Thierry Hebbelinck

Dear readers,

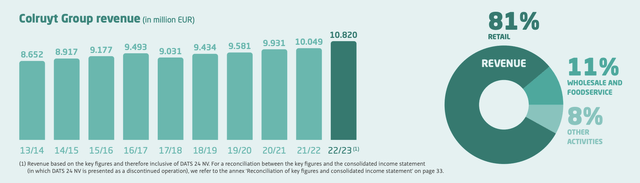

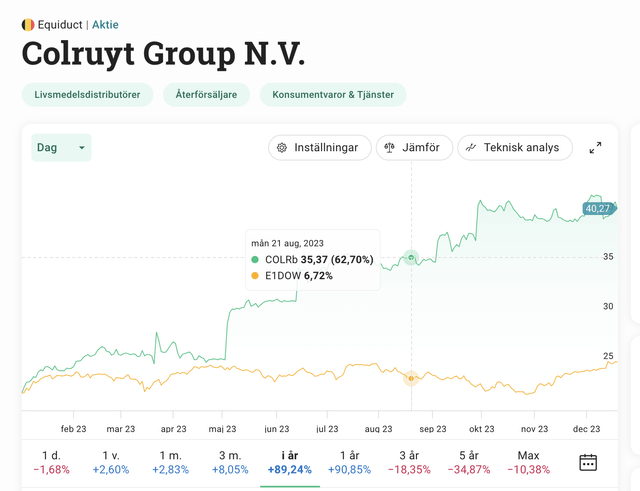

It’s time for an update on Colruyt Group N.V. (OTCPK:CUYTF) (OTCPK:CUYTY). I’ve been covering this company for about a year, and I finally initiated and expanded on my position when the company went below €35 in April. Overall, I’ve helped the “right” stance and recommendation on this company considering where it’s going, because Colruyt is up 89% in a single year.

In fact, in my initial article in 2022, I was at a “BUY”. However, I changed my recommendation and went “HOLD” in August – this was too early because the company is in fact up another 5% since that time.

Colruyt share price development (Avanza)

This is a Belgian grocer with a home market advantage, owning similar to Axfood AB (publ) (OTCPK:AXFOY) in terms of the native grocery market. However, unlike other companies in the sector, Colruyt faces significant margin challenges and has not been as successful as competitors in making certain that these do not impact results.

However, I believe the company may indeed rise to face and win over these challenges. There are a few factors that influence company appeal here – one of them is Colruyt’s non-food segments, which are not as impressive as its food segments and have challenges with its synergies.

Let’s look at the potential future upside for Colruyt.

The upside for Colruyt after the 3Q23 and forward

Etablissementen Franz Colruyt is a company I hold a close eye on because I hold a close eye on all of the conservative grocery companies across Europe and NA. They’re great, conservative investments with long-term appeal, and I’m only too happy to hold them for extensive periods of time.

My position, unfortunately, has remained small. While I took notice of the great dip in the last 1-2 years, I did not go as deeply as I should have, for a multitude of reasons.

But Colruyt is the “best” sort of company that one could invest in. Why? Because it’s a stable, family-owned grocer with plenty of motivation and shareholder interest behind it.

We’re talking about Colruyt supermarket retail chains, and the corresponding subsidiaries, including stores like OKay, Bio-Planet, DATS 24, Dreamland, Dreambaby, and others.

This means that the company has a very similar operating model to the native company Axfood. It also competes with publicly-listed grocers, including Koninklijke Ahold Delhaize N.V. (OTCQX:ADRNY), a company that I invest more money into. Colruyt is, as things stand, one of several such companies that I invest in and want more exposure to.

Colruyt’s argument for customers remains the pricing levels of its products – and this has been challenging in this market environment, given current inflation and other economic pressures across the board. Colruyt is a discounter, meaning it already sells at low margins, and this means in the current environment the company can suffer quite a bit when forced to lower prices or compress margins even further.

