Analysts say that China’s solar power sector faces a major shakeout because of vast production overcapacity.

Smaller manufacturers are likely to be forced out of the market, but excess production capacity is expected to remain and keep global prices low for years, they say.

China accounts for 80% of solar module production capacity after years of subsidies, driving oversupply that has triggered a collapse in global prices and provoked import duties from trading partners to stave off being swamped by low-cost equipment.

ALSO SEE: BYD’s EV Victory Over Tesla May Be Short-Lived As Sales Cool

US Treasury Secretary Janet Yellen, set to visit China this week, plans to warn Beijing of the harm done by subsidies for clean energy products including solar panels that she says are flooding global markets and pose a threat to US firms, workers and the global economy.

Overcapacity in China’s solar industry is emblematic of the challenges facing the world’s second-biggest economy. High levels of state-guided industrial investment and low levels of household consumption mean many sectors produce more than the domestic market can absorb.

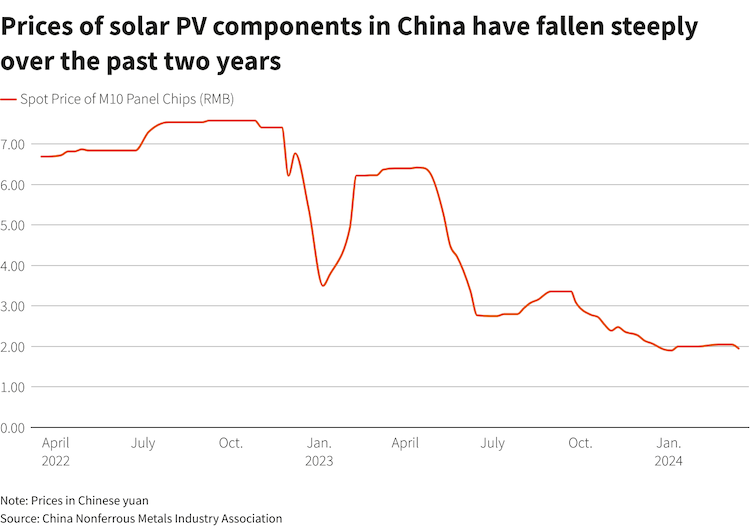

Oversupply pushed prices of finished solar panels in China down 42% in 2023, making Chinese panels more than 60% cheaper than US-made equipment, with some module-only manufacturers taking orders at negative margins to preserve market share, Wood Mackenzie analyst Huaiyan Sun said.

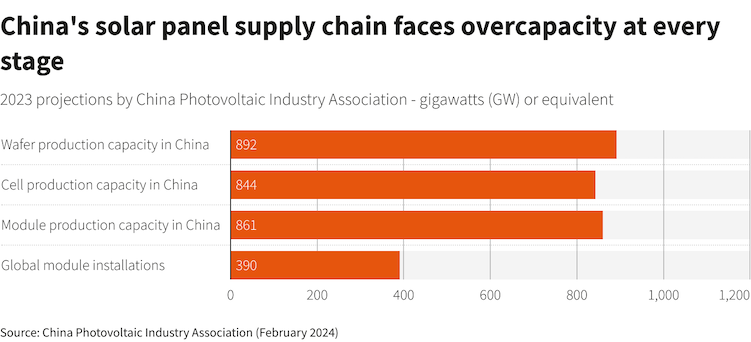

At the end of 2023, China’s annual production capacity for finished solar modules was 861 gigawatts (GW) equivalent according to China Photovoltaic Industry Association data, more than double global module installations of 390 GW.

Production capacity is expected to increase by a further 500 or 600 GW this year, according to forecasts by Wood Mackenzie and Rystad Energy, as Chinese heavyweights including Longi, Jinko Solar and JA Solar continue to build new plants.

Sector expansion has been driven by local government policy support and comes after years of breakneck demand growth.

“China’s estimated wafer, cell and module capacity that will come online in 2024 is sufficient to meet annual global demand now through to 2032,” Xuyang Dong, China energy policy analyst at the Climate Energy Finance in Sydney, said.

Nearly half of China’s solar panel exports in 2023 were to Europe, data compiled by energy think tank Ember showed, where multiple factories have announced plans to close due to the flood of imports.

Chinese solar panels have been subject to US tariffs for more than a decade, with further duties recently imposed on several Chinese solar panel makers who finished their panels in Southeast Asia.

‘Survival of the fittest’

China’s solar industry generated 2.5 trillion yuan ($346 billion) in investment, goods and services last year, according to a study by think tank Carbon Brief, making it the top contributor to the country’s economic growth as investment poured in.

“Many non-solar companies in China have been enticed by massive sustained market growth opportunities in solar and favourable policy support,” said Dong of Climate Energy Finance, who expects most plans by such players not to materialise.

Between June 2023 and February 2024, at least eight companies cancelled or suspended more than 59 GW of new production capacity, equivalent to 6.9% of China’s total finished panel production capacity in 2023, according to the China Photovoltaic Industry Association.

Utilisation rates for finished solar panel production capacity tumbled to 23% in February 2024, down from more than 60% a year earlier, according to data from consultancy PV Infolink.

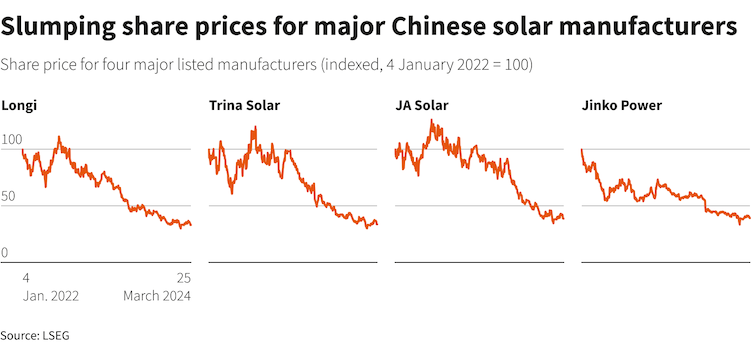

Marius Mordal Bakke, a solar supply chain analyst at Rystad, said the largest vertically integrated players will grow market share as smaller players are squeezed out.

The top four module manufacturers, Jinko Solar, Trina Solar, Longi and JA Solar, all have integrated cell and wafer supply chains.

Transition to more efficient N-type modules gives an advantage to higher tech manufacturers. N-type modules often incorporate additional chemical elements to silicon such as gallium to achieve better performance under high-temperature or low-light conditions.

Against this backdrop, consolidation is “good for the leading players, and also good for customers,” said Dennis She, vice president of Longi, which recently said it will lay off about 5% of employees in April.

Analysts cautioned that consolidation was unlikely to significantly support prices in the short term, meaning the dumping concerns being raised by Yellen this week are likely to persist.

“As supply is still set to outpace demand in 2024 a sustained increase in component prices is unlikely to happen unless supported by policy changes”, such as reforms to bidding for solar components that keep sales prices above input costs, Rystad’s Bakke said.

China has yet to announce plans for any such changes. Overcapacity means that buyers still hold bargaining power, making it difficult for individual manufacturers to raise prices, Wood Mackenzie’s Sun said.

“The overcapacity issue will not be easily solved in the short term as more capacity continues to come online,” Sun said, describing the industry as facing “survival of the fittest”.

- Reuters with additional editing by Jim Pollard