TrongNguyen

Last year, one of the companies that I was most bullish on for a good chunk of time was brokerage giant The Charles Schwab Corporation (NYSE:SCHW). After shares plummeted because of the banking crisis that began in March of 2023, I bought into the business and made the case that shares should trade meaningfully higher. Eventually, the stock did rise rather nicely. But by early January of this year, I ended up downgrading the firm on two separate occasions, eventually bringing it down from a ‘strong buy’ to a ‘hold’. Such a rating denotes my belief that shares should see upside that is more or less in line with the broader market. But since then, the stock has lagged the market to some extent. While the S&P 500 has been up 11.3% since then, shares of Charles Schwab have risen by just 7%.

From my experience, shares of companies offer the greatest opportunities, but also the greatest risks, when they announce earnings. This is because new data comes out that helps paint a picture as to the firm’s overall health. For Charles Schwab, the next such earnings date will occur on April 15th. That will cover the first quarter of the company’s 2024 fiscal year. Unlike most other firms, Charles Schwab does come out with some additional data on a monthly basis. And while the picture is not perfect, there are some reasons to be optimistic. But in my view, the picture is not yet bullish enough to justify an upgrade.

Interesting data

As I mentioned already, on April 15th of this year, the management team at Charles Schwab will be announcing financial results for the first quarter of the company’s 2024 fiscal year. Unless something changes, this is slated to occur prior to the market opening. Heading into that time, analysts have rather dour expectations. For starters, they anticipate revenue of around $4.72 billion. This is net revenue as Charles Schwab describes it. Although this is a nice chunk of change, it would represent a decline of 7.7% compared to the $5.12 billion the business generated in the first quarter of 2023.

With many financial institutions, a major pain point was the net interest margin. This is the difference between the net interest rate that they can capture on assets and the net interest rate that they have to pay out on liabilities. However, when it comes to the 2023 fiscal year, Charles Schwab was a bit of an outlier. Its net interest margin actually improved slightly from 1.78% to 1.98%. This does not mean that net interest revenue won’t decline. From 2022 to 2023, this metric fell 11.7% from $10.68 billion to $9.43 billion. This is because, although net interest margin improved, average interest earning assets declined substantially. Even though the company has been under pressure in the sense that bank account balances have been on the decline and what has been on the incline, such as money market funds, bring with them lower margins, I suspect that the company will experience a lot of pain because of its bank deposit fees and trading activities as well.

The aforementioned decline in bank deposits, combined with lower yields on them, brought bank account deposit fees for the company from $1.41 billion in 2022 to $705 million in 2023. And on the trading side, revenue dropped from $3.67 billion to $3.23 billion even as the number of transactions increased. This was driven by a reduction in order flow revenue and a fall in commissions. This is all part of a longer-term trend that the company has been subjected to.

On the bottom line, analysts are forecasting profits per share of $0.68. This would be down rather substantially from the $0.83 per share generated in the first quarter of the 2023 fiscal year. This would mean that net income would decline from the $1.53 billion it stood at during the first quarter of 2023 to around $865 million the same time this year. The drop in revenue, combined with some higher operational costs, will likely be responsible for this pain should it come to pass. But if analysts end up being proven wrong, then it’s possible shares could spike rather nicely.

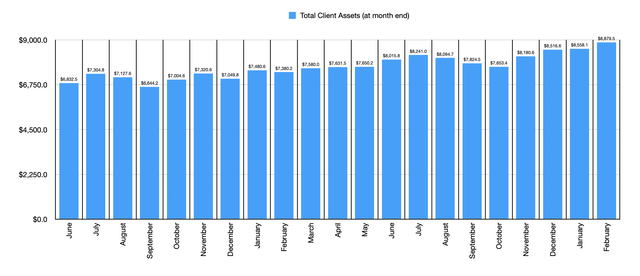

Heading into earnings, there is some additional data that we can use to see what kind of health we are looking at for the enterprise. The first should be total client assets. Management reports this and other important metrics on a month-to-month basis. And the most recent data we have covers through the month of February. For context, for the first quarter of 2024, data will only extend through March. When it comes to total client assets, the picture is very promising. The company ended February with $8.88 trillion worth of assets. This is an all-time high for the firm. It represents a 3.8% increase over the $8.56 trillion reported in January. And it is 20.3% above the $7.38 trillion reported for January of 2023.

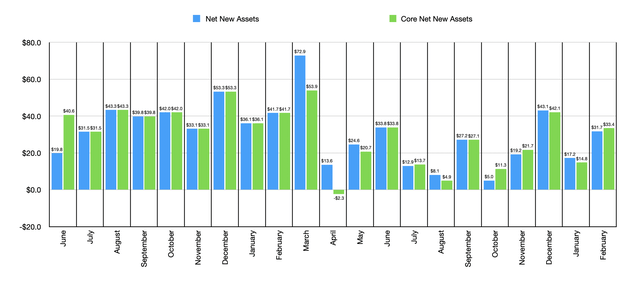

Most of the increase seen from January of this year to February was driven by strong market returns. However, the company did see net new assets of $31.7 billion and core net new assets of $33.4 billion. You can imagine the core net new assets as being an adjusted figure for net new assets. The company has a long history of volatility when it comes to assets added each month. But historically speaking, on a net basis, they have usually ranged between about $20 billion and $40 billion. Every so often, you will see some number higher than this or lower than this. In March of last year, for instance, the company saw net new assets added of $72.9 billion. That same month, core net new assets were $53.9 billion. But only one month later, in April, net new assets grew by only $13.6 billion, while core net new assets dipped by $2.3 billion. The most important thing is that the general trend looks healthy. And the number posted in February was, with the exception of what was seen in December, the highest reading for net new assets and core net new assets seen since June of 2023.

