Solskin

The best revenge is not to be like your enemy.” Marcus Aurelius.

Today, we are revisiting Bicycle Therapeutics plc (NASDAQ:BCYC) for the first time since our initial article on this small developmental company in October of 2022. We passed on making any investment recommendation on the stock at that time despite intriguing technology. That was mainly because sentiment on the biotech sector at that time was putrid and Bicycle’s pipeline was still early stage. We did promise to circle back on this name at some point in 2023, however. An updated analysis follows in the paragraphs below.

Company Overview:

This clinical stage biotech concern is based in the U.K. in Cambridge. The company is focused on developing a class of medicines for diseases that are underserved by existing therapeutics. The stock currently trades around $19.00 a share and sports an approximate market capitalization of $800 million.

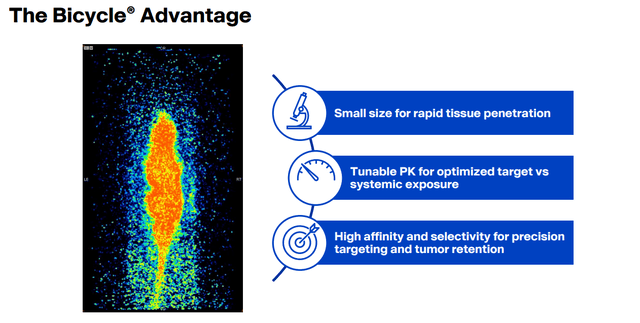

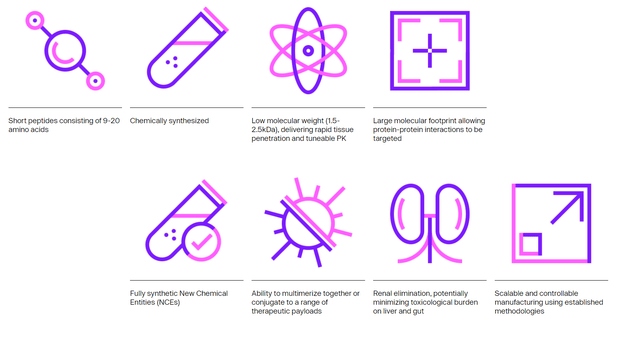

As noted in my previous piece on the company, Bicycle is:

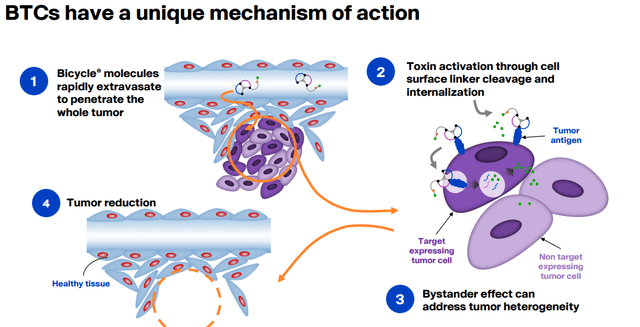

Developing drug candidates via its bicyclic peptide technology which they have branded as a “bicycle”. The company believes this allows drug candidates to deliver the pharmacologic properties of a biologic such as an antibody with the pharmacodynamic and manufacturing properties of small molecules. Given their large surface areas, this allows complex proteins to be drugged without using an antibody.”

Recent Developments:

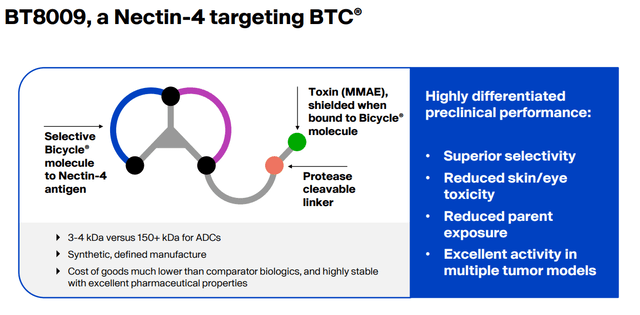

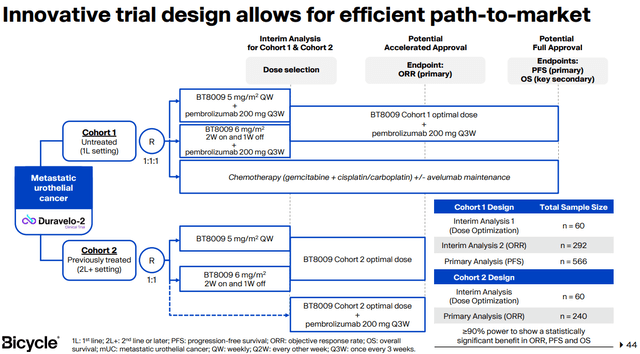

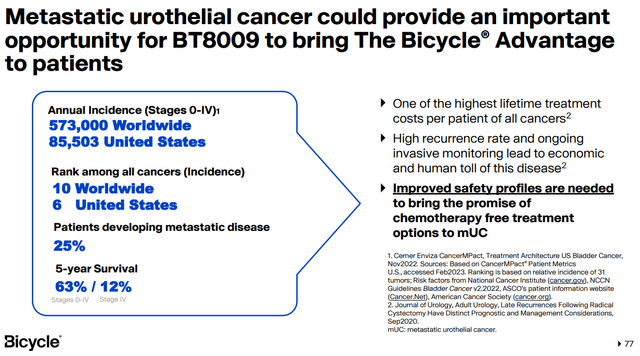

The company has made some progress advancing one of its lead candidates called BT8009, a second-generation bicycle toxin conjugate or BTC targeting Nectin-4, since we first looked in on Bicycle Therapeutics. At the start of this year, BT8009 garnered Fast Track designation from the FDA for adult patients with previously treated locally advanced or metastatic urothelial cancer. Six weeks later, Bicycle Therapeutics posted encouraging Phase 1 trial data for BT8009.

In mid-September, the FDA signed off on the plans of Bicycle’s Phase II/III registrational study for BT8009. The two parties are currently discussing the design of said study. This news prompted B. Riley Financial to upgrade the stock to a Buy, noting:

“Bicycle has not only found an accelerated pathway but will directly target the frontline market, the largest potential opportunity, from the get-go.”

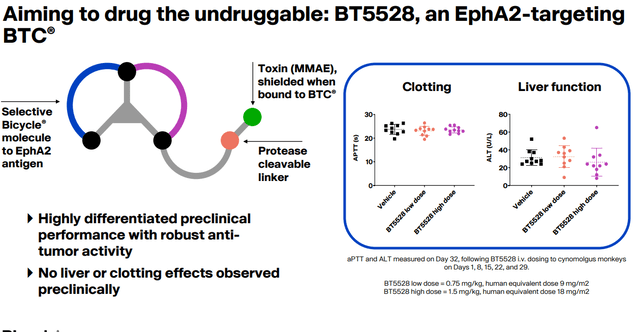

Candidates BT5528 and BT1718 are also in mid-stage development. For a look at Bicycle’s full list of candidates in development, click here.

In addition to the progress in advancing BT8009 in trial development, the company inked two new collaboration deals with large drug companies which further validated the potential of its development approach. In late March of this year, the company entered into an agreement with Novartis (NVS) to jointly develop and commercialize Bicycle radio-conjugates (BRCs) for multiple oncology targets. Bicycle Therapeutics received a $50 million upfront payment as part of this deal. It can also garner development, regulatory and commercial milestone payments totaling up to $1.7B plus royalties on any eventual commercialized sales.

Six weeks later, Bicycle reached almost an identical deal with Bayer (OTCPK:BAYRY) to develop Bicycle radioconjugates for multiple cancer targets. Bicycle already has an existing strategic immuno-oncology collaboration with Genentech prior to these new agreements.

Analyst Commentary & Balance Sheet:

The analyst community is largely sanguine about the prospects of Bicycle Therapeutics. Since the company disclosed its Q3 results on November 2nd, eight analyst firms including Oppenheimer, Needham and Piper Sandler have reissued Buy/Outperform ratings on the stock. Price targets proffered range from $32 to $60 a share. Morgan Stanley maintained its Hold rating on the equity and lowered its price target ten bucks a share to $30.

Just under eight percent of the outstanding float in the shares is currently held short. Insiders have been frequent but smallish sellers of the shares in 2023. So far in the second half of this year, they have sold approximately $150,000 worth of equity collectively.

The company ended the third quarter with just over $570 million worth of cash and marketable securities on its balance sheet, including some $215 million raised via a secondary offering in July of this year. The company also took in just over $19 million during the quarter via its at-the-market (ATM) offering program. Bicycle Therapeutics had a net loss of $49.2 million for the third quarter.

Verdict:

Bicycle Therapeutics plc has made solid progress advancing BT8009 in development since we first looked at the company. The firm replenished its coffers in July and has solid funding in place to continue to advance its pipeline. Two pacts with major drug makers not only provided a cash infusion but helped to validate Bicycle’s developmental approach. BT8009 seems to have solid potential as well. The stock also has solid support from the analyst community.

Given this, the Bicycle Therapeutics plc equity would now seem to merit a small “watch item” holding for aggressive investors in a broadly diversified biotech portfolio.

Revenge is simply justice with teeth.” Simon R. Green.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.