Felix Cesare/Moment via Getty Images

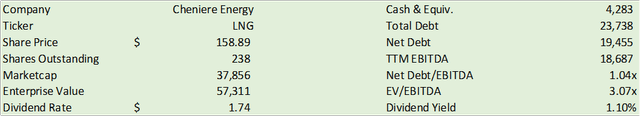

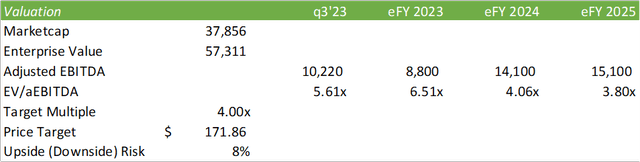

Cheniere Energy (NYSE:LNG) has made significant strides in building operations into a cash-generating machine. With Stage 3 at their Corpus Christi Liquefaction location expected to produce its first LNG at the end of eFY24, Cheniere is expected to experience strong aEBITDA and DCF growth. In addition to operational excellence, management has remained adamant in returning cash to shareholders either through dividends or their repurchase program, with $2.5b remaining as of Q3’23 and an anticipated 10% dividend growth rate through the middle of the decade as Stage 3 is completed. I provide LNG shares a BUY recommendation with a price target of $171.86/share at 4x eFY25 EV/aEBITDA.

Macroeconomics

The talk of the town is the new impediment on additional LNG export terminal approvals as climate activists pressure the current administration. Though this is a rather negative headline to read in relation to US-based gas producers, it may be coming at a good time for the exporters as nuclear facilities become the top choice for a clean-burning alternative fuel. In terms of growing capacity for the next generation of facilities and facility expansions, I don’t believe this news should be viewed entirely as a negative sign for the industry, but rather more as a pause to consider the total future demand for gas overseas and how it interrelates to nuclear capacity that is being built out. In terms of how this can impact Cheniere, this may impact the firm’s future growth ambitions beyond Stage 3 at Corpus Christi as well as Train 8 and Train 9 at Sabine Pass as Stage 3 is currently under construction. Whether Trains 8 and 9 are impacted remains to be seen, as the firm has not issued any updates since Q3’23.

One example comes from a report by Reuters suggesting that Japanese LNG imports declined by 8% in 2023 as the country has approved bringing their 12th nuclear reactor back online. According to the EIA, Japan now has 11GW of nuclear capacity online, with 10 additional units under review and five more that have passed review that have yet to restart. Despite this long-cycle paradigm shift, Japan currently has 90% of their LNG imports under long-term supply contracts, making me believe that a major power mix shift will be a slow burn as opposed to a quick shift.

Aside from Japan, which primarily sources their LNG from Australia and Malaysia, China and India remain as resilient markets for LNG imports.

On the more negative side, the WSJ reported on February 12, 2024, that China is actively installing solar and wind capacity at record rates. In 2023 alone, China installed 217GW of solar capacity, a 55% increase from the previous year. The region also installed an additional 76GW of wind capacity in 2023, further bolstering the region’s decarbonization initiative as they seek to offset coal capacity. Despite these potentially negative factors to LNG import demand, the Journal cited that these increases covered China’s annual increase in electricity demand and did not necessarily replace other capacity.

