dem10

Coursera (NYSE:COUR) is well known as one of the leading providers of online learning. It offers professional certificates, university degrees, and a range of courses from general interest to postgraduate qualifications. It has grown revenue consistently since it began in 2019 and delivered its first positive EBITDA in Q4 2023.

In this article, the second I have written on Coursera, I consider the possibility that the emerging general-purpose Generative AI technology will turbocharge revenue growth for Coursera, providing a significant upside surprise to Wall Street that could propel the share price to over $100.

I will suggest that Generative AI will be the defining technology of 2024. 90% of businesses are unprepared for it, and Coursera sees this opportunity and has positioned its offerings to make the most of it.

Coursera The Business

In 2023, Coursera acquired 24 million new users, taking their total to over 140 million; they worked with over 300 universities, delivering revenue growth of 21% and the first positive EBITDA quarter in the company’s history. (2023 10K)

They added 200 more paying enterprise customers and now have over 1,000 large-scale corporate customers.

The new industry microcredentials were launched, offering a pathway for learning specific skills to become part of a more comprehensive specialization or a pathway to a degree.

Coursera provides branded certificates for learners without a college degree or prior experience that will give them the skills to access digital jobs. The certificate comes with the brand of the course provider, and the providers are some of the biggest names in technology.

The branded certificates that Coursera provides are a growth area. The CEO referred to these in the Q4 2023 earnings call saying “To date, we’ve announced nearly 50 with partners like Google, IBM, Microsoft, AWS, and others, and we’re not slowing down.”

He also discussed his belief that microcredentials will continue to disrupt the existing educational establishment

We believe we are in the early stages of a long-term trend in higher education, where industry microcredentials play an increasingly prominent role in how learners acquire their first job or earn credit towards a college degree…….and also in how businesses rescale and redeploy talent in an era where emerging technologies like generative AI are expected to disrupt and automate a wide variety of job roles.

I believe the positive news about EBITDA, revenue growth, learner acquisition, and new qualifications is about to be eclipsed by an unprecedented surge in revenue as people and companies rush to learn an important new skill, possibly an essential skill for corporate survival.

Generative AI: What’s the big deal?

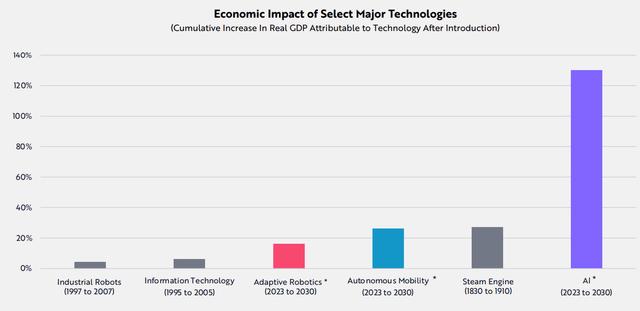

ARK Invest recently released its Big Ideas 2024 document; the first section covers AI, and page 12 shows this graph.

Impact of AI (ARK Invests)

ARK predicts that AI will deliver transformational growth to GDP over the next seven years, a level of growth we have not seen before. ARK is not alone in this view; McKinsey published a review on generative AI, suggesting it could add $4 trillion to GDP and giving examples of how this could easily double to $8 trillion.

I am not prepared to miss out on this growth and have decided to transition my portfolio towards companies that will benefit from this new technology in the hope of delivering outsized rewards. McKinsey says in its review, “To grasp what lies ahead requires an understanding of the breakthroughs that have enabled the rise of generative AI, which were decades in the making.”

Before changing my portfolio, I, like many other businesspeople, decided to put some time into learning about generative AI. I wanted to answer some key questions. Exactly what is it? How is it used? What can it do? And how will this transform the economy in the ways suggested?

