Orhan Turan

At a Glance

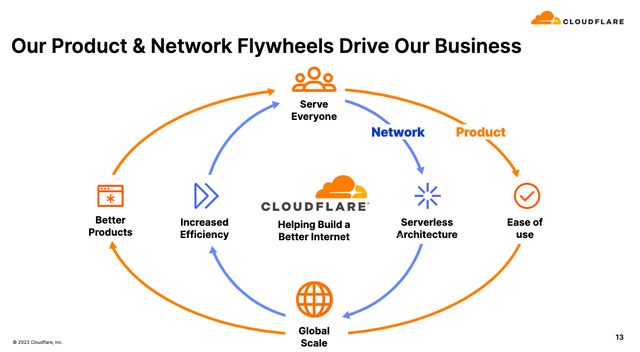

Cloudflare’s (NYSE:NET) venture into AI is a pivotal strategic decision, especially with their focus on enabling developers to build comprehensive applications on their platform. This advance is a bold bet in the rapidly expanding AI market, projected to exceed $300 billion by 2026. Cloudflare’s strategy is not just an entry into AI; it represents a commitment to reshape the industry by tackling key issues admire cost effectiveness, privacy protection, and regulatory compliance. The company’s mantra, “Help build a better internet,” is straightforward, feasible, and potentially revolutionary, with their flywheel becoming accustomed to spinning.

Financially, Cloudflare shows promising signs with solid revenue growth, impressive dollar-based net retention rate (116%), and improving margins, indicating a strong demand for their services. However, increased operational spending and continuous net losses point to a delicate financial balance. Analyzing Cloudflare’s finances, strategic initiatives, and position in the market, it’s clear that innovation and risk are closely linked in the AI and cloud computing space.

Cloudflare’s AI Leap: Rewiring the Future of Full-Stack Applications

Cloudflare’s strategic AI approach is twofold: first, making it easier for developers to build comprehensive AI applications directly on their platform, addressing the often daunting aspects of AI development admire speed, security, and compliance with regulations. This not only reduces the complexity involved in AI development but also addresses key issues such as cost, privacy, and regulatory adherence.

A key component of Cloudflare’s AI strategy is the introduction of Vectorize, their new vector database. This tool integrates AI and machine learning capabilities into applications, benefiting from Cloudflare’s global network to better performance and reduce latency. This integration is a strategic step that could redefine how AI is incorporated into applications across various industries.

Moreover, Cloudflare’s AI Gateway is a significant enhancement in their AI capabilities. It targets a crucial market need: making AI applications more reliable, insightful, and scalable. Cloudflare’s solution offers detailed analytics on AI traffic, including insights on ask volumes, user demographics, and the operational costs of applications. Importantly, it includes tools for cost optimization, admire caching and rate limiting, which are essential for developers to supervise expenses and scale their AI applications efficiently. This is particularly important at a time when both developers and executives are challenged by the complexities and costs associated with AI infrastructure. Developers, often constrained by technical intricacies and limited resources, find it increasingly difficult to efficiently incorporate AI into their applications. This challenge is compounded by the need for rapid development cycles and the pressure to stay ahead in a competitive market. On the executive side, the concerns are more strategic and financial. They face the daunting task of justifying investments in AI amidst a landscape of ever-evolving technologies, where the return on investment can be uncertain. Executives must steer not only the direct costs of AI implementation, such as data acquisition and computing resources, but also indirect costs admire training staff and restructuring business processes to accommodate AI-driven changes. Cloudflare’s approach, which simplifies and streamlines AI application development and integration, directly addresses these pain points. By offering a more accessible and cost-effective AI infrastructure, Cloudflare provides a solution that is attractive both to the developers who need to carry out it and the executives who need to finance and supervise it.

In the competitive AI and CDN landscape, Cloudflare faces formidable competition from major players admire Amazon (AMZN), Akamai, Fastly, Google (GOOGL), Microsoft (MSFT), and Imperva. Amazon CloudFront rivals Cloudflare with its extensive network of data centers, while Akamai boasts the largest CDN globally. Fastly differentiates itself with fully programmable products, offering greater flexibility. Google Public DNS, available at no cost, challenges Cloudflare in user-friendliness and reliability. Microsoft Azure’s comprehensive cloud tools and modern CDN architecture pose a significant threat, and Imperva’s integrated cybersecurity solutions vie directly with Cloudflare’s offerings. These competitors each bring unique strengths to the table, challenging Cloudflare to continually invent and improve its AI and CDN services to maintain its market position.

In summary, Cloudflare’s entry into the AI sector appears strategically sound, building on its existing strengths and addressing critical market needs. The company’s success will hinge on its ability to invent, execute, and distinguish itself from other AI service providers in a highly competitive landscape.

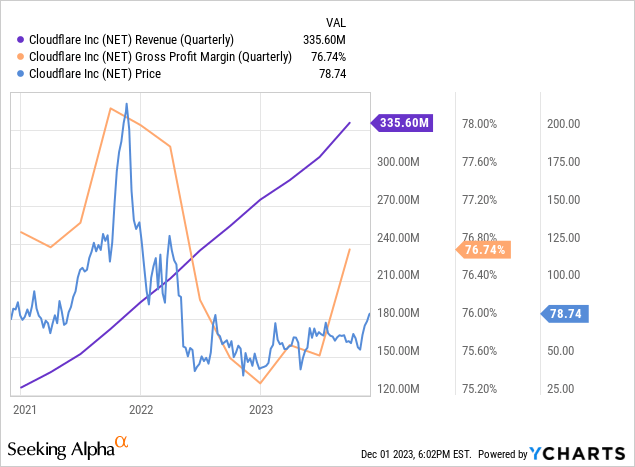

Q3 Earnings

Cloudflare demonstrated robust revenue growth in its recent quarterly earnings, with revenue increasing to $335.6M from $253.9M in the same period last year. This 32.2% Y/Y growth indicates a strong demand for Cloudflare’s services. The gross profit margin ratio improved to 76.7% from 75.6%, reflecting efficient cost management in relation to revenue generation. However, the company’s operating expenses rose significantly, with sales and marketing, research and development, and general and administrative expenses collectively increasing from $237.8M to $296.7M, contributing to a net loss of $23.5M, albeit a reduction from last year’s $42.5M loss in the same quarter.

