Buying solid companies and holding on to their shares for a very long time is a proven way to make money in the stock market, as this simple strategy helps investors take advantage of the power of compound growth and also capitalize on disruptive and secular growth opportunities.

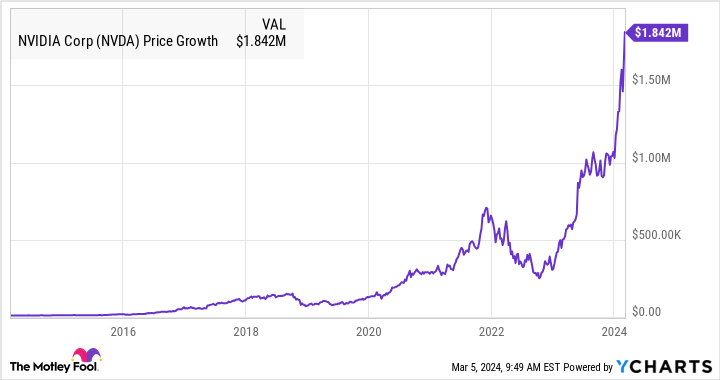

Nvidia (NVDA -5.55%) is a prime example of what a successful buy-and-hold investment can deliver over the long run. An investor who put $10,000 into Nvidia stock a decade ago and held on would be sitting on a position worth more than $1.8 million right now and more than $1.9 million with dividends reinvested.

But can Nvidia replicate this feat and help new investors become millionaires if they start with a $10,000 investment?

Is it realistic to expect such massive gains from Nvidia again?

Nvidia has grown by leaps and bounds over the past decade, and now, with a market cap of just over $2.25 trillion, it’s the third-largest company in the world. So for Nvidia to grow by 100 times from here, its market cap would have to exceed $200 trillion. That looks absurd: Last year, the entire global gross domestic product (GDP) was an estimated $105 trillion, up just 5% from 2022.

Nvidia’s market cap, therefore, is equivalent to about 2% of the global GDP. If it maintained that proportion over the long haul, it would be worth $200 trillion when the world economy had grown to an almost incomprehensibly large $10 quadrillion. That may not happen in our lifetime — global GDP has grown by between 2% and 5% a year since 1980 in most years, except during the 2008-2009 recession and at the onset of the pandemic in 2020.

Assuming the global economy grows at an optimistic 5% a year, it would take more than nine decades for it to grow to $10 quadrillion. We can’t know if Nvidia will even be around then. However, going by the company’s prospects and the multiple markets that it serves with its graphics processing units (GPUs), there is a good chance it could turn out to be a solid long-term bet — even if it’s unlikely to turn a $10,000 investment into a million-dollar position again in our lifetimes.

But if you have that much in investible cash after covering your bills, paying off any high-interest debt you have, and building up an emergency fund, putting $10,000 into Nvidia as a part of a diversified portfolio could indeed help you get closer to your financial goals.

Multiple catalysts make Nvidia a solid long-term buy

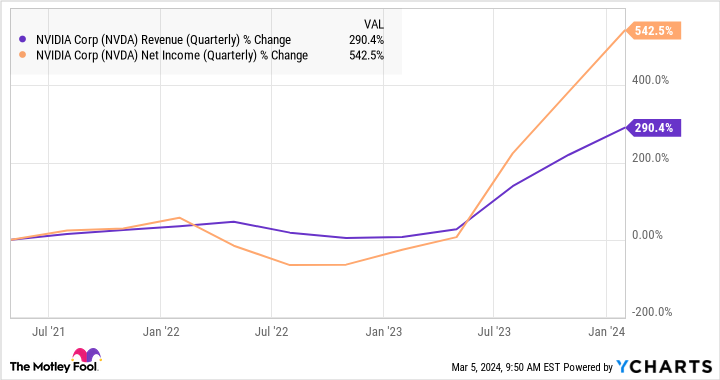

As the following chart shows, Nvidia’s growth has taken off from the end of 2022.

NVDA Revenue (Quarterly) data by YCharts.

The company’s data center business has played a central role in this growth. It delivered a record $47.5 billion in revenue in its recently concluded fiscal 2024, which was a massive 217% increase. The data center business produced 79% of Nvidia’s total revenue of $60.1 billion.

This business segment is moving the needle in a big way for Nvidia as customers are lining up to buy its most powerful GPUs for artificial intelligence (AI) training and inference. From Alphabet to Amazon to Meta Platforms and many more, Nvidia has an illustrious list of customers for its flagship H100 processor. More importantly, it will launch its next-generation H200 AI GPU soon, and demand for this chip is already high.

However, this is not the only GPU opportunity Nvidia is set to benefit from. The company’s gaming business has also gained solid momentum and could generate billions of dollars in annual revenue for the company in the future.

It is worth noting that Nvidia remains the dominant player in the market for both AI and PC GPUs. While its share of the discrete PC GPU market reportedly stands at more than 80%, Wells Fargo recently estimated that it controls a whopping 98% of the AI GPU market. Precedence Research forecasts that the global GPU market’s revenue will grow from $42 billion in 2022 to $773 billion in 2032, an annualized growth rate of almost 34%. Given Nvidia’s market share now, its outstanding pace of growth looks sustainable.

More importantly, Nvidia is looking to increase its reach beyond these two markets. For instance, it is reportedly looking to get into the custom AI chip market, a lucrative growth opportunity. On the other hand, Nvidia’s professional visualization business is now growing at an impressive pace as well.

The company generated $463 million in revenue in the professional visualization segment last quarter, a jump of 105% from the prior-year period. This segment includes the company’s Omniverse digital twin platform and graphics cards used in workstation PCs. For the full fiscal year, its professional visualization revenue was just $1.6 billion, so it is still a small segment for the company, but the opportunity here is huge, and the company has already started capitalizing on it.

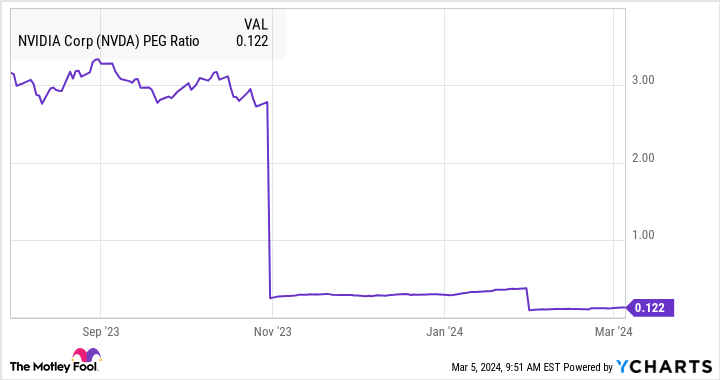

As such, there are multiple reasons this semiconductor giant could continue to grow at a healthy pace in the long run. This is also evident from the company’s price/earnings-to-growth (PEG) ratio, which stands at just 0.12.

NVDA PEG Ratio data by YCharts.

The PEG ratio is a forward-looking metric that’s calculated by dividing a company’s price-to-earnings ratio by the annual earnings growth it is expected to deliver, usually over five years. A result of less than 1 indicates that a stock is undervalued when compared to the growth it could deliver.

So, investors looking to add a potential long-term winner to their portfolios should consider buying Nvidia stock right now, as it could help them in their quest to become millionaires.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.