fcafotodigital/E+ via Getty Images

Coherus BioSciences, Inc. (NASDAQ:CHRS) is a commercial-stage biopharmaceutical company, that markets a few biosimilars and on October 27, 2023, achieved FDA approval of a new drug, Loqtorzi (toripalimab). Further, CHRS saw the approval of a new form of one of its biosimilars, Udenyca Onbody, in December 2023. This article takes a look at where CHRS stands now with two drugs launching in the context of the current financials.

CHRS Marketed Biosimilars pipeline

Starting off with CHRS’s biosimilars, the company has Yusimry, a biosimilar of AbbVie Inc.’s (ABBV) Humira (adalimumab), which is used in a range of autoimmune conditions, among other indications. CHRS also has Cimerli, a biosimilar of Lucentis (ranibizumab) from Genentech (a division of Roche Holding AG (OTCQX:RHHBY)), which is used in a range of ophthalmology indications. Lastly, CHRS markets Udenyca, a biosimilar of Neulasta (pegfilgrastim) from Amgen Inc. (AMGN). Pegfilgrastim is used to decrease the incidence of infection, manifesting as febrile neutropenia, in those undergoing chemotherapy, or to treat those acutely exposed to myelosuppressive radiation.

Figure: CHRS pipeline of currently marketed drugs. (CHRS website.)

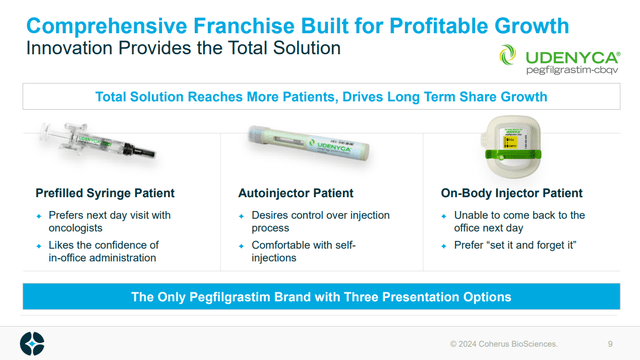

A recent addition to the biosimilar pipeline is Udenyca Onbody, which still contains pegfilgrastim, but rather than in a pre-filled syringe, comes in the form of an onbody injector. AMGN’s Neulasta Onpro has become a very popular way to administer pegfilgrastim, and so CHRS getting approval from Udenyca to get a share of that market is ideal. Indeed, the approval of Udenyca Onbody on December 26, 2023, was met with a 24% rally.

Figure: CHRS’s three forms of pegfilgrastim, note the recently approved (December 2023) On-body injector. (CHRS Presentation, January 2024.)

While the biosimilars do bring in revenue there is always competition with other biosimilars. As such the launch of a new drug, like Loqtorzi, and the development of other new drugs, is a key step towards creating a source of revenues with a slightly greater moat around it.

Loqtorzi and the immuno-oncology pipeline

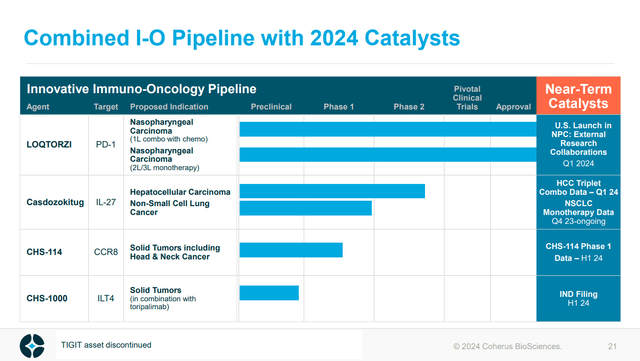

Loqtorzi was approved for the treatment of nasopharyngeal carcinoma (“NPC”) but has potential in other indications. Those other indications provide clinical catalysts which provides something for CHRS investors to follow outside of quarterly updates on the company’s financials.

