Joe Hendrickson

Churchill Downs Incorporated (NASDAQ:CHDN) is an entertainment and gaming company that owns the Kentucky Derby as well as a variety of online wagering businesses and operates a large number of casino resorts in several states. The company has been in business for more than 150 years and its growth has been accelerating in recent years with new investments and higher demand in being seen in its online wagering business.

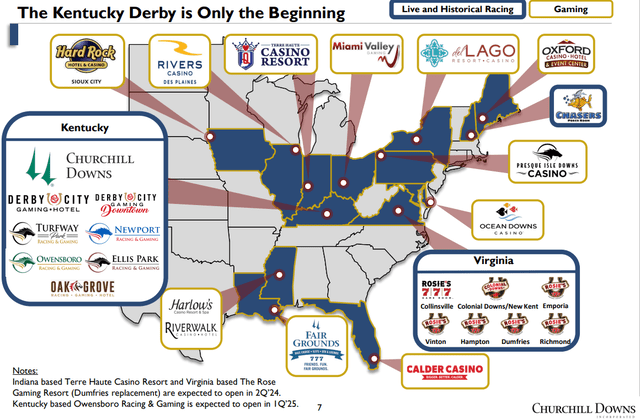

Historically the company’s main business was the Kentucky Derby for most of its existence. Kentucky Derby is going to celebrate its 150th year this year which will make it the longest continuously held sporting event in the US. In addition to this business, the company also owns TwinSpires which is an online wagering platform. In fact it is one of the largest horse racing focused wagering platforms in terms of revenues and profits. Furthermore, the company owns 11 full scale casino resorts with a total of 14,000 slot machines in 10 states and it’s in the process of building another casino in Indiana. Finally, between Kentucky, Virginia and New Hampshire the company operates a total of 14 venues and properties with more than 7,000 HRMs (Historical Racing Machines) which combine racing with video game capabilities and allow people to wager on races within a device that looks like a crossover between an arcade machine and slot machine.

Company’s Main Businesses (Churchill Downs)

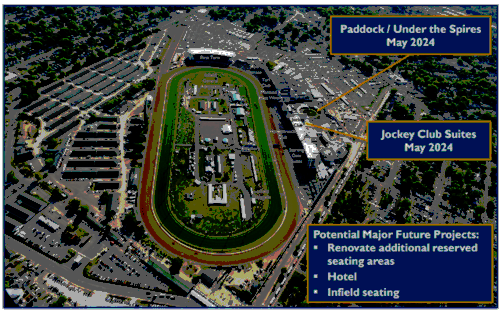

As the company is getting ready to celebrate the 150th year of the Kentucky Derby, it anticipates a strong year. As a matter of fact the event is expected to be a total sellout. The company is working on a few projects such as renovating Jockey Club Suites and other properties around the track in order to maximize its revenues from the event as well as future years. The company will be spending about $185-200 million on Paddock project (which will add 3k new premium seats and upgrade more than 3k existing regular seats into premium) and another $15 million on other renovations which are expected to be completed by May, just in time for the 150th anniversary events.

Kentucky Derby Improvements (Churchill Downs)

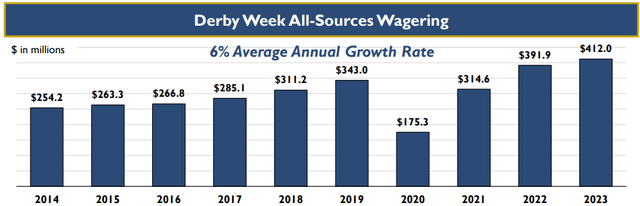

The Kentucky Derby has been seeing more interest in recent years, perhaps partly because people have more interest in placing online wagering these days. Between 2014 and 2023, Derby’s wagering totals rose at an annual compounded rate of 6% despite a dip in 2020 because of the COVID pandemic. After the pandemic, the Derby’s wagering numbers took a quick V shape recovery and reached a new ATH within 2 years. Last year, the Derby’s live broadcast received 16.6 million peak viewership and 14.8 million average viewership which puts it as the second highest watched NBC event after the Superbowl and passed some notable events like Daytona 500 and Indy 500 by a large margin (those events were watched by 8.2 million and 4.9 million people respectively).

