Dr_Microbe

Literature is a textually transmitted disease, normally contracted in childhood.”― Jane Yolen

Today, we focus on Corcept Therapeutics Incorporated (NASDAQ:CORT) for the first time since our last article on this name back in September 2022. The company just posted fourth-quarter results, making it a good time to circle back on Corcept. An updated analysis follows in the paragraphs below.

Company Overview:

This commercial-stage biopharma concern is headquartered just outside of San Francisco in Menlo Park, CA. The company is focused on the development of drugs for the treatment of severe metabolic, oncologic, endocrine, and neurological disorders. The company has one product on the market called Korlym (mifepristone) tablets. This is a once-daily oral medication which is approved for the treatment of hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing’s syndrome, who have type 2 diabetes mellitus or glucose intolerance. The stock currently trades just above $23.00 a share and sports an approximate market capitalization of $2.5 billion.

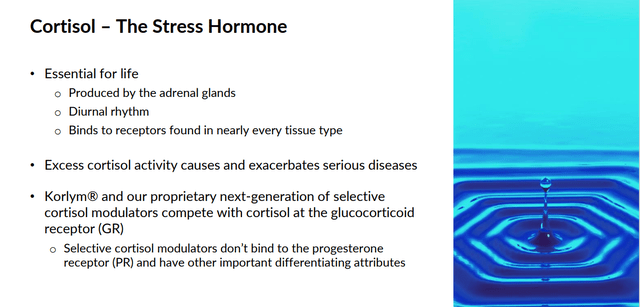

Corcept’s development approach is based on modulating a compound called cortisol and its activity at the glucocorticoid receptor that it believes can provide treatments for many serious disorders such as Cushing’s Syndrome and cancers such pancreatic, prostate, ovarian, triple-negative breast, and lung as well as other afflictions including NASH.

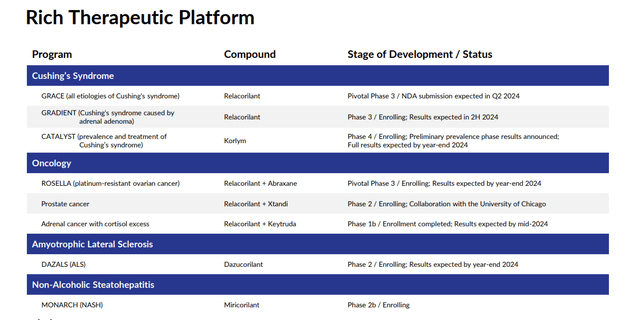

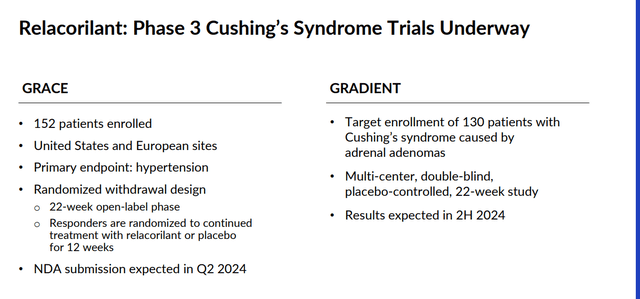

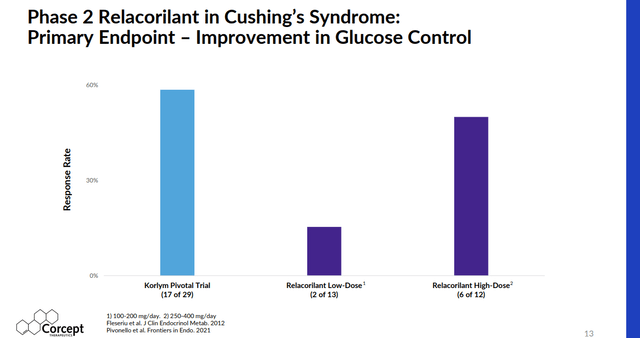

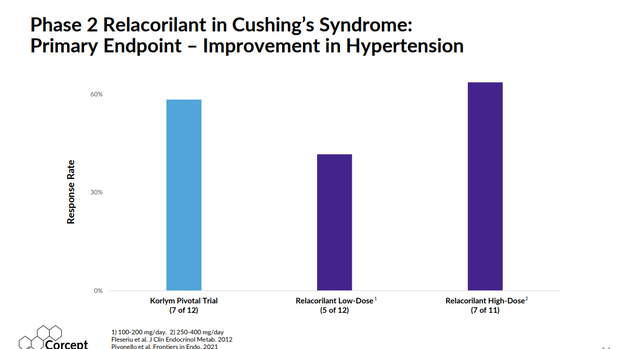

The company is also developing a compound called relacorilant to treat Cushing’s Syndrome as a monotherapy and also as part of combination therapies to treat various forms of cancer. The company has two key Phase 3 trials (GRACE, GRADIENT) in progress evaluating relacorilant to treat symptoms of Cushing’s Syndrome. Results from these two studies should be out in the second quarter of this year, and management anticipates submitting an NDA for this indication during the quarter as well.

