Carlos Duarte/Moment via Getty Images

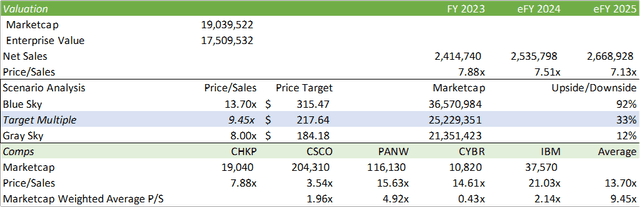

Check Point Software (NASDAQ:CHKP) reported a very strong end of the fiscal year 2023 with growth at both the top and bottom line. Despite the challenges faced at the start of 2023, Check Point overcame the slow customer acquisition at the start of the year and ended with resilience. With their Infinity platform rolling out, management is optimistic this level of growth can continue and potentially ride the AI software wave. I provide CHKP shares a BUY recommendation with a price target of $217.64/share at 9.45x eFY25 sales.

Operations

Similar to other cybersecurity firms, Check Point has been focusing on bringing customers onto their singular platform, Infinity, to leverage their various security features across the network, cloud infrastructure, and business software applications. Check Point introduced their copilot feature on the Infinity platform that allows users to navigate the platform and IT infrastructure using GenAI natural language processing. This feature is said to save cybersecurity professionals a significant amount of time navigating for errors and issues.

Something that would have taken an analyst anything from a few minutes to a few hours to analyze to understand… with one sentence to our generative AI, the Infinity copilot, it analyzes the situation. It explains why she wasn’t able to access. It suggests a solution either to a certain group. It asks the user whether you want to implement this change and whether they want to install the new policy, and boom, in a matter of 1 or 2 minutes, everything is done. – Gil Shwed

Management remains optimistic about growth going into 2024 as the business environment appears to be less cloudy when compared to 2023. Financing challenges was mentioned as a headwind to billings as interest rates remain elevated. As a result of this, I believe that customers will keep contracts for shorter durations until interest rates come down, relieving some of the financing costs. This will result in fewer dollars being paid up-front and more annual renewals.

Management did mention that there may be a shift in sales going forward as more customers adopt Infinity. The difference in this won’t necessarily be engagement, but rather, the transfer from a one-time product or licensing sale to a subscription-based sale.

I do believe that Check Point will have the opportunity to ride the AI wave as their entire product catalog now contains some form of AI. In addition to this, Infinity can be deployed using various form factors, whether it be through cloud, email, etc. Infinity secures all the core nodes of IT, from the network, cloud infrastructure, endpoints & applications, and the security ops. center.

Gartner forecasts a strong year for IT spend in 2024, with 13.5% growth in software spend. The research firm reported that 80% of CIOs anticipate increasing their cybersecurity spend in 2024 with a focus in managing costs. With this in mind, I believe that Check Point’s AI-powered platform can offer this level of investment as their copilot feature enables a user to analyze across the infrastructure in spoken language. I believe that this feature can offer a firm more flexibility in staffing as this feature may offer a lower learning curve while reducing time spent across IT operations.

Financials

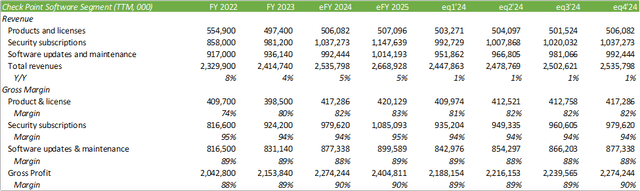

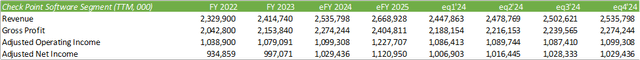

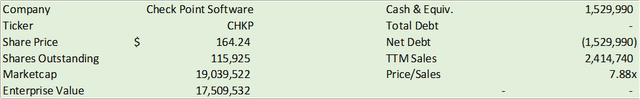

Management guided growth in-line with their historical growth rate with eFY24 revenue guidance of $2,475-2,625mm and adjusted EPS of $8.70-9.30/share. This represents revenue growth of 2-9% for eFY24 and net margin expansion to 41.60-41.93%, assuming static share count from FY23.

