Phiromya Intawongpan

Thesis

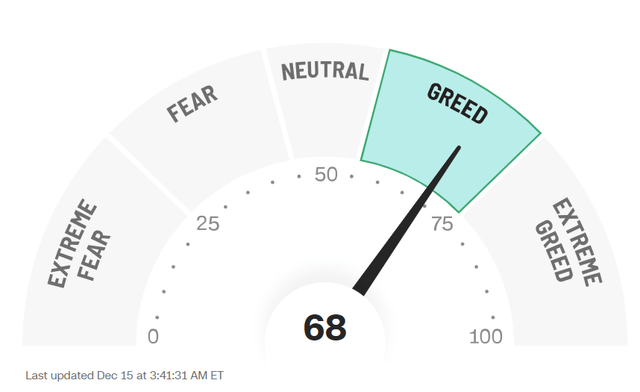

The last week has seen a furious rally on the back of a dovish Fed, rally which perversely is attracting stragglers in a bout of euphoria:

Euphoria never ends well, especially when rate cuts are still a while out, and the market is overbought on many metrics currently.

Convertible Opportunities and Income Fund (NASDAQ:CHI) is a closed end fund from the Calamos family, a premier manager for convertible securities. The fund provides for consistent monthly distributions via investments in a portfolio of convertible and corporate bonds.

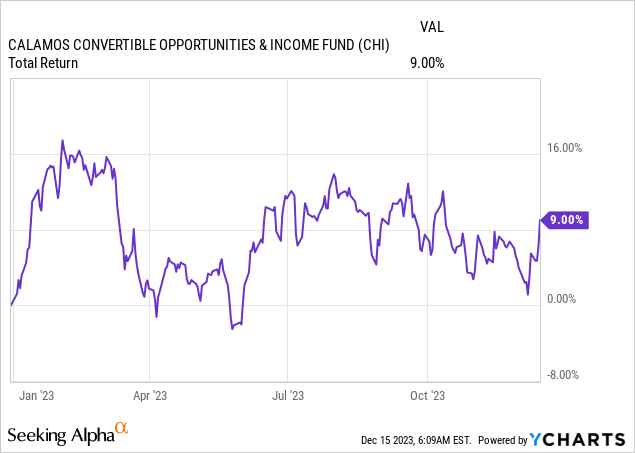

The CEF has had a good performance this year, up 9% so far, albeit with a high volatility (the fund had a -16% drawdown earlier in the year):

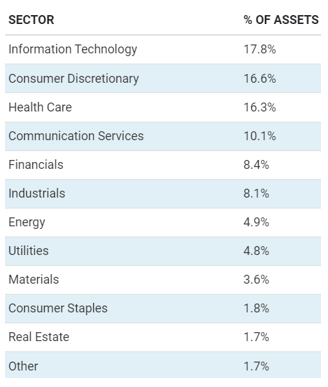

The fund has a high allocation to the technology sector (17.8% of the portfolio), and in particular to semiconductors, allocation which has helped it pilot 2023 in a positive territory. However, its high beta makes it susceptible to risk-off moves, with significant drawdown recorded when there is no bid for risk assets.

We feel the AI rally this year has peaked, and we will see some consolidation and profit-taking in the space during the next market advance. Furthermore we expect a modest overall equity market correction in the first half of 2024, which will have a double negative impact on CHI – on one side the fund’s equity delta will drag it down, while its premium to NAV will advance to 0%.

A retail investor would be well served to de-risk here and take profits, expecting a reversal of the 9% gain so far recorded this year.

Analytics

- AUM: $0.84 billion

- Sharpe Ratio: 0.19 (3Y)

- Std. Deviation: 17.8 (3Y)

- Yield: 10%

- Premium/Discount to NAV: 3.5%

- Z-Stat: -1.4

- Leverage Ratio: 37%

- Composition: Convertibles

- Duration: 2.4 yrs

- Expense Ratio: 0.86% (management fee + other fees)

Low Cost of Leverage

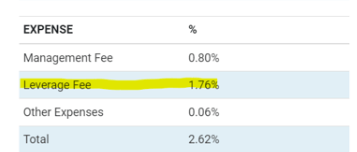

One thing to notice and commend the fund management upon, is the low cost of leverage. Although the CEF has an enormous leverage ratio of 37% (high leverage ratios are common in the convertibles space), the fund has been able to keep a very tight lid on its interest expenses:

Expense (Fund Website)

We can see the leverage fee is a small 1.76% (measured as a ratio of managed assets) versus Fed Funds at over 5% now. When measured as a percentage of actual borrowings, the leverage fee is much closer to Fed Funds, but still quite low when compared to fixed income CEFs as an example.

The reason behind this state of affairs is the presence of a $132 million preferred shares series in the CEF’s capital structure. Preferred share issuance locks in liquidity and cost of funds for term, and the management team did a great job in choosing the optimal funding structure for the vehicle long term.

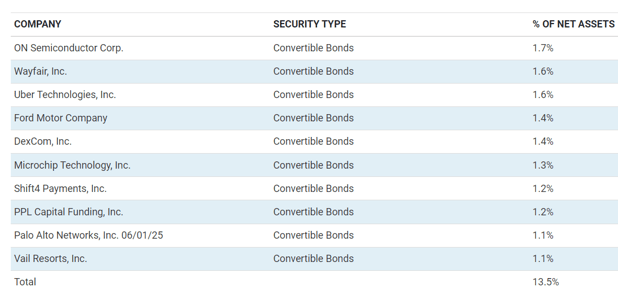

Holdings

The fund contains mainly convertible securities which make up most of the collateral pool at 66%. Corporate bonds are the other bucket in this fund, representing 23% of the collateral pool.

