Costco runs an incredible business, but its valuation has become expensive.

Costco Wholesale (COST 0.35%) has been a reliable market-beating stock for ages. The company operates under a warehouse model that breeds loyalty and sales growth, and it also pays a dividend. There’s nothing not to like about Costco stock — except for its valuation.

Is Costco’s premium valuation a setup for a fall?

Why Costco stock keeps climbing

Costco has 879 warehouse stores globally, 606 of them in the U.S. It stands out from other discount retailers like Walmart and Target with its membership model, bulk packaging, and rock-bottom prices. There are other chains that have a similar model, like Walmart‘s Sam’s Club and BJ’s Wholesale Club, but they don’t have the same size or scale.

The membership model does a few things for Costco. It creates a recurring revenue stream that goes straight to the bottom line, and it allows management to keep prices on its wares as low as possible, since the lion’s share of its profits come from its membership fees. It also generates customer loyalty, since customers want to milk their memberships for as much value as possible. That leads to high traffic and sales volumes.

The membership metrics are consistently outstanding. In its fiscal 2024 third quarter (which ended May 12), membership fee income increased 8% year over year, and U.S. and Canada renewal rates increased to 93%, while worldwide rates held steady at 90.5%. It also continues to upsell members to its executive tier, which costs double the basic $60 membership. Executive tier members make up 46% of membership, but account for 73% of sales.

Costco’s sales growth reached unprecedented rates early in the pandemic, and it experienced pressure as conditions began to normalize. It’s now rebalanced, but growth rates remain above pre-pandemic averages. It has likely captured market share over the past few years, and the business is especially resilient in times of inflation, when every buck counts for more shoppers and they’re looking for the lowest prices.

Sales in the fiscal third quarter increased 9.1% year over year, driven by a 6.6% increase in comparable sales (comps). Earnings per share increased from $2.93 in the prior-year quarter to $3.78 this time. Costco also provides monthly updates, and its strong performance continued into May, with an 8.1% revenue increase over last year and 6.4% higher comps.

More growth opportunities

Management plans to open about 30 stores annually, giving it a long runway for further growth. It also has plenty of opportunity to increase its executive membership base, and the customers who are signing up now will continue to drive organic growth over many years.

It will also raise its annual membership fee again at some point. It’s well past the average time between fee hikes, but management feels that it’s enjoying strong performance right now without the increase, and it’s holding off while its customers are still feeling pressure on their household budgets. It’s committed to the goal of creating value for its members, and a fee hike right now doesn’t align with that. But when the time is right, the next bump will add a large sum to its earnings.

Costco stock’s valuation keeps expanding

I’m a big fan of Costco stock, and in general, its high valuation doesn’t bother me. The reliable gains of the business justify a premium on the stock price.

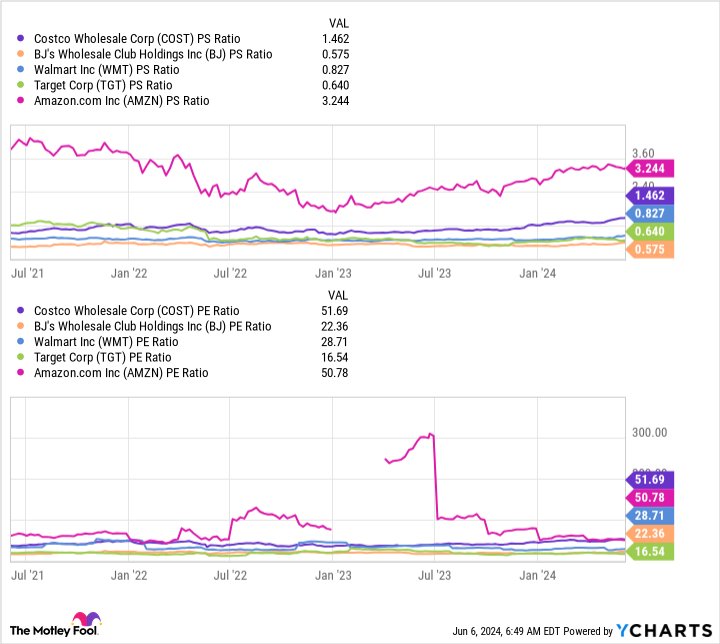

However, Costco stock is the most expensive it has ever been right now. In terms of its price-to-sales ratio, it’s more expensive than any of the competitors mentioned above, and its price-to-earnings ratio is even higher than Amazon‘s.

COST PS Ratio data by YCharts.

If you are investing with a long-term buy-and-hold philosophy, a higher-than-normal valuation shouldn’t be the biggest factor in your decision about whether or not to buy a great stock. Nobody can reliably “time the market,” and it’s not a smart strategy to attempt. There are no prophets on Wall Street.

That said, it’s not a great idea to buy a stock when it’s at its absolute peak valuation, because it doesn’t leave any room for error or weakness in the business. So if you’re interested in adding Costco stock to your portfolio, you might either want to wait for a better entry point or dollar-cost average your way into a position.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.