Clara Bastian/iStock via Getty Images

Times have been rather tough for shareholders of Clean Energy Fuels Corp. (NASDAQ:CLNE). On December 12th alone, the stock, on no news, plunged, closing down 12.7%. The picture was even worse earlier in the day, with shares down more than 14% at one point. In fact, during trading, units hit a fresh 52-week low point. As of this writing, the company is now down 49% from its 52-week high. The fact of the matter is that recent financial performance has been rather weak.

Low prices for its products, combined with concerns over weaker demand moving forward, has led to this pain. In the grand scheme of things, shares of the company are not ridiculously priced at current levels. But they aren’t yet attractive, either on an absolute basis or relative to similar players. In the near term, especially if energy markets weaken, I wouldn’t be surprised to see the stock drop even more. But for those who are in this for the long haul and who don’t mind some volatility, I would say that the company makes for a decent “hold” candidate right now.

A bad short-term play, a decent long-term one

For some companies, it’s impossible to know what they do based on their name. But for others, it’s quite easy. As its name suggests, Clean Energy Fuels is focused on the clean energy market. But more specifically, the company looks at a few key products that are very niche in the space. For starters, it is engaged in the procurement and distribution of RNG or renewable natural gas. For those who don’t know, RNG is produced from, often organic, sources. The most common source that you might hear about regarding this product is the local landfill.

As organic waste decomposes, it creates what is called biogas that companies can capture and then clean of non-methane elements, effectively turning it into a form of natural gas that can be considered renewable. It can also, however, be recovered from the waist from dairy or livestock farms thanks to the large quantity of manure that those places produce. Regardless of the source, the company primarily deals with CNG and LNG. The first of these, CNG, stands for compressed natural gas. In short, this is the gaseous form of RNG that has been compressed. Meanwhile, LNG stands for liquefied natural gas. It is RNG that is then cooled at a liquefaction facility until it condenses into liquid form.

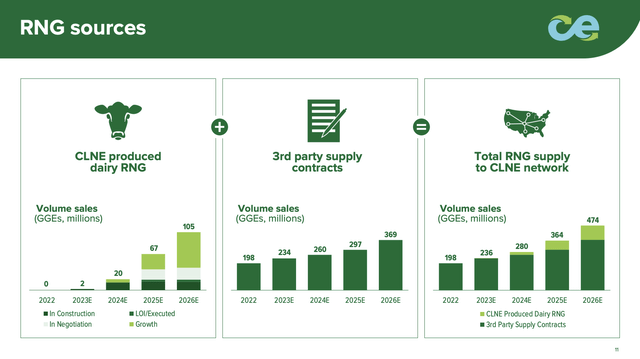

Historically speaking, Clean Energy Fuels has gotten its RNG from third parties. In fact, it was estimated that for this year alone, 234 million of the 236 million GGEs (gasoline gallon equivalents) that the company has had passed through its operations have come from third party contracts. That leaves only 2 million GGEs coming from its own dairy RNG operations. And those are ones that are currently under construction. However, management intends for that to change. By 2026, the firm hopes to grow its RNG supply to 474 million GGEs per annum. Of this amount, the expectation is for 105 million GGEs to come from its dairy operations. Fortunately, Clean Energy Fuels has some help in this.

Its largest shareholder is currently TotalEnergies SE (TTE). Back in 2021, Clean Energy Fuels and TotalEnergies entered into a 50/50 joint venture to progress RNG production facilities in the U.S. This particular relationship could bring with it up to $400 million worth of equity investments, with both parties initially providing $50 million each. Since then, some additional funds have been contributed. Another partnership involves BP p.l.c. (BP), which not only entered into a joint marketing agreement for RNG supply with Clean Energy Fuels, but also has agreed to invest up to $300 million through a 50/50 joint venture that the two companies set up.

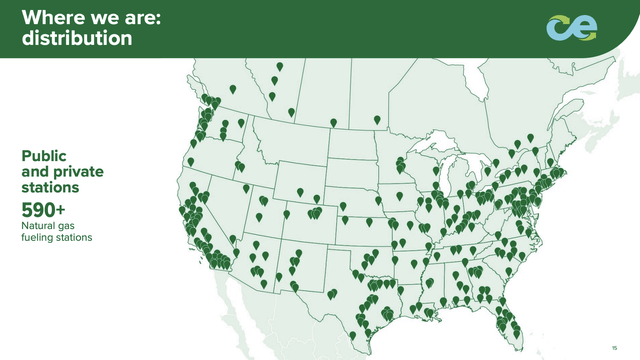

Even from just relying on third parties for the sourcing of RNG in recent years, the management team at Clean Energy Fuels has been successful in growing to the point where it now provides fuel for over 590 natural gas and fueling stations across the U.S. and parts of Canada. It is important to note, however, that much of its business is focused on one particular state. You can probably guess that that would be California. Of the 234 million GGEs that the company is going to be distributing this year across 34 different states, 124 million, or 53%, will go to customers in California. By comparison, Texas is a much smaller state from a demand perspective, accounting for only 19 million GGEs this year, with New York coming in at 11 million GGEs.