I like Axfood, in part because it has over 4% operating margin in this segment. This is a feat that Colruyt does not manage at this time, nor one it has managed at any point in the last few years. Also, Colruyt continues to have a relatively limited portion of retail sales – around 80%, where others have more.

Like other grocers, its appeal lies primarily in the stability of its earnings and its sales trends. Grocers aren’t going anywhere – neither are the customers. I belong to the category of people who do not believe these sorts of companies to be capable, under current circumstances, of long-term fundamental earnings downturns, even if the valuations can cycle up and down quite a bit.

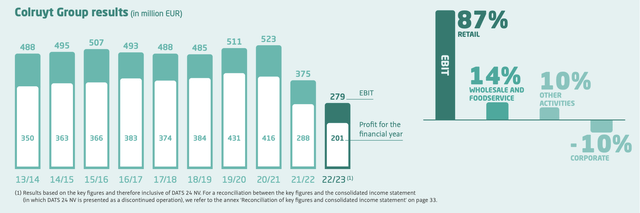

For the 22/23 year and also the 1H24, which we got in September of this year, which is the last set of results in both full-year and half-year we’re looking at, we’re seeing both good and less “good” results – in part explaining the trends we’re seeing here.

For the company, revenue was actually stellar.

Unfortunately, earnings were not as stellar – in fact, we saw significant declines in results, with what can only be called a trough in profit.

EPS for fiscal 2023 was down to €1.57/share, which at the €0.8/share dividend pushes payout to the 51% level, higher than the 42-44% typical level for the group – also obviously a far lower yield than previously.

The reason I am highlighting these trends is that despite the recovery in share price valuation, this does not mean we’ve seen an overall massive return to profitability on the bottom line. The company itself describes the environment as “challenging and uncertain” and the Belgian retail market is a very competitive environment.

It managed to score a 100 bps increase in market share, now at 31.1% in Belgium – but at what price? Revenue was up due to increased volume for 1H24, up 16% to almost €5.5B due to food inflation and market share gain as well as the consolidation of newpharma – but even ex this consolidation, the company was still up 13.5% in terms of revenue.

However, the company saw significant increases in operating expenses based on things like automatic wage indexation, and increased inflation on various OpEx, only impacted slightly by lower overall energy costs. The company managed to offset this through several one-offs, including some capital gains due to a Parkdwind sale, restructuring changes, and a limited impairment.

The company did manage to increase both net profit, operating profit, and net profit from continuing operations, now standing at around 3.5% in terms of revenue, but this is from a trough level.

My picture and view is that the company is struggling, but managing to currently maintain the current cost structures and upsides thanks to its longer-term overall strategy during times of increasing inflation and challenge. The company is also maintaining its lowest-price appeal, and for the time being this seems to be working. I can understand that some investors expected the company to turn this ship around, and I am never one to argue with a near-triple digit RoR from a trough – which is what I missed out on, as I should have invested far more than I did.

That being said, I do not expect the company to significantly increase earnings from the level it has managed to generate here for the full year. The trough level was never going to be somewhere where the company stayed for a very long time.

While Colruyt is no doubt going to continue to grow, I believe it will take time for the company to get back to 2019 levels and share prices. Of course, this could make a case for investing more at this particular time.

Let’s look at the risks and upsides.

Risks & Upside for Colruyt

The risk for Colruyt is continued margin pressures and challenges that the company will be unable to fully handle, which would further pressure the business margin and upsides. However, I don’t view these risks as operational or something that Colruyt can do much about. The company has chosen its business model – it’s similar to Walmart, and it also has a 30%+ market share.

These continued challenges are perhaps not as significant as I originally estimated, which is also one of the reasons I’m changing my rating back to “BUY” despite the company actually being somewhat higher than in my recent article.

I view the company as having a significant upside to a long-term growth trajectory – this is quite literally the upside you could get from investing in Colruyt.

Let me show you how such an upside could look and what it could be if these growth estimates materialize.

