JHVEPhoto

Elevator Pitch

My investment rating for Cognizant Technology Solutions Corporation (NASDAQ:CTSH) is a Hold.

CTSH’s good stock price performance in 2023 was driven by earnings beats, and better client and employee metrics. But I think that Cognizant’s stock price performance for 2024 will be flattish considering its valuations and revenue growth prospects. As such, I have a Neutral view and Hold rating for Cognizant.

Company Overview

CTSH describes itself as “a leading provider of information technology, consulting, and business process services” in the company’s press releases.

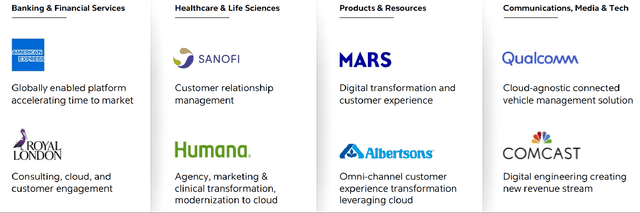

A Snapshot Of Some Of Cognizant’s Customers And Services Offered By CTSH

Cognizant’s Investor Briefing Slides

In the third quarter of 2023, the Financial Services, Health Sciences, Products & Resources, and Communications, Media, & Technology segments accounted for 30%, 29%, 24% and 17% of Cognizant’s revenue, respectively. With respect to geographic sales mix, CTSH generated 73%, 20%, and 7% of its top line from North America, Europe and Rest of World, respectively for the most recent quarter. These numbers were sourced from Cognizant’s Q3 2023 earnings presentation slides.

2023 Was A Great Year For CTSH

Both Cognizant’s share price performance and financial results were excellent last year.

CTSH’s stock price rose by +31.2% in 2023, and this was equivalent to a +650 basis points outperformance over the S&P 500. Cognizant’s consensus next twelve months’ normalized P/E multiple also re-rated from 12.7 times as of January 3, 2023 (first trading day of the year) to 17.0 times at the end of the prior year as per S&P Capital IQ data. In terms of its financial performance, Cognizant achieved significant earnings beats of +6.0%, +11.4%, and +6.4%, for Q1 2023, Q2 2023, and Q3 2023, respectively.

Last year, Cognizant named Ravi Kumar S, who had two decades of working experience at Infosys Limited (INFY), as the company’s new CEO in January. CTSH subsequently announced in February and March 2023 that Eric Branderiz, Nella Domenici, and Bram Schot had joined the company’s board. These three new directors had relevant knowledge in the areas of finance, strategy and operations.

The management and board changes had a positive impact on CTSH in many ways.

There was a substantial improvement in attrition, a key operating metric for Cognizant’s staff morale. Specifically, CTSH’s voluntary attrition rate for its technology services business decreased meaningfully from 25.6% for the final quarter of 2022 to 23.1%, 19.9%, and 16.2% in Q1 2023, Q2 2023, and Q3 2023, respectively as disclosed in its third quarter earnings presentation.

Cognizant revealed at the company’s Q3 2023 results briefing in November last year that its latest yearly “client Net Promoter Score survey which showed significant improvement year-over-year and hit a historic high” for the company. It is clear that CTSH’s client satisfaction has become better in recent times.

The company’s bookings grew by 9% from $23.1 million in the third quarter of 2022 to $26.9 million for Q3 2022. At the most recent quarterly earnings call, CTSH highlighted that the increase in bookings in the latest quarter was the result of “larger and longer-duration deals.”

In a nutshell, the positives relating to employee morale, customer satisfaction, and bookings momentum have led to CTSH recording above-expectations results and a +31.2% stock price appreciation in the prior year.

2024 Isn’t Likely To Be As Good As Last Year

I am of the opinion that it will be tough for Cognizant’s stock price performance this year to match what the company’s shares did in 2023. In fact, I think that CTSH’s shares will most likely be range-bound for 2024 considering these two key factors.

One key factor is that positives highlighted in the preceding section have been factored into Cognizant’s valuations to a large extent.

The market currently values CTSH at a consensus next twelve months’ normalized P/E ratio of 17.0 times. As a comparison, the Wall Street analysts’ consensus FY 2024-2027 normalized EPS CAGR is +16.8% (source: S&P Capital IQ). This implies that Cognizant is now trading at a Price-to-Earnings Growth or PEG of 1.01 times, and that is indicative of fair valuation.

The other key factor is that the outlook for IT spending is mixed based on third-party research.

In its latest forecast released on January 17, 2024, Gartner (IT) estimates that the growth in global spend on information technology will accelerate from +3.3% last year to +6.8% this year. But Gartner also cautioned in its most recent release that “change fatigue” will remain a headwind in 2024 “with CIOs hesitating to sign new contracts, commit to long-term initiatives.”

The results of an earlier survey published in late-October 2023 by Statista showed that 66% of European and North American IT buyers surveyed proposed to “increase IT budgets” this year. On the flip side, 63% and 84% of survey respondents expressed their concerns about a potential recession and a talent crunch, respectively in the same Statista survey.

It is worth noting that CTSH revised the upper limit of its full-year FY 2023 top line expansion guidance from +1.0% in August 2023 to flat in November last year. The company noted at its most recent quarterly earnings briefing that “economic uncertainty has increased and discretionary spending has softened throughout the last 3 quarters”, and stressed that “that trend” is “not stopping yet.” It will be reasonable to infer that Cognizant’s revenue growth momentum could potentially be weaker going forward.

Final Thoughts

A Hold rating for CTSH is justified. Cognizant’s shares are likely to trade sideways this year based on my evaluation of its top line outlook and valuation metrics.