Lemon_tm

By Elisa Mazen, Michael Testorf, CFA, & Pawel Wroblewski, CFA

Conditions Improving for Growth Comeback

Market Overview

International equities rebounded in the fourth quarter, sparked by moderating inflation and plunging bond yields in the U.S. and Europe. The benchmark MSCI EAFE Index advanced 10.42% for the quarter, while the MSCI Emerging Markets Index added 7.87%.

In an indicator of improved market breadth, the MSCI EAFE Small Cap Index rose 11.14%. This followed the first three quarters of the year when small and midcap stocks in Europe and other regions underperformed, reaching new lows in October. While narrow leadership in international markets has not merited the same attention as the dominance of the Magnificent Seven in the U.S., outperformance in the benchmark has generally been limited to large cap companies, many with a technology bias, as well as regions like Japan benefiting from accommodative monetary policy.

Currency returns were positive given weaker U.S. Treasury yields moving the U.S. dollar lower against most major currencies. The best developed currency returns for the quarter were for the Swiss franc at 8.8%, the Japanese yen and Australian dollar at 5.9% and the euro and British pound at 4.4%.

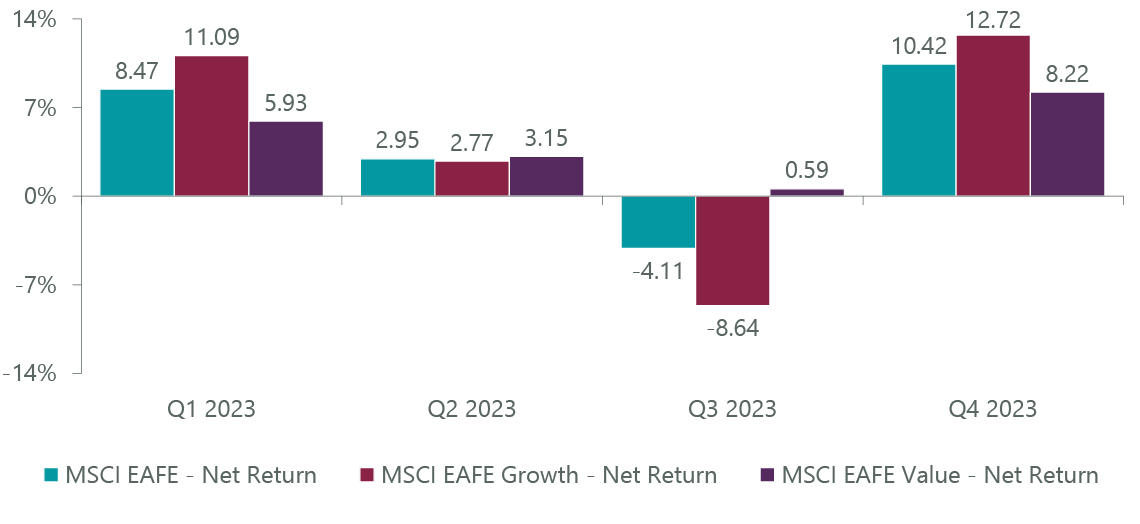

A more palatable yield environment supported growth stocks, after the preceding two quarters where rate rises were a concern, enabling the MSCI EAFE Growth Index to climb 12.72% for the quarter and outperform the MSCI EAFE Value Index by 450 basis points (bps). Growth’s resurgence closed the full-year gap between styles but the value benchmark still finished 137 bps ahead of growth.

Exhibit 1: MSCI Growth vs. Value Performance

| As of Dec. 31, 2023. Source: FactSet. |

The ClearBridge International Growth ADR Strategy outperformed the benchmark for the quarter, supported by contributions in the traditional growth sectors of information technology (‘IT’) and consumer discretionary. Further, we believe conditions conducive to growth outperformance will be more prevalent in the year ahead, from factors such as a more benign rate environment and more challenging overall macro backdrop, with economies already slowing through 2023. Room for continued fiscal stimulus measures, which has benefited a broader group of stocks, is also more constrained than previously. We continue to maintain a diversified portfolio across sectors and regions, focusing on our valuation approach to growth and risk management, a setup that should keep us well positioned to participate in a potential growth resurgence as financial conditions loosen.

Despite macro risks, our holdings in Europe and the U.K. found their footing in the fourth quarter, with nine of the top 10 individual contributors coming from these regions. Irish building materials supplier CRH, which has demonstrated strong value creation through M&A and optimization of its portfolio assets over the last several quarters, rose strongly on positive sentiment after its investor day highlighted the company’s accelerating growth in the U.S.

Another welcome change has been the recognition of generative artificial intelligence (‘AI’) opportunities for companies outside the U.S. While our IT holdings trailed their mega cap U.S. counterparts for most of the year, semiconductor equipment makers ASML and Tokyo Electron (OTCPK:TOELF), which we consider enablers of AI, as well as enterprise software maker SAP and IT consultant Accenture (ACN), which we see as facilitators of AI adoption in new product lines and/or enhanced business models, rose strongly in the quarter. Additional outperformers included RELX, a publisher of law and related business trade information, and Thomson Reuters (TRI), a business services conglomerate with leading positions across media and other industry verticals. Both companies own large, proprietary data sets and stand to become key beneficiaries of the processing power of the large language models that drive generative AI. These companies are rolling out new, AI-enhanced products at higher prices, which should positively impact earnings in the near term.