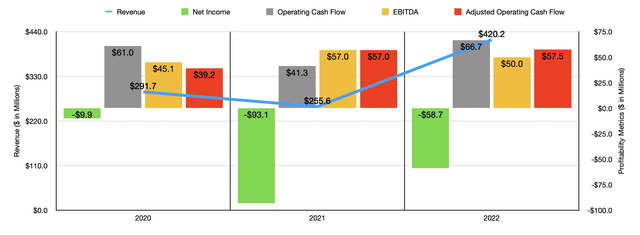

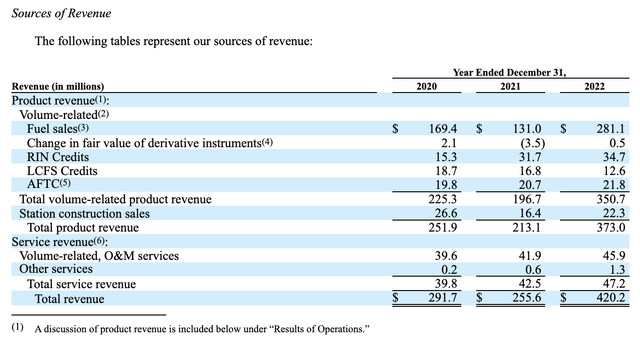

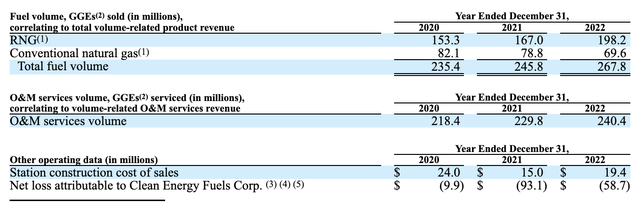

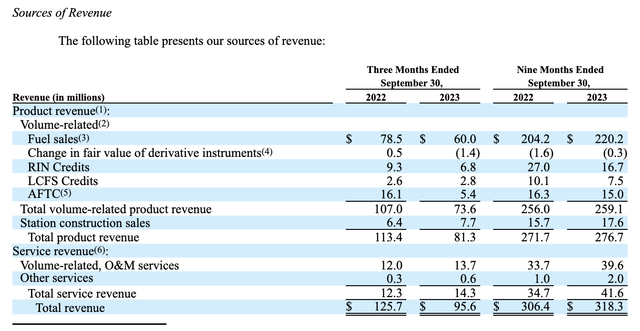

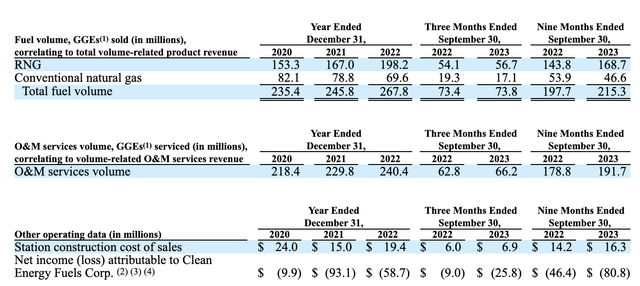

As volumes sold have increased in recent years, revenue has also gone up. Back in 2020, the company generated $291.7 million in sales. By 2022, revenue had skyrocketed to $420.2 million. As I mentioned already, some of this was driven by an boost in fuel volumes. For instance, in 2020, the company sold 153.3 million GGEs of RNG. By 2022, this had grown to 198.2 million GGEs. Over that same window of time, this growth was offset slightly by a reject in conventional natural gas sales from 82.1 million GGEs to 69.6 million.

But the company does have other ways to produce revenue as well. In fact, it also engages in the design and construction, as well as the operation and maintenance, of both public and private vehicle fueling stations across both the U.S. and Canada. It has other miscellaneous operations as well, such as selling and servicing compressors and other equipment that are used in RNG, plus it also sells government credits, such as RINs, to its customers. In all, the company experienced 240.4 million GGEs worth of services volume under its O&M (operating and maintenance) services operations. That’s up from the 218.4 million GGEs it handled two years earlier.

Clean Energy Fuels Clean Energy Fuels

In terms of actual revenue impact, most of the growth in sales for the company came from its fuel sales. Even the O&M services side of the business generated only $45.9 million of the $420.2 million of revenue the company generated in 2022. By comparison, fuel sales were responsible for $281.1 million. That’s up from the $169.4 million generated in 2020. Even though higher volume played a role in this, the largest contributor was an boost in fuel prices. This makes sense when you look at what has been going on with the energy markets during this window of time.