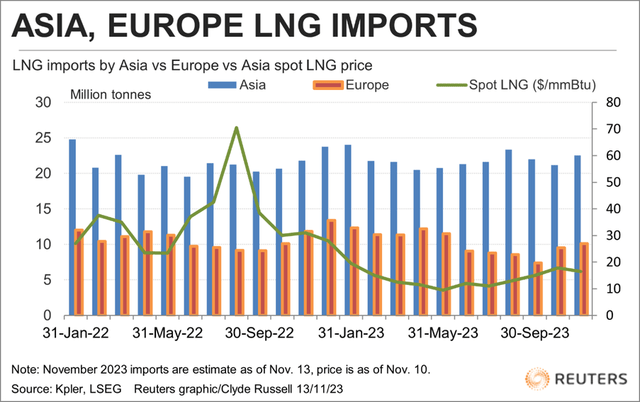

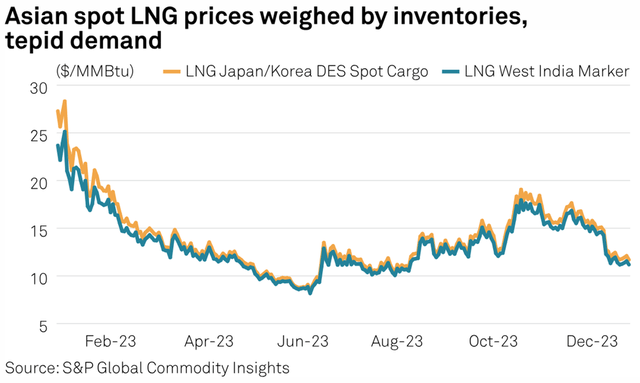

Reuters

In line with management’s commentary during Cheniere’s Q3’23 earnings call, India remains a strong growth engine for LNG imports as the region is ramping up their use of LNG to curb emissions. Though this recent headline suggests that the agreement is with QatarEnergy, which supplies 35% of India’s LNG imports, I believe that this is positive news for the overall LNG industry as it suggests demand remains in growth territory despite calls for decarbonization. S&P Global has suggested that India’s LNG imports can grow by 7-8% in 2024 given the reduced pricing pressure in the market. The reports suggested that the fertilizer sector remains the largest consumer of LNG in the region, and that the power and industrial sectors could further contribute to increased demand if spot prices remain near the average prices seen in 2023.

S&P Global

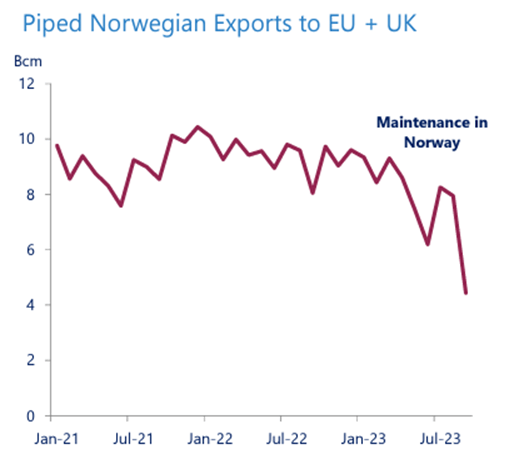

There are some positive supply constraints that can impact European gas supply that may be uncovered in the coming years as a result of less gas production in Norway. As discussed in my report covering Transocean (RIG), more firms are mobilizing harsh environment rigs out of Norway as the country reduces offshore production through 2025.

Cheniere Q3 ’23 Investor Presentation

I believe this loss of supply can lead to long-term ripple effects that can positively impact the LNG export industry as more of these midstream firms seek long-term take-or-pay contracts. Though EU storage capacity is near full, I believe that any signs of a supply/demand imbalance can lead to stronger pricing in the region.

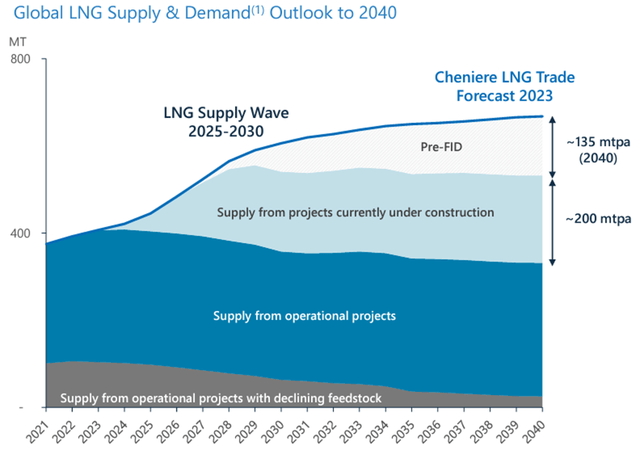

On a long-term basis, management believes that demand for LNG will grow at 3% per year through 2040 with strong growth in developing Asian economies. The firm forecasts a need for an additional 335MTPA by 2040, to fulfill demand on a global basis. 200MTPA of this demand is supplied from projects that are currently under construction, with the remaining 135MTPA pre-FID.