Valuation for the Colruyt Group

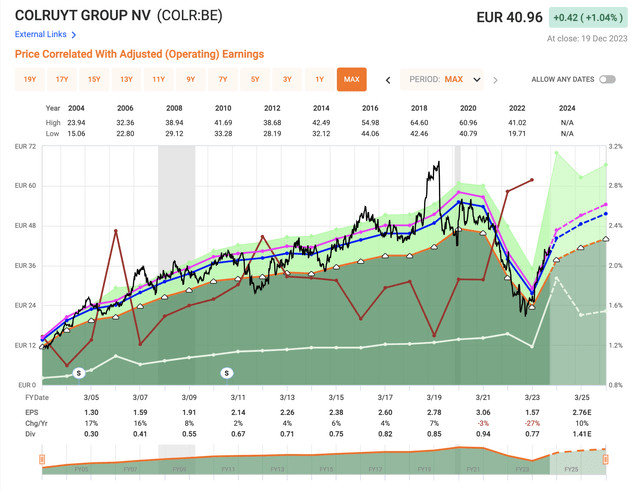

Colruyt has for the most part maintained a fairly consistent valuation premium. A P/E of 17-18x has not been unheard of. The 20-year average for this company comes in at 17.5x, though it is far more volatile than you might expect from its status as a grocer.

So too is the “crash” in earnings the company has been through. For the sort of company Colruyt represents, it was truly noteworthy.

F.A.S.T graphs Colruyt (F.A.S.T Graphs)

Obviously, the right choice in retrospect would have been to load up on Colruyt like there was no tomorrow – but this is always easy to say after the fact.

Colruyt has a number of peers that we can look at for a comparison in terms of valuation – even European ones. These include Tesco PLC (OTCPK:TSCDY), Carrefour SA (OTCPK:CRRFY), Axfood AB (publ) (AXFOF), Jerónimo Martins, SGPS, S.A. (OTCPK:JRONY), and J Sainsbury plc (OTCQX:JSAIY). As you may know, if you follow my work, I also own all of these except Sainsbury and Tesco. All of these trade at multiples of between 9-21X, which is a massive spread for a very similar sector.

S&P Global analysts for the company currently consider this company to be a conservative “HOLD”, with price targets going from €30 to €50, but with an overall average of €39.84. My own target is €10/share above this, which might be considered by many to be too high – but let me clarify it.

If this company does revert to its standard growth rates and manages the reversal in earnings that fiscal 2024 seems to bring, then this would mean 15.5% annualized RoR at around 18x P/E, which is the company’s longer-term valuation level.

You could, of course, lower this target to around €45 or thereabout – but even only a 17x P/E on a 2025-2026E EPS forecast puts this company at a share price of over €50. That’s why I’m not concerned, going for a share price of €49 for the long term.

That being said, most of the immediate upside, most of that really volatile movement up, that’s gone at this point and over the last year. What remains is perhaps market-beating, but not as great as it once was.

This shows us once again how crucial valuation is if you mean to invest conservatively, and why it’s important to recognize when a company is being underestimated by the market. That’s why the core of my strategy is finding contrarian investment potentials with a great upside over the long term.

But in this case, I failed to recognize the point of going “HOLD” – I went too early, and it resulted in me not buying enough. Colruyt should have been a 1% or even 2% portfolio holding. Instead, it is not even half that at this time.

That is a lesson for me.

Here is my current thesis for Colruyt.

Thesis

- The company does come with an ADR, but I don’t view the ADR as all that great. It isn’t liquid, it’s a 0.25X ADR, and I would say that in every way, the native ticker is far more appealing.

- So, for interested investors, I would recommend that you go for the native ticker in Belgium, COLR. The main issues for the company are competition and resulting market share erosion – but in my view, the company can handle these challenges.

- I maintain my previous price target of €49/share, which at less than €41 makes the company a “BUY” as of my December article just before 2024 begins here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansions/reversions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.