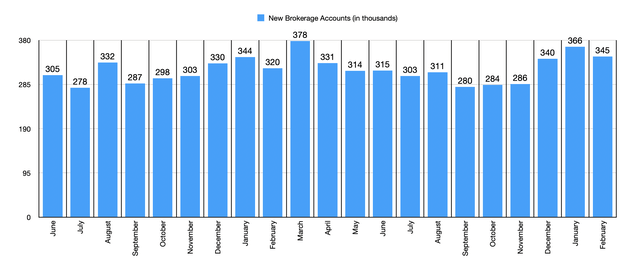

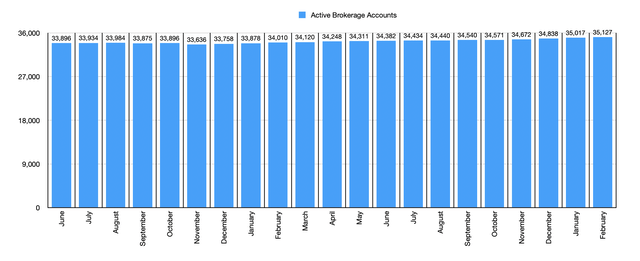

It will also be interesting to see how the month of March looks when it comes to new brokerage accounts added. In January of this year, the company added 366,000 brokerage accounts. This was the highest seen since March of 2023. And in February, the firm reported 345,000. With the exception of the January reading, this was also the highest since March of last year. The boost in new brokerage accounts also allowed active brokerage accounts to hit an all-time high of 35.13 million in February. That’s 110,000 higher than what was seen only one month earlier. And it is 1.12 million above with the company reported for February of 2023.

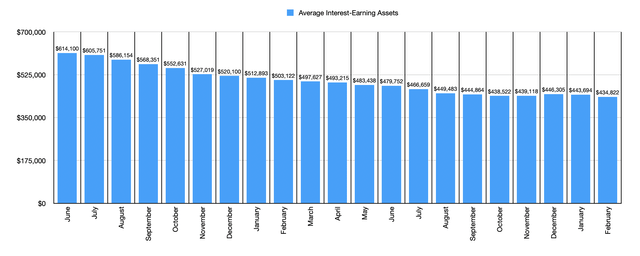

This is not to say that everything for the institution is positive or will continue to be positive. One weak point, as the chart below illustrates, has been average interest earning assets. This metric has been on the decline for a long while now. If we look at June of 2022, the firm had $614.10 billion in average interest earning assets for the month. Almost every quarter since then, we have seen a decline. The good news is that the declines have moderated over the past several months. But at $434.82 billion, average interest earning assets will likely play a role in revenue reduction.

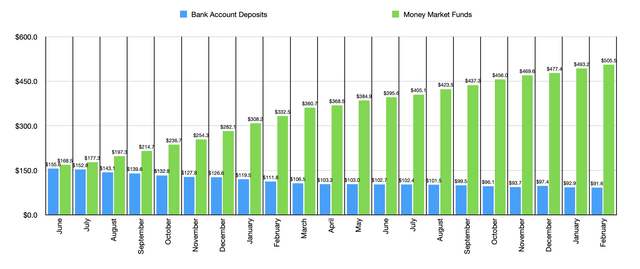

There are a couple of other metrics, metrics that have to do with the interest earning assets and liabilities of the company, that investors should be paying attention to. The first of these would be bank account deposits. And the second would be money market funds. Although total assets at the institution have risen significantly over the past year or so, bank account deposits continue to bleed. There’s a brief uptick in December of last year. But if we remove that from the equation, it has been a constant decline since at least June of 2022. Back then, bank account deposits totaled $155.6 billion. By February of this year, they had fallen to $91.6 billion. This is painful because deposits have historically been a source of cheap capital for financial institutions. But the rise in interest rates has made competition for deposits fierce, and many banks have seen their deposits fall. The good news is that money market funds have skyrocketed from $168.5 billion to $505.5 billion over the same window of time. But they bring with them far less net interest profit. With interest rates likely to start dropping later this year, we could see a stabilization of bank account deposits. But for now, we need to keep a close eye on them.

Takeaway

Based on the data provided, it does look as though Charles Schwab we’ll have a rather disappointing quarter. This is in spite of the fact that the institution is seeing attractive growth from an asset perspective. The institution is larger than it ever has been. Both revenue and profits are likely to fall, and shares having risen rather materially since I first took a bullish stance on the firm in 2023. Given these factors and seeing as how we’re not expected to see any major improvement yet, I would say that the ‘hold’ rating I assigned the stock previously still makes sense.