For example, on January 4, Inovio Pharmaceuticals, Inc. (INO) and CHRS announced a clinical collaboration to run a phase 3 trial of Loqtorzi with one of INO’s DNA-based drugs, INO-3112. That trial would test the combination of Loqtorzi and INO-3112 in human papillomavirus (HPV) 16 or HPV18-positive oropharyngeal squamous cell carcinoma (OPSCC, commonly known as throat cancer). CHRS will provide INO with Loqtorzi to run the study, which has the benefit to INO of keeping clinical costs down, and the benefit to CHRS of potentially expanding the indications in which Loqtorzi is used. Of course, a readout from that trial is likely a couple of years away, but it provides an example of potential label expansion opportunities for CHRS.

For something with near-term catalysts, the rest of CHRS’s immuno-oncology pipeline is of interest. Firstly, casdozokitug (an antibody against IL-27) has the potential to aid the benefit of other immuno-oncology agents and has some monotherapy activity. That being said the monotherapy data in NSCLC wasn’t that impressive, in my opinion, with two patients from 38 achieving a partial response (see slide 18).

Figure: CHRS Immuno-oncology pipeline. (CHRS Presentation, January 2024.)

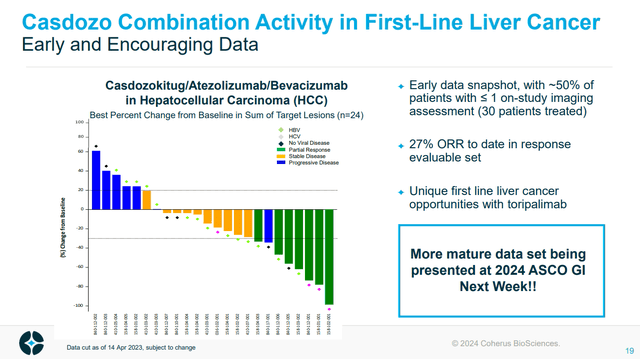

Notably, a particularly near-term catalyst is the presentation of more data from CHRS’s pipeline member casdozokitug in combination with atezolizumab and bevacizumab in hepatocellular carcinoma.

Figure: Waterfall plot of casdozokitug combination data in hepatocellular carcinoma. (CHRS Presentation, January 2024.)

The casdozokitug combination data is expected at the American Society of Clinical Oncology’s Gastrointestinal Cancers Symposium (ASCO-GI) which runs from January 18 to January 20. A title for the presentation of the combination data is already available and CHRS may provide a press release with details following the presentation, which if well received could cause the stock to rally. Notably, the previous update had a data cut-off of April 2023, when about 50 percent of patients had 1 or no imaging assessments performed following treatment. As such the waterfall plot (figure above) shows the best percentage change data in just 24 patients (of 30 that had been treated at that time). As such the update could include a substantial amount of more data, and if some patients take more time to respond, more mature data could actually produce higher response rates.

Beyond casdozokitug, the rest of the development pipeline includes CHS-114, an antibody against CCR8 which could deplete regulatory T-cells within tumors to aid immune response against cancer. CHRS is presenting data sometime in H1’24 from CHS-114 in solid tumors, including head and neck cancer, but there isn’t anything much to use currently to say whether or not that will work. Investors who are particularly interested in that asset should also keep an eye on Bristol Myers Squibb Company’s (BMY) BMS-986340, another anti-CCR8 antibody in clinical development for solid tumors, or Bayer Aktiengesellschaft’s (OTCPK:BAYZF; OTCPK:BAYRY) BAY3375968, or Gilead Sciences, Inc.’s (GILD) GS-1811. Obviously, there is a bit of competition there, and comparisons will be made between data sets from trials of those drugs.

The last member in the development pipeline is CHS-1000, which is just about to move into the clinic, with an Investigational New Drug application set to be filed in Q1’24. As such, at least in the first half of 2024, CHS-1000 won’t be much of a talking point for the average investor.

Financial Overview

CHRS ended Q3’23 with $131.1M in cash, cash equivalents and investments. Net revenue of $74.6M represented a 27% increase from the prior quarter and included $40M of net product sales coming from Cimerli in Q3’23 and $33M from Udenyca in Q3’23. Yusimry only launched on July 3, 2023, but brought in $1.4M in Q3’23. Notably, net revenues of $33M from Udenyca in Q3’23 actually represent a decrease from $45.4M in Q3’22. Comparing the first nine months of net revenues from Udenyca in 2022 and 2023 ($165.7M and $165.7M), the comparison is not so striking. Nonetheless, flat net revenues don’t create a picture of topline growth from one of CHRS’s main moneymakers right now, so recent approval of the Onbody form of Udenyca is key.

