Smith Collection/Gado/Archive Photos via Getty Images

Overview

Confluent (NASDAQ:CFLT), the leading player in data streaming, runs the largest managed version of Apache Kafka, the open source language that enables low latency data streaming, a language that was built by Confluent’s co-founders at LinkedIn. The demand for real time, low latency data streams from IoT, Ad-Tech, and Autos to name a few, is only going to get greater and Confluent has the best platform to constantly stream it at scale, enhance, maintain, and provide analytics for it.

I had recommended Confluent twice before, in Sep 2023, and Feb 2023 praising among others its main strengths, summarized below:

Confluent’s Data Streaming Platform gives it a significant competitive advantage of scale and integration. Its integrated platform with several modules also becomes a barrier to entry and leads to greater engagement and monetization. Amongst its competitors it has the highest enhancements and richer features.

Of course, open-source Kafka, upon which Confluent built its own product, remains the free alternative. However, it and many of Confluent’s competitors don’t have the focus, scale, rich features, implementation, integration, support, and cost savings, that Confluent does. Besides, Confluent having an agnostic platform, has partnerships with the CSP’s (Cloud Service Providers), such as Amazon’s (AMZN) AWS, filling in their data streaming product needs or bringing them customers for storage and processing.

Confluent also serves all markets, cloud, hybrid and on-prem with a focus on their cloud native subscription platform, which is their best bet for sustainable and recurring revenue streams.

4th Quarter 2023 – revenge of the bulls

4th quarter 2023 earnings were better than expected and reaffirmed Confluent’s growth trajectory. The stock skyrocketed after hours from $24 to $32, with several Wall Street analyst upgrades the next morning. This reversed the massive drop from post Q3-2023 results when the stock got hammered from $27 to $17 on weak guidance – slowing growth tripping analysts. This time, the bulls got revenge.

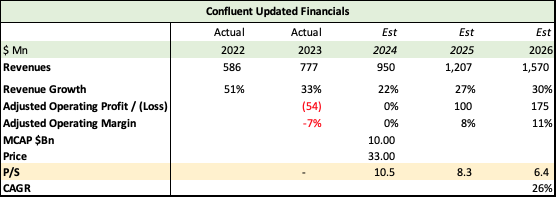

As we see below, revenue of $213Mn beat by $8Mn, versus consensus estimates of $205Mn, a growth of 26% YoY. Adjusted EPS beat by $0.04, coming in at $0.09 versus $0.05, expected an increase from $-0.09 last year. Confluent had promised margin expansion and adjusted profits, and they walked the talk. Adjusted operating margins were positive at 5%, easily surpassing the negative 22% from the previous year.

Confluent’s 4Q 2023 Earnings (Seeking Alpha, Confluent)

Confluent’s full-year performance also showed improvement, with revenue finishing 33% higher, and adjusted operating profit margins gaining 23 basis points from a negative 30% to negative 7%. And the first time, Confluent closed in the black for a full year, with an adjusted EPS of 4 cents, a whopping 62-point YoY turnaround.

It was great to be on the winning side after the Q3 drop. I had added more shares and nursed my position.

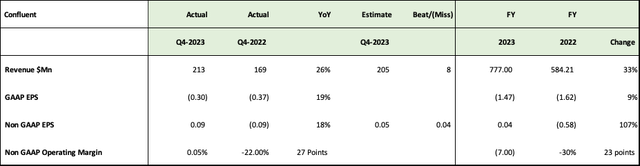

Let’s look at some of the metrics, which further cement my bull thesis

Confluent Q4-2023 Metrics (Confluent, Seeking Alpha)

Confluent walked the talk, with positive operating cash of $12Mn, a massive improvement from the burn of 27Mn last year. Revenue Performance Obligations, RPO climbed nicely by 24 points. Clients above $100,000 ARR (Annual Recurring Revenue) climbed 21%, Clients with ARR above $1Mn jumped even faster by 24% and the even newer category, clients above $5Mn in IRR more than doubled from 9 to 19, YoY. Dollar based (Net Recurring Revenue) NRR also came in as expected at 125%, with management mentioning that gross client retention remained in the 90% in spite of it being a difficult quarter.

