_ultraforma_

Investment Thesis – Q4 FY23 Update

Citigroup (NYSE:C) (Citi) remains one of my favorite big-bank stocks after what may seem like initially disappointing Q4 and full-year FY23 results.

CEO Jane Fraser has accelerated the bank’s turnaround program with tangible qualitative progress being made in FY23. While earnings data supporting the thesis of increased ROE, ROA and margins may take a few more quarters to surface, the job being done by management cannot be ignored.

The bank’s shares continue to be heavily discounted in my opinion with shares potentially trading at a massive 39% discount relative to intrinsic value.

Therefore, I continue to rate Citi as a Strong Buy and believe the bank makes for an excellent long-term buy-and-hold pick.

Company Background

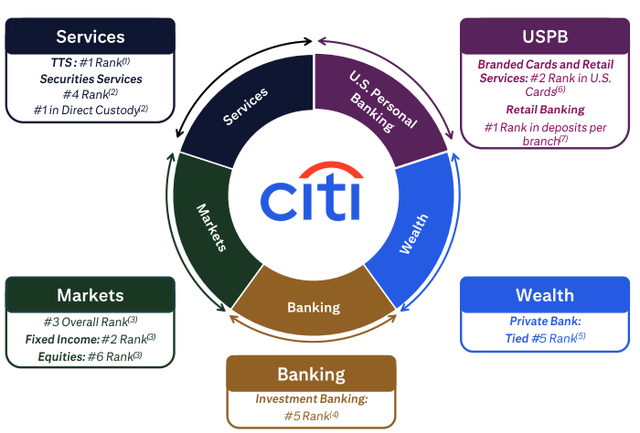

Citigroup is one of the “big four” banks based in the U.S. ranking fourth in terms of market capitalization behind JPMorgan Chase (JPM), Bank of America (BAC), and Wells Fargo (WFC).

The bank has a significant presence within the U.S. domestic retail and personal banking industry, the wealth management sector as well as in international commercial banking.

CEO Jane Fraser continues to lead the bank through a holistic turnaround process in order to reduce costs, increase efficiency and raise the ROA and ROE delivered by the bank.

Massive job cuts, the divesture of more risk-exposed and cyclical business divisions, and a refocusing of efforts on core banking principles define the turnaround being headed by Fraser.

While these end goals could return the bank to the low teens with regards to ROE, Citi is still very much a work in progress with at least another year left before tangible results start to emerge.

Economic Moat – Q4 FY23 Update

Citi may have an incredibly diversified portfolio of services and financial products, but I believe the firm harbors a narrow economic moat at best.

I conducted an in-depth multi-stage analysis of Citi’s banking operations and economic moat earlier in 2023 and urge you to read it here if you haven’t already.

In this Q4 FY23 update, I would like to discuss the progress made by Citi in divesting certain business divisions along with the current steps being made to lean their operating structure.

FY23 as a whole has seen Citi make massive progress towards simplifying its business in order to better align its operations with its strategic vision.

Citi has eliminated the entire regional management layer in their company in order to reduce duplicative governance and increase accountability in the execution of operations.

The bank has also eliminated its Personal Banking and Wealth Management organizational layers to bring its five businesses closer to each other in an effort to increase networking efficiency and cross-discipline communication.

Citi’s transformation doesn’t just include reorganizing the structure of their businesses. The bank has eliminated 390 legacy IT applications, and automated 90% of price verification of prioritized fixed income and equities securities. Significant automation has also occurred in their markets trading division with 80% (of total trading volume) now occurring without human input.

FY23 also saw Citi divest nine of their Asian banking operations to various organizations which resulted in a $6B capital benefit. The bank has also managed to make significant progress on their stalled Mexico banking separation which is now on track to be completed in H2 FY24 with an IPO for the business in 2025.

These massive operational changes should allow Citi to drive revenue growth through an increased focus on cross-border banking, wealth management and by simply offering customers more reasons to do business with the bank.

The significant operational simplifications will allow Citi to cut 20,000 jobs which is around 10% of their total 2023 workforce. These massive cost improvements start a new chapter for Citi which hopefully will be characterized by disciplined expense management and a return to higher levels of operating margins and efficiency.

I believe Fraser has taken the bull by the horns by accelerating their turnaround prospects and showing investors she means business when it comes to overhauling Citi’s previously archaic operations structure.

