The Competition and Markets Authority (CMA) finally decided on Friday to begin its investigation into the planned merger between Vodafone and Three – a move many saw as inevitable.

But one PR rep over at consultants Teneo may have been a bit too eager to break the news, sending out the companies’ response to the CMA’s decision a full day before it was even announced, followed by a very hasty recall email that ironically served to draw more attention to the snafu.

As if that wasn’t cringeworthy enough, an industry source told Whispers those in the room when Three and Vodafone discovered the premature statement experienced what they diplomatically referred to as an ‘absolute s**t show’.

When the CMA got around to announcing its inquiry, the companies’ response was sent out again, this time through a different Teneo employee. Vodafone also saw fit to deliver the missive via another PR outfit. A warning call, perhaps?

The CMA began its investigation into the merger between Vodafone and Three on Friday

Full steam ahead for shipbuilder Cammell Laird

Remember ‘Boaty McBoatface’? That was a popular choice of name for the polar research ship built by Cammell Laird after an unwise decision to put it to an online poll.

Now things are looking up for the Birkenhead-based shipbuilder after it reported a profit of £3.7million for the year to April 1, 2023 having lost £4.5million the previous year, according to recently filed accounts.

Perhaps Cammell could spice up its own name. Profit McProfitface?

Grainger to face grilling from investors

Residential landlord Grainger will be one of the first listed companies to face a grilling from investors this year at its annual meeting next month.

The firm may want to get the mud-slinging out of the way early, given it already has a fight on its hands.

In a newsletter last week shareholder advisor Pirc called on investors to vote against the group’s executive pay, saying awards granted to Grainger’s directors were ‘excessive’.

It added that the pay ratio between the boss and average employee was ‘not considered appropriate’.

The consultancy also took issue with Grainger’s plan to issue shares to raise cash for investment, arguing it was not linked to a specific deal.

Well, which of us hasn’t had a gripe with their landlord?

QCM gloats as defamation lawsuit thrown out

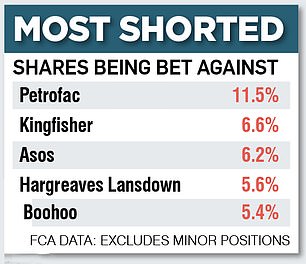

Short-sellers are often reviled in financial markets, with many accusing them of feasting on crisis and misfortune to rake in cash from bets on share prices tumbling.

But many observers fail to consider the legal risks taken by short-sellers in criticising a firm’s business model. So if they win, they like to crow about it.

Such a spat played out in the New York courts last week when Quintessential Capital Management, the hedge fund that shot to fame last year by targeting UK cyber security darling Darktrace, scored a victory when a defamation lawsuit against it by US pharma firm Cassava Sciences was thrown out.

‘To fellow truth-seekers, keep shining a light on darkness!’ QCM declared, humbly.