gorodenkoff/iStock via Getty Images

Check Point Software Technologies (NASDAQ:CHKP) is a global leader in cybersecurity solutions, protecting businesses of all sizes from cyberattacks across various landscapes. Founded in 1994, they offer a comprehensive AI-driven security platform, Infinity, which safeguards networks, clouds, mobile devices, and data with advanced threat prevention capabilities.

The stock has been performing really well in the market. Having gone public in 1996 at a price level of $4, it briefly reached its previous all-time high of $113 during the 2000 dot com boom, before tumbling down to mid-teens the following year. Since then, CHKP has been on a consistent upward trend. In 2017, it finally surpassed its previous all-time high. CHKP maintains its strong share performance today. 1-year and YTD return stand at 27% and 6.7%.

I initiate my coverage with a buy rating. My modeled target price of $187.6 presents a projected 14% upside. I consider CHKP a steady growth stock with good fundamentals and manageable risk. Under the currently challenging macro situation where the fundamentals of many growth stocks have been under pressure, I believe CHKP provides a “flight-to-quality” opportunity for growth investors.

Catalyst

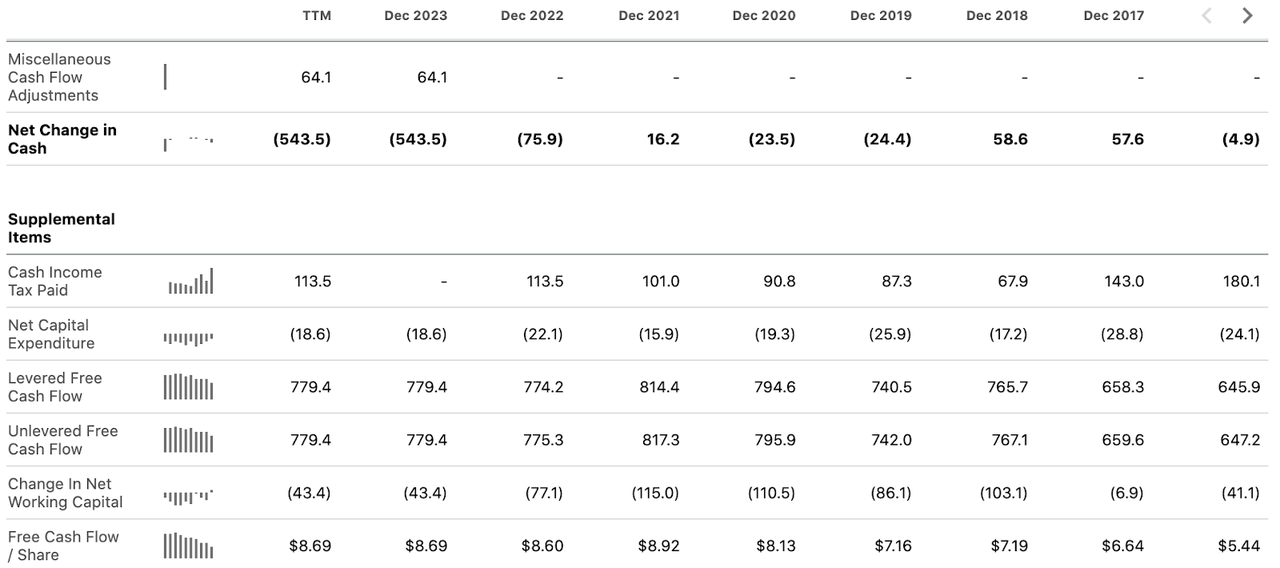

CHKP has very strong fundamentals. The company consistently delivers solid financial performance, with steady revenue growth and very strong profitability. Over the past decade, CHKP has been maintaining a mid-single digit revenue growth on average, but with over 35% – 40% net profit margin, an exceptional quality by any standards.

CHKP has also been generating over $700 million of FCF annually, making it a cash-rich company. Balance sheet is strong with virtually no debt and ample cash reserves with almost $3 billion of liquidity as of Q4. CHKP has also been using its cash to do share repurchase activities consistently, driving share performance.