I remain cautiously optimistic about the prospects for Citi and believe the greater focus on wealth management and cross-border banking may allow the bank to generate a greater degree of moatiness in their business in the future, should operating results improve in the coming 2 years.

Financial Situation – Q4 FY23 Update

FY23 was not all that kind nor impressive for Citi with their Q4 and full-year 2023 results being less than impressive from a first impressions perspective.

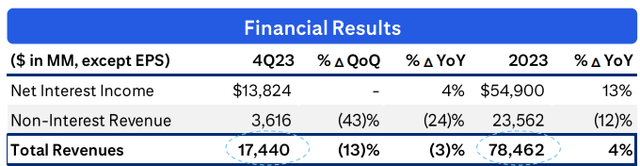

Q4 saw Citi generate $13.8B in NII which was up 4% YoY. In FY23 Citi also grew their overall NII to $54.9B which represented a superb 13% YoY improvement. This came from great growth in the bank’s Services and U.S. Personal Banking revenues which offset some slowdown in Markets, Banking, and Wealth revenue growth.

The fundamental increase in net interest income comes as no surprise thanks to the higher interest rates allowing the bank to originate loans at higher rates than in previous years. However, I am still glad to see NII grow so substantially as it illustrates Citi is attracting business and customers even amidst a highly competitive and difficult macroeconomic environment.

Citi also saw their non-interest revenue plummet 43% YoY in Q4 with a full-year decline of 24% being posted by the bank. While this massive decline may seem alarming, it is primarily due to the divestiture of unprofitable business divisions which ultimately did not contribute to earnings tangibly.

Furthermore, the overall 4% YoY increase in full-year total revenues illustrates that Citi’s refocusing on fundamental banking operations has actually allowed the bank to grow revenues despite divesting multiple auxiliary business units.

Expenses for FY23 grew 10% YoY with NCLs increasing a massive 70% compared to FY22. The increase in NCLs comes as credit card NCLs have continued to grow now matching levels last seen pre-COVID19.

This aligns broadly with my expectation of worsening consumer and corporate credit moving into 2024 which could begin to create problems for not just Citi, but the economy as a whole. However, as long as NCLs and NPAs stabilize at current levels (which could realistically occur if rates are cut in early 2024), I do not see any worsening credit quality at the bank.

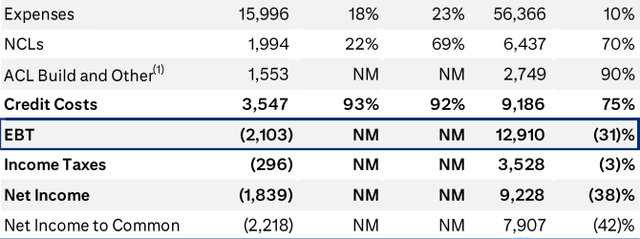

Citi also faced a $1.3B ACL build associated with transfer risk in Russia and Argentina in Q4 along with a $1.7B FDIC Special Assessment related to the regional bank failures of March 2023 which further increased the bank’s overall credit costs significantly.

This left net income at negative $1.84B with the bank operating to a dismal efficiency ratio of 92% in Q4 and 72% for FY23.

ROE dropped to -4.5% in Q4 with full-year returns being 4.3%. RoTCE for Q4 was also dismal -5.1% due to the aforementioned 920bps impact of one-off items.

However, even despite these difficult Q4 impacts Citi managed to generate RoTCE of 4.9% for FY23 which ultimately is not all that bad considering the restructuring expenses with the 72% efficiency ratio for FY23 actually being a 370bps improvement compared to FY22.

C FY23 Q4 Presentation

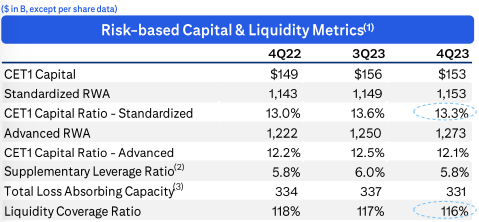

Citi’s CET1 Capital Ratio also remained at 13.3%, while its total capital ratio remained unchanged YoY at around 15.1%.

The bank’s latest Q4 updated balance sheet saw total assets flatline YoY at $2.4T while total liabilities dropped 1% to $2.2T. The bank’s crucial AFS and HTM securities were stable YoY at $256B and $254B respectively when accounted at fair value.