I learned about Generative AI on Coursera

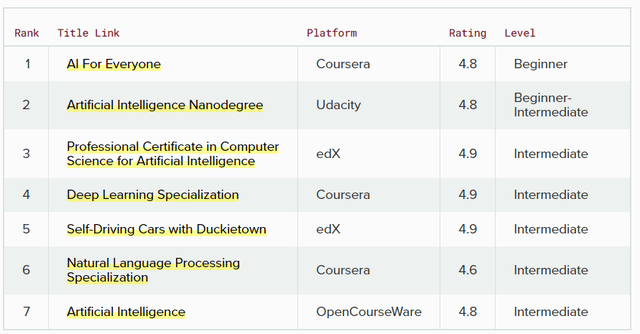

I did a quick Google search to find the best courses on Generative AI, lists were broadly in line with this one from Learn Data Science

AI courses ranked (Learn Data Science)

Three of the top 7 courses are on the Coursera platform; it is just one example, but all the Google listings I looked at pointed to Coursera as the principal place to go. I have often used Coursera and was happy to take a course on their platform.

The thesis of this article is that millions of people and thousands of companies will do the same thing and learn about Generative AI on Coursera, which will boost its revenue.

I last wrote about Coursera in September 2021. It had only recently been listed on the stock market, and I thought it offered a truly disruptive technology; it looked like the first large-scale EduTech company with a realistic possibility of disrupting the bricks-and-mortar higher education establishments like Universities and colleges. It was one of three EduTechs I reviewed then; the results of those articles are shown below.

Performance of Recommendations (Author)

Two out of three is not bad and enabled me to make some reasonable returns. Time has moved on, and I no longer consider online education a disruptive technology. During the pandemic, most schools went online, today’s young people are used to learning that way, and most teachers are skilled at delivering content over the Internet. It is the reason I have not covered any EduTech companies since the pandemic.

Although I no longer see Coursera disrupting the educational world, I do see the power of the disruptive general technology Generative AI to transform Coursera’s financial results and significantly increase its share price.

Coursera is well placed to make a transformational change to thousands of businesses and millions of learners, as generative AI powers growth.

The Rise of Generative AI

Having completed Coursera’s “Generative AI for everyone,” I, along with the more than 160,000 people who have already registered for the course, have a reasonable understanding of what this new technology can do and its limitations. I would encourage anyone interested in following this technology to take the course.

Generative AI uses large language models LLMs like ChatGPT from OpenAI, PaLM 2 from Google powers BARD, and Llama from Meta. Bing Chat from Microsoft is probably the easiest way to access and try this technology.

Thousands of different LLMs exist and can be closed or open to the net. The LLM a company chooses to work with could have unforeseen consequences. It could release sensitive data to the world or give incorrect information to users. A company’s implementation strategy may be the difference between the success or failure of the entire operation.

Generative AI is the ability of software to generate text or images in response to a prompt. The quality of the output is linked to the quality and depth of the prompt and the LLM it uses.

Generative AI can work with humans, taking over many tasks, but it is not intelligent; it only knows the information it has been trained on and does not understand what is true and what is false.

Many large Language Models have been trained on the internet and have no idea if what they have access to is real or imaginary. That is one of the reasons they can output what are called Hallucinations; they make things up and authoritatively output incorrect information. This has caught out many people and companies already. CIO has a page tracking some of these incidents, from the imaginary legal cases a lawyer submitted to a judge to customers receiving hate speech and even a company cutting 2000 of its workers based on incorrect AI output.

Without skilled and knowledgeable people in charge of the implementation of generative AI, the technology has the potential to be as destructive as it is transformational.

Corporate America is not ready for Generative AI

Earlier this year, the Boston Consulting Group published a report on the state of AI planning within businesses. The report contains significant data pointing to a formidable rise in company spending on generative AI over the coming year or two. 85% of companies said they will increase spending on GenAI this year, and 89% said it was a top three priority for their tech departments. The report highlights the problems business managers are facing: 62% of executives felt they were short on talent and skills, only 6% of companies have managed to train more than a quarter of their IT staff on generative AI tools, and 45% of business leaders say they don’t have any guidance on the use of generative AI yet. The report concludes that 90% of businesses are currently just observing the changes, but that the extraordinary and transformational nature of the technology will force them to catch up quickly.