Management mentioned on the FY23 earnings call that operating margins may experience a -2% headwind in eFY24 resulting from their acquisition of Perimeter 81 in September 2023. Perimeter 81 is said to have been a Pioneer Security Service Edge company that will bolster Check Point’s SASE solution. Check Point should also benefit from Perimeter 81’s expertise in cloud delivery, zero-trust, and fast deployment capabilities. I believe that after the Perimeter 81 is fully integrated into Check Point, margins will expand as the acquisition may bolster Check Point’s subscription-based service features.

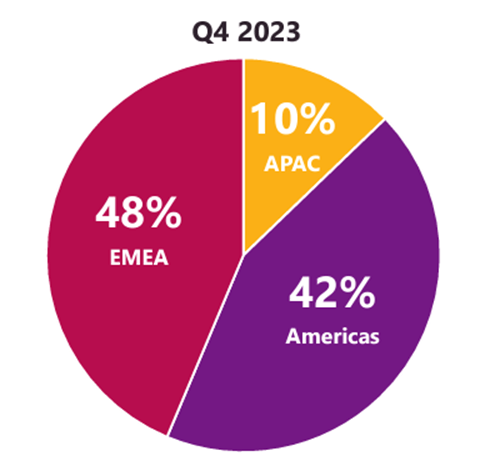

In terms of catalysts, I can see strong positive and negative catalysts that can push the company’s performance either way through eFY24. Starting with the negative, geographic outlay may create some headwinds for the firm as the European Bloc is going through slow/no/contractionary growth. More specifically, Germany’s productivity is going through a major contractionary state with industrial production down 1.6% in December 2023. As EMEA accounted for 48% of total sales in FY23, this may pose somewhat of a challenge going into eFY24.

Check Point Software Presentation

Looking stateside, there may be fiscal challenges on the horizon with higher for longer interest rates and persistent inflation. Though not directly affecting Check Point, the regional banking industry faces a $929b CRE debt wall that may be challenging to refinance at these higher rates. I believe that this headwind has the potential to send rippling effects across all industries and may pose a challenge for customers or potential customers of Check Point.

On the other hand, I do anticipate strong tailwinds to the AI cadence as more firms seek to limit spending while optimizing operations. Similar to Palantir’s (PLTR) ability to optimize operations, I believe Check Point has the ability to optimize the security department and overall IT environment. I believe that the hype-cycle for AI-enabled applications is just beginning for businesses and has a huge runway for growth. In addition to this, pertaining to cost cutting, I believe that Check Point’s GenAI copilot will enable a firm to cut costs by lowering the barrier to entry for executing complex security tasks while using natural language command functions. I believe from a cost-savings perspective, this will have the ability to reduce salaries, training time, and potentially headcount by reducing the time to execute certain tasks. Overall, I believe Check Point is in a good position businesswise and should strongly benefit from the renaissance of AI.

Lastly, Check Point is in the process of bringing in a new CEO as Mr. Schwed transitions to Executive Chairman. I don’t believe this should come as a surprise given Mr. Schwed’s tenure and I do not believe this will significantly impact the share price until a new CEO is placed.

Valuation & Shareholder Value

No question, CHKP isn’t going to be the high-throttle gainer as we see with firms like Palo Alto Networks (PANW) or CrowdStrike (CRWD), which can be a strength as a shareholder. With more dependable growth comes lower volatility risk and the risk of being caught on the wrong side of a bad trade. Though this risk cannot be eliminated, it can be somewhat mitigated by investing in a slow-grower like CHKP.

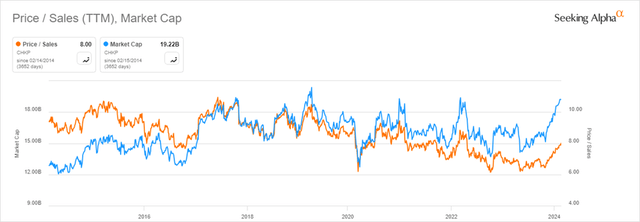

Considering the company’s valuation, the shares tend to be range-bound in terms of price/sales. CHKP shares tend to trade as low as 6.25x and as high as around 10x.

Though I do not anticipate a 10x multiple on this stock, I do expect the shares to have some room for expansion at the valuation level closer to its peers. I believe that the stock can reach the peer average of 9.45x sales on a market cap-weighted basis. Based on eFY25 sales, I value CHKP shares at $217.64/share, a 33% upside from the current price. I recommend CHKP as a BUY.