Felipe Cruz

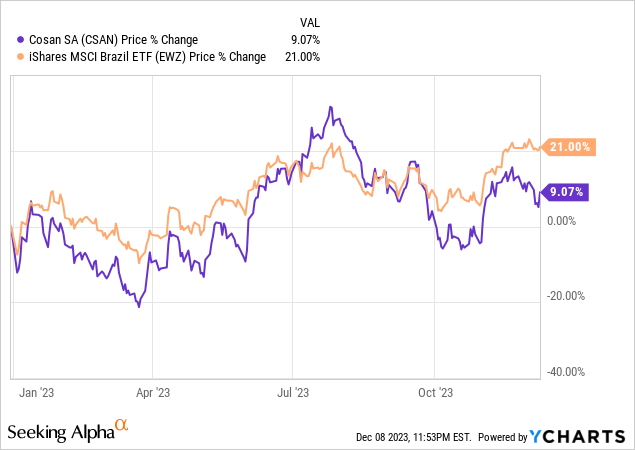

Throughout this year, the Brazilian holding company Cosan (NYSE:CSAN) has experienced a performance marked by fluctuations, influenced by the diverse nature of its businesses that rely on the economic cycles of various commodities. Despite a 9% enhance throughout 2023, this growth falls notably below the iShares MSCI Brazil ETF (EWZ) performance. The ETF tracks the performance of the major companies traded on Brazil’s stock exchange, the Ibovespa.

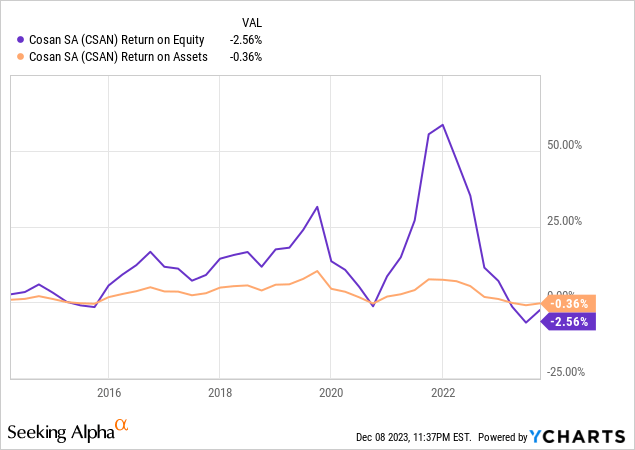

I highlighted Cosan’s investment thesis in my previous article, emphasizing its moderate and continuous growth history. The company has demonstrated resilience even in challenging economic scenarios marked by recessions, currency volatility, and political crises. My bullish thesis on the company is rooted in its capital-intensive nature, diverse revenue base, and possession of assets with robust cash generation. Despite facing oscillations in economic cycles over the past decade, Cosan has maintained a commendable track record of capital allocation.

Cosan reported solid numbers across practically all its subsidiaries in its most recent quarter. However, as Cosan operates as a highly diversified conglomerate, investors should not foresee significant swings in its share price and should grasp it as a long-term investment.

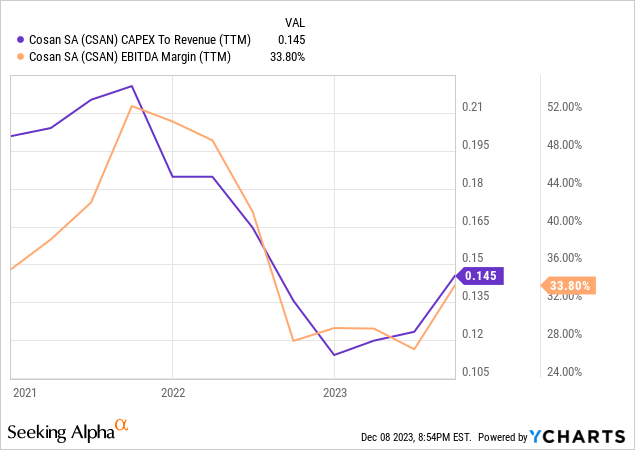

Given that Cosan may be approaching its investment peak, I currently view the company in the mid-cycle of its growth potential. This assessment considers its ongoing investments in subsidiaries, positioning it to potentially evolve into a Brazilian cash cow, especially considering its strong cash generation.