Coursera sees the opportunity

Coursera is moving quickly; they have opened the Generative AI Academy, providing a structured training program to enable businesses and individuals to gain the skills and knowledge needed to lead their companies into this new frontier. Industry leaders, including Microsoft (MSFT), Google Cloud, Amazon Web Services, and Stanford University, have partnered with the Academy to provide branded qualifications and courses.

The Academy is working on two things: first, delivering individuals the skills and knowledge they need, and second, providing executives with an understanding of the risks involved and how to design a strategic corporate plan to engage with and profit from this technology ethically.

In the Q4 earnings call, the CEO dedicated a significant part of his prepared remarks to discussing this move.

He discussed the new course he launched, “Navigating Generative AI: A CEO Playbook,” it is a hands-on course running on Google Gemini Pro that will allow companies to develop a strategic framework to adopt and integrate the new tech.

The Generative AI Academy provides a foundational literacy course that will give every employee an understanding of the core principles and potential impact of the technology using guided projects on how to use generative AI in their daily lives.

As every facet of our society grapples with the need to improve their productivity, agility, and human capital in this new world of generative AI, we believe that they will require education and training to do this quickly but safely.

(COUR: 2024 Earnings call 4 2023 Transcript, 2024-2-1)

The CEO discussed the company’s commitment to its scalable platform and how they believe that generative AI will drive their business forward.

Not just teaching but learning

Cutting costs, Speeding development

Coursera is becoming a model of how to use these new tools. Last quarter, they used generative AI to translate 2,000 courses into seven different languages; they now offer 4,000 courses in as many as 18 languages. In the Q4 earnings call, the CEO said this had been done at a fraction of the cost and speed of the conventional human methods they had been using. Generative AI allowed them to add Mandarin, Dutch, Greek, Italian, Polish, and Turkish. Mandarin is the second most spoken language on earth, adding 1.1 billion potential customers to Coursera’s platform.

Designing New Products

Coursera launched Coursera Coach, a Generative AI expert that helps and encourages learners; the CEO reported higher engagement and course completion with those customers trialing the Coach. It provides a vast array of personalized features for the learner, including pre-lesson quizzes, context-relevant videos, and lecture summaries.

Coursera is driving its business, cutting costs while expanding its products using generative AI and teaching others how to do the same.

Financials

Coursera published its full-year 10K for the year up to Dec 2023 on February 22nd; the main highlights were as follows:

Revenue increased 21% to $636 million.

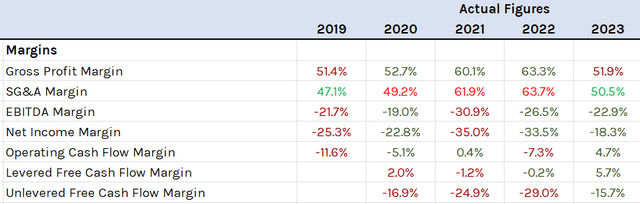

Significant improvement was shown on many important margins.

Coursera Key Margin Ratios (Author Database)

Gross profit margin was 52%, down from more than 60% in 2022; however, much of that has to do with a shift in expenses related to a contract extension with their largest industry partner (see earnings call transcript CFO prepared remarks).

Q4 2024 came in with a positive EBITDA of $5.7 million, the first positive read in the company’s short history, and free cash flow yield was positive for the first time at 1.1%

Coursera had $722 million of cash on the balance sheet at year’s end, with no debt. It has enough cash to last three years, but it has positive free cash flow and is in a very strong financial situation.

Forecasting and Valuation

I have built a three-statement mathematical model for Coursera, allowing me to look at different scenarios. These models are a key part of my investing and feature in many of my articles. When I first wrote about Coursera, I had very little data to work with, so I used a Montecarlo simulation to develop revenue and Netflix (NFLX) to get some cost data (Netflix because Coursera essentially makes videos and streams them).

I now have ample data and a good idea of Coursera’s cost base and how it develops over time. All key inputs are based on previous performance unless stated otherwise.