R&D expenses for Q3’23 were $25.6M and SG&A expense was $48.2M in the same quarter. CHRS reported a net loss of $39.6M in Q3’23. CHRS had $246.2M worth of long-term liability from its term loans on the balance sheet on September 30, 2023, and a further $226.6M worth of long-term liability relating to the convertible notes. The notes were issued in April 2020 and have a conversion price of $19.26 per share. Due to the slide in CHRS’s share price then, and the fact the notes don’t mature until April 15, 2026, there isn’t too much concern about the convertible notes. Further, the notes only pay 1.5% interest semi-annually in arrears. Taking all this together, CHRS’s debt situation is manageable right now, and it has time to grow its revenues to raise its cash balance for when it comes time to repay the principal on its term loans.

CHRS reported net cash used in operating activities of $161.9M in the first 9 months of 2023, and at that rate, the company’s cash would only provide it with 7 months of cash runway from the end of Q3’23. Of course, CHRS has the ability to reduce its expenses and the potential for revenue growth is certainly in play.

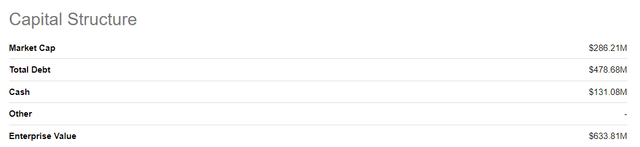

There were 111,364,152 shares of CHRS common stock outstanding as of October 31, 2024, giving CHRS a market cap of $286.2M. As of September 30, there were also 24.6M stock options outstanding, 2.1M restricted stock units and 11.9M shares issuable upon conversion of the 2026 convertible notes.

Conclusions

In a recent article on CHRS, Seeking Alpha’s Bhavneesh Sharma noted the compelling valuation of CHRS on an EV/sales basis. CHRS stock is up about 40% since that article was written. I note a current EV of $633.8M and CHRS recently provided some preliminary numbers for full year 2023 financials. Those numbers included 2023 net revenues in the range of $255M-$260M, so this yields an EV/sales of about 2.46. This is a pretty good number compared to the sector average multiple of six noted by Sharma in his article.

Figure: Table of capital structure for CHRS. (Seeking Alpha’s valuation tab for CHRS.)

I do still have concerns about the speed at which Loqtorzi will launch, however, and there could be short-term increases in SG&A due to the launch of that drug, and the new Onbody form of Udenyca. I don’t expect those increases in expenses with the launch of those drugs to be huge, based on comments from the company, but in the short term, any increase isn’t going to paint a picture of financial restraint.

As we launch new products, we are carefully controlling incremental spending to ensure the investment is appropriate for the opportunity and that we realize the efficiencies inherent in our portfolio. For example, our YUSIMRY strategy is to build a business with customers attracted to our lowest price adalimumab offering, and we have very low operating expenses associated with YUSIMRY. Toripalimab will be efficiently launched using the same commercial infrastructure market in UDENYCA.

McDavid Stilwell, Chief Financial Officer, CHRS, Q3’23 earnings call.

The company operating with just over $130M cash isn’t the best look with $246.2M in debt from its term loans on the balance sheet. I don’t rate CHRS a sell by any means however, even though the stock is down about 75% in the past 12 months, it looks like it might have formed a bottom and a couple of quarters of revenue growth, especially if the company can keep expenses in check, should be enough to see the stock rally.

Nonetheless, right now I will wait another quarter to see how the launch of Loqtorzi goes and how the other products help increase the top line. I do acknowledge the potential for Udenyca Onbody to quickly increase Udenyca sales, but I think the first quarter of Loqtorzi could be pretty modest given the approved indication, that’s the most obvious risk for me right now. All factors considered, I rate CHRS a hold.

Outside of the risks of underwhelming numbers from Loqtorzi, although I don’t rate the stock a buy right now, there is the risk that upcoming data from casdozokitug underwhelms. Further out, as we reach Q1’24 earnings, even if initial sales of Loqtorzi aren’t modest, expenses associated with the launch could cause doubt over CHRS’s financials.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.