Justin Sullivan

January 10 will go down in history books as the day the SEC welcomed cryptocurrencies with (almost) both hands. The SEC approved 11 spot Bitcoin (BTC-USD) ETFs on Wednesday, after years of turning a blind eye to ETF applications that have been piling up on its desks. For crypto adoption, this certainly is good news. For Coinbase Global, Inc. (NASDAQ:COIN), though, the implications of this decision may be mixed, as I highlight later in this analysis.

The Importance of SEC’s ETF Approval

Before I turn to Coinbase, let’s discuss the importance of the SEC’s decision to finally give the green light to spot Bitcoin ETFs. Below are the ETF products that were approved by the watchdog.

- Grayscale Bitcoin Trust (GBTC)

- iShares Bitcoin Trust (IBIT)

- Valkyrie Bitcoin Fund (BRRR)

- Ark 21Shares Bitcoin Trust (ARKB)

- Invesco Galaxy Bitcoin ETF (BTCO)

- VanEck Bitcoin Trust (HODL)

- WisdomTree Bitcoin Trust (BTCW)

- Fidelity Wise Origin Bitcoin Trust (FBTC)

- Bitwise Bitcoin ETF (BITB)

- Franklin Bitcoin ETF (EZBC)

- Hashdex Bitcoin ETF (DEFI)

Now that spot Bitcoin ETFs are finally here, you may ask, is this a big deal? To answer this question, we need to first identify the potential benefits of crypto ETFs and then refer to empirical evidence to determine the performance of different asset classes upon receiving the SEC approval for spot ETFs.

At a broad level, I can think of a few potential benefits of spot Bitcoin ETFs.

First, a spot ETF will bring cryptos to mainstream markets – markets that investors are already familiar with – making it considerably easier for investors to legally buy and sell Bitcoin. All else equal, the SEC’s decision should boost the interest in crypto investing in both the short and long term.

Until recently, potential crypto investors had to rely on crypto exchanges to invest in this asset class, which made it challenging for Bitcoin to truly emerge as an alternative asset class among the majority of the investing public. This can change in the future with Bitcoin ETFs now coming to the rescue.

Second, spot Bitcoin ETFs will make investing in Bitcoin a seamless, non-technical endeavor by removing the need to maintain crypto wallets and store private keys. In my opinion, this will be a huge step in pushing Bitcoin into the mainstream.

Third, the favorable decision by the SEC will incentivize institutional investors to embrace cryptos without attracting criticism from the main street. In the long run, this should bode well for crypto adoption on a global level.

With this understanding, let’s look at some interesting historical data.

The closest and the most meaningful comparison I can think of is the approval of SPDR Gold Shares ETF (GLD), the first-ever spot gold ETF, in 2004. This groundbreaking decision back in the day allowed investors to invest in and hold gold without physically purchasing the yellow metal. The approval of GLD played an important role in the 8-year gold rally from 2004 to 2012.

Exhibit 1: Gold price performance from 1996 to 2012

Business Insider

As illustrated above, gold entered a bull run in 2004 soon after the approval of GLD, but you may argue that treasury yields have also fallen during this time, enabling a rally in gold. This is true, but if you look at the 8-year period preceding the approval of GLD in 2004, treasury yields were still falling without much of an impact on gold prices. Oppenheimer strategists John Stoltzfus and Matthew Naidorf, speaking to Business Insider in 2012, distilled the impact of GLD on gold prices and said:

We surmise that the introduction of the U.S.-traded Gold ETF on November 18, 2004, has been in no small part responsible for the persistently good performance of the precious metal for close to 8 years since. In the 8 years prior to the introduction of the GLD, gold prices increased 16.84% while rates on the 10-year declined 33.55%. During the 8 years since the GLD ETF began trading, gold prices have increased 286.90% while rates on the 10-year declined 61.65%. Uncertainty, financial crisis, currency debasement, accommodative monetary policies, and central bank additions to gold reserves undoubtedly whetted investors’ appetite for the “safe haven” and “storehouse of value” attributes of the metal. We believe, however, that ultimately it was the accessibility and liquidity provided by the ETF structure that facilitated the momentum and scope of gold’s performance. Our chart illustrates the rise of gold eight years before and eight years after the launch of SPDR Gold Shares.

If you are a crypto bull, there is a good reason to be optimistic about what the future holds for this asset class in the coming years when the full impact of the approval of spot Bitcoin ETFs is felt. Based on FactSet data published by MarketWatch, these ETFs are off to a good start.

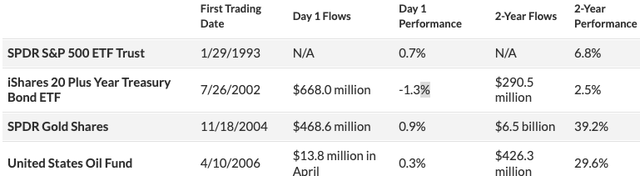

Yesterday (January 11) was the first trading day for approved Bitcoin ETFs, and over $4.6 billion worth of shares traded hands yesterday. In comparison, GLD, when it was first approved, attracted $468.6 million of net inflows on the first trading day (November 18, 2004). According to FactSet data, GLD attracted almost $7 billion in net inflows in its first two years. Bitcoin ETFs are set to easily plow through this figure in the coming weeks – not years.

Exhibit 2: Performance and fund flows of some of the first ETFs in their investment classes

Overall, our research suggests the approval of spot Bitcoin ETFs will prove to be a big win for crypto adoption. The question is, how will this decision impact Coinbase?

