FG Trade Latin/E+ via Getty Images

Investment Thesis

In continuing with our coverage for Century Communities (NYSE:CCS), we had rated CCS a Hold as a result of tough macro backdrop, persistently high mortgage rates which have been inching higher along with lack of valuation comfort compared to its peers. The stock had declined by about a fifth of its value before recouping some of its losses during the earnings release but is still down by about 13% since the publication. The company reported strong earnings and revised its guidance upwards which sent the shares soaring up to 8% before ending the day with over 5% gains. We remain positive on the company’s ability to drive home sales with higher ASP, however, the implied guidance suggests a marginal decline, albeit remaining relatively stable. We reiterate our Hold rating as current multiple provides limited margin of safety amidst potential for further P/E derating. We ascribe a target price of $70 (at 9x Fwd P/E in line with our Tri Pointe Homes (TPH) thesis.

Macro Trends Challenging

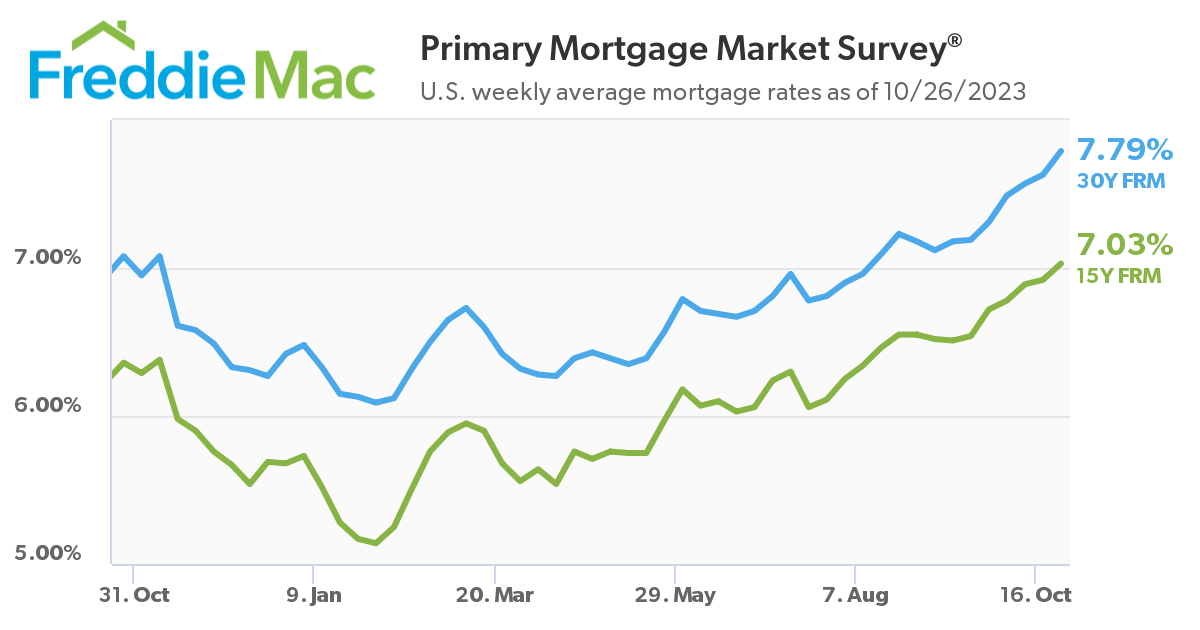

Mortgage rates continue to inch higher nearing the 8% mark, highest in over two decades, which has lead to a significant demand headwind for the homebuyers.

Freddie Mac

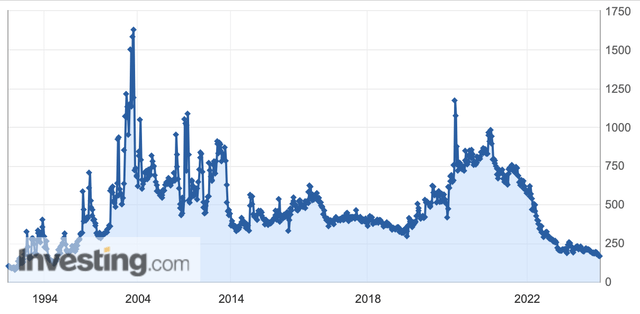

This has led to the a substantial decline in mortgage applications with mortgage market index, a measure of mortgage loan application volumes, near 1990 levels. Mortgage index declined by 1.0% over the past week amidst persistently higher mortgage rates keeping homebuyers out of the market.