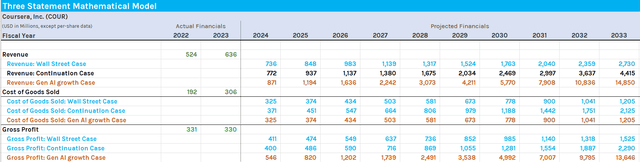

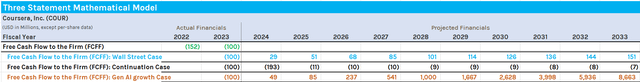

Below, I look at three possibilities: the Wall Street case, the continuation case, and finally, a Generative AI growth case.

The Wall Street case uses the revenue forecasts on Simplywall.st gathered from the Wall Street analysts covering Coursera. Wall Street assumes costs will continue to fall and assume a small margin improvement.

The continuation case assumes that Coursera continues to grow its revenue and costs in line with the 2022-2023 percentage changes.

Finally, the Gen AI growth case assumes that Generative AI provides Coursera with a revenue boost, returning its growth rate to the average of its first five years.

Coursera has almost no additional cost per new learner; the cost of a course is virtually the same whether one person follows it or a million people do.

Revenue Forecasts (Author Model)

Wall Street is forecasting a moderation of the revenue growth rate; maybe Wall Street is applying standard rules about the growth of early-stage companies and the penetration of the marketplace. They may be looking more at the original Coursera business plan to disrupt brick-and-mortar educational establishments rather than service the current need for AI knowledge and skills. It is common to see a revenue surge at first and then see a slowing down of the growth rate as it tends towards the long-term one.

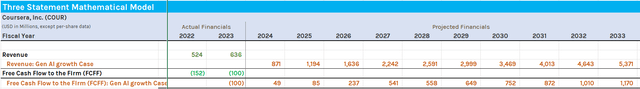

The Generative AI case assumes that revenue will continue to grow at 37%, the average annual growth rate the company has achieved between 2019 and 2023.

The three scenarios deliver the following free cash flow forecasts.

Free Cash Flow Forecast (Author Model)

Accepting that Generative AI will boost Coursera’s revenue in the coming years does not seem a stretch, but that boost is unlikely to last for the entire forecast period. By 2033, generative AI will have completely penetrated many markets and seem as revolutionary as word processing today.

Adjusting the scenario, assuming the boost from generative AI lasts only for three years, after which point the growth returns to the percentages predicted by Wallstreet, seems to be a more realistic proposition.

In this altered scenario, the key line items for revenue and Free cash flow are:

Adjusted Cash Flow Forecast (Author Model)

Using this forecast generates a discounted cash flow valuation per share of $172 using a WACC of 3.61%. The Wall Street case gives a DCF value of $18, highlighting the potential of generative AI to deliver a significant positive surprise for Coursera.

Risks

The most obvious one is that this thesis fails, and generative AI does not deliver any boost to Coursera. In that case it is likely that Coursera would follow the path given by Wall Street, it would still be moving forward and heading towards profitability.

Coursera has a solid balance sheet, a growing reputation, and a history of good performance. All investments have downside risks, but this one appears less than many, thanks to proven performance and solid finances.

Conclusion

Coursera had a very good 2023, it grew its user base both in terms of learners and providers. The first quarter of positive EBITDA is a milestone achievement and alleviates any lingering cash concerns.

Coursera launched its microcredentials and the Generative AI academy as it pivots its business to make the most of a transformational technology.

Generative AI is a general-purpose technology forecasted to transform industry, boosting GDP and the profits of those companies that can harness its enormous potential.

It would appear that the world’s businesses are aware of the potential of this technology but only 10% of them currently have the necessary skills and knowledge to move forward.

Coursera has positioned itself as the go-to place to acquire the necessary skills and knowledge to make the most of this opportunity.

Coursera would have a fair value of $172 if this scenario plays out. I am long Coursera at $16.50 and will update in the comments as the trade progresses.