Cloudflare also provided forward guidance for Q4, anticipating sales in the range of $352 million to $353 million, slightly below the consensus calculate of $356.31 million.

In the broader cloud computing industry, trends in 2023 have likely influenced Cloudflare’s operational strategies. The industry is pivoting towards managing complexity and enhancing data control. The perception of cloud computing has evolved from a technology platform to a critical business enabler. Notably, cloud service prices began rising in early 2023, a shift attributed to inflationary pressures and a change in market dynamics. Trends such as hybrid work maintain, AI-driven growth, and the expansion of XaaS models are prevalent. However, the sector also faced challenges admire industry-wide layoffs.

Financial Health

Turning to Cloudflare’s balance sheet, their assets under ‘cash and cash equivalents’ and ‘available-for-sale securities’ total approximately $1.57B, with cash and equivalents at $94.1M and securities at $1.48B. The current ratio, calculated as current assets divided by current liabilities, is approximately 3.89, indicating a healthy short-term financial position. When comparing assets to liabilities, Cloudflare has significant convertible senior notes at $1.28B. Other liabilities include accounts payable ($40.6M), accrued expenses and other liabilities ($55.7M), accrued compensation ($52.2M), operating lease liabilities ($35.1M), and deferred revenue ($294.1M). These liabilities are substantial but seem manageable given their asset base.

In summary, Cloudflare’s short-term financial health is robust, supported by strong liquidity. Their long-term financial health appears adequate, although the significant amount in convertible senior notes warrants monitoring.

Peer Comparison

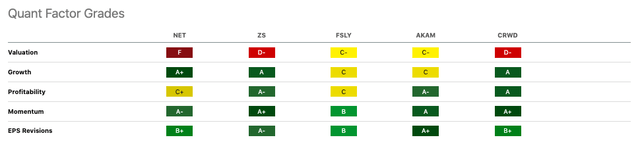

In the competitive Information Technology [IT] sector, Cloudflare (NET) is positioned alongside Zscaler (ZS), Fastly (FSLY), Akamai (AKAM), and CrowdStrike (CRWD). Analyst ratings for NET are consistently “Hold” across Quant, Seeking Alpha Analysts, and Wall Street Analysts. This is similar to ZS and CRWD, but contrasts with AKAM’s “Strong Buy” and FSLY’s varied ratings.

Focusing on key metrics, NET’s growth is exceptional with an A+ grade, surpassing FSLY’s C and AKAM’s C. However, its valuation ($25.9B market capitalization) is a concern, reflected in an F grade. For profitability, NET scores a C+, which is modest compared to ZS’s A- and CRWD’s A. Momentum-wise, NET is robust with an A- grade, slightly behind ZS’s A+.

In valuation metrics, NET’s P/E Non-GAAP (FY1) is 169.29, considerably higher than AKAM’s 18.95, indicating a premium valuation. Its Price/Sales [TTM] at 21.17 also suggests a richer valuation compared to FSLY’s 4.32 and AKAM’s 4.75.

Regarding profitability, NET’s Gross Profit Margin is competitive within its peer group. However, its EBIT Margin (-15.67%) and Net Income Margin (-16.71%) highlight profitability challenges, especially when compared to AKAM’s EBIT Margin of 18.58% and Net Income Margin of 13.76%.

Cloudflare shows strong growth potential and market presence, but its challenges in profitability and high valuation metrics propose a need for cautious evaluation by investors.

My Analysis & Recommendation

Cloudflare’s strategic foray into the AI arena, capitalizing on a burgeoning market, showcases the company’s adaptive nature and its commitment to addressing critical areas admire privacy and compliance. With its recent advancements in AI technology, Cloudflare positions itself as a pivotal player, leveraging its global network and innovative AI Gateway to improve the AI application encounter. These developments ponder Cloudflare’s potential to face the escalating demand in the AI sector, which is integral to its future growth trajectory.

However, Cloudflare’s financial landscape presents a multifaceted scenario. On one hand, the company demonstrates robust revenue expansion and a solid financial foundation. Yet, it grapples with substantial operational expenditures and persistent net losses, which warrant attention. Additionally, a Seeking Alpha article from August highlights concerns about the impact of debt repayments on their journey towards achieving positive net income. These elements, when coupled with the fierce competition within the AI and CDN sectors, highlight the formidable hurdles Cloudflare must surmount to uphold its market standing in the face of formidable competitors such as Amazon CloudFront, Akamai, and others, each wielding unique competitive strengths.

Given Cloudflare’s solid operations but sky-high valuation, a “Hold” investment recommendation is prudent. Investors should exercise caution, balancing the company’s strong growth prospects with the inherent risks associated with its high valuation and competitive landscape. To mitigate risk, investors can diversify their portfolios within the IT sector and closely monitor Cloudflare’s operational efficiency improvements and market share gains in the upcoming quarters.