Annual Derby Wager Totals (Churchill Downs)

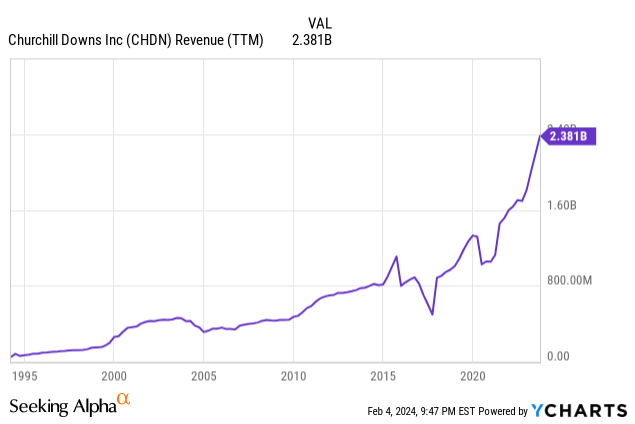

When we look at all the company’s businesses including the Derby, casinos, online wagering, racing machines and hotels, we see a trend of accelerating growth. In the chart below you will notice that the company already had a decent revenue growth up until 2019 but it accelerated notably in the last 4-5 years and almost went vertical. Between 2020 and 2023, the company’s revenues jumped from $1 billion to $2.4 billion and a good portion of this growth came from a variety of investments made by the company and expansion into new businesses such as casinos and online wagering.

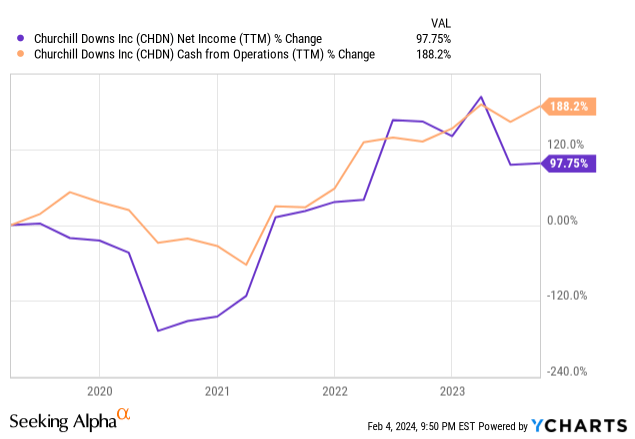

What is more impressive is that the company’s growth was actually profitable growth which is rare to find these days. In the last 5 years, the company’s net profits rose by close to 100% while its operating cash flow rose by 188%. This is noteworthy considering all the new investments the company made in recent years many of which are very capital intensive businesses. For example, the new casino resort being built in Indiana will cost the company close to $300 million and I already mentioned $200 million worth of improvements being made at the location of the Derby.

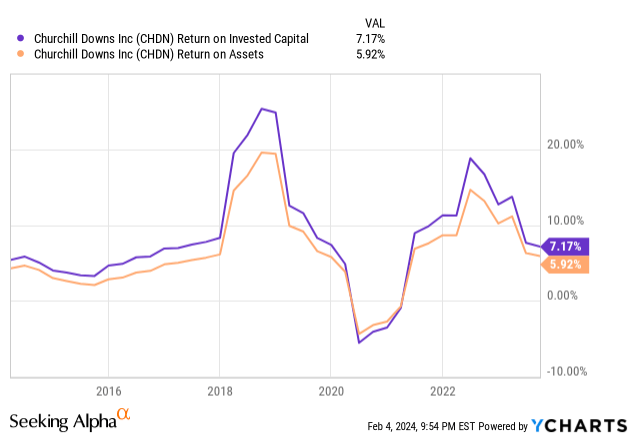

Which brings me to our next couple metrics which are Return on Invested Capital and Return on Assets. The first metric refers to how much the company is making in a year for each $1 it invests into new assets and the second metric refers to how much money the company is making in a year for each $1 it owns in assets. The first metric gives us 7% and the second metric gives us about 6%. At first these may seem like a low number but keep in mind that we are not looking at a software company or a drug company which tend to have very high ROI numbers. This is basically a real estate company that builds hotels, casinos, race tracks and other real estate assets as its main business and for this type of business a return of 7% on invested capital is a very respectable number. Think of this as if you are building a hotel for $100 million and it generates $7 million of profits in its first year of operations. Once you build a hotel or a casino, you can collect profits from it for many decades to come as long as you do a good job of managing it. The fact that this company has been collecting profits from the Kentucky Darby for the last 150 years probably is a good enough proof for me.

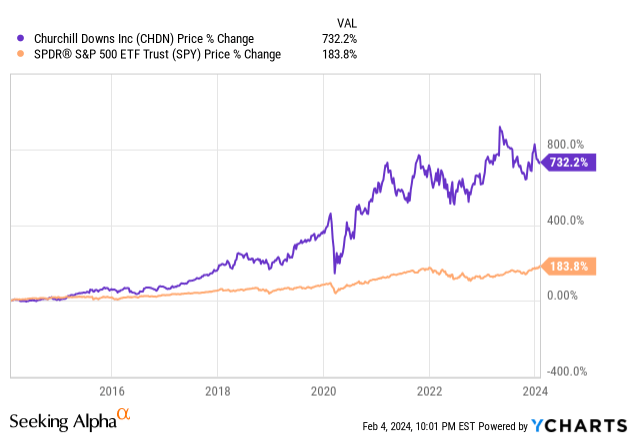

One thing is clear though. It is true that this company has been performing greatly in recent years but it’s no surprise and investors have been paying attention. As a matter of fact, the company’s stock is up 732% in the last 10 years, easily and vastly outperforming the overall market’s 183% during the same period. It is interesting and rare to see a stock outperform the markets by this much margin without it being a tech stock.