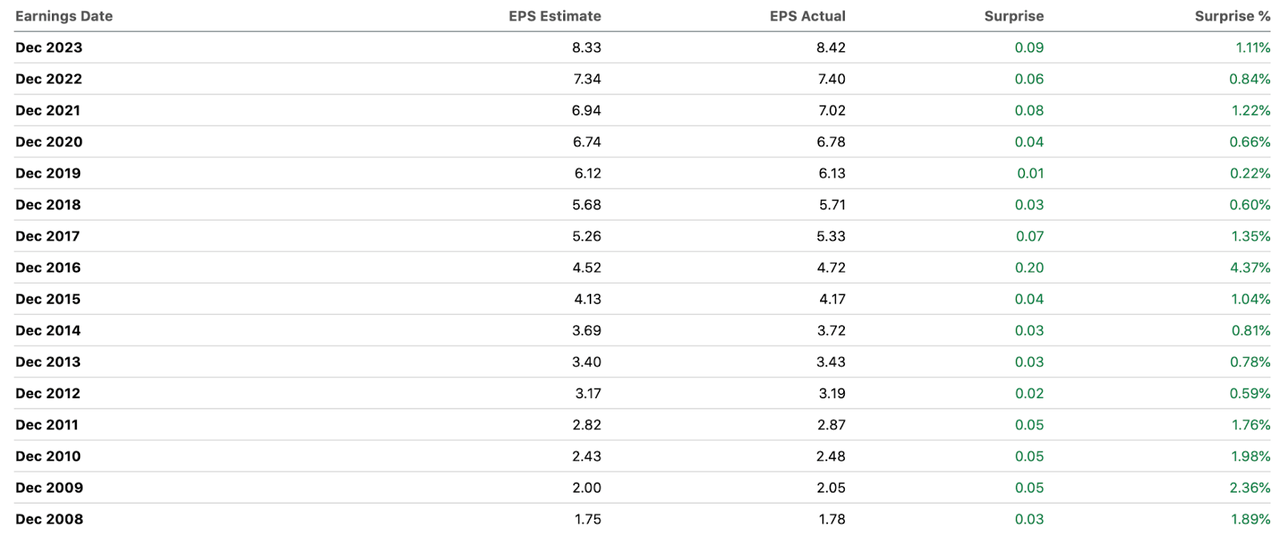

The steady business has enabled CHKP to be associated with financial stability and reliability. For the last 15 years alone, CHKP has not only delivered on its guidance, but also beat them.

reputation (CHKP presentation)

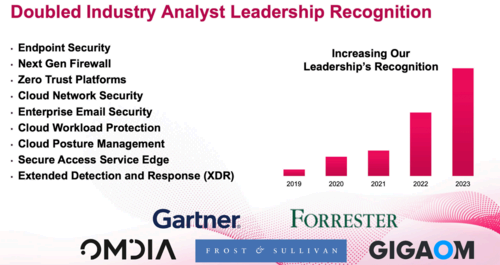

In 2024, I expect the increasing use of generative AI in enterprises to increase demand for cybersecurity solutions due to new attack vectors, sensitive data needs, and compliance complexities.

Such a trend will greatly benefit CHKP, which is well-positioned to capture the opportunities by leveraging its industry-leading AI expertise and over 100,000 existing customers with its new security subscription product suites. In my opinion, there is an opportunity here for CHKP to achieve annual revenue growth reacceleration from its historical mid-single digits to a double-digit territory, driven by its latest AI-driven offerings.

growth chart (company presentation)

