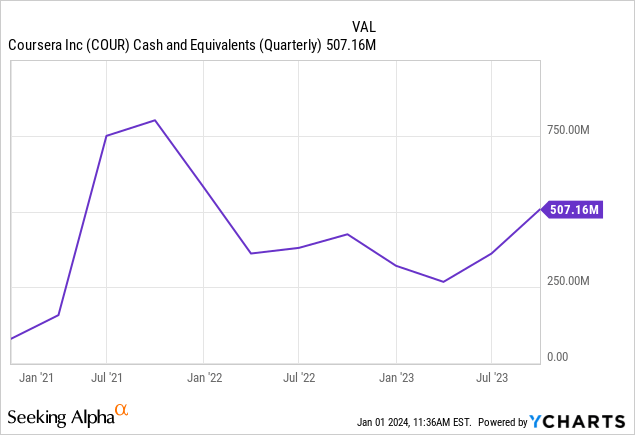

Its cash-at-hand at the end of the period has increased by almost $200 million since the end of ’22, or over 80% QoQ in Q3. The replenishment of cash position is the result of both stronger cash flow and net income. The company carries little debt, they are mostly short-term and long-term operational leasing obligations. Totally, its cash-to-debt ratio has risen from 50x to now 85x.

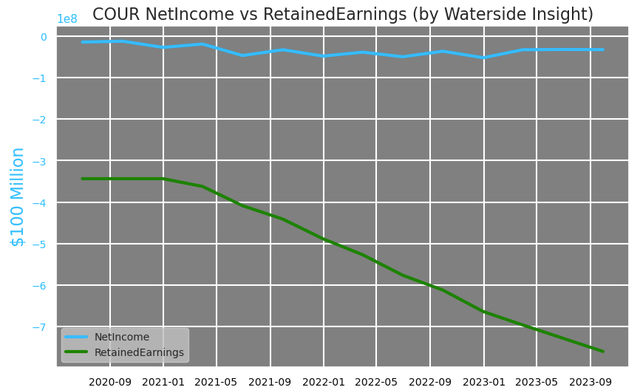

Coursera doesn’t pay dividends, but its retained earnings have continued to decline compared to a more stable net income. By now, it a record negative $700 million retained earnings by Q3 of last year, 23% of its market cap on a quarterly basis.

Coursera: Net Income vs Retained Earnings (Calculated and Charted by Waterside Insight with data from company)

In summary, Coursera’s improvement in both earnings and cash flow came from both strong top line growth and effective management of its financials. However, as it speeds up growth, there is an increase of cost impacting it profit margin. This goes back to our original concern that fast top line growth and increased costs will still co-exist for the company.

Financial Overview and Valuation

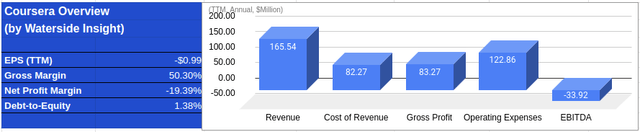

Coursera: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

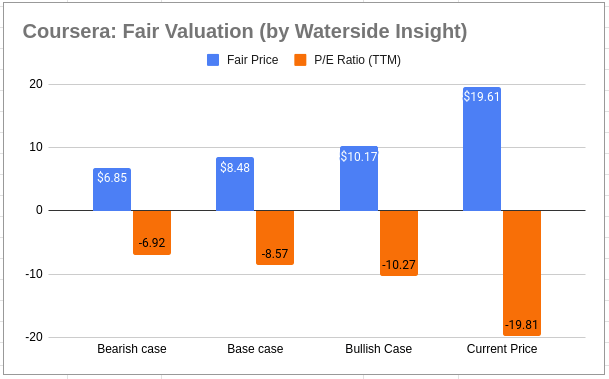

By the time it reports this quarter, we expect Coursera will show its growth in 2023 essentially hit our bullish case scenario estimated. We have updated our models based on their improvement last year discussed above, but kept the long term estimates intact. Fair prices for all three scenarios have been lifted. The bearish case has moved from $5.89 to $6.85, base case from $7.48 to $8.48, and the bullish case from $9.65 to $10.17. This mostly reflected the positive free cash flow in Q1 and Q3 of last year while expect also positive for Q4. However, we are cautious about the cost structure that comes with fast expansion, which will constrain its speed and quality of growth. We factor in all above and projecting its top line and earnings could grow into about 20x more than its current level in ten years, yet we still cannot match the market’s lofty valuation of $19.61. We think the stock is grossly overvalued at this point.

Coursera: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

We are optimistic about Coursera’s growth and were essentially right to predict it could recover this year, resulting in a buying opportunity. But the market has front run itself in the stock price with a high premium that is hard to match too even if the company makes no mistake and has no burden of increasing cost for earnings erosion. We will recommend a sell at this moment.