3Q23 Cosan’s Financial Results

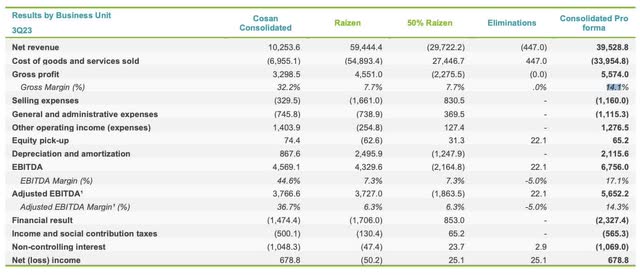

In the pro forma consolidated figures, which encompass all direct subsidiaries and 50% of Raízen’s results, Cosan demonstrated improved performance in 3Q23 compared to the previous year.

Notably, margins exhibited significant growth compared to the third quarter of 2022: the gross margin expanded by 5.2 percentage points, reaching 14.1%, while the EBITDA margin saw an enhance of 8.1 percentage points, reaching 17.1%.

Despite a decrease in net revenue from R$43.7 billion in the same period of 2022 to R$39.5 billion, the gross profit surged to R$5.6 billion, a notable enhance from R$3.9 billion in 3Q22. EBITDA also witnessed substantial growth, totaling R$6.8 billion compared to R$3.9 billion in 3Q22. Net profit, reaching R$678.8 million, reversed the loss of R$14.9 million reported in the same period the previous year.

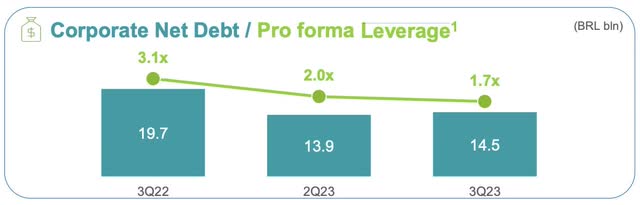

Turning to the group’s indebtedness, the 3Q23 concluded with a leverage ratio of 1.7 times, considering the pro forma net debt/EBITDA ratio. This level is lower compared to 3Q22, primarily attributable to the expansion of EBITDA. Combining this leverage level, a well-structured amortization plan, and robust cash generation from the group’s companies alleviate concerns.

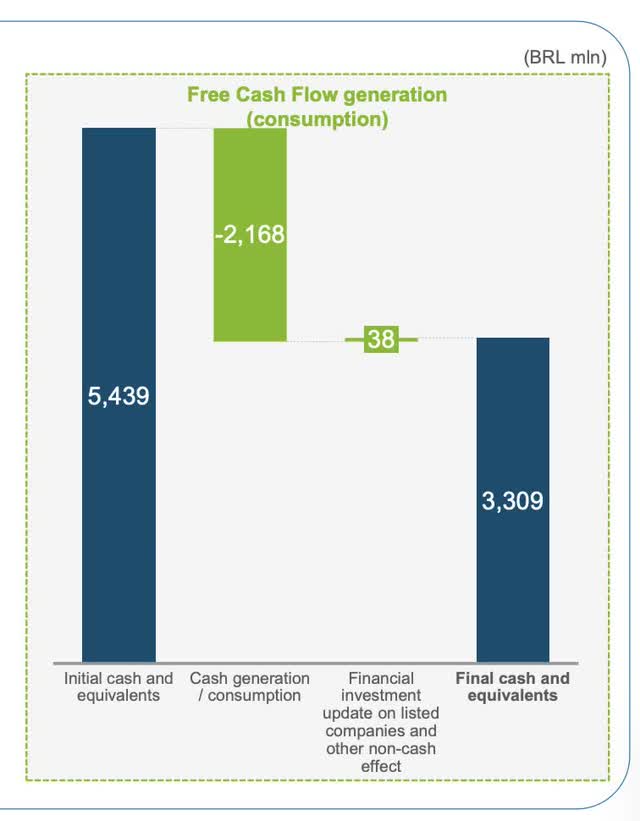

Cosan’s sash consumption in the quarter also reflected the company’s liability management process, partially offset by the receipt of interest on equity from Vale and dividends from Raízen and Land, the primary sources of cash in the quarter. With these movements, Cosan Corporate ended the period with a robust cash position of around R$3 billion.

Cosan’s Portfolio Results

In 3Q23, Cosan delivered positive financial results across its diverse portfolio of investments. Let’s delve into the key highlights for each investee:

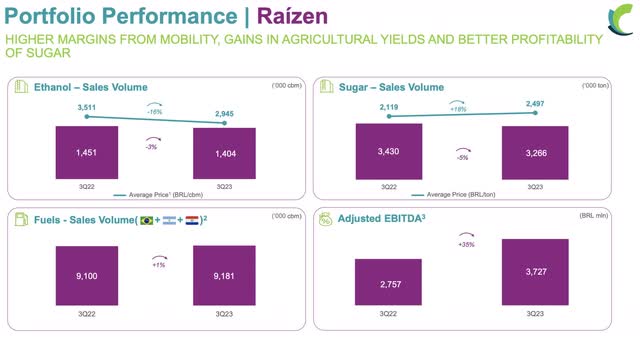

Raízen: Cosan’s joint venture with Shell (SHEL) demonstrated strong performance, achieving an adjusted EBITDA of R$3.7 billion, marking an impressive 35% enhance compared to 3Q22. This success is credited to heightened margins in the mobility sector, improved sugar segment profitability, and agricultural productivity advancements.