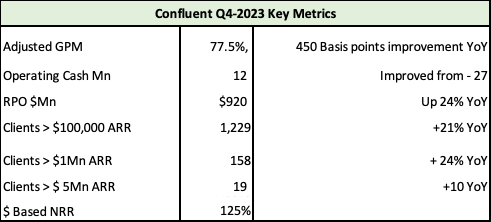

The guidance for 2024 was also reasonable:

Confluent 2024 Guidance (Confluent, Seeking Alpha)

2024 revenues are slated to be 22% higher, but more importantly they continue to focus on profitability. Confluent guided to adjusted break even for 2024, with a 7% increase in operating margins for the year and a 19% increase in margins for the 1st quarter. This lack of profligacy restores a lot of confidence in investors and paves the way for better multiples.

Key Takeaways from the 4th quarter earnings call

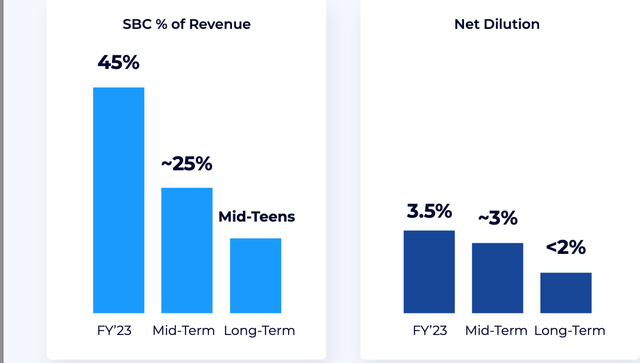

Management’s commitment to decreasing dilution is a huge deal, especially when share count grew a whopping 91Mn or 48% from 189Mn to 280Mn in 2022, and the much smaller 3.5% decrease and forecast to less than 2% from management is so much healthier for a company that went public just 5 years ago.

Confluent Share Based Comp (Confluent)

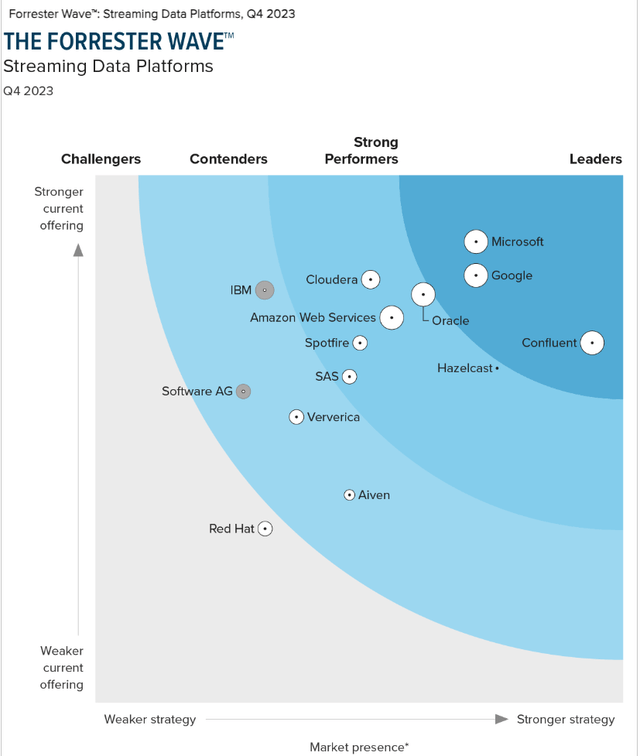

One of the themes, CEO Jay Kreps harped on the earnings call was the importance of streaming in new data architecture and why Confluent was in the best position to make the most of these opportunities. Forrester, realizing its importance, published a study on streaming as a separate category and listed Confluent as a leader, confirming its pole position in an industry segment that would be crucial for processing of large language models and machine learning.