Investing.com, Mortgage Bankers Association

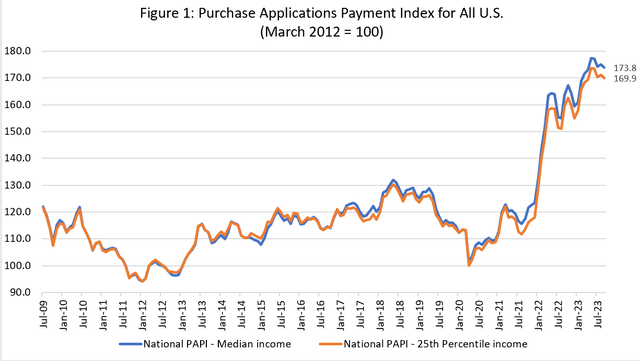

According to Mortgage Bankers Association, Purchase Applications Payment Index (PAPI), a measure of monthly mortgage payments relative to median income, improved slightly since May demonstrating improving affordability on the back of relative growth in median income. Mortgage application payments declined to $2,155 from $2,170 in August as a result of decline in higher denomination mortgages and growth in lower value homes.

Mortgage Bankers Association

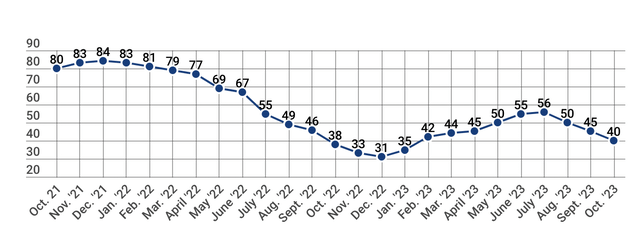

September new home sales surprised the street which increased 12.3% MoM to 759k with bulk of the homes were sold between $150k-$500k range amidst a decline in housing inventory which remains at 19 year lows. Builder’s confidence continue to drop amidst weakening demand and persistently higher mortgage rates marking a third straight quarter of decline, down 16 points from June levels.

NAHB

Although there was a modest improvement in affordability last month, higher rates and low housing inventory are both keeping many would-be buyers out of the housing market. Challenges remains as 2023 comes to an end, but MBA is forecasting for a slight rebound in originations and a moderation in mortgage rates in 2024.

– Edward Seiler, Associate Vice President, Mortgage Bankers Association

Strong Q3 Earnings

CCS reported strong Q3 earnings with revenues declining by 22% YoY to ~$890 mn ahead of street expectations pegged at ~$810 mn. This was driven by a 14% drop in total deliveries to 2,264 along with a 10% decrease in average selling price (ASP) to ~$382k. On a sequential basis however, deliveries remained flattish vs 2,235 in Q2 while revenues jumped over 5% as a result of a sequential improvement in ASP. Adjusted Homebuilding gross margins reported a marked improvement up 20 bps YoY as well as 480 bps sequentially (Q2 HB gross margins was up 140 bps QoQ) to 25.8% as a result of improvements in construction costs and cycle times along with reduced incentives. We are positive on the stability of the average selling price for the homes as well as the company’s ability to make marked improvements in its cycle times to drive 25%+ gross margins.

SG&A deleverage by 90 bps YoY as a result of sticky fixed costs amidst sharp decline in sales, however, improved sequentially. Adj. EBITDA margins came in at 14.4%, expanding by 460 bps sequentially as a result of strong gross margins QoQ along with SG&A leverage, however was down 200 bps primarily due to SG&A deleverage and lower land sales and other revenue. Non-GAAP EPS came in at $2.58 significantly ahead of the consensus expectations pegged at $1.64 driven by beat on both topline and margins.

Balance sheet position remained strong with the company ending the quarter with a liquidity of over $1bn including ~$250 mn in cash and undrawn RCF facility of ~$800 mn. Leverage ratio remains comfortable with Homebuilding debt to capital of 25.3% and Debt to LTM EBITDA of 2.7x. S&P recently upgraded its rating for CCS from BB- Positive to BB Stable on the back of comfortable leverage ratios, no near term maturities and strong cash generating capacity. It expects that the company’s Debt to EBITDA will be in the range of 2.0 – 2.5x as a result of strong earnings momentum which is further expected to ease below 2.0x by 2024.