The technology of Raízen is emphasized as potentially valuable in South America, particularly in light of the growing presence of electric cars.

Raízen directed R$2.3 billion towards E2G projects and distributed energy generation through Raízen Power.

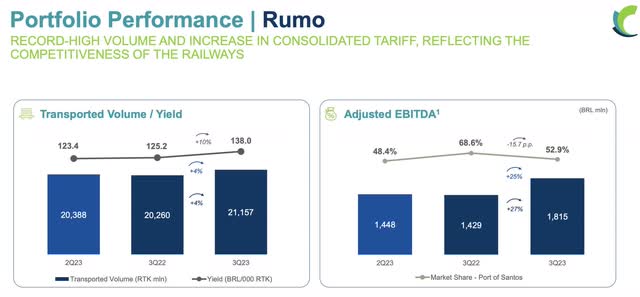

Rumo: Brazil’s leading independent rail logistics operator, Rumo (OTCPK:RUMOF), reported a 4% growth in volume, reaching 21.2 million tons per useful kilometer (TKU) compared to last year. The adjusted EBITDA soared to R$1.8 billion, marking a 27% enhance from 3Q22. Improved margins and tariffs played a pivotal role in these positive results. Notably, there was a 15.7 percentage point reduction in the share of grain exports through the port of Santos, decreasing to 53% due to surplus demand allocated to alternative transportation options.

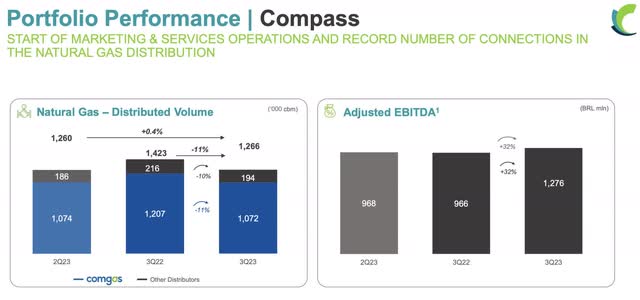

Compass: The natural gas distribution company, Compass, experienced an 11% reject in the volume of distributed gas compared to 3Q22, primarily attributed to reduced industrial activity. Despite this, EBITDA expanded by an impressive 32% to R$1.3 billion. This growth was fueled by a substantial enhance in connections and the successful handling of the first LNG cargoes.

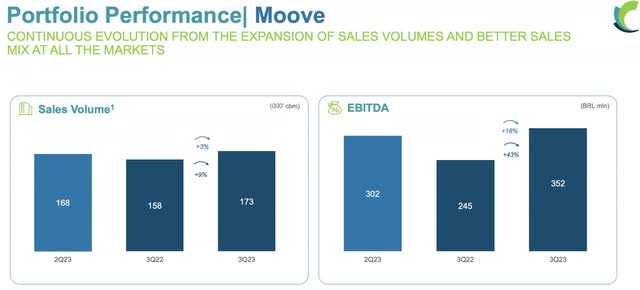

Moove: Cosan’s lubricants subsidiary, Moove, reported a substantial 43% enhance in EBITDA, reaching R$352 million, driven by heightened sales volumes of lubricants.

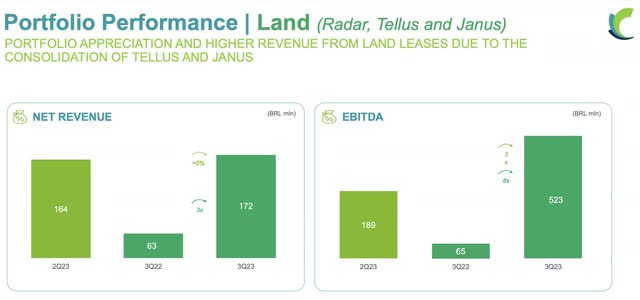

Cosan Investimentos: Responsible for overseeing the holding company’s investment projects, Cosan Investimentos reported an EBITDA of R$503 million. The Land segment played a significant role in this success, generating revenue from land leasing and portfolio revaluation.