Confluent is right there as a leader with strong strategy with Microsoft (MSFT) and Google (GOOG).

Streaming Data Platforms (Forrester)

In my opinion, Confluent could be the first mover and the standard setter by providing processing within the streaming layer instead of having it done at the storage stack.

Confluent’s data platform could be the new paradigm for stream processing as it emerges as a critical nervous system for data in motion.

From the CEO, Jay Kreps on the 4th quarter, 2023 earnings call, emphasis mine.

The potential for data streaming is to collapse the fragmentation of Data in Motion technologies and create a new data platform that supersedes each of these limited precursors. Since Confluent’s creation, that has been our central thesis that the data streaming platform would be a data platform of similar importance and scale to databases, but acting as the central nervous system handling all the data in motion.

To extract the full value of data in motion, organizations need to connect to the systems they have, process data in real-time, and govern these flows of data across the enterprise. Each of these capabilities, connectors, stream processing and governance, is on a path to become a sizable business on their own.

For Confluent this represents a significant growth opportunity. Today the spend on applications around the data stream is significantly higher than on the stream itself. By making these applications easier to build and bringing that spend into our platform, we believe both adoption of our platform as well as the growth of our business will be accelerated.

Kreps went to give several use cases with clients on why a central nervous system was important, including an airline with its several streaming requirements of flight times, weather information, and customer information. Or for a logistics company, that tracked fleet schedules, packages, delivery schedules and breakdowns, and an e-commerce retailer that had to be nimble enough to juggle inventories, order fulfillment and manage customers in real time. The key need Confluent was fulfilling for these disparate customers was combining data streams into enriched analytics to cascade through their various data silos to improve productivity.

Here’s another major factor that Jay Kreps talked about on the same call, emphasis mine.

In classical data architecture, data largely lived in a silo and at most was extracted to a single destination, the data warehouse, where it was processed to clean it up and make it usable for various reporting and analytics use cases. In modern data architecture, the data warehouse is no longer the single destination for data. Dozens or even hundreds of other systems feed off critical data streams. Repeating the processing that cleans up data for use dozens or hundreds of times is completely infeasible. The result is that the processing is being pulled upstream from the destination to the source to produce high quality, reusable data products. This means the processing is happening on the stream as data enters the system rather than in the destination, and this is pulling workloads from batch processing in the destinations into stream processing at the source. This is why, structurally, we expect the bulk of stream processing won’t happen in destination systems like databases, data warehouses, or data lakes. We think these three reasons are each powerful enough to draw processing workloads into the data streaming platform and put together will make the DSP the nexus of NextGen data workloads.

Confluent’s another crucial strength is leveraging the widespread adoption of Flink – an open source, unified stream processing and batch processing framework. Like Kafka, Confluent offers this as a paid, managed, scalable service and adds another layer of a high-quality product.

Flink is already in several sophisticated user bases of clients like Apple (AAPL), Capital One Financial (COF), Netflix (NFLX), Stripe and Uber Technologies (UBER), and is very popular with nearly 1Mn downloads and a 43% increase in open job requisitions for Flink developers in 2023.

A winning combination and a coherent product – Because Kafka is the de facto standard for data streaming, Confluent can leverage it further by unifying stream processing via Flink. This would be the easiest and fastest choice for developers and could make the Confluent Flink offering, a default option when it comes to processing data in Kafka. As the pure play data streaming platform, this would be a competitive advantage over giants Microsoft, Amazon, and Google,

The Artificial Intelligence imperative

This is a tremendous opportunity. As it emerges as a critical nerve system for data management, Confluent could be the new paradigm for AI related applications, or at least the preferred vendor, partner, or platform for the major AI players. These relationships should ensure not just a steady revenue stream but could also become a strong moat especially for large language model processing.