Consumer loans grew 6% YoY while total loans increased by 3% to $674.7B. The origination of loans at higher rates is prudent in my opinion with the potential for a great NIM to be generated. Total ACLs increased 7% as a result of the FDIC special assessment.

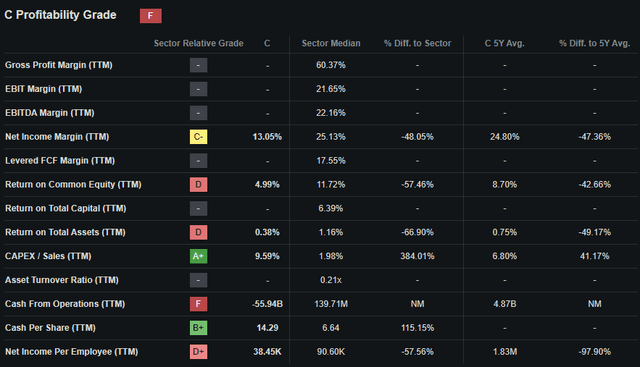

Seeking Alpha | C | Profitability

Seeking Alpha’s Quant calculates an “F” profitability rating for Citigroup which I believe to still be an excessively pessimistic representation of their current situation.

The relative grades assigned by the quant do not in my opinion effectively capture the underlying improvements being made at the bank nor the impact of one-off items that reduced profitability for Citi in Q4 or FY23 as a whole.

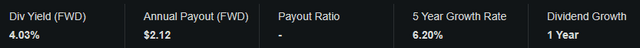

Citi also declared a $0.53 per share quarterly dividend which remains in line with the previous quarterly payout. The forward yield has dropped to 4.07%.

Personally, I am incredibly glad to see Citi continuing to reward shareholders despite a difficult FY23 and a very tricky Q4.

While a $1.8B loss is not the most positive result for the bank in Q4, I must admit I am still a big fan of their overall earnings report. The bank is clearly focusing on their core businesses which grew modestly in revenues in FY23 with the promised cost reductions of 2024 ultimately suggesting their promise of increased ROE and RoTCE are not too far away on the horizon.

I believe the job being done by Fraser and the entire management team should not be discounted with the excellent execution of their turnaround objective further increasing my trust and admiration for the CEO.

The year 2024 could already allow investors to see some real increases in operating efficiency and earnings especially if macroeconomic conditions allow for a soft landing in the U.S. economy.

Valuation

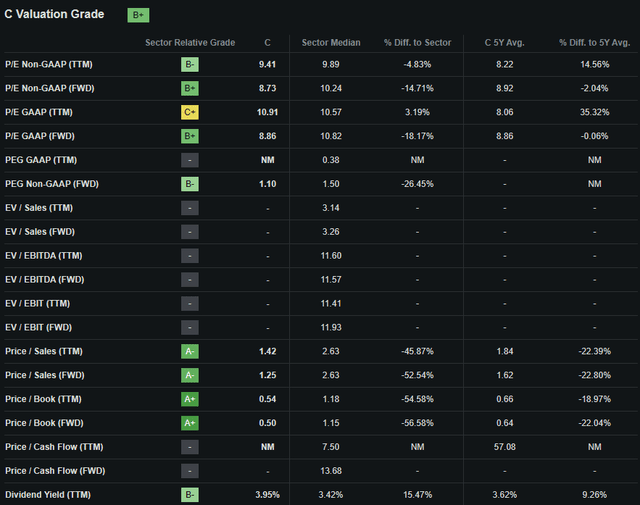

Seeking Alpha’s Quant assigns Citi with a “B+” Valuation grade. I believe this is an accurate representation of the value currently present within Citi stock from a relative perspective in comparison to the current valuations of their peers.

The bank currently trades at a P/E GAAP FWD ratio of 8.86x which I believe is still an excessively pessimistic metric given the further efficiency improvements promised for 2024.

Without special impacts and a leaner expense profile, I believe Citi could see solid 10% GAAP earnings growth in FY24 implying P/E GAAP FWD ratios of around 5.00x at present.

Their TTM Price/Book of just 0.54x is impressive in my opinion especially when considering the relatively small paper-losses and lack of real balance sheet concerns present at the bank.

Considering these basic valuation metrics alone I still believe Citi is trading at a solid undervaluation with a massively discounted P/B and pessimistic FWD GAAP P/E falsely implying some inherent instability at the bank.