With the boost in revenue came some higher cash flows. But in many respects, the company’s bottom line disappointed. In fact, the business went from generating a net loss of $9.9 million in 2020 to generating a net loss of $58.7 million in 2022. Operating cash flow barely budged, climbing from $61 million to $66.7 million. You only get a sizable boost if you adjust for changes in working capital. In this case, the metric expanded from $39.2 million to $57.5 million. But then you have EBITDA, which only increased slightly from $45.1 million to $50 million.

Clean Energy Fuels Clean Energy Fuels

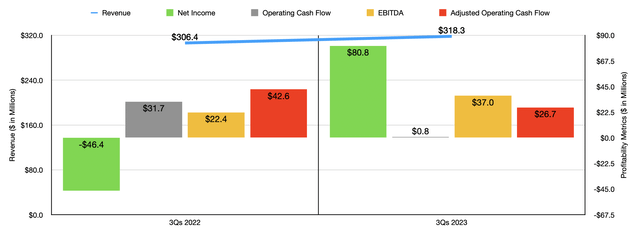

When it comes to the current fiscal year, the picture has been rather messy. When you look at the first nine months of the year as a whole, things look mixed but not bad. Revenue expanded from $306.4 million last year to $318.3 million this year. This boost came even at a time when some parts of the business were particularly weak. Credit sales, for instance, dropped from $53.4 million to $39.3 million. But fuel sales managed to rise from $204.2 million to $220.2 million. Even though the company reported a reject in conventional natural gas sales from 53.9 million GGEs to 46.6 million GGEs, RNG volumes jumped from 143.8 million GGEs to 168.7 million GGEs. The company also benefited from an boost in its O&M services volumes from 178.8 million GGEs to 191.7 million GGEs.

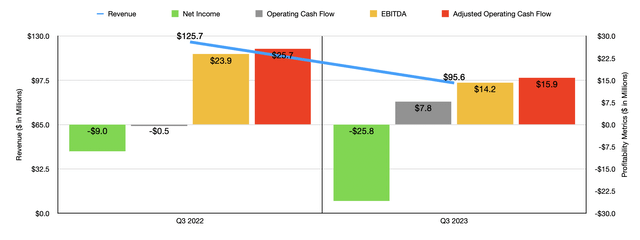

The problem, however, is that the third quarter on its own was rather painful. Revenue of $95.6 million came in quite a bit lower than the $125.7 million reported one year earlier. This came even as RNG volumes rose modestly and as O&M service volumes also increased. This reject was driven largely by a drop in average prices on fuel that the company sold because of a drop in natural gas prices more broadly. And unfortunately, the end result was additional pain on the bottom line as well. Net profits and two of the three company’s cash flow metrics worsened year over year as the chart above illustrates.

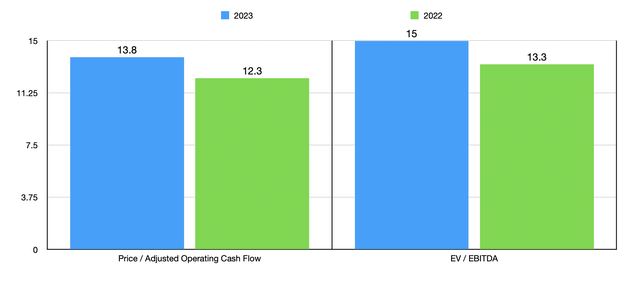

When it comes to 2023 in its entirety, management believes that the company will produce a net loss of between $98 million and $103 million. Meanwhile, EBITDA should come in positive to the tune of between $42 million and $47 million. At the midpoint, that should imply adjusted operating cash flow of around $51.2 million. Using this data, I was then able to value the company as shown in the chart above. And in the table below, I compared the firm to five similar enterprises. When it comes to the price to operating cash flow approach, three of the five companies look cheaper than Clean Energy Fuels. This number increases to four of the five if we use the EV to EBITDA approach.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Clean Energy Fuels | 13.8 | 15.0 |

| REX American Resources Corp (REX) | 10.5 | 6.1 |

| OPAL Fuels (OPAL) | 6.0 | 1.9 |

| World Kinect Corp (WKC) | 7.1 | 4.6 |

| Vertex Energy (VTNR) | 17.6 | 3.3 |

| Montauk Renewables (MNTK) | 27.9 | 26.2 |

Takeaway

As things stand, Clean Energy Fuels is facing some issues because of a reject in energy prices more broadly. There are concerns, because of interest rates aimed at combating inflation, that the economy could worsen, not only here at home, but abroad as well. That would definitely work to push prices lower, perhaps for an extended window of time.

If shares of Clean Energy Fuels Corp. were incredibly cheap, I would be more bullish about it. But as things stand, I think a “hold” rating is appropriate if we look at the picture from a long-term perspective.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.