The CEF is focused on Information Technology and Consumer Discretionary:

Sectors (Fund Website)

Many convertibles CEFs have technology as their highest allocation due to the capital raising mechanics in the sector – convertibles issuance is prevalent due to the low cost of funds on a pure cash basis. If the company is successful, then investors can partake in the upside of the fund:

When tech companies need to raise money, they typically issue stock — either in the public or private markets — or borrow money through debt. But they’ve increasingly opted for a middle ground: Convertible bonds. These let companies raise cash at lower interest rates without immediately issuing stock and diluting their shareholders. And they let the lenders — institutional investors admire mutual funds or asset managers — select to get paid back in cash or stock, depending on how things go.

Source: Vox

The top names in the CEF are as follows:

Top Holdings (Fund Website)

Some of these names have seen their common equity skyrocket this year (ON Semiconductor common equity is up 40% this year) which has helped the convertible bonds gain significantly in 2023 as well.

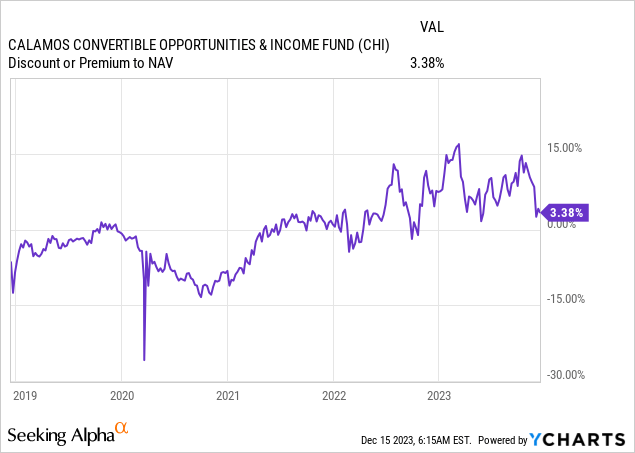

Premium / Discount to NAV

The fund’s premium to NAV is towards the top end of the CEF’s historic range:

We can see from the above graph, courtesy of YCharts, the CEF has seen its premium to NAV balloon this year on the back of strength in the semiconductor space (the CEF contains several names from the respective sector).

The fund has a high beta to risk-on / risk-off environments, meaning we expect said premium to narrow to zero during the next market-wide sell-off.

A retail investor should not want to buy convertible CEFs at high premiums to NAV in a 5% interest rate environment.

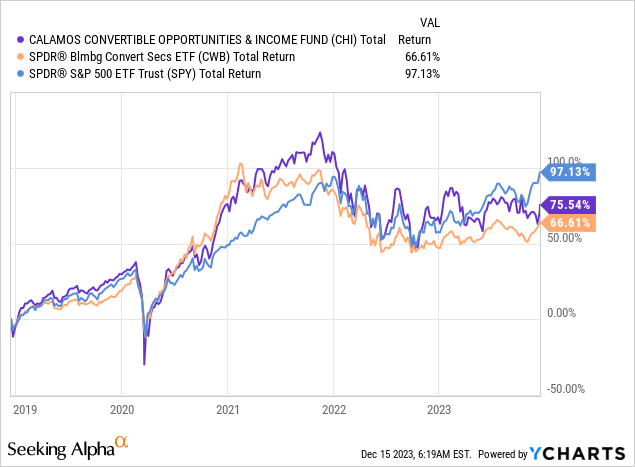

Correlation to overall Equity markets

Long term, CHI does a good job of tracking the S&P 500, with outperformances recorded during periods with extremely low interest rates:

By layering in a high leverage factor on a portfolio of mainly convertibles (with high equity deltas), the fund manager is able to accomplish a total return profile similar to the wider index.

We can notice how CHI outperformed only during the low rates environment experienced in 2020/2021. Conversely the CEF started underperforming once the Fed started raising rates in 2022.

We are still in a high rates environment, and the forward curve is telling us to expect higher rates for longer (until mid 2024 as of now).

Conclusion

CHI is a closed end fund focused on convertible securities. The CEF has had a positive 2023, but a volatile one. The fund is up 9% year to date, but has recorded a -16% drawdown earlier in the year.

The CEF’s premium to NAV has a high beta to risk-on / risk-off environments, meaning that we should see it collapse during the next significant market risk-off event.

CHI has a high allocation to technology, and in particular semiconductors, allocation which has helped prop its performance this year. We feel the AI rally is done for the year, and we will see consolidation and profit taking next in the space.

The fund has a high correlation to the S&P 500, and will see its performance severely hampered by the next risk-off event. We expect a double whammy here, with the fund recoding both fundamental negative performances as well as a decrease in the premium to NAV. We are penciling in a reversal of the positive performance so far this year, with the premium to NAV moving towards 0% as well as fundamentals taking their toll during the next risk off event. A retail investor would do well to cut risk here and take profits on the back of a general euphoria sentiment in the markets currently.