These positive financial outcomes emphasize the resilience and strategic focus of Cosan’s diversified portfolio, positioning the company for continued success in the evolving market landscape.

Cosan: Nurturing a Future “Cash Cow”

Despite already housing companies in its portfolio making significant investments, such as Telos and Vale, and initiating operations, particularly with Raízen and the commencement of second-generation ethanol plants, Cosan is on track to evolve into a “cash cow.” This transformation is primarily attributed to the strategic characteristics of its portfolio companies, encompassing public and private concessions, long-term contracts, and essential operations in sectors appreciate logistics, fuel distribution, land cultivation for agribusiness, and infrastructure.

The realization of this potential is expected to become more pronounced as capital expenditures decrease and the operational contributions of second-generation ethanol plants commence enhancing EBITDA.

The portfolio’s diversification encompasses vital players such as Rumo, pivotal in logistics, Raízen with its critical role in fuel distribution, and Moove, despite its volatility, holding a significant brand presence in the distribution of Shell service stations. Additionally, the inclusion of OXXO, from Mexico, underscores the company’s commitment to international expansion.

Acknowledging the leverage and volatility, Cosan’s dividend is stable, paying $0.35 per share annually in 2022 and $0.33 per share in 2023. There is potential for additional dividends in December, currently sustaining a yield of 2.45%, although it still falls short of being considered an income stock.

While Cosan may not yet be a cash cow that commands investors’ attention for dividends, there is an expectation that the company will reach this status at some point in the future. This transformation should make it an attractive holding for investors seeking effective resource allocation, especially given the quality of the companies within its portfolio.

Valuations and Holding Discount

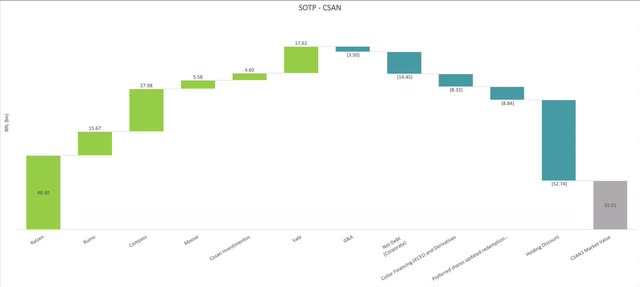

In valuing Cosan, my approach involves considering the aggregate value of all its components, given the company’s operations in capital-intensive industries and the cyclical nature of some of its businesses.

As part of a renewed commitment to transparency, marked by significant improvements in disclosing its results, particularly in demystifying Vale’s complex financial engineering, the company has provided an interactive spreadsheet showcasing the valuation of its subsidiaries. This tool empowers investors to reckon the holding discount.

For Raízen, Rumo, and Compass, the valuation method utilized their EV/EBITDA guidance’s implicit multiples of 10x, 11x, and 8.5x, respectively. This implies a market value for Raízen of R$48.4 billion, Rumo of R$15.7 billion, and Compass of R$27.98 billion. The valuation for the position in Vale was determined using the price target, resulting in a total value of R$17.6 billion.

Moove underwent valuation through the EV/EBITDA method over the last twelve months, yielding a value of R$5.58 billion. For Cosan Investimentos, the equity value valuation method presented at Cosan’s Investors Day was applied, assuming Compass is priced at R$4.60 billion.

Cosan’s subsidiaries “Sum of The Parts” (Cosan’s IR)

After deducting G&A, corporate debt, collar financing, and the redemption value of preferred shares, Cosan’s current market value stands at R$32.01 billion, equivalent to $6.72 billion. This implies a 52% discount on the holding company’s market value.

Conclusion

Cosan reported strong results in 3Q23, improving Adjusted EBITDA across all levels. A highlight was Compass, which benefited from a better mix, overcoming challenges in natural gas distribution volumes, and saw positive results from selling the first volumes of liquefied natural gas (LNG). Rumo also experienced continued positive yield dynamics and volume increases. Raízen saw a solid recovery in Mobility results and positive dynamics in Renewables. Moove achieved its highest margin ever.

The increased EBITDA also contributed to a reduction in leverage, alleviating significant concerns for investors not too long ago, despite the gradual elimination of collar derivatives related to the Vale acquisition. On the downside, corporate expenses continued to rise.

Nonetheless, the 3Q23 results present a very positive net balance. Despite ongoing developments, the company retains a substantial holding discount of 52% based mainly on Cosan’s company’s guidance. This reinforces my decision to preserve an optimistic outlook on the company, focusing on the long term. I believe it holds significant potential to evolve into a future cash cow.