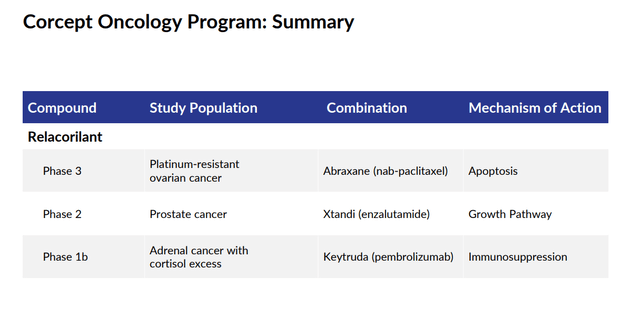

Relacorilant is also in various development stages being evaluated within partnerships as a potential combination therapy for various forms of cancer.

The company is also conducting a Phase 4 study called CATALYST. This is the largest clinical trial ever conducted to examine the prevalence of hypercortisolism in patients with difficult-to-treat type 2 diabetes. Preliminary data from the first 700 patients enrolled. Data showed a hypercortisolism prevalence rate of 24%, higher than expected, which could eventually open a new market for Corcept.

Fourth Quarter Results:

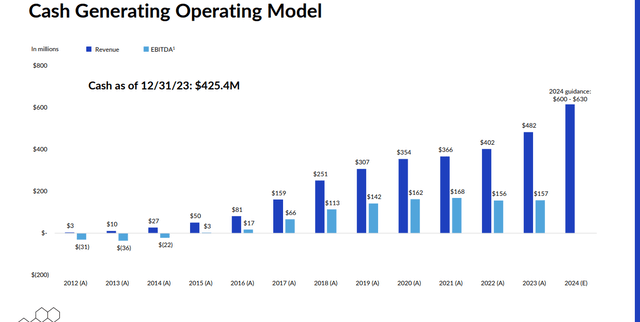

Corcept Therapeutics posted its Q4 numbers after the bell on February 15th. Corcept delivered GAAP earnings of 28 cents a share, two pennies a share above expectations. Net income rose impressively to $31.4 million for the quarter, compared with $16.6 million or 14 cents a share in the prior period a year ago. For FY2023, net income came in at $106.1 million, up slightly from $101.4 million in FY2022. For the full fiscal year, GAAP earnings came in at 94 cents a share, compared to 87 cents a share in the previous fiscal year.

Revenues rose just over 31% on a year-over-year basis to $135.4 million, some $6 million north of the consensus. Management reiterated initial FY2024 revenue guidance of between $600 million to $640 million.

Analyst Commentary & Balance Sheet:

Since the fourth quarter results were posted, Truist Financial ($42 price target, up from $36 previously), Piper Sandler ($35 price target), and H.C. Wainwright ($38 price target) have all reiterated Buy ratings on the stock.

Just under 23% of the stock’s outstanding float is currently held short. Numerous insiders were frequent and consistent sellers of stock throughout 2023. In the fourth quarter of 2023, they disposed of approximately $3.2 million worth of equity. So far in 2024, under $90,000 worth of stock has been sold by company insiders.

Corcept Therapeutics ended FY2023 with just over $425 million in cash and marketable securities on its balance sheet. Corcept bought back nearly $155 million during the fiscal year. Corcept Therapeutics listed no long-term debt on its fourth quarter 10-Q. Leadership believes it will exit FY2024 with between $600 million to $630 million of net cash on its balance sheet.

Verdict:

Corcept made 94 cents a share of profit in FY2023 as sales jumped 20% on a year-over-year basis to $482.4 million. The current analysis firm consensus has profits moving up sharply to $1.63 a share in FY2024 as sales rise over 20% to nearly $645 million. The latter figure is likely to come down some based on management’s initial sales guidance for the new fiscal year.

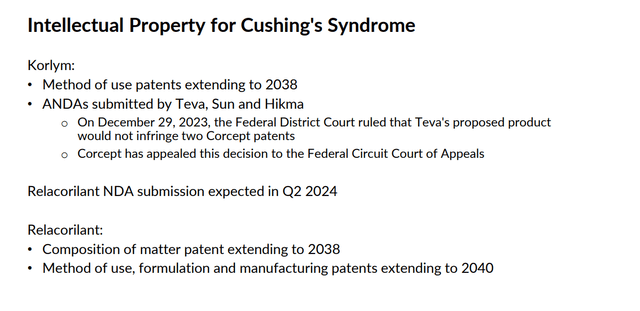

CORT seems a decent value given its growth rates at roughly 14 times forward earnings and 4 times forward sales. The stock is cheaper considering the more than $400 million of net cash on the company’s balance sheet. Approval of relacorilant for Cushing’s Syndrome is key to the company, as Korlym has faced patent litigation issues, primarily with Teva Pharmaceutical Industries Limited (TEVA). An article on Seeking Alpha in November goes over that litigation battle in good detail. The stock of Corcept Therapeutics fell hard on a recent litigation setback, which Corcept has already appealed.

February Company Presentation February Company Presentation

Relacorilant also does not have some key side effects of Korlym such as vaginal bleeding and endometrial thickening. In earlier studies, relacorilant showed better results around glucose control and hypertension compared to Korlym as well.

Given all the above, I have chosen to establish an initial position in CORT via covered call orders pending further developments on both the litigation and development fronts. Options against this equity are quite lucrative and have decent liquidity. This strategy provides significant downside risk mitigation as well. This is a story we will circle back on late in 2024 as the current risk/reward profile on CORT seems appealing at current trading levels.

After you find out all the things that can go wrong, your life becomes less about living and more about waiting.“― Chuck Palahniuk