Seeking Alpha | C | 5Y Advanced Chart

From an absolute perspective, Citi shares are still trading at a huge discount relative to previous valuations with current share prices of around $52.62 representing a five-year low for the bank’s stock.

When compared to the 84% growth seen in the S&P 500 tracking SPY index over the past five years, Citi has been massively outperformed by the U.S. market index as a whole by over 95%.

Seeking Alpha | C | 3M Advanced Chart

However, since my last article on Citi the stock has surged 30% from $39.00 per share at time of writing to over $52.62. This sudden increase in valuations appears to have come from suggestions by the Fed that rate-cuts are on the horizon for early FY24 resulting in investor optimism for the near future.

The Value Corner

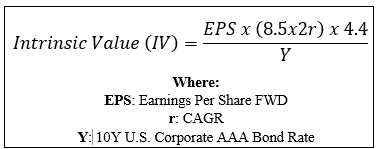

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from an objective perspective.

Using Citi’s current share price of $52.62, an updated 2024 EPS estimate of $6.02, a realistic “r” value of 0.04 (4%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $85.20. This represents a massive 39% undervaluation in shares.

Even when using a massively pessimistic CAGR value for r of 0.02 (2%) to reflect a scenario where a globally spanning recession causes Citi to struggle to grow revenues and earnings despite increases in efficiency, shares are still valued at around $64.50 representing a tangible 19% undervaluation in shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that Citi is still trading in deep-value territory despite the significant 30% rally in prices over the last four months.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. While I believe the bank may begin to generate positive earnings growth and improved efficiency ratios as early as Q3 FY24, a sudden downturn in investor sentiment, the U.S. economy or both could yield to a sudden loss in valuations.

In the long term (2-10 years), I am even more confident than before in the prospects of Citi’s turnaround. Fraser has illustrated her management expertise and ability to improve the operating structure of Citi with positive gains in FY23 further supporting this hypothesis.

While I would like to believe 2024 could already see Citi generate great earnings, I believe the bank will still incur charges related to layoffs and restructuring expenses as the year goes by. Therefore, I still believe the brunt of Citi’s turnaround improvements will be seen in FY25 with some positive elements already emerging in FY24.

Risks Facing Citi – Q4 FY23 Update

Citigroup faces significant regulatory risk and a large amount of macroeconomic risk due to the nature of the global banking industry and Citi’s increased focus on core banking operations.

To read an in-depth analysis of the risks facing Citi, please see my previous article here.

The main change to Citi’s risk profile in Q4 FY23 comes from one of their improvements: a leaner business model.

While I do think the focus on core banking operations, wealth management and cross-border transactions will allow the bank to be more profitable in the long term, Citi now faces more exposure to cyclical business areas.

The increased reliance on consumer and corporate interest income means a sudden drop in interest rates could reduce Citi’s NIM and overall profitability. The bank also must deal with a difficult macroeconomic environment which in the worst case could plunge the U.S. economy into a deep recession.

Such an event would place strain on Citi’s balance sheets with a drop in deposits and NII tangibly hurting the bank’s profitability. Nevertheless, I still believe the overall leaner business operations pursued by Citi will help the bank prevail even in the toughest banking conditions especially compared to the bloated business the bank was even two years ago.

From an ESG perspective, Citi still faces no tangible threats that could place a strain on its reputation or fiscal situation.

I believe the overall lack of major environmental, societal, or governance concerns would make Citi an excellent pick for a more ESG-conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research before investing in Citi if these matters are of concern to you.

Summary

Citi’s turnaround is progressing better than I expected. Real progress has been made with regard to their operational structure thanks to updating business processes and removing excess governance, management, and baggage from their banking operations.

The divesture of key unprofitable businesses has allowed Citi to focus more on their core competencies which are evidenced by the modest revenue growth in FY23 despite the massive downsizing of the bank’s global operations.

While the FY23 Q4 results may initially seem disappointing, I believe they show Citi’s turnaround is working as intended. An unfortunate flurry of special items in Q4 left the bank with a $1.8B loss for the quarter, but I still remain positive about the overall earnings report, especially after a constructive call with Fraser.

Shares remain tangibly undervalued with the bank trading at a potentially huge 39% discount. Therefore, I still rate Citi a Strong Buy and plan on maintaining my stake (now worth around 12% of my total portfolio) in the bank.