Cheniere Q3 ’23 Investor Presentation

Financials

Despite the near-term headwinds at the top line, Cheniere has proven to be a highly profitable business as the firm’s LNG export vision comes to fruition.

Corporate Reports

As the firm focuses on steady, long-term fee-based contracts, I believe that revenue and margins should be relatively stable, dependable, and less commodity-sensitive going forward, similar to other midstream operators like Enterprise Products (EPD) and ONEOK (OKE). Though this approach won’t necessarily experience the highs during strong commodities markets as seen by the producers, the industry will not experience the slumps as well. I believe this stability will significantly contribute to Cheniere’s ability to return more cash to shareholders through their dividend growth and share buyback program, as I will discuss in the Valuation & Shareholder Value section below.

Cheniere remained adamant in upgrading the firm, both in operations and capital. Cheniere’s debt was upgraded to investment grade by the three major ratings agencies back in August 2023 as the firm deleverages and bolsters the balance sheet. As of Q3’23, Cheniere is currently levered at 1.04x net debt/EBITDA, a significant improvement from FY22 at nearly 8x. I believe that Cheniere has successfully positioned itself to no longer be valued as a speculative play and more as a midstream operator with steady cash flows with their operational excellence and deleveraging. As the firm brings CCL Stage 3 into operations, the steady cash flow accumulation will pay off for shareholders. As of Q3’23, construction for Stage 3 was 44.1% completed and the application for Trains 8 and 9 have been filed with FERC. Management guided the first LNG resulting from the Stage 3 expansion to be processed by the end of FY24. The firm guided in their Q3’23 earnings presentation that the 9 Trains and Stage 3 will have an accretive run rate of $6.4-$6.9b aEBITDA and $3.2-$3.5b in DCF, assuming a CMI run rate of $2-$2.50/MMBtu.

In addition to these growth opportunities, the firm is evaluating CCUS opportunities at their SPL location that I believe has the ability to enhance their operations as other midstream operators, O&G producers, and industrial firms focus more heavily in CO2 CCUS. I believe that CCUS should also help with European customers as carbon emissions are more heavily scrutinized across the European Bloc.

In terms of future projects, Cheniere should have some flexibility as the price of steel has significantly dropped over the last year, findings that I have discussed in my coverage of Nucor (NUE) and US Steel (X). This can significantly impact capital investment costs for future projects as the firm expands operations.

Valuation & Shareholder Value

Corporate Reports

Management discussed significant features to their shareholder benefits in their Q3’23 earnings call. As the firm has reached a more sustainable capital structure, management anticipates free cash to both pay down debt and to shareholder benefits on a 1:1 basis. Management anticipates that they will have the flexibility to grow the dividend rate by 10% into the mid-2020s as Stage 3 is constructed. As of Q3’23, Cheniere had $2.5b remaining for repurchase under their September 2022 share repurchase program. I believe that as this program is exhausted, management will initiate a new repurchase program as they intend to repurchase 10% of their marketcap over time.

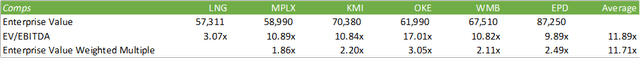

Referencing my statement from above in terms of trading like a midstream operator, my presumption isn’t necessarily that the firm will experience significant expansion to its trading multiple, at least not yet, as the average midstream multiple is at 11.71x on an enterprise value-weighted EV/EBITDA.

Seeking Alpha

One catalyst that can further drive the valuation expansion for Cheniere will be their dividend growth. As the firm expands on their shareholder returns, I believe that shares have the ability to trade at a higher multiple. Because Cheniere holds additional geopolitical and geographical risk when compared to domestic midstream operators, I don’t believe that the shares will reach that 11.71x average.

At this time, I value LNG shares at 4x eFY25 aEBITDA for a price target of $171.86/share. I recommend LNG shares with a BUY rating given the firm’s ability to grow their dividend, expand operations, and sustainably generate free cash flow. Though the firm’s operations are challenged in the near-term, I believe these headwinds will be overcome with their expanding operational footprint given Stage 3 coming online towards the end of 2024.

Corporate Reports