The company revised its guidance higher on the back of the strong order bookings as well as YTD performance and now expects home deliveries for 2023 to be around 8,600 – 9,000 (vs 8,300 – 9,000 previously) implying about 2,400 deliveries for Q4 which also represents a sequential improvement, albeit down from 2,900 deliveries last year. It upgraded its guidance for full year revenues to $3.3 bn at mid point compared to $3.25 bn earlier, implying a marginal decline in Q4 revenues at $880 mn and ASP to further fall sequentially to ~$367k.

Valuation

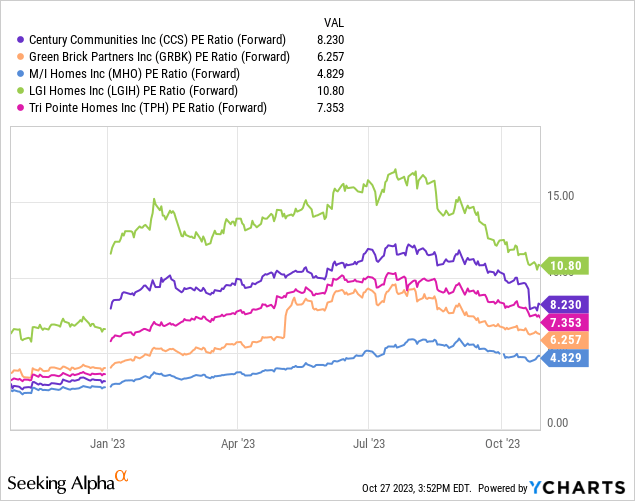

Homebuilders have reported P/E derating as a result of persistent increase in mortgage rates inching the 8% mark and weakening demand environment. Despite the sharp drop, CCS trades at about 8.2x, a slight premium to its peers as well as at a 20% premium to its long term average.

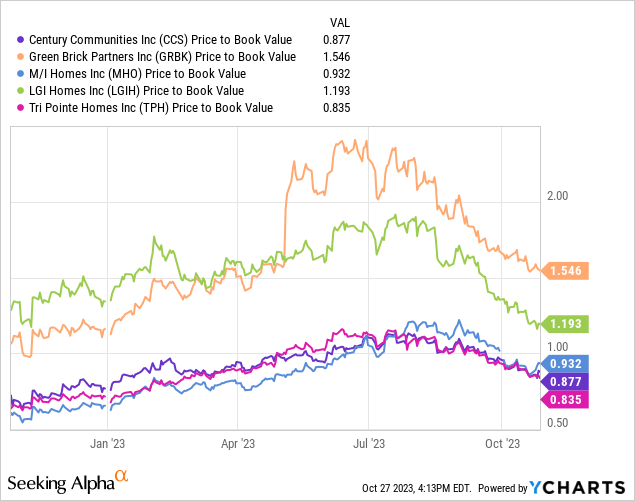

In addition, on Price to Book basis, the company trades in line with its peers with the exception of Green Brick Partners (GRBK) and LGI Homes (LGIH).

We believe despite the strong beat and raise, current value continue to provide limited margin of safety and further derating of P/E amidst persistent mortgage rates as witnessed since September (P/E derated by 3x in last two months). Reiterate Hold.

Risks to Rating

Risks to rating include

1) Continued decline in housing inventory can spur demand for new homes leading to a jump in order growth and higher sales

2) Prolonged economic slowdown as a result of persistently higher mortgage rates can lead to significant worsening of demand

3) Gross margins can be adversely or positively affected as a result of any impact in construction cycle times along with construction costs which has been a major driver in driving gross margins since past few quarters

Final Thoughts

CCS has reported a strong earnings raising guidance on the back of another successful quarter in Q2. However, the company’s valuation provides limited margin of safety in case of a further derating amidst persistently high mortgage rates. In addition, the company’s guidance implies that the current jump in ASP sequentially could be a blip and may face further pressure downwards as homebuyers look for smaller homes amidst challenging macro outlook. We reiterate our Hold rating as a result of lack of valuation comfort.