A Long-Term Win, But Short-Term Pains Are On The Cards

After analyzing the potential impact of the SEC’s approval of spot Bitcoin ETFs on Coinbase’s financial performance, I have concluded that long-term and short-term implications can be contradicting.

There will be a mixed impact on Coinbase’s trading revenues in the short term. On one hand, the company will benefit from increased crypto trading activity as a general improvement in the sentiment toward cryptos will lead to higher trading volumes, and thereby higher trading fee income. On the other hand, if ETFs attract the attention of crypto investors – as they should – Coinbase may be forced to slash trading fees to compete with low-cost Bitcoin investment products.

Answering a question from an analyst during the Q3 earnings call in November, Coinbase COO Emilie Choi claimed that they have no plans to reduce transaction fees yet. However, I believe Coinbase and many of its peers will have to make some changes to their business strategy to remain relevant at a time when the world’s leading ETF providers are aggressively vying for a piece of the pie.

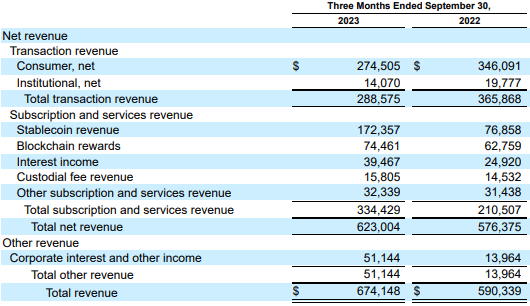

Even on the back of commendable diversification efforts, Coinbase still relies heavily on transaction revenue. In the September quarter, transaction revenue accounted for 43% of total revenue.

Exhibit 3: Revenue by segment (Q3 2023)

10-Q

Diving deeper, we find that Bitcoin accounted for 38% of total trading volume in the third quarter, with Ethereum coming a distant second by contributing to 19% of trading volume. Coinbase’s significant reliance on Bitcoin-related transaction revenues may prove to be an obstacle to continued growth in the coming quarters unless the target market expands meaningfully as a result of spot Bitcoin ETFs. The company, in full disclosure, is betting on the target market to expand dramatically with the arrival of spot Bitcoin ETFs. COO Emilie Choi said:

ETFs should expand the pie and bring new people and institutions into the crypto economy. One stat that I find really powerful is that 52 million Americans own crypto today despite the current regulatory overhang. So imagine what will happen once ETFs are introduced and widely available.

I am encouraged by the enthusiasm of Coinbase executives, but I fear ETF providers taking a larger share of the crypto trading market in the coming years, forcing Coinbase to slash transaction fees. This will hurt the company’s margins and eventually its bottom line.

Offsetting some of this negative impact, Coinbase’s custodian business will thrive in the coming years as the company has positioned itself as the go-to custodian solutions provider to almost all the major asset managers rolling out spot Bitcoin ETFs. As I highlighted earlier, 11 spot Bitcoin ETFs are in the market today, and Coinbase is serving most of them in a custodian capacity. Grayscale, BlackRock (BLK), Ark, and Invesco are all using Coinbase’s custodian services for their newly launched Bitcoin ETFs. The company is set to be the custodian partner of many other large asset managers, including Franklin Templeton and WisdomTree. This sends a strong signal of Coinbase’s wide appeal as a top-notch services provider to the Bitcoin ETF sector.

That said, I believe Coinbase’s future is still closely tied to transaction fees and trading volumes, and I do not expect custodian revenues to help the company offset a potential loss in trading market share. In the long run, though, Coinbase may find more ways to monetize crypto ETFs. In addition, a meaningful expansion of its target market may help the company grow even amid declining transaction fees.

Wall Street Is Divided

Analysts are divided on the impact of Bitcoin ETFs on Coinbase. Mizuho’s Dan Dolev believes the potential upside to Coinbase revenue from Bitcoin ETFs may be more muted than thought. In a note to clients, he wrote:

Deeper cannibalization of high-margin spot bitcoin trading and/or share loss to brokers offering ETFs could offset future benefits.

Wedbush, on the other hand, struck a bullish note and wrote:

COIN’s future results are bound to benefit from the SEC’s bitcoin ETF approvals, given the company’s dominant role in these ETFs, ETFs facilitation/unlocking of increment institutional investing in crypto assets (now under 10%), as well as recent legal/financial woes impacting COIN’s peers (re. Binance).

Morningstar has a cautious stance too, with director of passive strategies for North America, Bryan Armour, saying:

Spot bitcoin ETFs appear poised to take volume away from crypto exchanges.

JPMorgan analysts have struck an even more cautious stance. Analysts wrote:

Novice crypto investors get their initial exposure and possibly final exposure through ETFs rather than Coinbase. Many of these neophyte traders will never go beyond bitcoin, thus never needing the services of Coinbase.

It is still very early days to evaluate the potential impact of the SEC’s approval of Bitcoin ETFs on Coinbase. Going by the findings of this analysis, I believe caution is needed today.

Takeaway

In a watershed moment, the SEC approved 11 spot Bitcoin ETFs on January 10. Crypto adoption will rise, but Coinbase may face some challenges in the short term. I am maintaining my hold rating for COIN stock in the absence of more data to work with. The fourth-quarter earnings report due February is likely to shed more light on the future of Coinbase at a time when crypto ETFs are going mainstream.