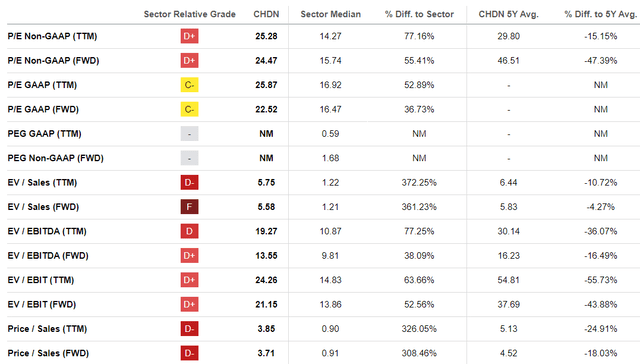

Does it mean the stock is now overpriced? Well the company’s stock looks pricey as compared to its peers. It supports a trailing P/E of 25 versus sector median of 14, forward P/E of 24 versus sector median of 16 on non-GAAP basis and a similar comparison also holds for GAAP figures. On most metrics, the company seems to be trading at a premium ranging from 30% to 70% as compared to its peers and there is not a single metric where it looks cheaper than its peers.

Valuation Metrics (Seeking Alpha)

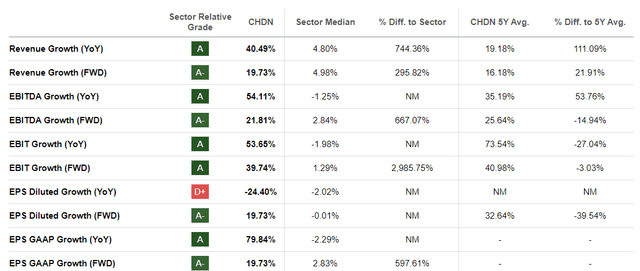

But then again, this premium might be warranted because it also posts much higher growth rates than its peers not to mention how its growth has been actually accelerating in recent years. CHDN’s revenue growth of 40% is almost 10x of growth rate enjoyed by its peers which stood at 4.8%. The company’s 54% EBITDA growth was much better than its peers posting a -1.25% drop in their YoY EBITDA. The company seems to do better than its peers in almost every growth metric and by a large margin as well.

Growth Metrics (Seeking Alpha)

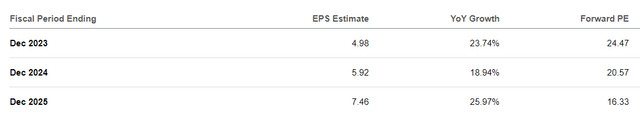

Moving forward, analysts estimate the company to continue growing its earnings at an average rate of 20% for the foreseeable future. If the company were to match or beat these estimates, it would be looking at 2025 earnings of $7.46 per share or better which would give it a forward P/E of 16.3 or lower. This would put the company at about the same forward valuation as its peers on forward basis.

Analyst Estimates (Seeking Alpha)

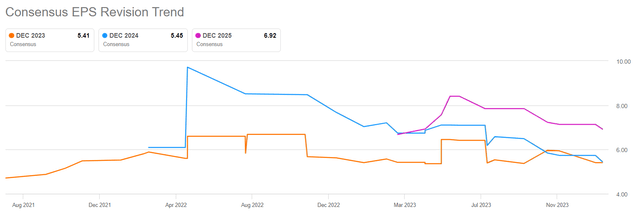

The company will announce its earnings for the last quarter and full year of 2023 on February 22nd. Analysts are expecting the company to post earnings of 65 cents per share on revenues of $553 million. In the last 8 quarters (2 years) the company beat earnings estimates 6 times and revenue estimates 7 times but keep in mind that analysts revised their earnings estimates last month. I expect this earnings report to mostly to uneventful and for the company to meet analyst estimates but the real test will be in May when the Kentucky Derby goes live for its highly anticipated 150th anniversary event. That quarter will likely be the most important quarter for the company and determine how the rest of the year will go.

Analyst Estimate Revisions (Seeking Alpha)

There is a lot to like about this stock and the company, especially acceleration of its recent growth, its new investments and its history of strong profitability. At the same time I also understand that the company’s valuation is pretty rich right now and the stock is already up 700% in the last decade which means its successes are already well known and anticipated by the markets. What you do with this stock really depends on what type of investor you are. If you are a growth investor at early stages if your accumulation phase, you might want to start buying up a small position. If you are more of a value investor or closer to your retirement, you might want to perhaps wait for a pullback before pulling the trigger. I can understand both sides of the argument regarding this stock and both make sense depending on what your goals are and where you are coming from. Personally, I will likely start a small position (less than 1% of my total portfolio) in this stock with a plan to hold for a very long time rain or shine unless something drastically changes in the company’s overall direction.