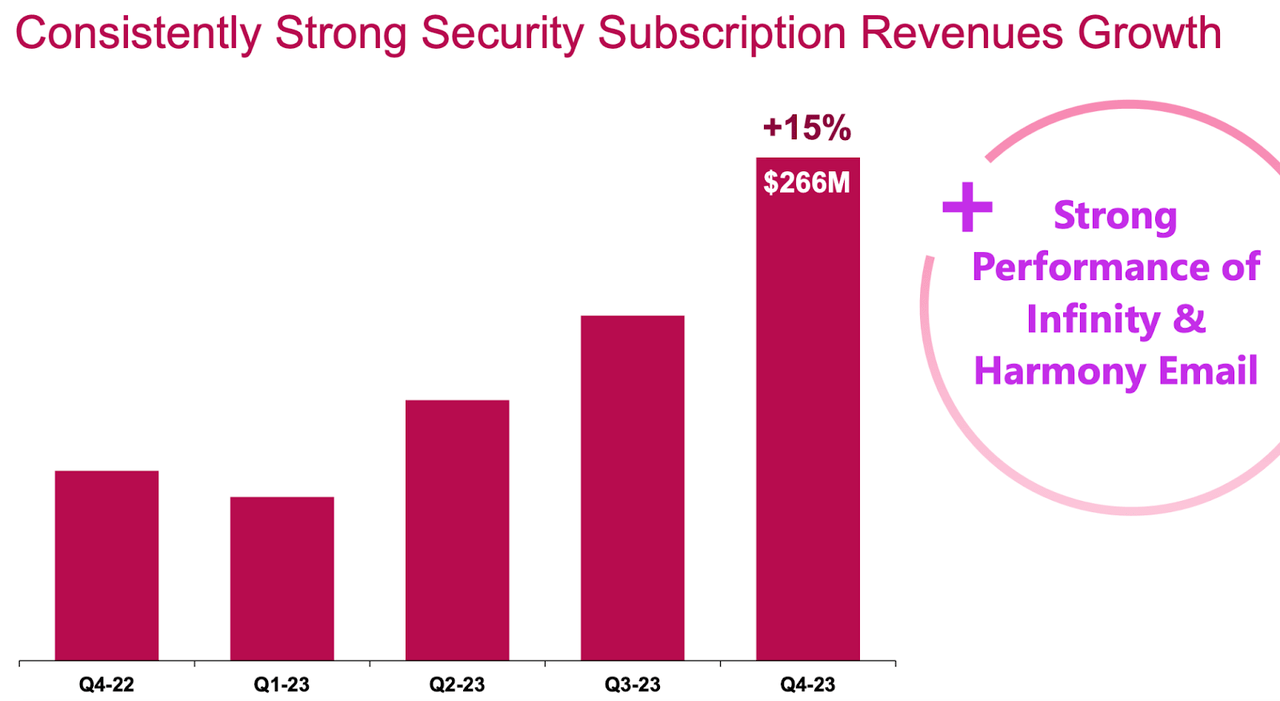

Given its proven quality, CHKP’s AI-driven offerings are highly sought-after by organizations looking to address cybersecurity threats. I expect its security subscription packages, which include Infinity CloudGuard and Harmony, to continue seeing double-digit revenue growth as a result, as it has in recent times.

Harmony, for instance, saw a significant uptake in Q4 to help CHKP achieve 15% YoY revenue growth in security subscription. Harmony shields workspaces from email-based threats by employing AI to do advanced detection, phishing protection, or real-time threat intelligence to block malicious emails. The rise of generative AI supercharges email attack vectors. AI could write hyper-personalized phishing emails, craft deepfakes for targeted scams, or even generate malicious content like fake invoices.

Harmony’s growth may come from increasing adoption within CHKP’s customer base more evenly across other geographies in line with generative AI trends within those regions:

As for the revenues by geography, we saw strong demand in America. We see 42% of the total revenues came in America. It represented double-digit growth in revenues in America, mainly driven by Infinity’s strong demand for Infinity there and Harmony E-mail business. 48% of the revenues came from EMEA, and the remaining 10% came from Asia Pacific.

Source: Q4 earnings call.

customers (company presentation)

With over 100,000 existing customers, some of them global enterprises, CHKP already has a large audience to upsell its products without having to spend aggressively to acquire new customers to deliver growth every time. This “land-and-expand” approach has been the go-to-market strategy for most SaaS companies, and to a greater extent, large-cap software companies like CHKP. In Q4, we found the predominant growth driver to be the expansion and renewals from existing customers, instead of new lands. I would expect CHKP to continue with such a motion, further driving growth at steady margins:

So new customers, we had a very nice jump of new customers, I think, in 2001 and — 2021, sorry, 2021 and 2022, a big increase in new customers. Not enough. It’s not a big enough percentage of our business, but it’s still good numbers. And by the way, it’s on all sectors. We get a lot of small customers, especially from some of our acquisitions, and we get hundreds of very large customers on our enterprise and very large enterprise business. In 2023, despite the tough economy and despite the fact that for three quarters, we had a decline in new business, we had it stable. So it didn’t — it grew a little bit, but not by a lot.

Source: Q4 earnings call.

