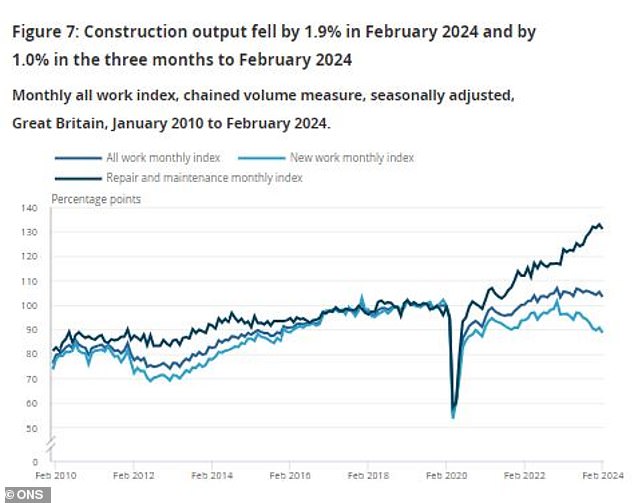

- Construction sector output slumped 1.9% in February, according to the ONS

- The industry is hoping for interest rate cuts to boost demand

Construction output slumped in February, weighing on overall economic growth, as wet weather and high interest rates hammered activity.

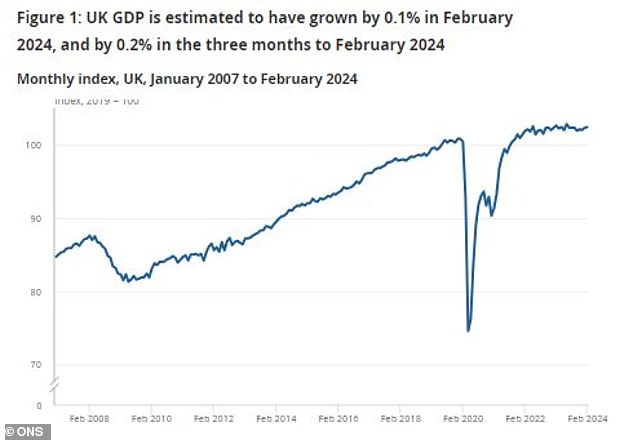

The construction industry’s output for the month fell 1.9 per cent in volume terms, holding GDP growth back to just 0.1 per cent after every other sector showed growth, figures from the Office for National Statistics showed on Friday.

The fall, which marks a 1 per cent contraction in the three months to February, was driven by a slump in activity in eight out of nine sub sectors – with private housing repair and maintenance the only area of growth, adding 0.2 per cent.

Project delayed: Construction sector output weighed down by poor February weather

Non-housing repair and maintenance, and private commercial new work were the worst affected, contracting by 2.5 and 4 per cent, respectively.

Experts pinned the decline on particularly poor weather for the month holding up construction projects after more than double the usual amount of rainfall this February, according to the Met Office.

But the sector was also hampered by the dominant influence of Britain’s housebuilding sector, which is building fewer homes this year.

The rise in the Bank of England’s base rate to its current level of 5.25 per cent has driven mortgage rates higher, leading to a drop in new home purchases and a slowdown in house price growth.

Repair and maintenance work has led construction since 2020 amid weak output in the rest of the sector

Shares in the housing, building materials and merchants sector are down roughly 1 per cent over the last month, led by a 5 per cent drop for housebuilders, as investor fret the potential for interest rates to remain higher for longer.

Nicholas Hyett, investment analyst at Wealth Club, said the construction sector ‘is in the doldrums’ and ‘an interest rate cut could be quite helpful’.

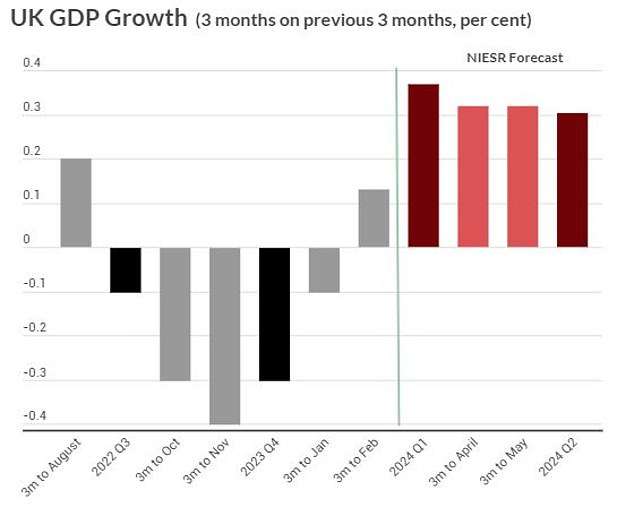

Generally improved economic output globally combined with higher-than-expected US consumer price inflation this week has driven back forecasts for the BoE’s first rate cut and the scale at which base rate will fall this year.

UK GDP grew by 0.1% in February, while January’s growth was upgraded to 0.3%

Current market pricing now suggests that the first BoE cut won’t come until August, while the forecasted scale of 2024 cuts is less than 50 basis points – meaning the current base rate of 5.25 per cent will not fall below 4.75 per cent by year-end.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: ‘Falls in construction activity also indicate a broader malaise the UK is yet to shake off.

‘We’ve known for some time that major housebuilders have been building fewer homes, as people wait for finances to improve before making large financial decisions.

‘All-in-all, the rate of economic growth has slowed, and there’s still a lot of extra coals needed to stoke the UK’s engines.’

The National Institute of Economic and Social Research predicts UK GDP growth will improve by remain weak in the first half of 2024