Brandon Bell/Getty Images News

Mexican-themed restaurant operator Chipotle (NYSE:NYSE:CMG) has been on a great run this year, gaining around 65% amid robust comparable sales figures. Chipotle ticks just about every box you want in a restaurant operator: unit level economics are great, unit growth potential remains attractive, and solid comps appear to show the company is firing on all cylinders. While there is not a lot to dislike at the business level, at over 40x consensus 2024 EPS these shares leave little room for error, and investors should consider rotating out of the name.

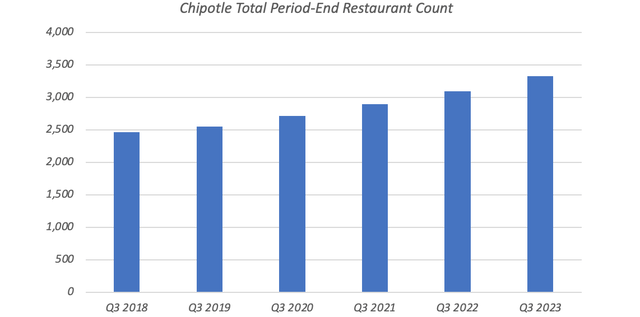

In recent articles on franchised operators admire Yum (YUM) and Domino’s (DPZ), I made a point of beginning with a brief look at store-level profitability. That is for the simple reason that growth is unlikely to materialize if underlying returns are not attractive for franchisees. While Chipotle doesn’t function a franchised model – its 3,321 restaurants are company run – the point stands regardless: an economic return on investment would mean it makes financial sense to open up new outlets. Chipotle has been growing its estate at a very healthy clip, which is probably a good sign that it does indeed sport attractive unit-level economics.

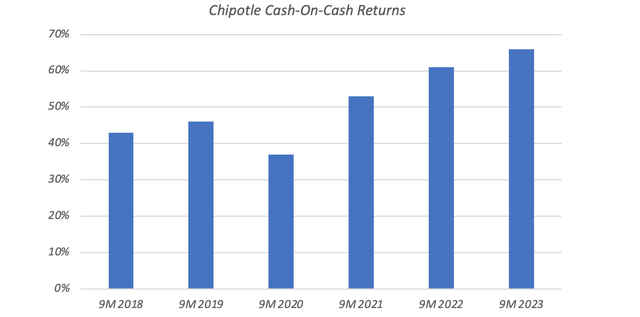

We can confirm this for ourselves using data from recent financial disclosures. In its most recent 10-Q, Chipotle disclosed average annual restaurant sales of around $3 million. For the nine months through Q3, restaurant-level margin – that is, what is left after food costs, rent, labor costs, utilities, payment processing fees and so on – was 26.9%, or $795,000. The company’s last 10-K disclosed an average build cost of $1.1-1.2 million for a new restaurant, with quick math implying cash-on-cash returns in the 65-70% area. That is exceptional and has been growing:

Source: Chipotle Forms 10-Q and 10-K, Author Calculation

Chipotle has a long-term target to grow its store count to 7,000 in North America. This does not strike me as a particularly aggressive figure. Taco Bell, a rival Mexican concept owned by Yum that also sports very attractive unit economics, has 7,279 stores in the United States and is still growing. With cash-on-cash returns as good as they are for Chipotle, there isn’t much to suggest it will stop growing its restaurant count any time soon.

Same store sales performance has also been robust here recently. Chipotle reported 5% comparable restaurant growth last quarter, which followed on from 7.4% growth in Q2 and 10.9% in Q1. Around 80% of its recent comp came from an boost in transactions, with the remainder coming from higher prices/mix. This suggests Chipotle is gaining customer share given that few firms are posting anywhere near that level of transaction growth at this stage in the cycle, and certainly not Mexican-themed peers admire Taco Bell (2-3% growth in Q3) and Del Taco (negative transaction growth).

Recent minimum wage legislation in California has been a topic of slight concern here. Effective Q2 next year, the minimum hourly pay for fast-food workers in the state is rising to $20 per hour. This applies to employees of companies with more than 60 units nationwide, which obviously includes Chipotle.

California accounts for around 15% of the company’s store count, with management disclosing an average wage of $17 there. As a result, Management expects circa 20% pay hikes in the state, leading to circa 2.5-3% labor cost inflation company-wide:

We’ve taken on some significant labor inflation over the last few years. And this California Act that we just talked about, California is only 15% of our restaurants. But that’s all by itself. Next year, that’s going to add 2.5% to 3% inflation to our overall company, inflation in labor.

Jack Hartung, CFO & CAO Chipotle Mexican Grill, Q3 Earnings Call

While management will look to make up for this in price – and indeed has indicated as much – the worry would be that this leads to a drop in transactions as customers walk away from an eroding value proposition. Firstly and most obviously, this is an industry-wide issue, and given Chipotle’s generally superior labor cost leverage it should be better placed than peers to absorb this. Moreover, the impact seems unlikely to not just be confined to fast-food outlets. The law may be targeted at them, but workers can obviously proceed across from other parts of the industry (and even different sectors) if the pay incentivizes this. So, this could easily demonstrate an issue for, say, an independent full-service restaurant, even though the law is explicitly targeted elsewhere. Indeed, it’s not hard to imagine a scenario in which Chipotle actually benefits from this in the long run. All told, I see this as much ado about nothing.

The biggest problem for Chipotle is the growth required to make the current valuation work. Chipotle stock trades for $2,288 at time of writing, putting it at circa 43x the consensus 2024 EPS assess ($52.96). This isn’t a complex business: unit growth, same restaurant sales growth, and restaurant/corporate-level cost leverage are its route to earnings growth. We can add buybacks too if we are talking in per-share terms.

Growing its estate at a high single-digit annualized clip would put the company on course to hit its 7,000 restaurant target in a decade. Let’s say it can reach consistent mid-single-digit comps on top of that – no small order by any means – for circa 13% sales annualized sales growth, and leverage that into high-teens annualized EBIT growth. Chipotle has been swelling its net cash balance in recent years, but it ought to be capable of reducing shares at a low-single-digit annualized clip. Thing is, implied 20% EPS growth needs a 20x terminal EPS multiple just to create 9-10% annualized returns. That’s a consequence of the current high starting multiple.

These are lofty numbers. I would also be slightly concerned about growth potential once Chipotle gets much past its long-term restaurant target number. Assuming it retains its brand strength, U.S. growth need not stop dead at 7,000 units of course, but Chipotle won’t be able to lean on international growth in the way that McDonald’s (MCD), KFC, Burger King (QSR) and Domino’s can. That is for the simple reason that Mexican concepts do not travel as well as burger, fried chicken or pizza concepts do. While Taco Bell does have 1,100 international units (with plans to get to 2,500), it will always be a clear minority of its total estate. Corporate owner Yum Brands also runs a franchised business model, so it is somewhat less sensitive to the unit economics of these outlets. Maybe Chipotle has some future in franchised stores abroad, with a recent franchise agreement in the Middle East possibly pointing in that direction, but I wouldn’t bet on it being a huge growth avenue for the firm.

Chipotle is a great business. Its domestic growth story is far from over. But with the current stock price baking that in and then some, I would be inclined to rotate and of the stock and into cheaper names until a higher margin of safety is on offer.