With over $3 billion in cash and short-term investments, CHKP’s robust liquidity also unlocks attractive inorganic growth opportunities, in my view. They can leverage it for strategic acquisitions within Israel’s vibrant cybersecurity scene, expanding their offering and capitalizing on promising startups, as they most recently did with Atmosec and Perimeter 81. With M&A track record dating back to the early 2000s, CHKP’s deep M&A experience should also further increase the chances of success in the integration of new takeover targets.

Risk

In my opinion, risk remains minimal for CHKP. However, one thing that is worth mentioning out of the latest development here would be Gil Shwed’s move from CEO to Chairman. Shwed was CHKP’s founding CEO who has been with the company since inception in 1993, and I believe the recent move could present a little bit of uncertainty.

Shwed’s departure represents a potential loss of visionary leadership ingrained since the company’s inception, which could affect CHKP’s ability to adapt to an increasingly competitive and dynamic cybersecurity landscape. Additionally, as Shwed already touched on during the Q4 earnings call, finding and onboarding a new CEO will be a delicate process:

And I think starting tomorrow, we will start a more thorough succession planning process. We will start search for replacement for my current role as CEO, which will take anything from — again, we may be lucky and it will be very short, but to find the right person, to find the right women or men that can be the Check Point CEO, can take — usually would take anything from six months to two years.

Source: Q4 earnings call.

In the worst case scenario, I would foresee the interim period bringing uncertainty and instability, affecting market confidence and pressuring share performance.

Valuation / Pricing

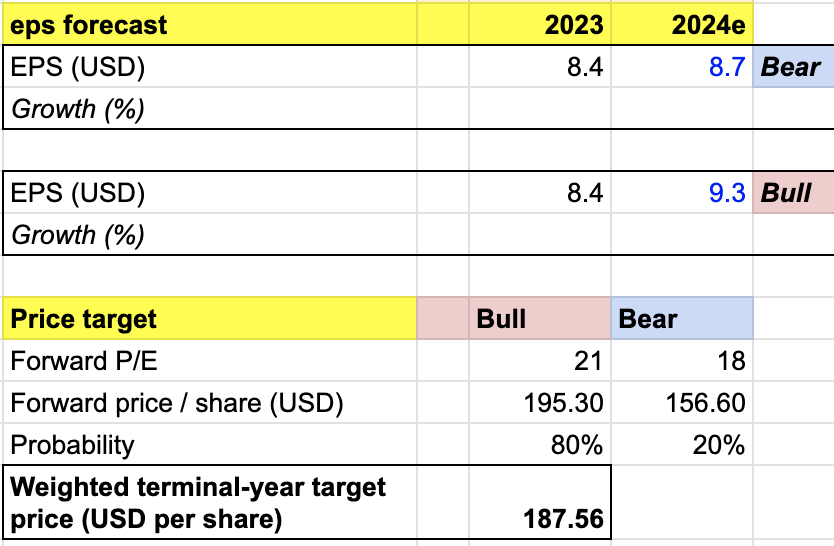

My target price for CHKP is driven by the following assumptions for the bull vs bear scenarios of the FY 2023 projection:

-

Bull scenario (80% probability) assumptions – CHKP to achieve the high end of its FY 2024 EPS estimate of $9.3. Since CHKP’s P/E has been trading steadily between 18x – 21x on average in recent years, I assign CHKP a P/E of 21 in the bullish projection.

-

Bear scenario (20% probability) assumptions – CHKP to deliver an EPS of $8.7 in FY 2024. I assign CHKP a P/E of 18x in this scenario.

price target (own analysis)

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $187.6 per share, suggesting a 14% upside from the current price level. I would rate CHKP a buy.

Conclusion

CHKP presents a compelling investment opportunity with its leadership in cybersecurity, strong financials, and robust growth potential. Its comprehensive AI-driven “Infinity” platform safeguards businesses across diverse environments, solidifying its position in the ever-evolving cyber landscape. A few catalysts, such as generative AI trend and also seasoned M&A strategy, to continue in maintaining the solid outlook, in my view. I rate CHKP a buy with a 1-year target price of $187.6, representing a projected upside of 14%. I believe CHKP remains a low-risk growth stock with significant potential for long-term value creation, making it a flight-to-quality growth investment opportunity today.