These gains, and the tailwinds of a period of growth outperformance, were partially offset by weakness among the Strategy’s industrial and consumer staples holdings. U.K.-based pest control provider Rentokil (RTO) was the largest detractor for the quarter, dragged down by weaker than expected third-quarter results and forecasts for similarly sluggish earnings in the fourth quarter due to a slower than expected integration from its 2022 acquisition of U.S. pest control leader Terminix. Japanese cosmetics maker Shiseido (OTCPK:SSDOY), meanwhile, continued to be pressured by weakness from Chinese consumers due to highly publicized information over the Fukushima water discharge controversy impacting Japanese cosmetic companies.

Portfolio Positioning

We were active in the quarter, initiating three positions while closing out five others. The largest addition was the opportunistic repurchase of Hoya (OTCPK:HOCPY), a high-quality manufacturer of technology products and health care instruments based in Japan. Hoya maintains high rates of innovation and a strong focus on attractive market niches such as optical products critical for the manufacturing of semiconductors. We believe the market underestimates the durability of earnings growth of this franchise.

We also purchased IT and cloud services provider Nomura Research (OTCPK:NRILY), a secular growth company benefiting from increased spending on digital transformation among Japanese companies while its cloud-based software solution for financial services customers has the potential for higher client uptake and higher margins over time.

Activity also included meaningful additions to several newer positions. We believe SMC, a secular grower in the industrials sector, is well-positioned for continued share gains in the growing markets of manufacturing automation for semiconductors, rechargeable batteries and others. Emerging growth company Shopify (SHOP) continued to show improved operational performance, boosted by cost-cutting measures and its exit from capital-intensive logistical operations. Additionally, margins are supported by increases in prices for software subscriptions and continued growth in e-commerce and online payment volumes.

Our largest sales were Tencent (OTCPK:TCEHY), Recruit Holdings (OTCPK:RCRRF) and Cellnex (OTCPK:CLNXF). While the business of Chinese social media, online advertising and fintech provider Tencent has recovered post-COVID, the continued regulatory uncertainty in China and weak consumer confidence have undermined the expected speed of further market improvement. We exited Japanese employment services provider Recruit Holdings in anticipation of a weakening U.S. labor market weighing on its Indeed job search business. Spanish telecommunication infrastructure provider Cellnex, meanwhile, was sold due to portfolio construction considerations and an investment thesis change. The company’s leverage has limited its ability to grow in a high interest rate environment while new management has transformed the business strategy to value preservation, significantly reducing its growth appeal.

As part of our fundamental research on new and existing holdings, we engage our portfolio companies regularly on ESG issues germane to their business model and profitability. During the quarter, ClearBridge led an annual engagement on behalf of the Access to Medicines Index (“ATMI”) with portfolio holding Novo Nordisk (NVO). Novo provides insulin to 46,000 children in low- and middle-income countries (LMIC), making progress toward the company’s goal of 100,000 by 2030. The company needs both deeper penetration in existing countries and to add new ones to achieve its goal. In recognition of current conflicts and humanitarian challenges, Novo has also made outright donations of insulins to Ukraine and to NGOs helping the people of Gaza.

Novo would like to run its LMIC access programs as a viable and sustainable business, not solely a donation program, providing an incentive to the company and to the employees involved in its LMIC efforts. Notably, despite supply shortages of its blockbuster GLP-1 therapeutics due to production backlogs, the company explicitly prioritizes maintaining current insulin production “because of its moral obligation to do so.”

Outlook

One of the greatest headwinds to growth stock performance over the last two years has been tightening liquidity leading to higher bond yields, a scenario that could abate as the new year unfolds. It has been the predominant driver of investment style moves and returns as well as currency performance. Following the lead of the U.S. in discussing a moderation of rates, the ECB and BoE are expected to commence rate cuts as early as the first half of 2024 as inflation continues to normalize toward their targets and labor costs moderate. Stocks will be volatile around whether market expectations for cuts are met, but missed expectations also provide an opportunity to purchase growth at a discount. With our broader portfolio allocation around multiple sectors, we were surprised that areas including consumer staples and health care, which are defensive in challenging economic environments, did not work in 2023. In watching for a broadening of international market leadership, we are hopeful that an extended decline in rates can start to benefit these areas, which have lagged and seen de-ratings of their multiples.