As management emphasized in its Q4-2023, earnings call, it is already working with the best of the breed in AI, such as OpenAI, Anthropic and Pinecone, to build and scale AI applications that connect their proprietary systems to LLMs, or Large Language Models, so they can deliver trustworthy and contextually rich insights to their customers.

Jay Kreps, CEO offered their interaction with OpenAI as an example, emphasis mine.

OpenAI has become the poster child of Gen AI. In Q4 OpenAI signed with us to improve their visibility into customer usage patterns. We are still in early stages with this customer, but we have already identified additional use cases, including ways to help reduce costs across their stack. This customer and others like it continue to validate the strategic role of data streaming in the generative AI landscape. I think increasingly streaming is a critical part of the architecture for these generative AI applications.

And our goal was really to support the integration across the best technologies in that space and I think was very much embraced on the other side by these companies that are trying to do that.

And then OpenAI, this is an incredible technology company that I think has the potential to be the size of Google over time in terms of the scale of their infrastructure. We’re extremely happy to be part of that stack.

Risks and Challenges

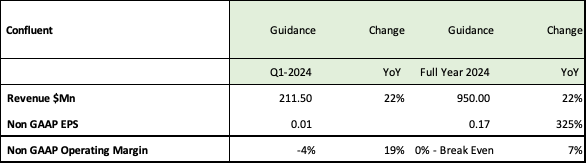

Valuation Risk – One of the key risks is overvaluation, I saw firsthand – the destruction of 40% of my position when revenue guidance was lowered for Q4-2023 from $212.3Mn to $204Mn – $205Mn. Now the stock has almost doubled from its November 2023 low of around $17 to $33, giving it a P/S ratio of 10 with a revenue growth forecast for 2024 of 22%. If there is any underperformance I would not rule out a big drop. Secondly, with such a high P/S ratio, the stock could also move sideways for a while.

AI monetization may not materialize – While management waxed eloquent about the AI possibilities with the collaboration with Anthropic and OpenAI, there is no clear path to monetization yet, and the markets may have rewarded this in euphoria.

A long way to GAAP profitability – While Confluent does expect to break even at the operating profit level on an adjusted basis in 2024, I don’t expect it to break even on a GAAP basis for at least another three years. As we saw in the table above, SBC is still 45% of revenues, and coming down to 25% in the midterm, which is higher than the 11% adjusted operating profit forecast for 2026. Management’s efforts to reign in dilution are very commendable, but adjusted EPS will not attract the same multiple as a GAAP EPS and likely keep some investors away.

A must-have in the portfolio

To summarize, these are the reasons I continue to buy on declines and plan to keep it in my portfolio for the better of this decade.

Confluent can become the central nervous system for data streaming as the best-in-class platform and the pure play with the best product features.

The combination of Flink and Confluent makes it a likely default choice for data streaming customers, Flink will also add materially to revenue from 2025.

Partnering with the best AI companies for data streaming could make Confluent’s Data Streaming Platform the de-facto standard and a moat in that segment, similar to Super Micro Computer’s (SMCI) partnership with NVIDIA (NVDA) in data center, and Arista Networks’ (ANET) role with Meta Platforms (META) Networking.

It’s focus on profitability, and reduction of SBC and dilution are very positive steps. With gross retention rate remaining strong, and attrition below forecast, NRR is likely to get back to >125% by 2025.

The valuation is a little expensive at 10.5x sales, with an estimated 3-year revenue CAGR of 26%, but they have committed to adjusted breakeven in 2024, and also expect to return to 30% revenue growth in the medium term.

Given the strong estimated revenue growth of 27% in 2025 and 30% in 2026, the improvements in operating margins will accelerate to 8% and 11% resulting in adjusted operating profits of $100Mn and $175Mn in 2025, and 2026.

Confluent Financials (Seeking Alpha, Confluent, Fountainhead)