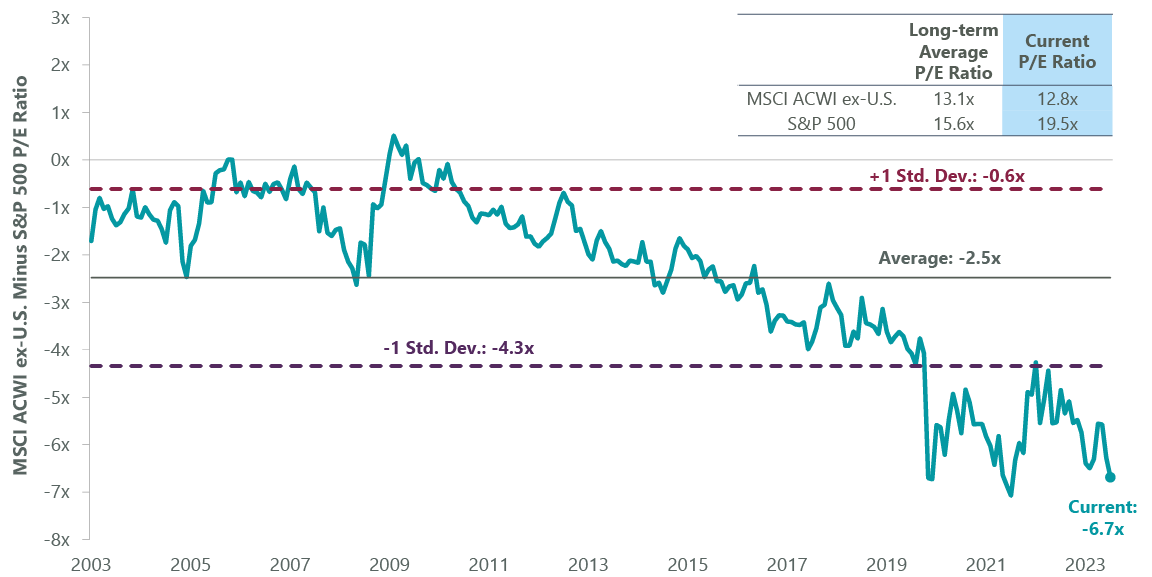

Exhibit 2: International Valuations Look Attractive

|

As of Dec. 31, 2023. Source: FactSet, MSCI, S&P. |

Equity performance improvement, however, will also be dependent on earnings, which are expected to remain soft outside the U.S. through the first half of the year due to tough comparisons. Navigating potentially weaker macroeconomics will require vigilance of consumer behavior trends and policy moves and a focus on highly innovative companies that generate cash and can finance their own growth through market share gains and acquisitions.

We are paying particular attention to Japan, which remains an outlier among global equity markets in several ways. Among developed markets, it is the only one that has not raised policy rates, trying to engineer inflation after decades of deflation with rates being kept very low by the Bank of Japan. Inflation has remained relatively muted but above their 2% policy target. Whether it’s sustainable and causes the BOJ to move from their easier policy is the debate the market is focused on. Policymakers appear to be garnering some success in generating inflation, primarily in wages, which should also support an increase in interest rates if maintained. Given cash-rich balance sheets on the corporate side and 50% of Japanese consumer assets in cash, even a small rate rise should be beneficial.

We have discussed in past commentaries the multiple programs underway to improve profitability and encourage more equity ownership in Japan. Improvements are taking place at the company level, which we are seeing at Japanese machinery company SMC (OTCPK:SMCAY), around improving capital allocation and returns, board independence, linking compensation to performance and better disclosure. Without tangible changes at the company level, it would be hard to justify the moves in the Japanese market.

Portfolio Highlights

During the fourth quarter, the ClearBridge International Growth ADR Strategy outperformed its MSCI EAFE Index benchmark. On an absolute basis, the Strategy experienced gains across nine of the 10 sectors in which it was invested (out of 11 total) with the IT, consumer discretionary and industrials sectors the primary contributors while the energy sector was the lone detractor.

On a relative basis, overall stock selection and sector allocation contributed to performance. In particular, stock selection in the consumer discretionary, health care, IT, financials and utilities sectors, an overweight allocation to the IT sector and an underweight to the energy sector drove results. Conversely, stock selection in the industrials and consumer staples sectors, an overweight to health care and an underweight to materials detracted the most from performance.

On a regional basis, stock selection in North America, Japan and Europe Ex U.K. and an underweight allocation to Japan supported performance while an overweight to North America and stock selection in Asia Ex Japan and the U.K. proved detrimental.

On an individual stock basis, the largest contributors to absolute returns in the quarter included ASML, Tokyo Electron and SAP in the IT sector, London Stock Exchange Group (OTCPK:LDNXF) in the financials sector and Novo Nordisk in the health care sector. The greatest detractors from absolute returns included positions in Rentokil in the industrials sector, Argenx (ARGX) in the health care sector, Shiseido in the consumer staples sector, Hong Kong Exchanges & Clearing (OTCPK:HKXCF) in the financials sector and Suncor Energy (SU), our only holding in the energy sector.

In addition to the transaction mentioned above, we initiated a position in 3i Group (OTCPK:TGOPF) in the financials sector and exited positions in SolarEdge Technologies (SEDG) in the IT sector and Adyen (OTCPK:ADYEY) in the financials sector.

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Michael Testorf, CFA, Managing Director, Portfolio Manager

Pawel Wroblewski, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.